Yongyuan Dai/E+ via Getty Images

Investment thesis

In my previous article on Blackrock’s iShares MSCI Hong Kong ETF (NYSEARCA:EWH) I made a comparison between EWH and their ETF for Singapore (EWS) and Taiwan (EWT), concluding that if I had to choose just one, it would be EWS.

But that does not mean EWH is not attractive.

Roughly one-third of my portfolio is in companies listed on the Hong Kong Exchange. My own preference is to pick stocks that I believe would give me alpha over just picking EWH, but it does take time and is certainly neither suitable for everyone nor is it a guarantee that alpha can be found.

Therefore, we shall reexamine the status of EWH as an investment

Since my previous article, it is down slightly less than the S&P500 ETF (SPY)

EWH versus SPY since 21 Jan 2022 (SA)

Financial results and the prospects of the top 10

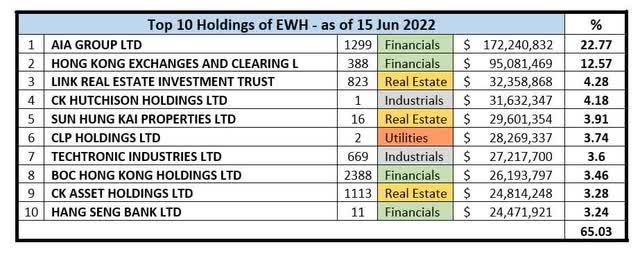

We shall look at the top ten companies in EWH which constitute as much as 65% of their portfolio.

EWH top 10 holdings as of 15 Jun 2022 (Blackrock iShares home page)

As can be seen, it is heavily tilted towards financials and real estate.

Bear in mind that Blackrock chooses to exclude companies that are controlled by the People’s Republic of China and listed on the Hong Kong stock exchange. That is a large part of the Hang Seng Index. I am thinking of large companies in the index such as; Meituan (OTCPK:MPNGF), Alibaba (BABA), JD.com Inc. (JD), CNOOC (OTCPK:CEOHF), China Petroleum & Chemical (SNP), Industrial and Commercial Bank of China (OTCPK:IDCBF), and China Life Insurance (LFC).

Here is a brief review of the financial performance over 2021 of the top ten companies.

1. AIA Group Ltd.

AIA is well known to many investors. Market capitalization is HKD 965 billion making it the largest listed company on Hong Kong Exchange that is registered and headquartered in the city.

Since its IPO in 2010, the Group has delivered strong cash flow generation which has led to an increase in its free surplus since their IPO to USD 24.8 billion on a pro forma basis. In addition to the rather low dividend, the management has approved a further return of capital to shareholders of up to USD 10.0 billion through a share buy-back program. Judging from the share price of HKD 80.40 in relation to its net book value of only HKD 38.97, I am not sure this is a good capital allocation at this time.

Their 2021 EPS was HKD4.80 which leaves us with a P/E of 16.75

Last year’s dividend increased by 8% to HKD 1.08 which gives investors a low yield of just 1.82%

The insurance landscape in Asia is getting quite competitive with strong competition coming from Chinese insurers, such as China Life Insurance, and also HSBC which is increasing their focus in this field. There are still untapped markets within China as the pension system is reforming with more optionality for people to invest in life insurance products from foreign companies.

It is a Hold in my opinion.

2. Hong Kong Exchanges and Clearing (OTCPK:HKXCF)

With a market capitalization of HKD 454 billion, it is the third most valuable clearing house in Asia, with only Japan and the Shenzhen Stock exchange having a larger market cap. If they ever were to merge Shenzhen and Hong Kong exchange it would then become the third largest in the world, after NYSE and Nasdaq.

Their 2021 EPS was HKD 9.91 and the current price is HKD 358.40 gives us a P/E of 36.18. The book value is only HKD 39.14 which means that the price to net book value is a staggering 9.16

The dividend yield of 2.48% is also not much to get excited about. I find HK Exchange to be too expensive based on fundamentals, and as such would rate it a Sell.

3. Link REIT (OTC:LKREF)

It is Asia’s largest REIT by capitalization. With 151 properties, predominantly in retail, located in Hong Kong and some in China, the value of their real estate portfolio is HKD 228 billion.

They have started to diversify by adding two office properties, with one located in London and the other in Sydney, Australia. In addition, they have a 50% interest in 3 landmark retail properties also in Sydney.

Their gearing is a comfortable 22%, and their credit rating is A.

Since their IPO back in 2005, they have delivered quite a remarkable 15% compounded annual total return to unitholders. Their annual distribution has also grown about 10% since 2005.

