kupicoo

Summary

I recommend a Buy rating on Sovos Brands (NASDAQ:SOVO). It has a decent moat stemming from its portfolio of key brands, and a clear growth strategy that has been repeatedly executed successfully in the past. I believe SOVO’s current valuation can generate investors a long-term IRR of 10% over the long term, but it would be better if SOVO traded down to a lower valuation, which would give investors a better margin of safety.

Company overview

Sovos Brands is a large food company based in the United States that focuses on acquiring and building disruptive growth brands in order to provide modern consumers with delicious food that suits their lifestyles. The company embraced its “one-of-a-kind” branding and ensured premium quality. As a result, each of SOVO’s brands provides customers with genuine, honest, and unforgettable food experiences. Furthermore, SOVO’s commitment to the well-being of its people drives the core of the company. SOVO gives its teams the tools they need to be brave and persistent leaders. This gives them the confidence and flexibility to build relationships with customers and retail partners that help the business grow.

The company believes that the combination of its “one-of-a-kind” products and well-empowered people makes SOVO an ultimately “one-of-a-kind” company. This enables SOVO to achieve its goal of developing a growing and sustainable food enterprise that generates more financial growth than its competitors.

Customers in the United States make up the majority of SOVO’s consumers. These customers include traditional supermarkets, mass merchants, warehouse clubs, wholesalers, specialty food distributors, military commissaries, and non-food stores like drug stores, dollar stores, and e-commerce retailers.

Attractive business model

SOVO’s business model is grounded in the acquisition of “one-of-a-kind” brands and the leverage of common infrastructure and a shared playbook to drive development and growth. What’s great about the brands SOVO has bought is that they all have important things in common, like being tasty, having a strong customer following, being able to shake up established categories, and using their brand strength to move into other categories.

In general, consumers who are younger, more family-focused, and have higher disposable incomes are more likely to purchase SOVO’s brands. According to company-sponsored research by third parties, SOVO customers have a strong love for taste and quality, place high importance on having clean ingredients, and have bigger basket sizes at retail than the average categories in the market.

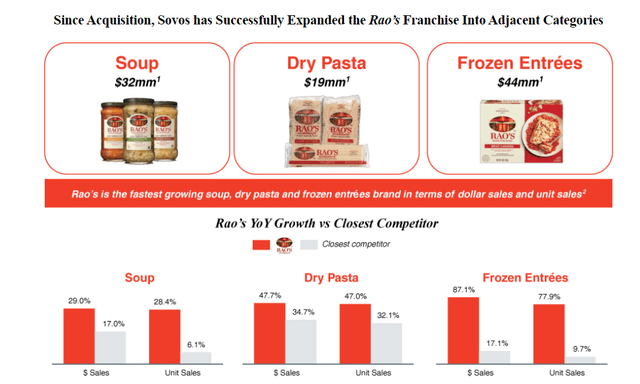

It’s evident that SOVO’s brands all follow the same growth playbook, focusing on increasing household penetration through expanding brand awareness, increasing distribution, enhancing sales and marketing execution, and innovating into new categories. I think that the popularity of the Rao’s brand is an example of how well SOVO has been able to grow.

SOVO has proven its ability to drive growth through M&A. Looking back, SOVO has successfully closed on four different acquisitions over the past four years. The company uses selective criteria when evaluating potential acquisition targets, beginning with “what it takes to be a Sovos Brand.” Since its founding, SOVO has conducted these evaluations on over 200 brands, as mentioned in its prospectus. With its systematic approach and broad array of seasoned industry specialists, I believe SOVO can continue to grow through M&A, allowing it to add value-enhancing brands to its portfolio over time.

Ultimately, SOVO’s past purchases have been successful because the company has improved each brand it has bought, grown its TAM, saved money, made its employees more productive, and found synergies.

Strategic partners to retailers

I believe retailers find value in SOVO’s brands and strategy. The company’s retail customers love its premium price points and strong sales velocities, which create significant gross profit per unit for investors. SOVO’s brands grow in center-store categories as the company’s premium rates are affordable to average customers, giving SOVO further access to a broad demographic and retail classes. The company firmly believes that its attractive value proposition to retailers will provide a significant opportunity to grow distribution throughout its portfolio, as the market still has a substantial amount of whitespace among distributors and retailers.

Significant room to continue penetrating household demand

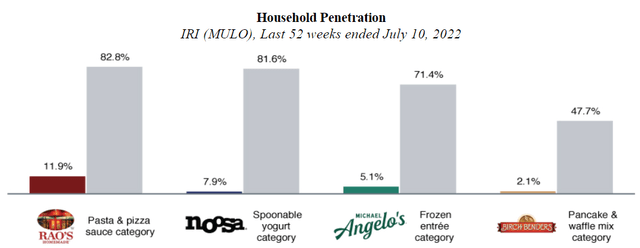

SOVO can continue to increase household penetration. I see a clear and tangible opportunity for SOVO to increase household penetration for each brand. Looking at SOVO’s Rao’s, the business household penetration for this brand’s sauces in the 52 weeks ended July 10, 2022, was 11.9% compared to the sauce category’s 82.8%. For Rao’s pasta and pizza sauces, each 1% household penetration corresponded to nearly $54 million in retail sales during the same period. Below is the household penetration of other major Sovos Brands in the 52 weeks (ending July 10, 2022):

- Noosa spoonable yoghurt was 7.9%, compared to its category of 81.6%.

