Feverpitched

The current bear market has surprised many investors in both its duration and severity. No one can precisely tell where an absolute bottom may happen, and those who are trying to predict one are largely missing the point of long-term wealth creation. That’s because money is made when one buys quality stocks that are trading at a discount, and not by trying to predict a bottom, because no investor can do that with absolute certainty.

This brings me to Schwab U.S. REIT ETF (NYSEARCA:SCHH), which holds a number of high quality names that are now trading well in bear market territory. In this article, I highlight whether if SCHH is a buy or hold at the current price, so let’s get started.

Why SCHH?

The Schwab US REIT ETF is focused on tracking equity REITs, and excludes the more volatile mortgage REIT segment. This means that SCHH does not include residential mortgage REITs such as Annaly Capital (NLY) and AGNC Investment (AGNC), which are more volatile and sensitive to interest rates.

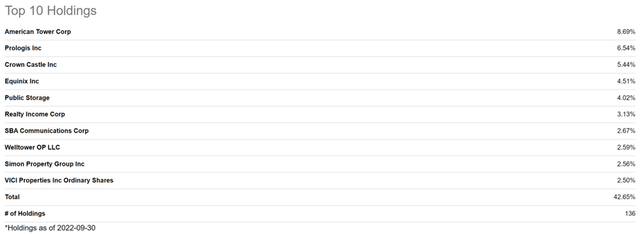

Moreover, SCHH is heavily weighted towards well-respected and moat-worthy REITs with strong balance sheets. This includes the cell tower juggernauts American Tower (AMT) and Crown Castle Inc. (CCI), industrial giant Prologis (PLD), data center giant Equinix (EQIX), and a popular favorite among retail dividend investors, the net lease Realty Income Corp. (O). As shown below, these are among SCHH’s top 10 holdings, which comprise a very high 43% of the total portfolio.

While no investment is risk-free, SCHH’s top holdings do indeed have sleep well at night attributes. For instance, I recently wrote a piece about Crown Castle Inc, which operates over 40K cell towers and 85K+ miles of fiber. I remarked how cheap it’s gotten, especially considering its moat-worthy attributes and strong forward growth prospects, as highlighted here:

CCI enjoys a very steady and growing revenue stream from its towers, which represent around 70% of revenue. That’s because once a cell tower is in place and leased out, there are high switching costs that disincentivize tenants from leaving. This, combined with the proliferation of mobile devices over the past 2 decades has given CCI site revenue growth every year, including through two recessions. This trend has continued this year, with site rental revenues growing by 10% YoY during the second quarter.

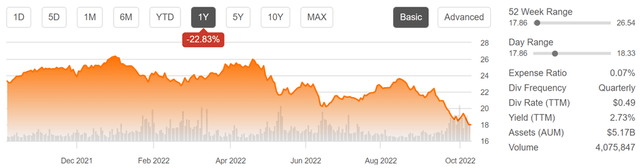

Furthermore, SCHH carries a low expense ratio of just 0.07%, well below the 0.45% median expense across the entire ETF universe. This goes a long way in helping to preserve shareholder returns. Some ETFs charge high expense ratios at or above 1% and while that may not seem like much, this can meaningfully dent investment performance over the long-run due to compounding. SCHH’s expense ratio is also easily covered by its trailing 12-month dividend yield of 2.7%.

Turning to performance, SCHH has gotten really cheap on a technical basis and is now in oversold territory with an RSI score of 28 (score of 30 or below is considered to be oversold). It’s now trading just a tad above its 52-week low of $17.86, and well below its 52-week high of $26.54. It’s fairly obvious that the market has soured on real estate due to higher interest rates.

However, I view the negative sentiment as being overblown, as SCHH’s top holdings carry strong balance sheets and have long-weighted remain terms on debt. This gives REITs plenty of time to raise rents on new and renewal leases while they gradually refinance debt.

Fortunately for investors, SCHH isn’t the only game in town when it comes to Real Estate ETFs. The Vanguard Real Estate ETF (VNQ) is a top one that comes to mind. Like SCHH, VNQ also counts many top tier REITs among its top 10 holdings, and yet, through better allocation, has managed to outperform SCHH over the trailing 5 and 10 years. As shown below, VNQ produced a 75% total return over the trailing 10 years, comparing favorably to SCHH’s 54%. Moreover, VNQ sports a higher 4.0% dividend yield, sitting well above SCHH’s 2.7%.

Investor Takeaway

SCHH is a quality real estate ETF with a low expense ratio, and pays a decent dividend yield. It’s also gotten cheap in recent months due to negative market sentiment around rising rates, and I view the market reaction as being overblown. However, SCHH isn’t the only game in town, as it’s been outperformed over the trailing 5 and 10 years by VNQ. At this point, I believe investors could do better by simply buying VNQ instead.

Be the first to comment