NAV per share is HKD 77.10

Their share price is HKD 63.40

The net book value per share is HKD 77.10 per share leaving investors with a low price to net book value of only 0.82

12 months trailing DPU is HKD 3.0567 and as such, the yield is not fantastic at 4.82%

I rate this a Hold.

4. CK Hutchison Holdings (OTCPK:CKHUY)

I regularly cover CK Hutchison Holdings. My last article was published on 21 April with a comprehensive review of their 2021 performance.

Since then, their share price has come down 11% which means their P/E is only 6, their P/NBV is a tantalizing 0.39 and you get paid 5.1% in dividends while waiting for the value to potentially be realized. The problem is how long will you have to wait and what would be the catalyst that makes it happen?

I had a Hold stance in April, and this remains the case today.

5. Sun Hung Kai Properties (OTCPK:SUHJY)

Another company that I cover is this real estate giant. It has been one year since I had a buy call on SUHJY. The market has not been kind to the shares of SUHJY as it is down 25.8% in a year.

Their EPS improved by 13.4% over the last year coming in at HKD 9.21 per share. Out of these earnings, they paid out HKD 4.95 for the year resulting in a dividend yield of 5.4% based on the present share price of HKD 91.50. Net book value per share is as high as HKD 204.91

Price/Net Book Value is therefore just 0.45

The title of my article last year stated that you could sleep well at night if you bought the stock, and I would still sleep well if I had bought it at that time, despite the considerate fall in the share price.

I maintain a Buy on SUHJY and would sleep well even if the shares got cheaper.

6. CLP Holdings

China Light & Power, with a market capitalization of HKD 169.5 billion is one of two utilities in Hong Kong. These two operate in a duopoly with very favorable terms from the government of Hong Kong which basically guarantees them a given return on their investment where they simply can pass on the cost to their consumers.

But things are not as rosy in other parts of the world where they operate. Australia is a large market for them too, and they just issued a profit warning due to substantial unfavorable fair value movements on some forward contracts with the taker of the electricity in Australia. As a result, the Group will record a consolidated loss for the six months ending 30 June 2022. The share price subsequently fell 5.58% on 20th June to HKD 68.5

EPS over the last year was HKD 3.36, giving it a P/E of 20 based on this reduced share price. They do pay out quarterly dividends, which on an annualized basis is HKD 3.1 giving it a yield of 4.6%.

My stance on CLP is a Hold.

7. Techtronic Industries (OTCPK:TTNDY)

They have a market capitalization of HKD 152 billion. It is a large manufacturer of tools with well-known brands such as Milwaukee Tools and Ryobi.

Last year’s EPS was HKD 4.68 with a price of HKD 80.80 per share, and that leaves us with a P/E of 17.3.

Their price to net book value is 4 and the dividend yield is 2.29%

I generally just do not have much interest in such a type of manufacturing sector, and would personally pass on this investment.

8. Bank of China Hong Kong

This is not the same as Bank of China (OTCPK:BACHF) which is listed in Hong Kong under ticker code 3988.HK. It is their local business unit which to the best of my knowledge restricts their business to lending and deposits within the Hong Kong market, which does give it a somewhat different risk profile than their main bank in mainland China. Their market capitalization is HKD 334.6 billion.

BOC HK had EPS of HKD 2.17 and based on its share price of HKD 31.65 it gives us a reasonable P/E of 14.57.

Their dividend yield is quite comparable with many other banks here in Asia as it is 3.57%. If we compare that with the Bank of China’s (HK.3988) which gives its shareholders a dividend yield as high as 8.68%, one can see the difference in risk reflecting the large gap in yield.

My take on BOC HK is that of a Hold.

9. CK Asset Holdings (OTCPK:CHKGF)

When Li Ka Shing’s two main listed companies Hutchison Whampoa and Chueng Kong Holdings merged back in 2015, they separated the real estate under this new venture called CK Asset holdings. Other activities, like retail, infrastructure, ports, and others became CK Hutchison Holdings which is number four on this list

Property development and sales are the largest contributors to their earnings with a contribution of as much as HKD 18.17 billion.

The investment property portfolio of approximately 17.6 million square feet (including shares of joint ventures but excluding car parking spaces) contributed to a rental income of HKD 5.66 billion, which was HKD 274 million lower than the year before mainly due to a decrease in occupancy of retail and office properties in Hong Kong under the pandemic.

Despite this, the value of these properties saw an increase of HKD 1.5 billion in fair value which was recorded in their accounts based on valuation using a cap rate between 4% and 8% depending on the type of property assessed.

