subman

Shares of JPMorgan Chase & Co. (NYSE:JPM) rose about 2% in early trading on Friday as the company reported genuinely strong results. This quarter showed the value of JPM’s diversified business and prudent underwriting policies, which should assuage concerns of an immediate downturn and severe deterioration in credit quality. Even as it added to reserves, the bank grew earnings quarter-over-quarter (“QoQ”) and boosted capital, which should allow buybacks to start within the next six months. At less than 9x 2023 earnings, a company of this quality is just too cheap.

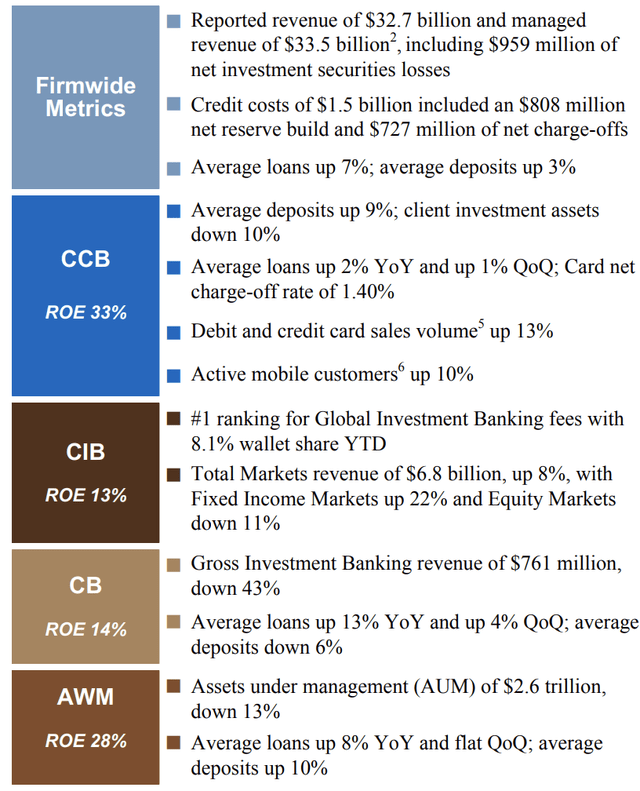

In the company’s third quarter, JPM generated EPS of $3.12, which was up from $2.76 last quarter and well ahead of the $2.85 consensus. Across the organization, JPM earned a return on equity of 15%, a solid outcome well above its 8-10% cost of capital, which justifies shares trading at a premium to book value. Each of JPM’s four main units generated over 10% ROE, even the corporate & investment bank, which saw fee revenue plunge 47% as economic uncertainty essentially stopped M&A activity. JPMorgan also built $808 million in reserves against credit losses, primarily on the corporate side.

Its consumer unit (CCB) was the standout in the quarter to me. Credit card volumes are rising double-digits, showing that consumers continue to spend and create more fee revenue. Very interestingly, whereas it built $150 million of consumer credit loss allowances last quarter, it withdrew $150 million this quarter, primarily from home loans. Despite all of the fears about a housing market downturn and rising credit card balances, JPM is not seeing troubling enough signs to build reserves. That should be good news for more consumer-facing lenders like Synchrony (SYF) and Capital One (COF) when they report in the coming weeks.

Thanks to higher interest rates, revenues rose 14% while expenses rose just 11%. With interest rates rising, we are starting to see the company build net interest margin, which provides a cushion against losses. As a consequence, consumer profits rose $1.2 billion sequentially to $4.3 billion, down just 0.4% from last year. I would note that deposits fell 1% QoQ, which I think management is happy to see as it tries to improve its leverage ratio to enable more buybacks. As the company is happy to have some deposit attrition, it will likely keep deposit rates a bit lower and let some funds leak out, which will keep net interest margins rising.

On the corporate and investment side of the ledger, there was a bit more deterioration, but it was manageable. As noted above, IB fee revenue nearly halved, and overall investment banking revenues fell 43% to $1.7 billion. A volatile market hurts advisory and fee activity, but it also tends to increase trading revenue. Indeed, we saw just that. Markets revenue was up 8% to $6.8 billion thanks to a 22% jump in fixed income offset by an 11% drop in equities. In this segment, there were credit costs of $513 million as the company is prepping for a worse macro environment. It is interesting that while much of the discourse in recent weeks has focused on the health of the consumer, JPM is being more cautious on corporate credit risk.

In commercial banking, C&I loans rose 7% QoQ, while deposits were down 6% to $281 billion, consistent with management’s willingness to let excess deposits leave the bank. On the asset management side, I was pleasantly surprised. Given markets, assets under management (“AUM”) were down 13%. However, its asset mix was favorable. While there were $36 billion of liquidity outflows, there were $12 billion of long-term inflows, which are higher fee products. This drove revenue up 3% sequentially to $2.2 billion, and it remains JPM’s highest return unit.

Overall, we saw the benefit of higher interest rates outweigh economic uncertainty and somewhat higher credit costs. JPM grew loans 7%, increasing its net interest capacity while letting 3% of deposits leave to de-lever its balance sheet. We are at an interesting moment because management said that “The actual current U.S. economy, consumer and business, remains healthy,” but there are “Fairly significant headwinds in the near future.” For now, we can say these headwinds are not enough to materially erode the bank’s profitability.

Further, management raised its net interest income guidance to at least $61.5 billion from $58 billion, with a Q4 run-rate of $66 billion. While higher rates increase the risk of recession, they boost JPM’s revenue, and with these funds, JPM can afford higher credit losses without actually being worse off. If the Q4 rate holds next year, JPM could see another $4.5 billion in credit losses before its earnings are actually worse off thanks to higher interest income. With consumer credit holding firm, this appears unlikely, meaning JPM is more likely to grow earnings next year in my view.

CEO Jamie Dimon also wrote, “we hope to be able to resume stock buybacks early next year.” This quarter, the company only paid out the $1 dividend as it builds capital to meet the plethora of supplementary capital buffers being applied to big banks. Thanks to strong earnings, its CET1 capital ratio was 12.5%, up from 12.2% last quarter, as the firm tries to get to 13% by Q1 next year. The company also reduced risk-weighted assets by $23 billion in the quarter and kept its leverage ratio at 5.3%. Management expects capital to get to 13% in Q1, which should enable buybacks. Whereas the company is returning about 33% of earnings via dividends currently, that figure could rise to the ~75% area next year, pointing to $12-15 billion in buyback capacity.

JPMorgan is performing strongly, fears of a credit crisis are simply not materializing, and it continues to well out-earn its cost of equity. Accordingly, it deserves to trade substantially above its $87 book value. With higher interest rates and expense discipline, this is a company with $13 in earnings power, and it should trade at least 10x earnings or $130, or about 1.5x book value. I would be a buyer here with nearly 20% of upside potential.

Be the first to comment