Christina Radcliffe/iStock via Getty Images

This article was co-produced with Cappuccino Finance.

All year we’ve been dealing with persistent market volatility.

It started with a surging Covid variant late last year.

Then the Federal Reserve’s tightening monetary policy rocked the market.

By the time we thought the bad news was over, Russia invaded Ukraine and created a new wave of market volatility.

The combination of an ultra-easy money policy, high energy costs, and supply chain bottlenecks has led to the highest inflation since the early 80s.

It just feels like a continuous flood of bad news this year.

High-quality REITs can offer some nice gains along with peace of mind during times like these.

Since they have a strong portfolio and balance sheet, we know that they aren’t likely to experience a financial mishap.

Also, an economic downturn will have less impact on their business because of their quality tenants and well-managed debt maturity schedule.

Collecting a juicy dividend from high-quality REITs is a great strategy during this period of volatility.

A few days ago, I wrote about 3 SWANs (stands for sleep well at night), so in this article I decided to focus on 3 SWAN-a-Bees.

What’s a SWAN-a-Bee?

That’s a company that is on the cusp of being a SWAN, and perhaps just one or two dividend increases away from this elite classification of dividend growing stocks.

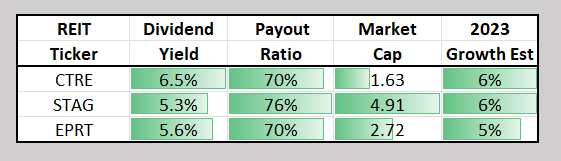

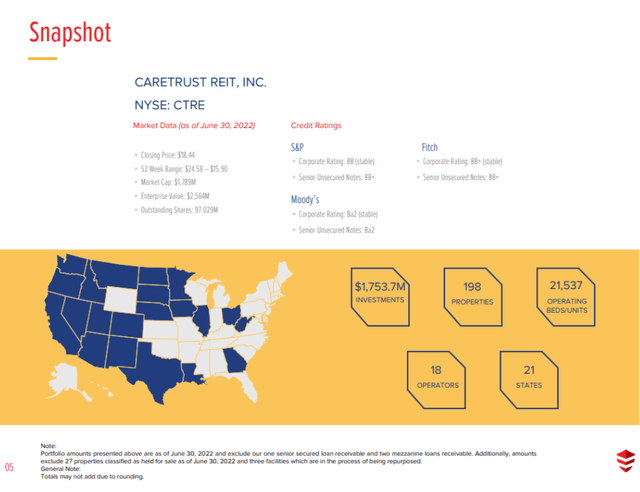

CareTrust REIT (CTRE)

CareTrust owns, acquires, develops, and leases properties to nursing, senior housing, and healthcare related operators.

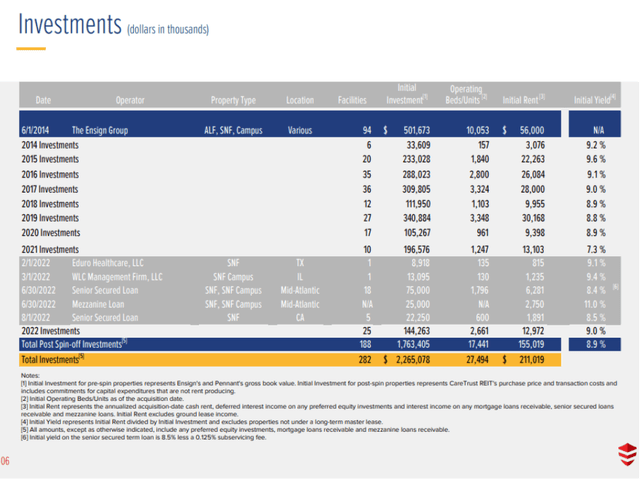

They generate revenue primarily by leasing the properties to healthcare operators in triple net lease agreements. CareTrust REIT holds almost 200 properties over 21 states, and they have over 20,000 operating beds/units.

In the past several years, CareTrust has been growing nicely. Their AFFO growth averaged 6.33% (5-year CAGR), while dividend growth rate averaged 8.5% (5-year CAGR).

