bennymarty/iStock via Getty Images

Investment Thesis: Swiss Re could come under some pressure in the short to medium-term, as losses from Ukraine and rising interest rates pose risks to profitability.

In a previous article on Swiss Re (OTCPK:SSREF) back in August of last year, I made the argument that significant potential upside could lie ahead for the company.

My reasons for making this argument were the fact that performance across the Property & Casualty sector was expected to remain strong. Additionally, Swiss Re had been showing significant growth in earnings and cash flow.

Despite this, the stock is down by over 15% since my last article:

With that being said, the stock had actually seen upside past the CHF 100 mark before falling steeply in February when the ongoing geopolitical situation in Ukraine transpired. According to Life Insurance International, Swiss Re had to set aside $283 million in losses as a result.

Given that recent events will have had an impact on Swiss Re’s business – the purpose of this article is to assess whether Swiss Re could see upside to previous highs once again once the global macroeconomic situation starts to become more stable.

Performance

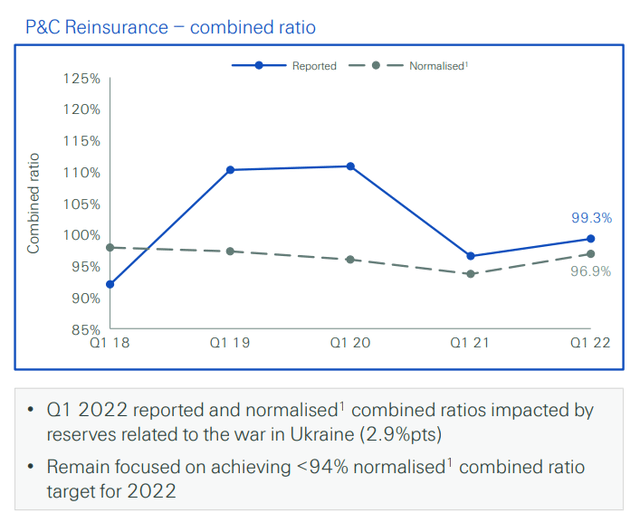

When looking at the combined ratio for P&C insurance, we can see that losses related to Ukraine significantly pushed up the combined ratio beyond the 94% target that the company is aiming for in 2022.

Swiss Re: First Quarter 2022 Results

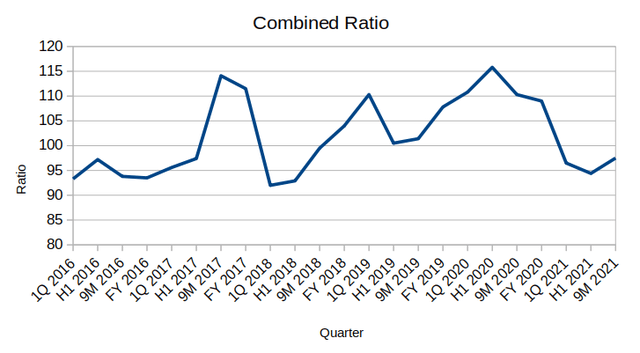

For reference, the combined ratio refers to the ratio of expenses and losses relative to the earned premium. A lower ratio is better, as it indicates that the earned premium generated is sufficient to cover expenses and losses. When looking at the historical combined ratio for Swiss Re from Q1 2016 to Q3 2021, the ratio came in at a mean of 101.7 with a standard deviation of 7.8.

Figures sourced from historical quarterly reports for Swiss Re. Graph generated by author.

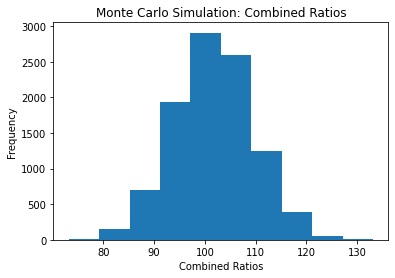

It was decided to run a Monte Carlo simulation of 10,000 trials using these parameters – it is calculated that the combined ratio would fall below 94% just over 16% of the time.