Another part of their business is owning and operating hotels and serviced apartments. As expected, this has been taking a beating during the pandemic with lower occupancy rates. The contribution to earnings did improve to HKD 399 million from HKD 260 million in 2020.

They also have controlling interests in 3 listed REITs. They are Hui Xian REIT, in which I have a long position, Fortune REIT and Prosperity REIT. All are listed on the Hong Kong exchange. Distributions received from these REITs worked out to HKD 621 million.

To complicate matters, in my opinion, CK Assets brought over infrastructure and utility assets from the Li Ka Shing Foundation in May last year for HKD 17 billion. Why it was not bought by CK Hutchison is beyond my understanding.

The company also has an aircraft leasing division. This generated earnings of HKD 887 million. In December of 2021, CK Assets agreed to sell this division which included 120 narrow-body aircraft and 5 wide-body aircraft to a third party for USD 4.28 billion.

It also has interests in UK Rails, Australian Gas Networks and Park ‘Fly plus full ownership of a large Pub chain in the UK. Therefore, it seems to me that it is morphing more into another conglomerate than being a pure specialist in real estate investments and development.

EPS for the holding company in 2021 was HKD 5.78 and the share price is HKD 52.55. As such the P/E is only 9.1 The net book value is equally attractive with HKD 101.89 per share which means the P/NBV is only 0.52. They declared and paid out a dividend of HKD 2.20 which translates to a yield of 4.19%

Fundamentals look good, but I just do not particularly like the fact that they are steering away from a pure real estate play to something that looks a lot more like a conglomerate.

Therefore, I would have to say my stance is Hold.

10. Hang Seng Bank (OTCPK:HSNGY)

This local Hong Kong bank is 62% owned by HSBC (HSBC). It has a market capitalization of HKD 267 billion. Over the last year, they delivered EPS of HKD 6.93 which based on a share price of HKD 139.70 gives us a P/E of 20.15. The net book value per share is HKD 96.42.

I prefer to own HSBC as opposed to Hang Seng Bank which I am long.

Economic development of Hong Kong

It is important that we do not look at Hong Kong in isolation.

I believe this could also be the root cause for many of those that believe it is realistic that it can maintain some form of self-governance independently from mainland China. Eventually, it will become one big and important city in China. That is my opinion.

As an important city within the Greater Bay Area, it is important to bear in mind that it had a GDP of US$1.89 trillion last year – making it about the same size as South Korea’s economy. A country which is number 12 on the list of the countries with the highest GDP in the world.

The immediate concern is related to the negative effect on the economy that the pandemic is causing. While many countries have adopted a strategy of learning to live with the pandemic, Hong Kong has, voluntarily or forced, decided to restrict the movements of people. That is not so good if you want to be the gateway between China and the rest of the world, and it makes it difficult for all the people regularly traveling between China and Hong Kong.

However, there are signs of improvement, so I am optimistic that the worst is over.

Nevertheless, The Hong Kong economy did contract at a seasonally adjusted rate of 3% Q-o-Q in Q1 of 2022, which was slightly more than a preliminary estimate of 2.9%. This was the first decline in GDP since the second quarter of 2021 and was the steepest since Q1 2020.

The fact that the U.S. Federal Reserve decided to step on the accelerator and increase the interest rate by 0.75% last time around does have an impact on what the Hong Kong Monetary Authority does, as the Hong Kong dollar is pegged to the US Dollar. On the 16th of June HKMA announced that the base rate was adjusted upward to 2.00% with immediate effect according to a pre-set formula.

It will take some time for these increases in rates to start adding to borrowing costs for mortgagors. Banks do need to be cautious about lending requirements going forward.

Conclusion

We have to live with volatility and market cycles.

Interestingly, my portfolio which is heavily tilted towards Singapore and Hong Kong is falling less than what we see happening with the S&P 500.

I do realize that when America sneezes, the whole world does get a cold. There are few, if any, places to hide. The world is intertwined.

However, we could see different fortunes between the U.S and that of China, and Hong Kong. China has gone through a different rate environment and wants to stimulate consumer sentiment by lowering its interest rate level.

Perhaps we will see more funds flow into Hong Kong and China as institutional investors try to soften the decline in their portfolios. That is obviously assuming that we will see better prospects from Hong Kong and China than what is expected from Europe and the U.S.

EWH has come down 14% since my last article, which I at the time had a Buy call on. Since there is only one lonely Buy stance out of the ten companies above, I have to reduce my stance to Hold.

Be the first to comment