jetcityimage

Before the market opened on October 20th of 2022, the management team at telecommunications conglomerate AT&T (NYSE:T) announced financial results covering the third quarter of the company’s 2022 fiscal year. Compared to what analysts were anticipating, the company exceeded expectations. Digging deeper, the picture becomes even better than that. Based on all the data currently available and considering how cheap shares currently are, the company does seem to offer some significant upside despite rising approximately 9% during the day as of this writing. All things considered, I still feel comfortable rating the enterprise a ‘strong buy’, reflective of my belief that it should tremendously outperform the broader market for the foreseeable future.

Great fundamentals

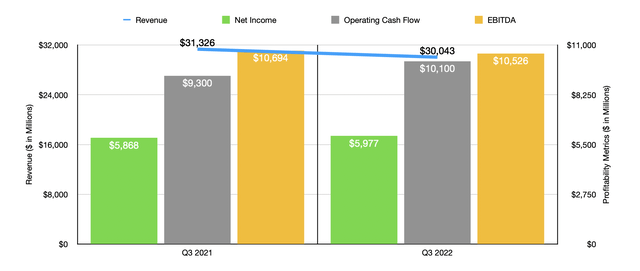

Back on October 13th, I published an article discussing what investors should anticipate for the company’s third quarter release. So far, my reiteration of a ‘strong buy’ rating has played out well. While the S&P 500 is up by 5.7%, shares of AT&T have jumped by 17.5%. This return disparity was not without cause. Let’s first touch on the headline news. Revenue for the company came in during the quarter at $30.04 billion. Although lower than the $31.33 billion generated the same quarter last year, it did beat analysts’ expectations by $140 million. Earnings per share, on an adjusted basis, came out at $0.68 cents. That beat expectations by $0.07.

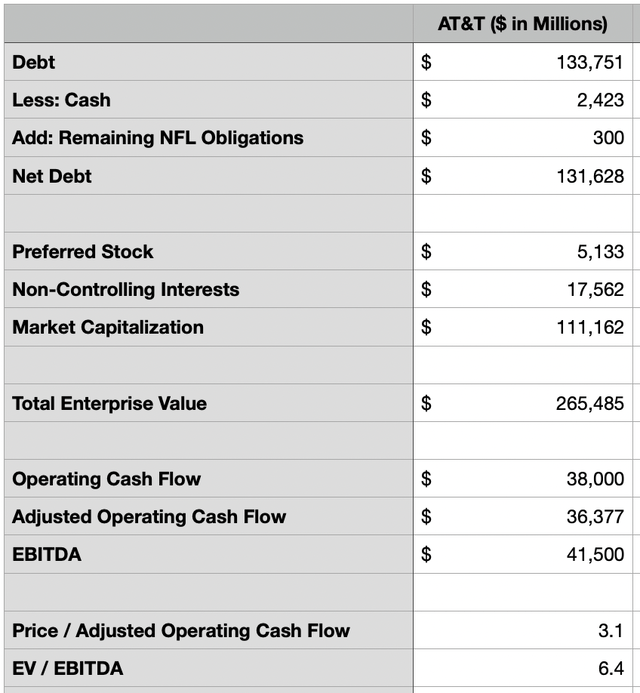

Judging just based on this data alone, things are looking up for the company. But it’s important to dig deeper to truly understand what kind of value proposition the company currently offers. In my prior article, one thing that I mentioned that investors should pay attention to would be debt and cash flow. It’s important for the company to continue paying down its debt as it seeks to get its net leverage ratio to 2.5 or lower. By the end of the quarter, net debt had declined to $131.33 billion. This represents a decrease of $1.23 billion compared to the $132.56 billion the company had just one quarter earlier. This brings the company’s net leverage ratio to 3.22 on a trailing 12-month basis and to 3.16 on a forward basis. Although any sort of improvement it’s nice to see, I personally would have preferred if debt fell further.

