SIphotography/iStock via Getty Images

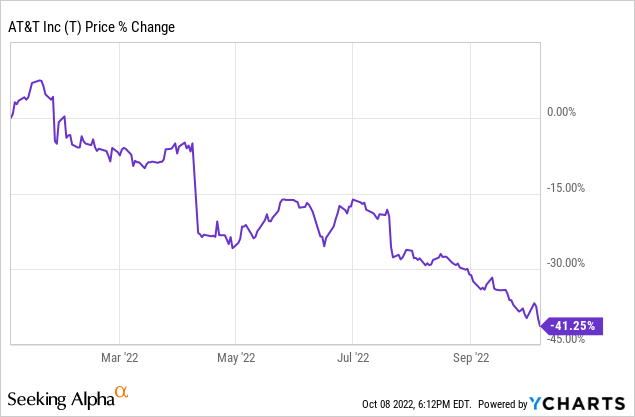

AT&T (NYSE:T) stock has gotten absolutely pummeled this year, even underperforming the S&P 500 (SPY) by nearly two-to-one despite the index having one of its worst years in a long time.

We have been persistently bearish or neutral on T stock for several years now. Over that period, we have constantly heard variations of the same refrain from bulls over and over again:

T offers an exceptional dividend yield that is very safe, making it an excellent pick for retirees.

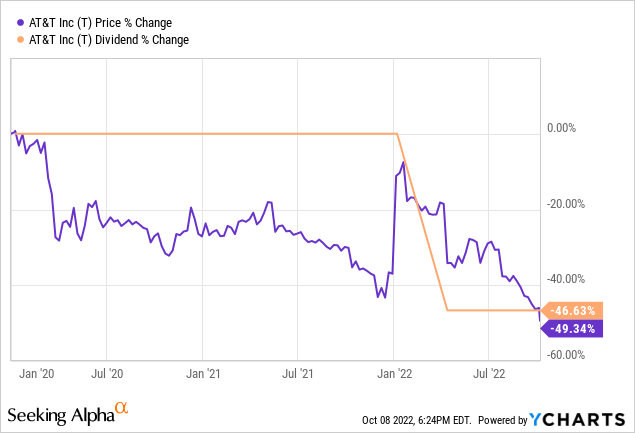

Well, that mantra has not worked very well at all. Since the beginning of 2020, T has seen its dividend per share slashed deeply while its share price has lost nearly half of its value:

Yes, there was a spinoff involved there that recoups some of that loss in principal, but even when counting that, the principal and income erosion delivered by this stock in a little over 33 months has been catastrophic for retirees and anyone else who bought it for income and safety.

That said, what about moving forward? Has the stock finally fallen enough to make this company and its 7.4% dividend yield worth buying? In our opinion, while we do not think the company is overvalued right now, we also think investors should be prepared for disappointing income and share price growth moving forward. Here are three reasons why.

#1. AT&T’s Abysmal Track Record

T’s track record has already been discussed, but it is worth elaborating on it further to show why we are very hesitant to place our hard-earned capital into the hands of this company.

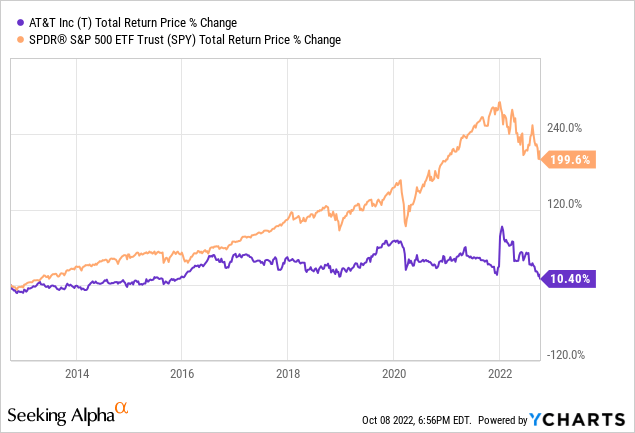

T has excelled at destroying shareholder capital for quite some time now, including effectively destroying $67 billion through its failed acquisition of DirectTV along with billions of dollars in additional write-offs for other fool-hardy ventures. As a result, T has badly lagged the SPY over the past decade, generating a meager 10.4% return over that period of time (equating to a less than 1% CAGR over that span) despite the broader stock market having one of its best decades ever:

On top of that, T’s reckless leveraging of the balance sheet to pay for bad businesses forced them to not only end their impressive 36-year dividend growth streak and Dividend Aristocrat status, but ultimately led to them spinning off their growthiest businesses in an attempt to deleverage while also slashing their dividend.

With all of this garbage in the rearview mirror, it would take a highly compelling valuation to interest us.