Given their pattern of consistent investment, it is not surprising to see this expansion of their property footprint and profit.

CareTrust has been regularly acquiring new facilities and upgrading their current ones, and this will drive AFFO and dividend growth in the future.

CareTrust is also doing great job at managing risk.

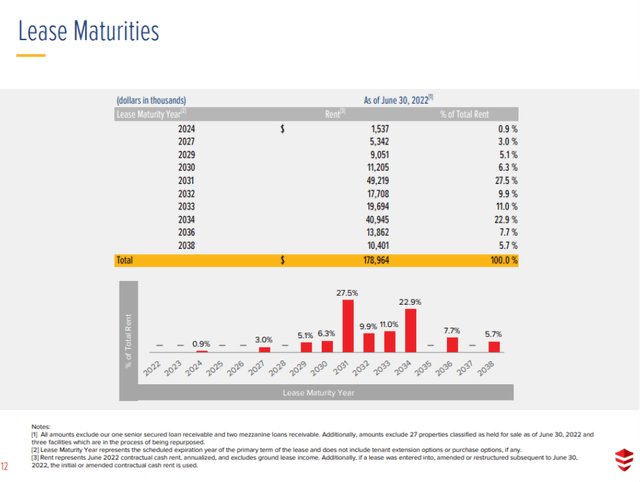

Looking at their lease maturity schedule shows that there isn’t a significant maturity until 2031, and the overall maturity schedule is very well spread out.

Also, their properties are geographically very well diversified. They have properties in 21 different states, and no state represents more than 30% of their total rent.

So, a local market slump won’t have too big of an impact on CareTrust’s overall performance.

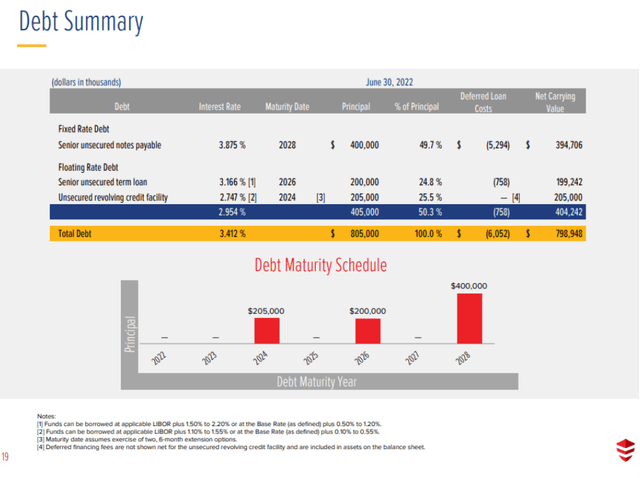

For the REIT to grow, it is critically important to manage their debt properly, and CareTrust is doing a great job at that. They have until 2024 before significant debt maturity, and the debt is evenly spread out afterwards.

Also, the weighted average interest rate is a manageable 3.4%. I don’t think CareTrust will be seeing a dividend cut anytime soon.

