Tom Pennington/Getty Images News

Magellan Midstream Partners, L.P. (NYSE:MMP) units are cheap in light of the company’s high returns on capital and low-priced equity. For the past few years, the company has been dogged by concern among many investors that its refined product transportation system’s useful life would be cut short by the rollout of electric vehicles. But recent developments in the energy markets-from the wide-reaching consequences of Europe’s renewables rollout to the rising costs of batteries – have strengthened our conviction that refined petroleum products are going to be with us for decades to come. We don’t see a risk that MMP’s assets will become obsolete for a very long time.

Irreplaceable Assets That Generate High Returns

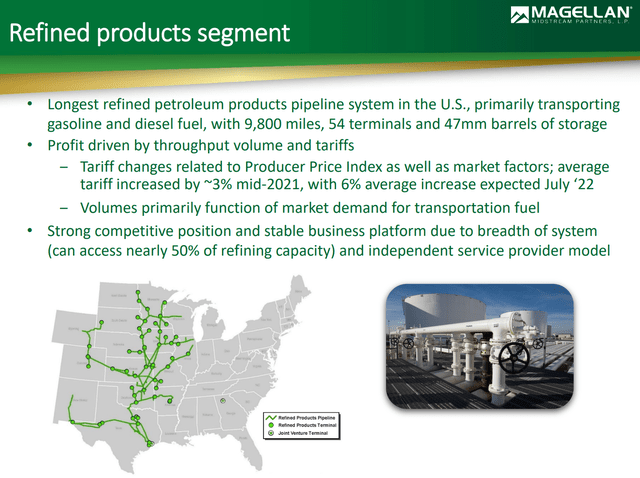

MMP’s system runs through the U.S. heartland. It can access nearly half of U.S. refining capacity, so it isn’t dependent on a particular source of supply or demand.

The system is competitively positioned, generating some of the best returns in midstream. It accounts for 72.5% of MMP’s operating income and is likely to be the engine of its growth for at least the next few years.

MMP’s returns on capital are a result of its refined products system’s strong pricing power. Approximately 70% of its contracts are priced through private negotiations, which have permitted price increases by 3% to 4% over the past few years while inflation was low. We expect additional price increases over future years. The remaining 30% of contracts are priced by reference to the FERC Index. Year-over-year changes in the Producer Price Index for Finished Goods suggest that the FERC Index should increase by more than 8% starting on July 1, which will deliver an outsized benefit to MMP. Given this pricing power, MMP’s equity remains one of the most inflation resistant in the midstream sector.

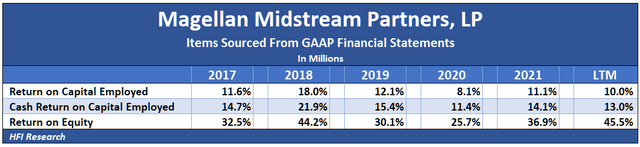

MMP’s pipelines’ high returns and strong competitive positioning allow it to generate unusually stable cash flows. It can therefore operate with a high debt-to-equity ratio in a low-risk manner. These attributes allow it to generate the highest returns on equity in the sector, as shown in the table below.

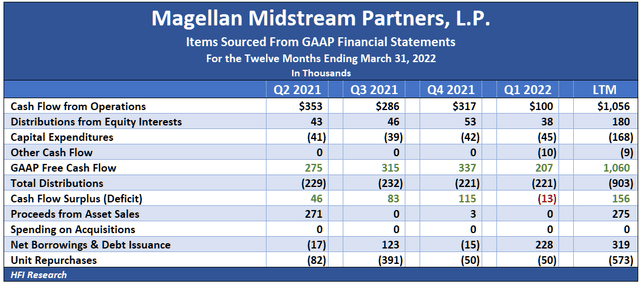

MMP regularly generates a cash flow surplus. Our estimates in the following table show that it has generated a surplus in three of the last four quarters.

Repurchases Grow Value per Unit

Over recent quarters, management has allocated MMP’s cash flow surplus toward unit repurchases. With MMP units trading at a significant discount to our estimate of value, we believe this is the best use of cash for unitholders.

The pace of repurchases over the past eight quarters has been impressive. During the first quarter of 2022, MMP repurchased more than 1 million units for $50 million at an average price of slightly under $48. Over the course of 2021, it repurchased 10.7 million units for $522 million at an average price of $48.89 per unit. MMP’s third-quarter 2021 repurchases were funded primarily by MMP’s $270 million sale of a partial interest in its Pasadena refined product terminals. Throughout 2020, the company repurchased 5.6 million units repurchased for $277 million at an average price of $49.45.

Altogether, since 2020, the company has repurchased 17.5 million units for $850 million at an average price of around $48.50. Over this timeframe, it reduced units outstanding by 7.4%. Since distributions are now spread over fewer units, the repurchases have increased MMP’s distributable cash flow per unit, its distribution coverage ratio, and its ability to increase distributions in the future.

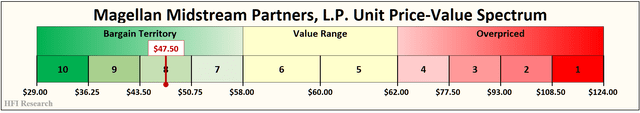

We expect the repurchases to continue. In June of 2021, MMP announced the sale of its independent terminal assets for $435 million. It took the company a year to receive regulatory approval, but it finally closed the sale on June 8. We expect management to allocate the lion’s share of the proceeds toward unit repurchases. However, given management’s discipline, we expect it to only do so if the units trade below $50. Since last Friday, MMP units have declined by 10.9%, from above $53 to $47.50. This should allow management to repurchase units as aggressively as possible. We hope they’re buying hand over fist.

Valuation

We value MMP units in the range of $58 to $62. We’re setting our price target at $60, the middle of the range.

In 2022, we expect MMP to generate a cash flow surplus of at least $150 million. Combined with the proceeds from the asset sale and the company should generate more than $550 million of cash flow that management can allocate as it sees fit. Since 2020, MMP’s debt balance has crept up by $600 million, so we wouldn’t be surprised to see management pay down some debt. We’ll assume that it allocates $250 million toward debt reduction and $300 million toward repurchases at $50 per unit in 2022.

We assume further that MMP uses a $150 million cash flow surplus in 2023 to repurchase 2.7 million units at $55 and a similarly-sized cash flow surplus in 2024 to repurchase 2.5 million units at $60. We also assume that MMP’s inflation-protected assets are able to increase the company’s free cash flow and Adjusted EBITDA by 4.0% and distributions by 3.5% each year through 2026.

Our free cash flow valuation indicates that the units are worth $58.87 in 2022 and that buybacks and free cash flow growth increase the value to $70.91 in 2026. Including distributions, our valuation implies that units bought at $48 will generate a 91.8% total return by 2026.

From an Adj. EBITDA perspective, our valuation indicates the units are worth $56.97 in 2022, somewhat less than indicated by the free cash flow valuation. However, their implied total return increases by 95.6% through 2026.

Conclusion

MMP’s underlying cash flow stability makes the units a low-risk alternative for conservative income investors. Even in a recession, the company’s throughput should hold up well. MMP’s equity remains one of the cheapest among the industry’s stalwarts, and we wouldn’t be surprised if it was acquired by a larger competitor. In the meantime, as long as its units continue to trade below intrinsic value, unitholders can count on management to buy back more equity. For these reasons, we believe MMP should be a part of every income portfolio and rate its units as a “Buy.”

Be the first to comment