#2. Still Too Much Debt

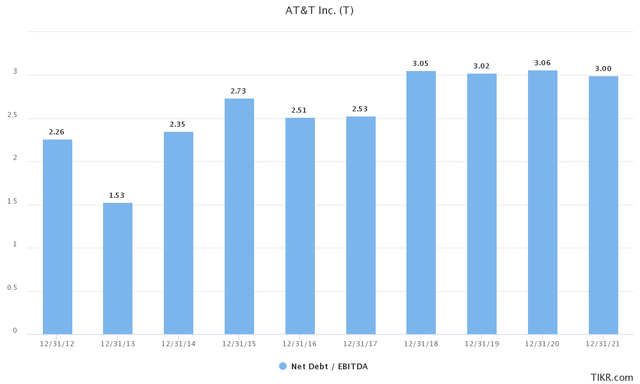

In addition to its troubled past, T is still grappling with a heavy debt burden. As management admitted at a recent investor conference:

we’re going to…get the balance sheet in order, as we get to 2.5x debt-to-EBITDA and ensure that by the end of 2025, we’re in a much better place in that regard…we’re using discretionary money to get the balance sheet back in order.

What does this mean? Well, it simply means that management acknowledges that its leverage ratio is too high, especially in a rising interest rate environment where debt refinancing will undoubtedly become more costly. As a result, all “discretionary money” is going to be put towards reducing debt. This means that investors can say goodbye to buybacks and any meaningful dividend growth for the next several years. Given its slow-growth business model, a lack of shareholder capital return growth does not bode well for outstanding returns, barring meaningful valuation multiple expansion. However, as we will see in the next section, the prospects for that are not great either.

#3. T Stock’s Unexciting Valuation

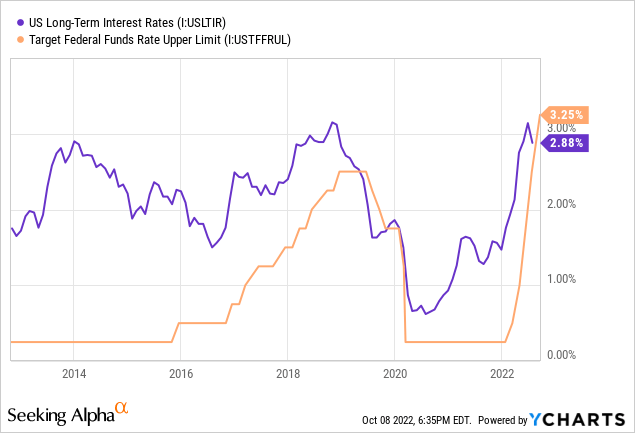

In addition to the company’s poor track record and need to focus excess cash on improving the balance sheet, T’s valuation is also not anything to get particularly excited about. Despite its recent catastrophic stock price decline, T’s EV/EBITDA is still higher than its historical average (6.8x vs 6.4x). Perhaps most telling is the fact that its current EV/EBITDA of 6.8x is identical to its 10-year average of 6.8x while long-term and short-term interest rates are either at or near 10-year highs:

As a result, there is little to no case to be made that T is undervalued based on these metrics, whereas there is actually a decent case still to be made that it is overvalued. This is particularly the case when you consider its past track record of delivering horrible results for shareholders and its current issues with needing to focus on debt reduction rather than accelerating growth investments/shareholder capital returns.

Granted, its dividend yield and price to earnings ratios look much more attractive relative to T’s 10-year averages (6.1x vs 11.3x and 7.4% vs 5.9%), but it is also important to keep in mind that interest rates are higher today too (thereby leading to a higher discount rate) and its leverage ratio is also at the high end of its 10-year range, which makes its P/E ratio and dividend yield look more attractive than they would be otherwise.

Last, but not least, it is also important to keep in mind that we are expected to face increased economic hardship and higher interest rates for at least the near future, so this will undoubtedly weigh on T’s results and makes its current valuation look even less appealing.

Investor Takeaway

Ultimately, while T’s selloff certainly makes the stock more palatable today than it was earlier this year, it still does not trade at a cheap enough valuation to get us excited about buying or even simply being bullish on the stock. When you factor in its terrible track record, continued issues with getting its leverage ratio down, and the increasingly challenging economic environment, we continue to remain on the sidelines with T and believe investors buying today will likely be disappointed, especially relative to other opportunities in the market today.

Given that T’s track record is so terrible, it is clearly not a growth stock in any way shape or form (analysts forecast a meager 2.1% earnings per share CAGR through 2026 and a microscopic 0.4% dividend per share CAGR over that time span), and its EV/EBITDA valuation is not attractive either, what exactly is the reason for owning T stock now?

Be the first to comment