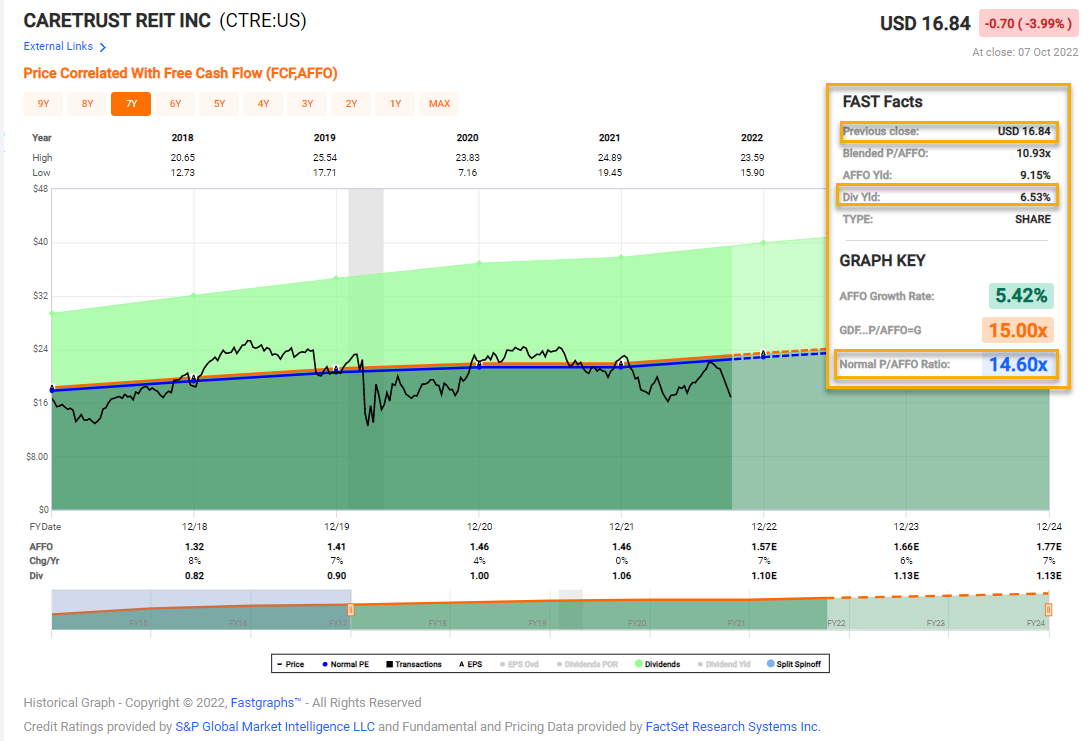

CareTrust’s stock slumped in the past couple of months, and it is significantly undervalued at this point. The valuation metrics like P/AFFO (11.56x) and P/FFO (12.17x) are significantly lower than their historical average.

This slump in stock price also pushed up the dividend yield (5.98%), which now looks quite attractive. Their dividend is also safe, as demonstrated by their cash dividend payout ratio (70.43%) and FFO payout ratio (73.73%).

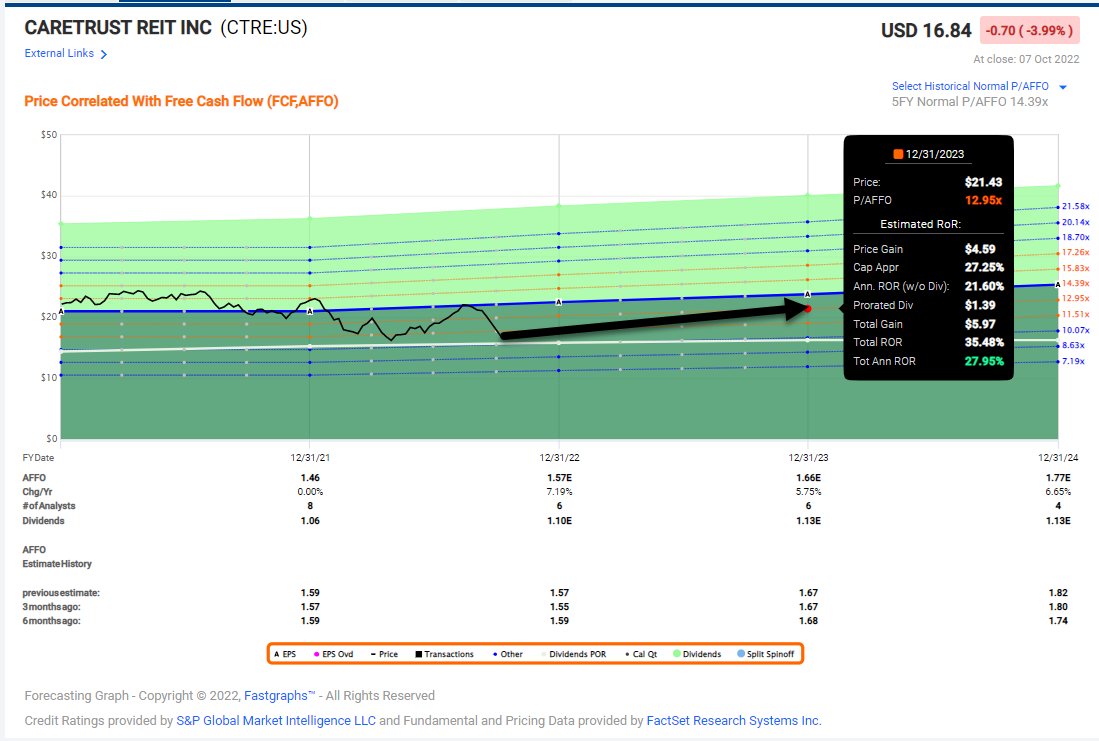

FAST Graphs

Surging inflation, rising interest rates, and fears of a recession have soured sentiment towards CareTrust’s short-term outlook and brought down the stock price.

