Darren415

The classic formula is simple. Take the population growth rate and add to it the change in the productivity of the working portion of the population and you get the growth rate of the economy in real terms. Inflation changes the nominal pricing of the elements. And the distortion of inflation can lower the rate of real growth because inflation impacts behavior in nonproductive ways.

But, as my friend Philippa Dunne asks, what happens when the population doesn’t grow? Or, to add a nuance, what happens if the working population lags the growth rate of the total populations? Oops. Then things get dicey. And they get worse if the population stops growing.

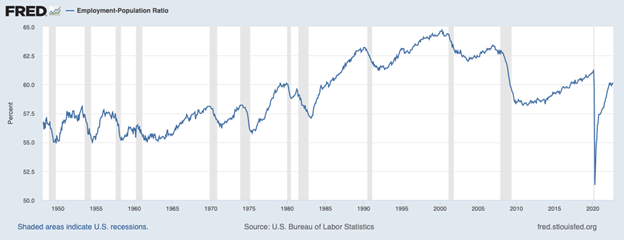

Here’s a chart from the St. Louis Fed database that shows the long-term history of the Employment Population Ratio (EPOP).

(“Employment-Population Ratio,” FRED, St. Louis Fed, https://fred.stlouisfed.org/series/EMRATIO)

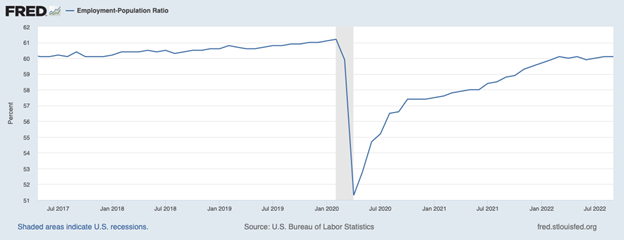

Now here’s the same series with a close-up of the last five years. We want to capture the Covid shock and focus on it and its continuing long Covid aftermath.

(“Employment-Population Ratio,” FRED, St. Louis Fed, https://fred.stlouisfed.org/series/EMRATIO)

The simple conclusion is that we don’t have enough workers.

In the October 13th edition of their economic newsletter TLRWire, “Short version: We’re in a pickle,” Philippa Dunne and Doug Henwood note that the population growth slowdown is “remarkable.” Why? Because growth is so low. In fact, they cite that it is the lowest rate of growth since the actual population decline of the Spanish Flu year 1918. They conclude that “every component of population growth is contributing to the slowdown.” Of specific note is that “immigration, which began declining in 2017 as official policy turned hostile, is approaching 0.”

So, if we don’t have population growth, to get a rebound in growth in real terms, we would need a robust acceleration of productivity in the upward direction. Okay. The framework is simple, but how do you get productivity gains when the education and training level of job applicants is lagging and a deepening teacher shortage is forcing school systems to hire new teachers who may collectively have less knowledge to impart and little or no prior training in education?

Add to this the recent estimates that Long Covid disability continues to rise and that the portion of long Covid disabled (partial, temporary or permanent) among working-age adults is now estimated to be over 4 million persons (“New data shows long Covid is keeping as many as 4 million people out of work,” New data shows long Covid is keeping as many as 4 million people out of work).

Factor in 4 million missing workers with a disability and then add the unknown factor of the folks who are their caregivers to that number. To make matters more difficult still, according to the Migration Policy Institute and the US Census Bureau, we have an estimated 2 million fewer immigrants even though there are many people wanting to come into the United States and work here to do jobs that we need to have done.

The bottom line? The number of job openings exceeds the number of job seekers, and the result is a wage inflation pressure that is triggering the Federal Reserve’s hard focus on fighting inflation. The Fed has only one tool it can use to curb inflation and that is to raise the interest rate to slow down the economy’s growth rate (recession?). I have just described an economic maelstrom to rival a hurricane.

As this commentary is written, we are continuing to hold our large cash reserve in the US Equity ETF portfolios; we have deployed some cash into the market and clients will see those trades. But remember that financial markets are discounting mechanisms. They are looking forward. And the stock market selloff (coupled with the bond market selloff) has made many stocks and bonds much cheaper. At some point the markets will start to sniff out the end of this painful adjustment mechanism. And the markets will start to price in the recovery even though the full force of the hurricane recession winds are howling.

Our remaining large cash position may change at any time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment