adventtr/iStock via Getty Images

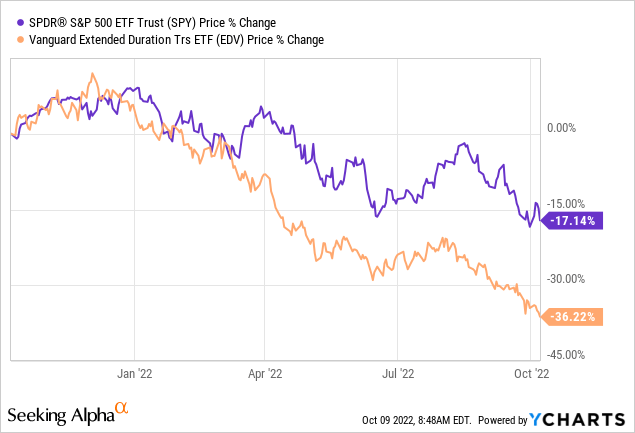

The global chaos running through the fixed income assets has been greater than that seen on stocks. You have doubts about what we said? Well, look at the chart below comparing the returns of S&P 500 (SPY) versus the Vanguard Extended Duration Treasury ETF (EDV). Which would you have liked to have owned over the past 12 months? Take your time.

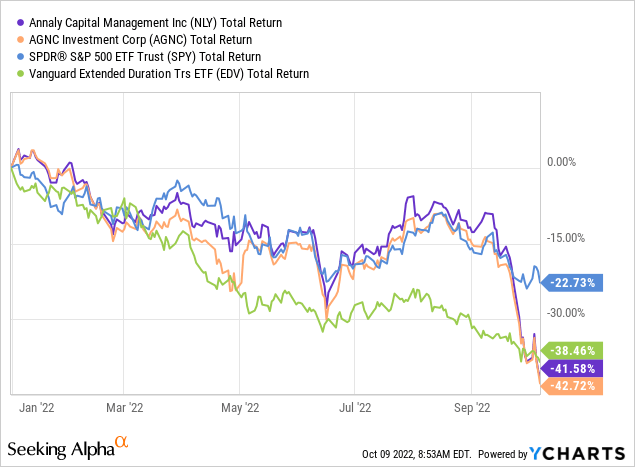

Our 60:40 portfolio dodged most of this madness by refusing to buy return-free-risk, bonds. While we turned from bearish to neutral in May 2022, we still are wading very carefully in these waters and staying out of risky plays. An extension of that thinking is staying out of mortgage REITs like AGNC Investment Corp. (NASDAQ:AGNC) and Annaly Capital Management Inc. (NYSE:NLY). Total returns including distributions have been exceptionally negative for both.

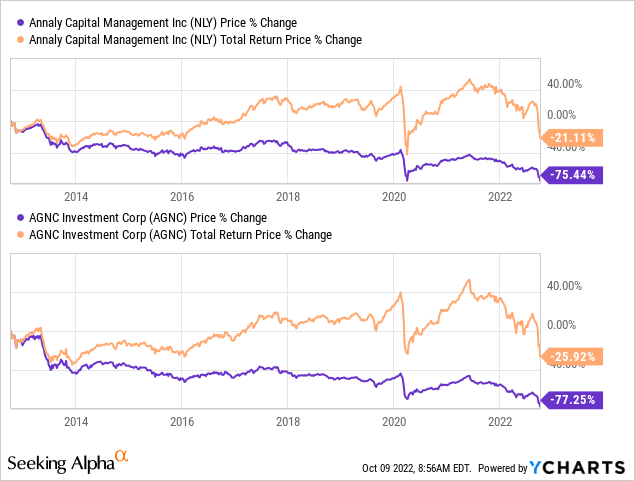

One aspect that frequently comes up here is whether someone should own their preferred shares. Our general answer has always been “if you have to go into this dangerous area, do so only with the protection of preferred shares.” That has worked out of course. Preferred shares have provided positive returns over the last decade and common shares with and without dividends reinvested look like this.

The two have a lot of preferred shares (yes one has been purposefully left out) to choose from.

- AGNC Investment Corp. 6.12 DP SH PFD F (NASDAQ:AGNCP)

- AGNC Investment Corp. 6.5% DP SH PFD E (NASDAQ:AGNCO)

- AGNC Investment Corp. 6.875 DEP REP D (NASDAQ:AGNCM)

- AGNC Investment Corp. CUM 1/1000 7% C (AGNCN)

- Annaly Capital Management, Inc. 6.95% PFD SER F (NYSE:NLY.PF)

- Annaly Capital Management, Inc. 6.75% PFD SER I (NYSE:NLY.PI)

- Annaly Capital Management, Inc. PFD SER G (NYSE:NLY.PG)

That said, we don’t own the preferred shares. So here is why.

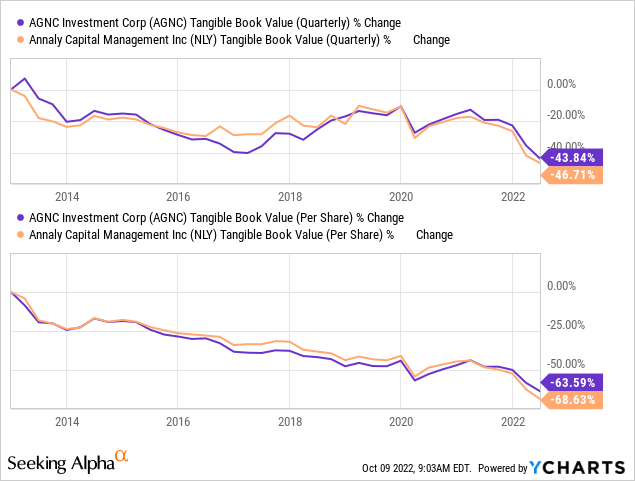

1) We Prefer (Pun Intended) Companies That Grow More Valuable Over Time

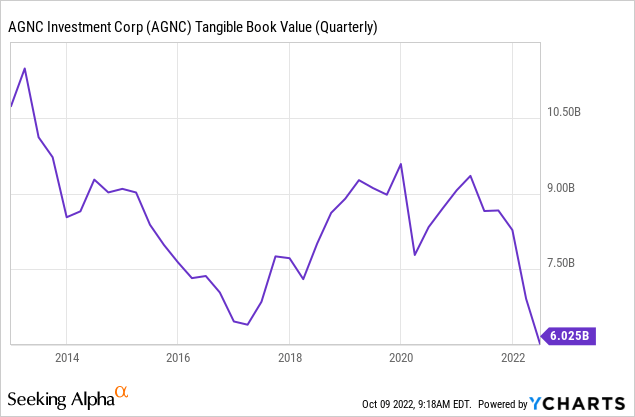

Preferred shares are a claim on the balance sheet and tangible equity over time. While we don’t get capital appreciation from them in general, we do want to see the collateral (read tangible equity) increase over time. So when we get a picture like this, it does not inspire us one bit.

We will note that the drop in total tangible equity is less than tangible book value per share. That is of course the result of stock issuance and stock dilution. This is not something we would complain about if we were to take a position in the preferred shares. In fact, it is something to be celebrated, as dilution of the common shares enhances safety of the preferred. Nonetheless, those declines are not something an investor wants to see. A quick word here for those that will apply this to US equity REITs. Don’t. Mortgage REIT analysis works great with GAAP. For US equity REITs, this GAAP measure is useless.

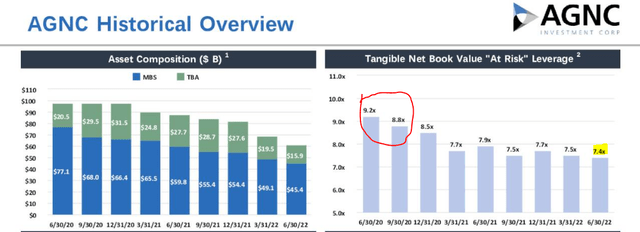

2) We Prefer Less Leverage

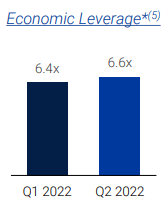

Mortgage REIT preferred shares do pay high yields, but come with extreme leverage. That leverage means that real coverage is extremely weak. Historically, AGNC ran with over 8.0X leverage at points and on last check was at 7.4X.

NLY was running at 6.6X.

NLY Q2-2022 Presentation

Keep in mind that these are multiples of total net book value. So the leverage on the common shares (if you use preferred shares as debt equivalent) is even higher. You tend to get paid 1.0% to 1.5% more for these shares than other types of preferred shares, but to us, this is generally not worth it.

3) Preferred Share Relative Risks Are Higher Today

Here is AGNC’s common equity over time.

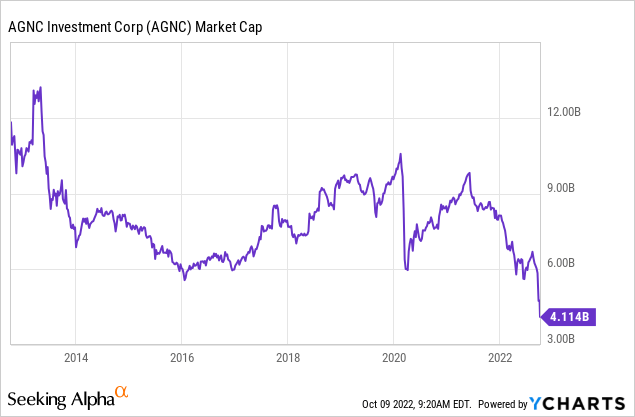

That goes till Q2-2022. Current book values are incredibly hard to ascertain on account of mortgage rate volatility and the lack of knowledge of how much selling has occurred on the way down. But it would be fair here to use AGNC’s stock equity capitalization.