However, CareTrust has a strong portfolio and stable capital structure. I expect them to thrive in the future, and now is a good time to buy this stock.

FAST Graphs

Essential Properties Realty Trust (EPRT)

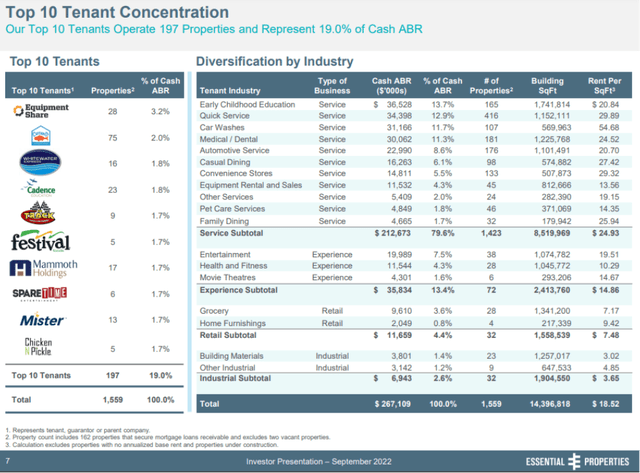

Essential Properties Realty Trust acquires, owns, and manages single-tenant properties using net lease agreements.

They have a diversified portfolio of properties in key locations, and their tenants include early childhood education, car washes, restaurants, medical services, convenient stores, and fitness centers.

Essential Properties has more than 1,500 properties over 46 different states in their portfolio, giving a total footprint that exceeds 14 M square feet. As of June 30th, 2022, their properties are 99.9% leased.

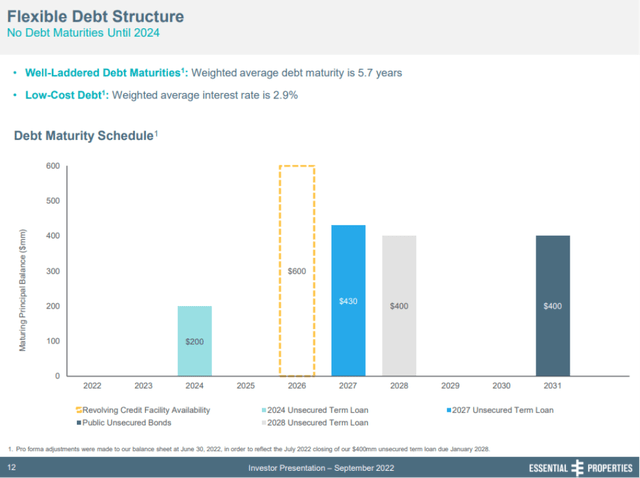

The backbone of Essential Properties’ growth is their strong balance sheet.

They have low leverage with a net debt to EBITDA of 3.9x and excellent liquidity (~$1.0 B). Also, their debt is well laddered, and the cost of their debt is nice and low (weighted average interest rate at 2.9%). There is no significant debt maturity until 2024, and the debts are well spread afterwards.

Their portfolio is very well diversified.

Their largest tenant represents only 3.5% of the portfolio, and the most represented industry (early childhood education) is only 13.7% of the total portfolio.

Also, 93% of Cash ABR comes from service-oriented and experience-based tenants, which means their portfolio is resistant to e-commerce.

Combining this diversified portfolio with unit level stability (unit-level rent coverage: 4.0x), Essential Properties presents low volatility with a stable growth trajectory.

During the most recent quarter, Essential Properties stayed active in investing ($176 M investment through 23 transactions), and the demand for their properties remained solid (99.9% leased).