Author’s calculations

From this standpoint, while the trajectory regarding Ukraine is uncertain – I would deem it more unlikely than likely that Swiss Re would see a normalized combined ratio of below 94% this year, based on both historical performance as well as the expectation that losses in Ukraine will continue to have an impact.

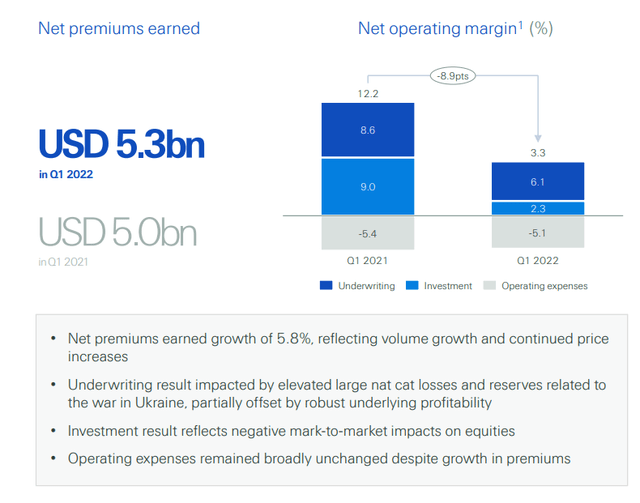

For Property & Casualty as a whole, we can see that while net premiums grew by 5.8% due to volume and price growth – net operating margin showed a decline from the same period last year.

Swiss Re: First Quarter 2022 Results

Therefore, while Swiss Re may be in a position to benefit from inflation (as rising property prices makes it more likely that property owners will seek insurance) – it is unclear whether such gains will be sufficient to offset catastrophic losses – as we have seen with the situation in Ukraine.

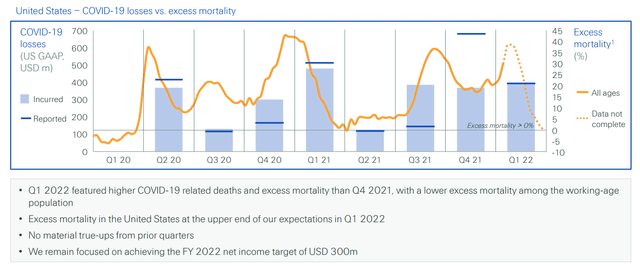

Moreover, while it is increasingly accepted that the emergency phase of COVID-19 is over in many parts of the world – Q1 2022 still showed a significant degree of excess mortality as a result of COVID.

Swiss Re: First Quarter 2022 Results

This could become a seasonal pattern for the foreseeable future, and thus the Life & Health segment could also face ongoing pressure.

Looking Forward

With a bear market recently being indicated by the S&P 500, markets seem to be pricing in a period of decline in economic growth, if not a recession outright.

This, combined with the effects of inflation, could affect the demand for insurance as a whole.

Particularly, given the fact that we are seeing a trend in rising interest rates to combat inflation – with the Federal Reserve having recently risen rates to the highest level since 1994 – this could have the impact of slowing down property demand in the medium term. As a case in point, housing starts in the United States fell by over 14% in May, which was the largest drop since April 2020.

In turn, this could also have the impact of lowering demand for property insurance. In this regard, while Swiss Re originally saw significant gains from the P&C segment which helped shield the company from losses on the Life & Health side – there is a risk that demand for insurance could start flattening out more broadly, as property demand potentially slows and demand for life and health insurance slows as the pandemic abates.

Conclusion

To conclude, Swiss Re has come under some pressure as a result of the ongoing situation in Ukraine. However, an environment of inflation and rising interest rates may be challenging if this significantly reduces demand across the property market.

From this standpoint, the stock might come under some pressure in the short to medium-term.

Be the first to comment