So tangible book value is close to $4.5-$5.0 billion today.

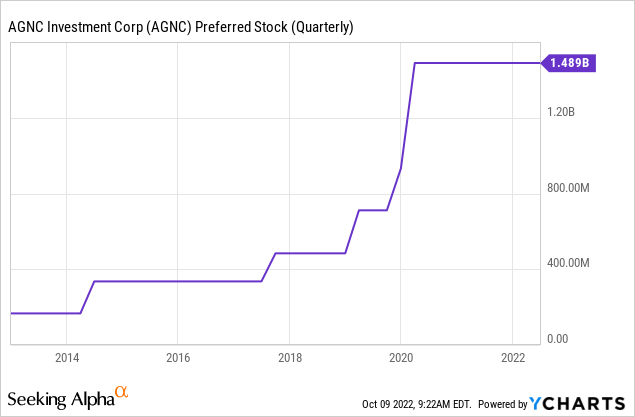

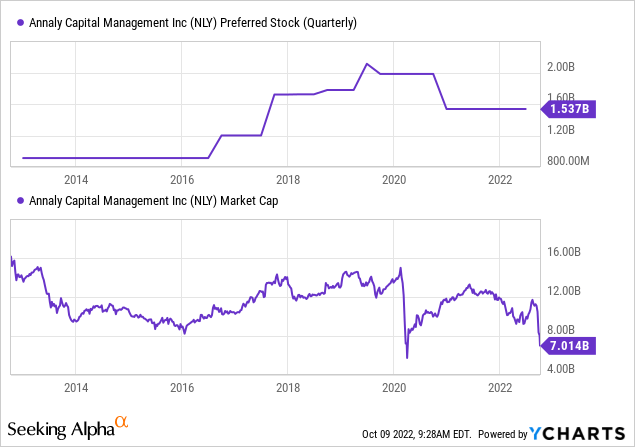

Ok, now let’s look at preferred share Par value outstanding over time. This is also a 10 year chart.

This ignores the recently issued AGNC Investment Corp. 7.75% DP PFD G (NASDAQ:AGNCL) shares which came after Q2-2022 and hence is not included in those numbers. When we add that in we are over $1.6 billion. Tell me again, how safe do you feel in those preferred shares when the common equity buffer is being blown to smithereens?

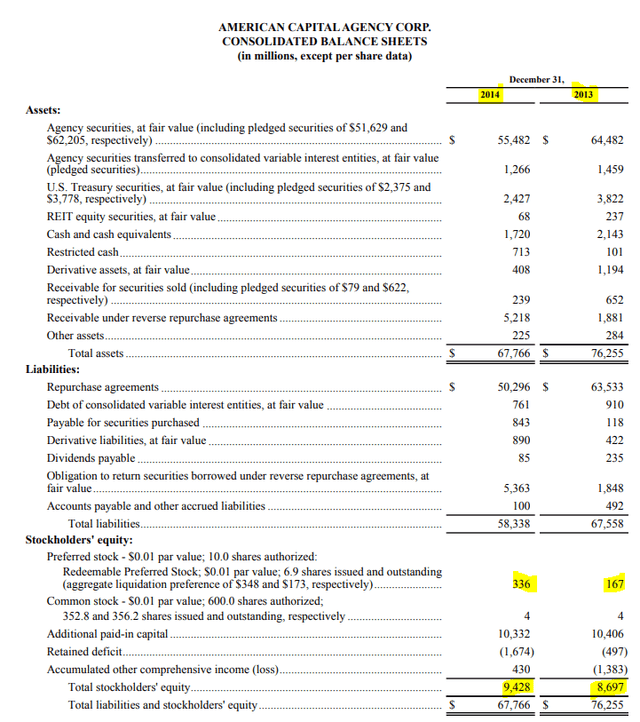

In case any one has any doubts about the Y-Chart numbers (we actually did), here are the 2013 and 2014 balance sheet numbers showing $167 and $336 million of preferred shares outstanding respectively.

NLY’s relative change is better (preferred shares outstanding have moved up less), but the risk is way higher than 10 years ago when preferred shares were just 5% of equity market capitalization.

Verdict

We don’t want to yell “fire” in a crowded theatre. Of course, one could argue that this theatre of mortgage REITs is already on fire and people are running out. We also don’t want to present a long term analysis while ignoring that you could get a nice bounce at any time on such oversold conditions. This can make the dime chasers look brilliant with a quick 15% gain. But take a 50,000 foot view of this and ask yourselves, is the reward of this dividend worth it? Yes, preferred shares are supposed to be safer and of course they are safer than the common equity. To us, the risks are not worth it, especially with full blown curve inversion coming soon. If we had to choose, we would buy the preferred shares of some other mortgage REITs, where the setup is better.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment