Joe Raedle/Getty Images News

Investment Thesis

We followed up with an update on Block, Inc. (NYSE:SQ), as there have been significant developments in its market action since our previous article. We highlighted that we saw a short-term rebound opportunity as its price action was constructive. However, we urged investors to execute risk management strategies to protect their positions if our near-term thesis did not play out.

Given its sizeable revenue exposure to Bitcoin (BTC-USD), Square was also pummeled over the past month as Bitcoin plunged further in June, setting up lows not seen since December 2020. Also, its exposure to the BNPL space through Afterpay has been impacted, as BNPL players faced increasingly challenging competitive headwinds. In addition, they are also facing challenges with falling consumer demand and rising rates. Therefore, we believe the multiplicity of significant headwinds forced SQ down from the previous near-term support it held since February 2022.

As a result, we believe the market dynamics have shifted toward re-testing its subsequent support zone. Given recent developments, we also remodeled our valuation analysis to assess the market’s current perception of its valuation.

Therefore, we believe revising our rating on SQ from Buy to Hold is appropriate. We urge investors to be patient before considering adding exposure.

The Market Didn’t Like Its Bitcoin Exposure

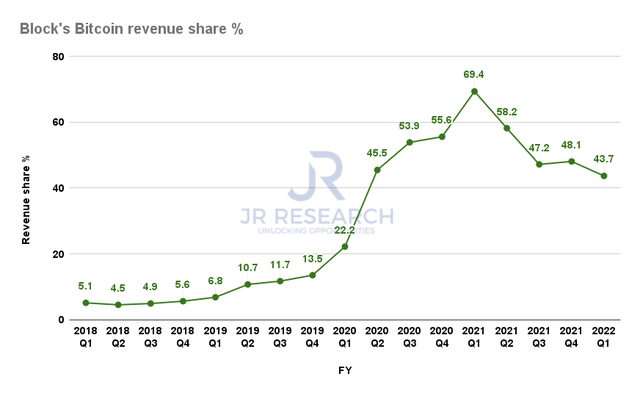

Block Bitcoin revenue share % (Company filings)

Given Block’s pivot to crypto and blockchain from its core payments business, Bitcoin has consistently accounted for a sizeable share of its revenue since 2019. Block reported a Bitcoin revenue share of 43.7% in FQ1, down from the heights of 69.4% in the previous year.

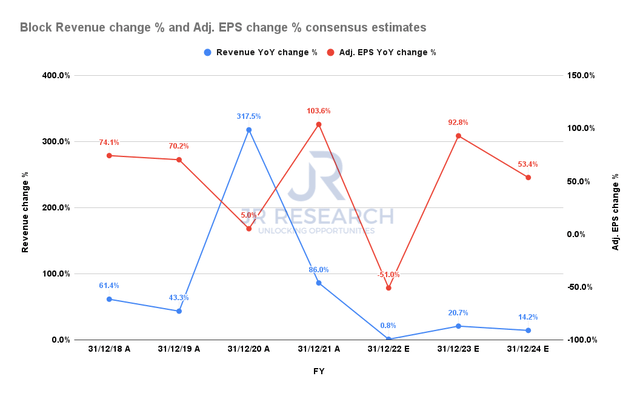

Block revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

As a result, the Street has also revised its estimates to factor in the impact of crypto winter. Coupled with the current macro headwinds, the Street downgraded Block’s FY22 revenue growth to just 0.8%. It’s significantly down from FY21’s 86%. In addition, Bitcoin’s surge and collapse have impacted the variability in Block’s revenue, leading to tremendous uncertainty in the market.

Notwithstanding, the Street’s consensus remains cautiously optimistic about its recovery from FY23. We believe these estimates do not reflect a prolonged economic downturn. As such, we believe the market has priced them into SQ’s valuation. Therefore, investors should be prepared for a further markdown if the economic conditions worsen further than expected.