They also disposed of 8 properties for $26.1 M (6.2% weighted average cash yield) to raise capital for future investment.

Net income was $35.8M for the quarter, and total FFO was $54 M ($0.41 per share), which was 28% higher than the same period last year. Thanks to their strong performance and solid outlook, management raised their 2022 AFFO per share guidance from $1.50-$1.53 to $1.52-$1.54.

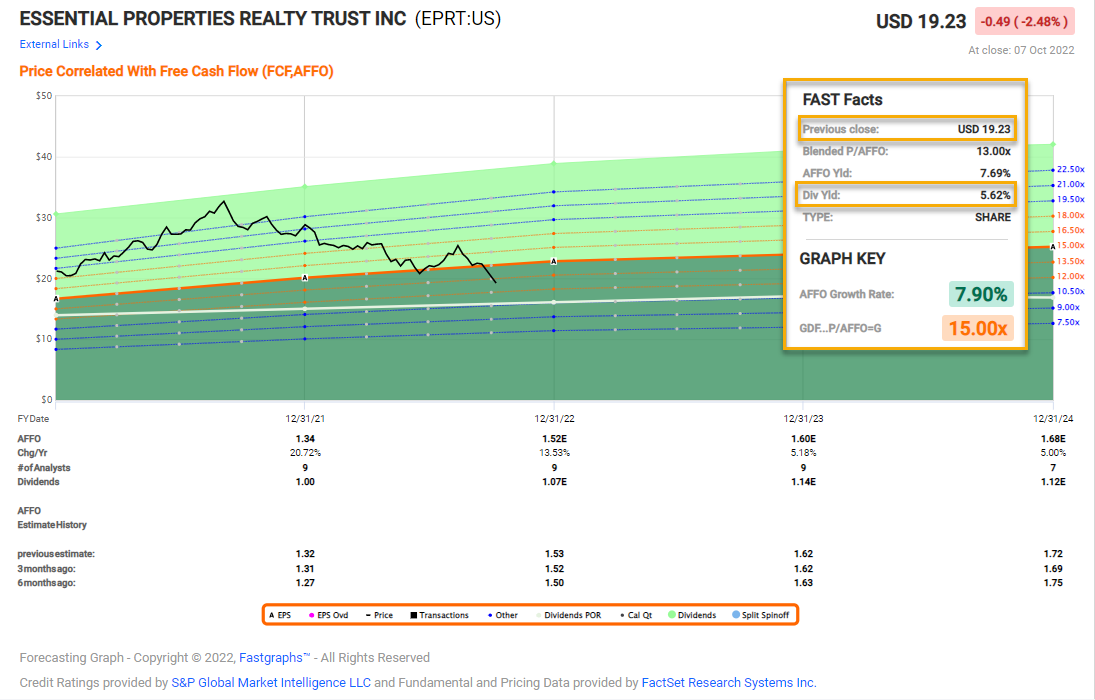

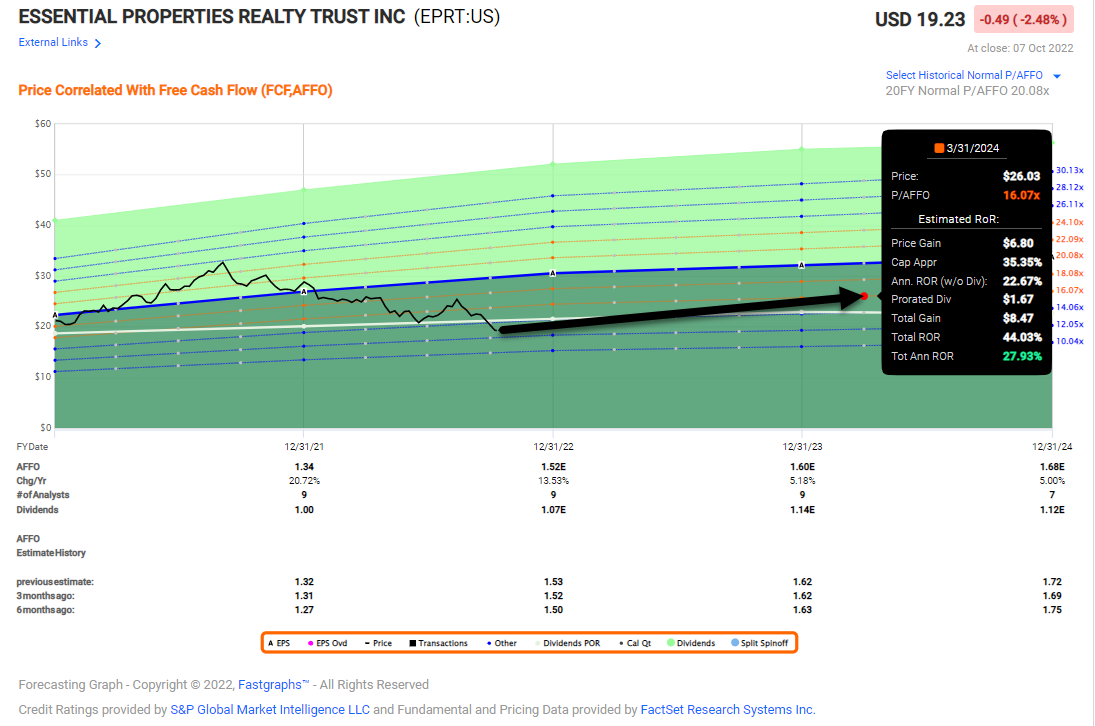

FAST Graphs

According to iREIT’s rating, Essential Properties is undervalued, offering a 28% margin of safety. Their current valuation figures such as P/AFFO (15.41x) and P/FFO (12.64x) are significantly lower than historical levels.

These low valuation numbers also indicate that the stock price is undervalued at this point. This would be a good time for investors to grab shares of this high-quality net lease REIT. The dividend yield of 5.7% looks very attractive as well.