In order for debt to fall, we should expect cash flow to come in strong. And strong it was. During the quarter, the company reported operating cash flow of $10.1 billion. This represents a nice improvement over the $9.3 billion generated the same quarter last year. Although it is worth noting that not every profitability metric improved year over year. Yes, net income rose from $5.87 billion in the third quarter of 2021 to $5.98 billion the same time this year. But EBITDA declined from $10.69 billion to $10.53 billion. Although earnings per share came in higher than what analysts were anticipating, management has not changed their guidance for operating cash flow or free cash flow for the current fiscal year. They did, however, say that earnings per share should be $2.50 or higher. That compares to the prior expected range of between $2.42 and $2.46. The company also said that it’s still on track to achieve more than $4 billion of the $6 billion in run-rate cost savings that it has targeted by the end of this year.

Growth engines are faring nicely

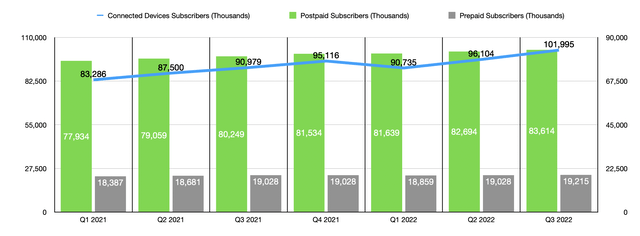

Many investors at this point likely view AT&T as a tired, old firm that is incapable of achieving real growth. Having said that, this description of the company would be inaccurate. The fact of the matter is that the firm continues to see some impressive financial results from quarter to quarter. This is true not only from a fundamental perspective, but in regards to the particular growth sections of the company. One of the aspects of the firm that I like to point to most when talking about this because of how under-appreciated it is involves its Connected Devices operations. During the third quarter of 2022, the firm had 101.995 million subscribers on this platform. This was up compared to the 90.979 million reported the same time last year. Growth year over year would have been even stronger had it not been for the fact that the company lost 8.8 million subscribers over the course of a single quarter because of its decision to end support for 3G devices. Compared to the latest quarter, the company still reported a nice increase of 5.716 million after we account for some adjustments made to prior numbers.

Management is also reporting attractive growth elsewhere. During the second quarter, the company added around 708,000 postpaid phone subscribers to its platform. And it saw 108,000 net additions to its prepaid phone plans. Another growth area for the company was fiber. Over the next couple of years, management hopes to grow its fiber network so that it can reach 30 million customer locations. At the end of the second quarter, the firm had access to 18 million. Today, that number has been increased to 18.5 million. In total, the company reported 338,000 net additions to its fiber network compared to the 29,000 losses, excluding DSL losses, for broadband. This shows continued growth for the company’s big initiatives. And speaking of big, consider that the company has increased its guidance yet again when it comes to its mid-band 5G spectrum. By the end of the year, the company now hopes to be able to cover more than 130 million people. Back during the second quarter, the number targeted by the company was 100 million. And prior to that, it was between 70 million and 75 million.

Shares still have a lot more upside

At this time, I run an incredibly concentrated portfolio that consists of only seven different holdings. There is a reason why AT&T is one of them. Frankly, I believe that the company is significantly undervalued, even after factoring in the recent increase in price that shares experienced. Prior estimates called for EBITDA this year of $41.5 billion and operating cash flow of $38 billion. Though to account for non-controlling interests and preferred distributions, I have reduced the operating cash flow figure down to $36.38 billion.

Based on where shares are priced today, the company is trading at a forward price to adjusted operating cash flow multiple of only 3.1 and at a forward EV to EBITDA multiple of 6.3. For a healthy cash cow with debt that is coming under control, these numbers look incredibly cheap to me. At present, from an EV to EBITDA perspective, shares do more or less match the valuation of Verizon Communications (VZ), which is trading at a multiple of 6.4. But on a price to operating cash flow basis, Verizon is trading at a multiple of 4.2. Making up that spread would imply upside for AT&T of 37.4% from where the stock is right now. But again, I believe that the entire space is underpriced.

Takeaway

Personally, I view the latest quarter reported by AT&T’s management team to be nothing less than stellar. Not only did management beat expectations on both the top and bottom lines, they also reported strong cash flows and continued debt reduction. All of the growth areas of the business are performing at least as well as I would have anticipated. And shares of the enterprise looked to be trading at incredibly cheap levels on an absolute basis and cheap from one perspective relative to Verizon. All of these factors combined make me feel confident in my previous ‘strong buy’ rating on the firm.

Be the first to comment