The Good Brigade/DigitalVision via Getty Images

Investment Thesis

Zillow (NASDAQ:Z; NASDAQ:ZG) is the undisputed leader in the digital residential housing market. The company has the top real estate app on the market by a wide margin. But the housing market is sliding badly. Transaction volume is declining as well.

Zillow has struggled to move outside of its core marketing and advertising segments. The company is also struggling with its margins as well as high stock-based compensation. I think that the risk to reward is unfavorable right now due to the uncertain outlook.

Secular Trends Are Reversing

After a few years of fantastic performance, Zillow’s growth trajectory is reversing. The company had benefited from a very hot housing market. But the housing market is pulling back. High price appreciation and aggressive rate hikes have hurt home affordability. In September, pending home sales dropped by over 24% year over year.

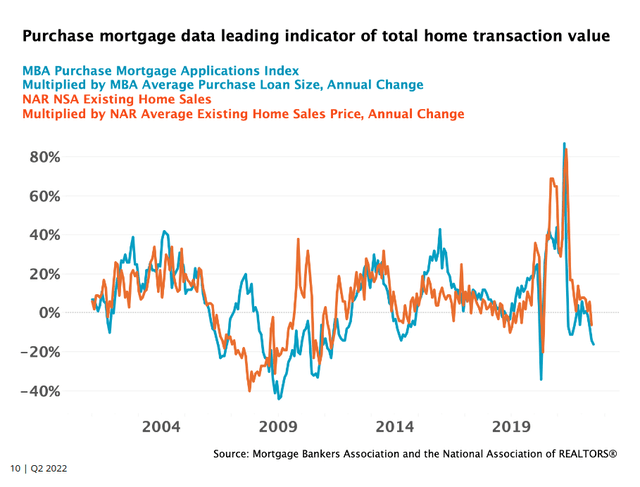

Zillow makes most of its money off of home transactions. Unaffordable homes will price buyers out of the market and decrease total sales. This will hurt the company’s top line. Additionally, real estate agents will likely pull back spending on lead generation. This will likely continue until prices decline significantly or the Fed cuts rates. Neither of these seems to be happening soon. Zillow’s management pointed out heavy declines in mortgage applications as a leading indicator of further declines. The most recent MBA purchase index reported a 40% drop year over year.

Zillow Q2 2022 Shareholder Letter

In the last quarter, Zillow guided for a 19% year-over-year decline in its third quarter revenue. The company’s lead generation services are a major part of this decline. Management expects a 21% drop in the business, which it calls its Premier Agent segment.

Zillow’s mortgage origination segment is also at risk. The company’s loan origination volume cratered by 63% in the second quarter. This was driven by a huge 79% drop in refinances year over year. In 2021, refinances made up three-quarters of Zillow’s origination volume. The segment is expected to report a negative adjusted EBITDA of $28.5 million in the next quarter.

The only part of Zillow’s business that has any tailwinds is its rental segment. As the rental market cools, increased inventory will drive increased rental volume. Additionally, people priced out of homebuying will need to rent a place to live. Zillow’s rental revenues increased 16% sequentially. I think that this demonstrates some strength in the current environment. The site’s rental traffic was up 31% year over year in Q2, compared to a low-single-digit rate for the whole site.

But this segment only made up 13% of Zillow’s revenue in the first half. The company’s results still heavily depend on home sales and transaction volume.

Long-Term Strategy

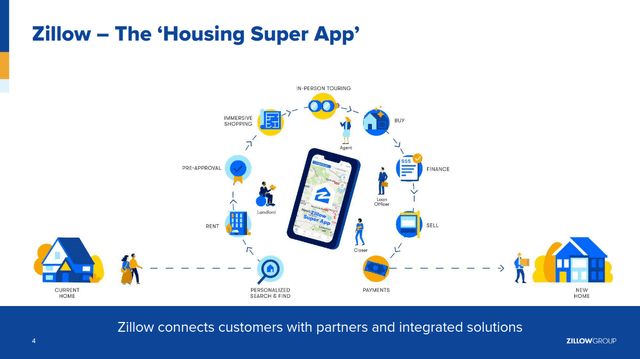

Zillow’s ambitious strategy is to transform into a “Housing Super App.” The company wants to build a variety of small services for various parts of the homebuying process. These can be combined into one app that guides buyers through each step of the process.