- Michael Angelo’s frozen entrées were 5.1%, compared to its category of 71.4%.

- Birch Benders pancake and waffle mixes were 2.1%, compared to its category of 47.7%.

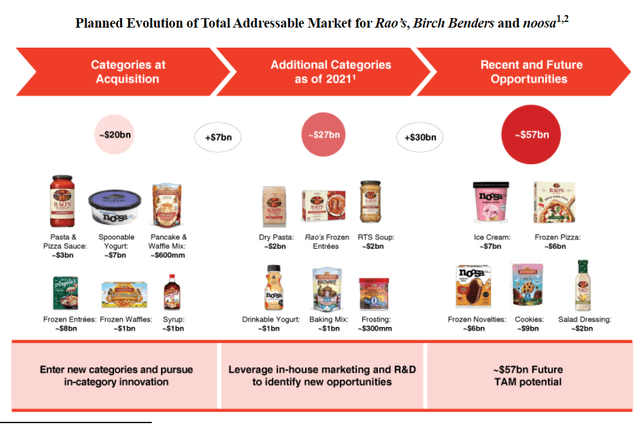

Strong innovative culture enables SOVO to penetrate a $57 billion TAM

Continuous innovation is ingrained in SOVO’s culture, making it an essential component of the company’s playbook for creating value. The company’s integral marketing, research, and development teams are actively identifying new chances for the business to build unique usage occasions for its brands by capitalizing on its existing brand strength and infrastructure. SOVO believes it has grown faster than most CPG companies. According to management estimates, SOVO’s portfolio as a whole has successfully entered into new categories that have expanded its brands’ total market reach by approximately $7 billion, from approximately $20 billion to approximately $27 billion as of December 2021. Since acquiring its brands, SOVO’s Brands have expanded into new product categories on a national scale, including ready-to-serve soup, frozen entrées, dry pasta, drinkable yogurt, baking mixes, and frosting. These new product categories were introduced after the company acquired its brands.

Valuation

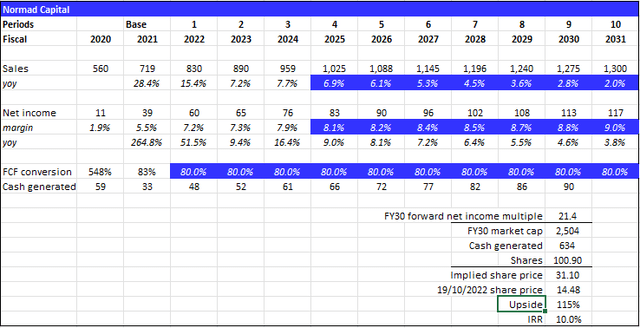

At the current stock price of $14.48 and 100.9 million shares, the market cap is ~$1.4 billion. I believe the current valuation is leaning slightly towards fair value and a better entry point would be when it trades down. That said, investors today can still expect ~10% IRR based on my model. I want to highlight that my model did not factor in major growth from acquisitions as it is hard to forecast. Hence, with acquisitions, IRR could be better than what I expect.

I believe SOVO will make $1.3 billion in sales and $103 million in net income in FY31. This will be driven by declining sales growth from consensus estimates in FY24 to a long-term inflationary rate of 2% in FY31. Net margin to remain flat after 2024, giving it a market cap of $2.6 billion inclusive of cash generated and a stock price of $31.1 in FY30, assuming it trades at 21x in FY30.

Assumptions:

- Sales: to follow management’s guidance in FY22 and consensus estimates until FY24, afterwards a gradual decline over a 10-year period as growth slows down from market saturation and lack of acquisition targets.

- Net income: to expand to follow consensus estimates until FY24 and expand to industry level of 9% over the long term.

- Valuation: I assume no change in valuation and that it should continue to be valued using the current forward earnings multiple of 21x in FY30.

Risk

Highly competitive industry

SOVO competes with large multi-brand consumer packaged food firms, smaller companies producing a single product, developing enterprises, and companies focused on dairy products and dairy alternatives. There are a lot of brands and products that compete for shelf space and sales.

Value destructive acquisitions

There is a present possibility that SOVO would not be able to properly integrate and manage the brands that it acquires, nor would it realize the acquisition’s budget cost and targeted synergies in the anticipated timeframe. There are many potential downsides to acquiring a company, such as challenges in integrating and realizing targeted synergies in the acquired company’s sales; distribution; purchasing, etc.

Change in consumer preferences

The success of SOVO depends on the continued demand for its premium, on-trend, and high-quality products. If that demand were ever to decline, it would have a negative impact on the company’s operations, financial position, and results of operations.

Conclusion

SOVO, as a food company embracing its “one-of-a-kind” image, is not afraid of innovation and will continue to produce one-of-a-kind premium food. To expand and reach more consumers with value creation and continually grow through acquisitions in the face of tough competition, M&A risk, and unpredictable market changes, calculated risks must be taken at each step.

More than the company’s attractive business model, to strategic positioning in retail partners, to growing household demands, to having an innovative culture, investors looking to put and grow their money in a reputable business that not only cares for its products and profit but as well as its people, should know more about SOVO and how the company multiplies value like it multiplies its brands. The current valuation is not ideal but could still yield investors a long-term IRR of 10%.

Be the first to comment