Fear of a recession has worsened the outlook for the retail industry, and negatively impacted REITs like Essential Properties. However, given their diversified portfolio and strong demand for their properties, I expect Essential Properties will see nice gains in the long run.

FAST Graphs

STAG Industrial (STAG)

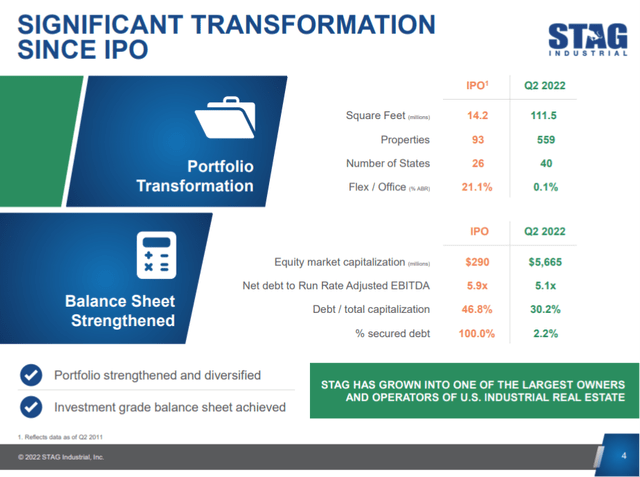

STAG Industrial acquires, owns, and operates industrial properties in the U.S. They have over 500 buildings in 40 states (over 100 million square feet), and their buildings are over 95% leased to more than 500 different tenants. Since their IPO in 2011, they have been consistently expanding.

Their leverage level has consistently declined, while their footprint of building square footage has increased substantially.

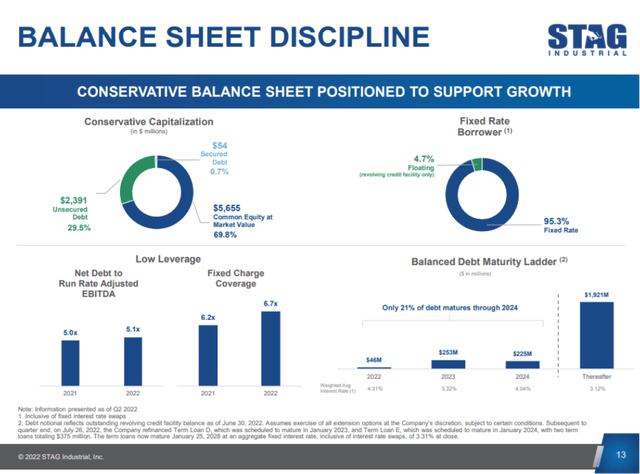

STAG Industrial has been doing a great job at maintaining a conservative balance sheet to support growth. Their Net Debt to Adjusted EBTIDA rate is slightly above 5.0x, and fixed charge coverage is at 6.7x.