Zillow 2022 Investor Strategy Presentation

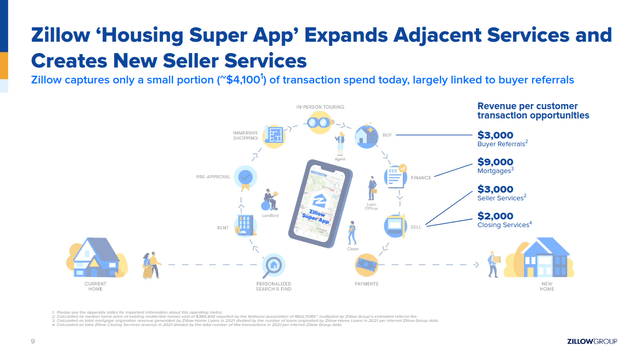

The idea is that Zillow only captures a small portion of the transaction revenue in its deals. Right now, most of its revenue is connected to its website’s function as a lead generator for real estate agents. The company wants to expand its reach into other parts of the transaction. Some of management’s ideas include financing and title services. In the long term, the company even sees opportunities outside of home buying. Management expressed interest in renovation services, home insurance, and moving services.

Zillow 2022 Investor Strategy Presentation

But the company is a long way away from achieving this vision. The company depends on its IMT segment, which provides advertising and marketing services. That segment accounts for 93% of the business’s continuing revenues. In the last quarter, it was the only part of the business with positive adjusted EBITDA. Zillow’s Premier Agent offering was responsible for two-thirds of the company’s revenue in the quarter.

Zillow started to move further into the real estate transaction process in 2018. Since then, it has had very mixed results. Years later, the company still makes most of its money as a lead generator. The only major new segment the company has recently added was its mortgages segment. This only accounted for 7% of revenue in the first half and loses money.

The company’s big play was its move into iBuying. As you probably already know, this was a total disaster. The business could not accurately predict housing prices and quickly exited the segment. It was forced to take a writedown of hundreds of millions of dollars as a result.

Zillow’s long-term strategy sounds impressive. But the business has been working towards these goals for years with limited results. I want to see concrete evidence of these new products gaining traction.

Profitability And Dilution Headwinds

Even after an 85% drop, I still think that Zillow’s valuation is risky. The company is trading at an LTM adjusted EV/EBITDA of 6.7 times. At the same time, revenue headwinds are hurting the company’s bottom line. Zillow expects its adjusted EBITDA margins to drop by over 18 percentage points year over year in Q3. This would translate to a 58% drop in profit. The housing market has softened further since Zillow’s guidance. I think that this increases the possibility of additional downside.

Zillow’s balance sheet is reasonably healthy. The company has a lot of cash due to the liquidation of its iBuying segment. This $3.5 billion in cash on hand offsets the company’s $1.7 billion in debt. The company is using some of its excess cash to buy back its own shares. This helps to offset the tremendous dilution over the past few years.

From 2016 to 2021, management diluted the company’s shares by 37%. This includes over a billion dollars in stock-based compensation and two billion in share offerings. Recently, the company has been trying to reverse this. In the last three quarters, management spent $900 million to reduce the company’s shares outstanding by 5%.

But the dilution is an ongoing issue. The company has very heavy stock-based compensation expenses. In the last quarter alone, the company paid out 100 million in its own shares. This is equivalent to 1.9% of the business’s enterprise value. On their last earnings call, management announced that they were increasing their stock-based compensation even further. They expect an incremental $180 million to $190 million in stock comp over the next two years.

I understand that stock-based compensation is normal in the tech industry. But I think that it should be reported as a regular expense. I don’t like it when companies exclude SBC from their adjusted EBITDA numbers. If Zillow had not excluded SBC from its results, its LTM adjusted EBITDA would have dropped 45%.

I think that the company’s profitability profile isn’t very strong. The current macro headwinds could cause a significant decline in Zillow’s margins.

Final Verdict

Zillow clearly has a strong platform. It’s not a stock that I would avoid at all costs. But there’s not a lot of clarity on its future results. I would want a significant margin of safety to compensate for the high risk.

The company has had issues expanding outside of its core IMT segment. It has questionable profitability and high stock-based compensation. I don’t think that there’s a high chance that shares are hugely undervalued right now. Because of this, I believe that the risk to reward is unfavorable right now.

Be the first to comment