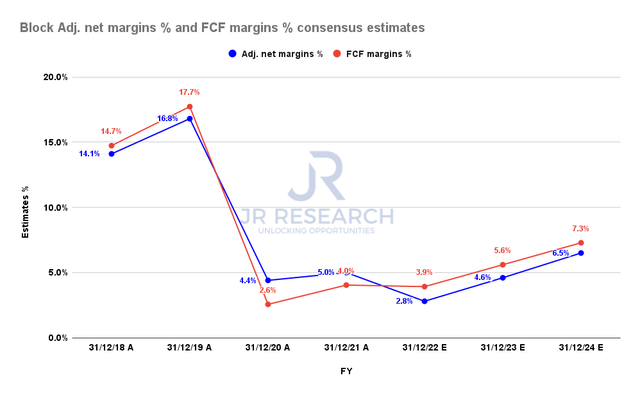

Block adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

However, one of the key hurdles that has hampered Block’s valuation in the face of slower topline growth is its profitability. As seen above, Bitcoin’s low-margin revenue model has significantly diluted Block’s adjusted net margins. Consequently, it has also impacted Block’s free cash flow (“FCF”) profitability, whose performance is closely linked to its net margins. Moreover, the consensus estimates suggest its relationship could continue through FY24.

As a result, we believe the market has focused on assessing Block’s valuation based on its ability to generate sustainable profitability, given its dramatic moderation in revenue growth.

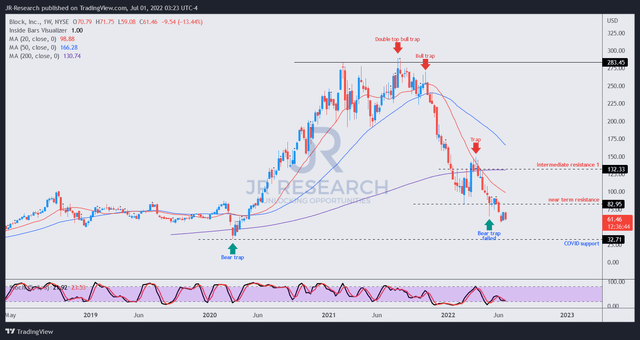

SQ – Broke Down From Its Support Decisively

SQ formed a validated bear trap (significant rejection in selling momentum) in early May. However, it has been invalidated by the decisive breach of its previous near-term support (now its near-term resistance). We were awaiting a potential re-entry signal which would have revalidated its bear trap.

However, the market has demonstrated its conviction to break its previous support; therefore, our last PT of $130 is no longer in play.

SQ’s price action remains tentative. However, investors should be prepared for a steeper fall if it forms a bull trap (significant rejection in buying momentum) close to its near-term resistance.

The Market Has Likely De-rated Block’s Valuation Further

| Stock | SQ |

| Current market cap | $35.76B |

| Hurdle rate (CAGR) | 10% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 4% |

| Assumed TTM FCF margin in CQ4’26 | 7% |

| Implied TTM revenue by CQ4’26 | $31.38B |

SQ reverse cash flow valuation model. Data source: S&P Cap IQ, author

Given the decisive break in its price action, we believe the market is asking for higher FCF yields to compensate for the potential of higher implied macro and crypto risks. Our valuation model indicates that the market expects SQ to slightly underperform at its current valuation.

We raised our FCF yield to 4% to account for higher implied risks and markedly slowing revenue growth. As a result, based on a TTM revenue target of $31.38B by CQ4’26 (which should be achievable), it indicates an implied hurdle rate of 10%.

As such, we believe the market has significantly de-rated the performance profile of SQ.

Is SQ A Buy, Sell, Or Hold?

We revise our rating on SQ from Buy to Hold.

For a close to market-perform 10% hurdle rate, we believe there are other higher-quality stocks to choose from. Otherwise, other opportunities from well-beaten down growth stocks could provide a much better risk/reward profile to deliver potential market outperformance.

Also, our price action analysis indicates some caution is warranted. We believe the market could be staging another potential bull trap before forcing a steeper sell-off. Notwithstanding, the current price action remains tentative, and we urge investors to be patient.

Be the first to comment