Only 21% of their debt matures through 2024, and the rest of the debt is evenly spaced afterwards.

Combining this strong balance sheet with ample liquidity, STAG Industrial has been steadily growing through acquisitions and developments. I expect the trend to continue well into the future.

STAG Industrial saw solid performance in the past quarter. Their Core FFO per share was $0.56, which was 7.7% higher than last year. The same store NOI continued to grow and has been a big contributor to their solid performance.

Cash available for distribution was $87.2 M for the quarter, and the figure represents a 16.6% gain compared to the previous quarter. This solid performance led to an increase in their same-store guidance, from a range of 4% to 4.5% to a new range of 4.25% to 4.75%.

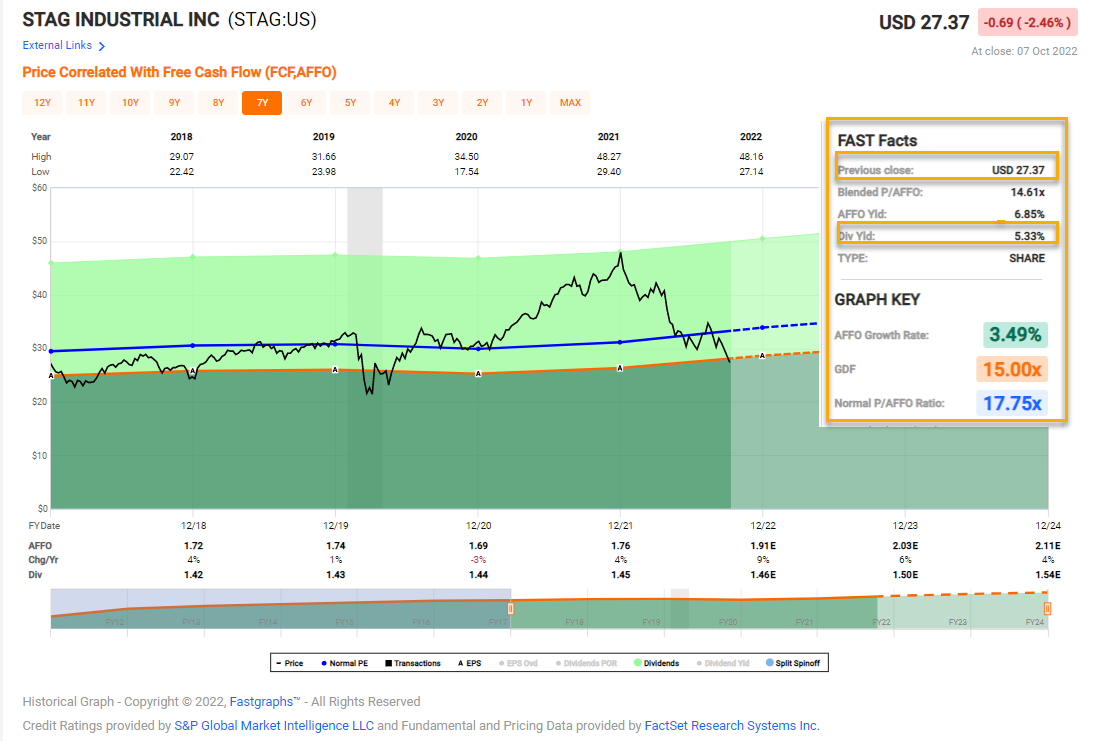

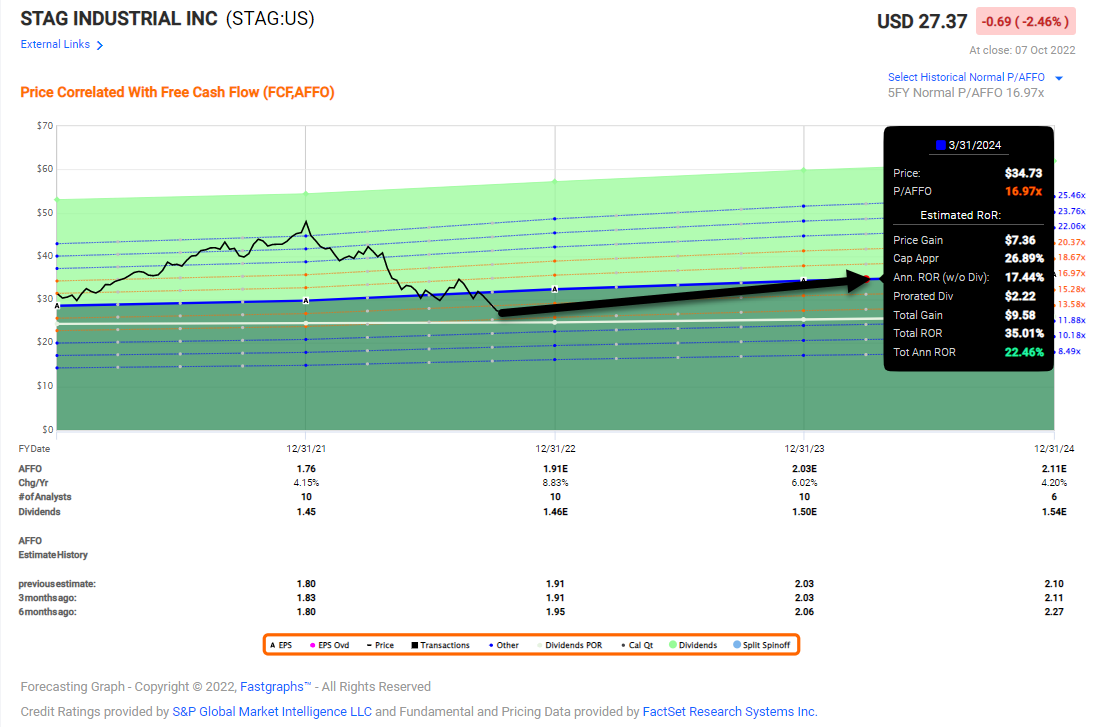

FAST Graphs

STAG Industrial is undervalued at this point. Their P/AFFO (15.04x) and P/FFP (13.29x) are significantly lower than their historical average.

Also, based on iREIT Alpha’s ratings tracker, the current stock price represents a 22% margin of safety. The 5.2% dividend yield is also very attractive, given the quality of their portfolio and strong balance sheet.

FAST Graphs

Risk is Inescapable

“You’re unlikely to succeed for long if you haven’t dealt explicitly with risk.” – Howard Marks

As some REIT CEOs have noted, the high interest rate environment has created turmoil in the commercial real estate market.

There will be fewer opportunities for acquisitions and growth in the near term.

This shouldn’t have a long-term impact on the growth trajectory for these three REITs, but it may negatively impact their profit and dividend growth in the near term (although we believe all of these REITs will continue to grow their dividend).

The economic slowdown may decrease the availability of capital, and a high interest rate environment may worsen margins.

With less capital availability and liquidity, the pace of acquisition and development may slow, and high debt servicing costs may increase expenses substantially.

“Skillful risk control is the mark of the superior investor.” – Howard Marks

Important Conclusion

Volatility will likely continue for the rest of the year and into the early part of next year.

As inflation persists, the Federal Reserve will maintain their hawkish tone, and the stock market will continue to struggle.

These 3 Swan-a-Bees listed in the article have a strong balance sheet and solid portfolio to carry them through the economic slowdown.

Also, they have a solid growth plan in place to drive profit and dividend growth over the long term.

These three high quality REITs are great options that could allow an investor to enjoy solid dividend growth right now and capture an upside in the future when the bull market returns.

“A skilled and sophisticated investor can look at a portfolio in good times and divine whether it’s a low-risk and high-risk portfolio.” – Howard Marks

iREIT on Alpha

Be the first to comment