bjdlzx

Shares of EOG Resources (NYSE:EOG) have been an excellent performer this year, gaining over 57%. The company has obviously been a major beneficiary of higher oil and gas prices, enabling it to dramatically increase shareholder returns via special dividends. At the same time, it is investing sufficiently to grow production. With its stellar balance sheet and stringent investment criteria, EOG is a best-in-breed operator that is well-positioned to perform across economic cycles.

Of course, like any exploration and production (E&P) company, EOG’s cash flows will be tied to the performance of oil and gas. Arguably more so than companies in any other industry, E&P companies have little control over the price they sell their product for, which as we have seen in the past few years can swing wildly. If you believe oil prices were going to $50, for instance, you’d likely be best to avoid the sector altogether. To me, the backdrop looks more constructive.

Last week, OPEC+ announced a 2 million barrel/day cut in production quotas. OPEC is working to keep oil prices higher and putting a floor under the market, limiting the potential downside to oil even as economic activity slows. In markets, you often hear, “don’t fight the Fed.” In the oil market, I’d amend that to “don’t fight OPEC.” When you are investing in EOG, you have OPEC+ on your side. That shifts the risk/reward in your favor from the start.

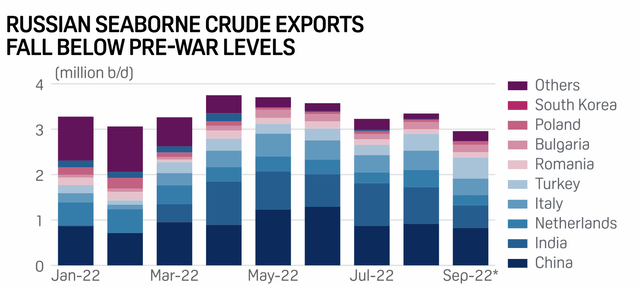

Beyond OPEC+ being committed to keep the market from getting oversupplied, I still see risks of the market getting tighter. In particular, Russian export volumes continue to fall as our technology export bans weigh on their fields’ performance. Later this year, Europe is poised to ban Russian oil, threatening to take more of their supply off of the market. There is also the possibility that Russian President Vladimir Putin could voluntarily withhold oil to increase economic pain on the West, just as he has natural gas. These create upside risk to prices. Plus, with the Strategic Petroleum Reserve down to a forty-year low, the amount of crude released onto the market will likely be lower the next six months than the past six months, a positive for prices all else equal.

S&P Global

In addition to being an oil producer, EOG also produces natural gas. Much has been made of the fact European prices have skyrocketed this year as it has tried to buy more LNG in the export market as Russia has reduced exports to zero with the Nordstream 1 pipeline even being blown up. As difficult as this winter may be for Europe, it is important to remember that Russia was supplying Europe with gas through the first six months of 2022, albeit at a declining pace. With Nordstream offline, 2023 Russian exports to Europe will certainly be lower than 2022. In other words, high natural gas prices are more than a one-time event, they will persist for some time, and I expect EOG to benefit given its marketing strategy discussed below.

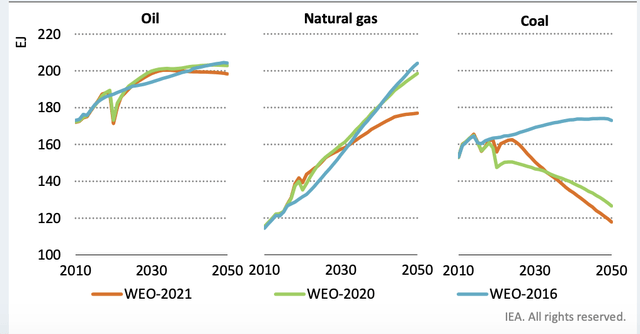

Finally, I know that there is always some concern that the regulatory push away from fossil fuels endangers this industry’s long-term prospects. Keep in mind that the International Energy Agency expects oil demand to rise through 2030 and only modestly fall while natural gas demand will rise through 2050. Given Russia may be structurally losing market share, the outlook for non-Russian production is even better. We will be using oil & gas for a very long time.

International Energy Agency

Given this favorable industry backdrop, I see EOG as a high-quality way to benefit. During the company’s second quarter, it earned $2.74 and generated $1.3 billion in free cash flow, leading to a $1.50 special dividend. EOG has committed to returning a minimum 60% of free cash flow to shareholders. Consequently, it pays a variable dividend on top of a base $0.75 dividend, so while its stated yield is 2.35%, shareholders effectively receive a much higher yield.

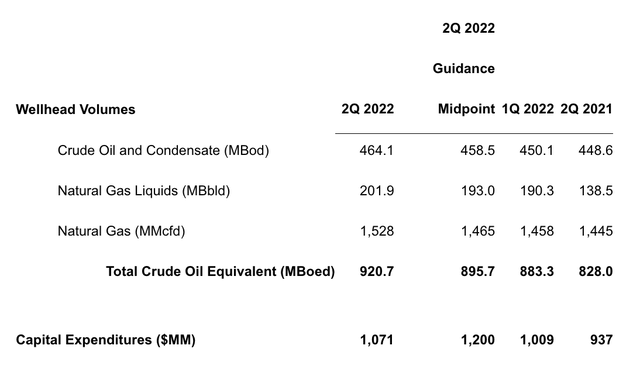

Impressively, the company managed to beat the midpoint of its production guidance while also undershooting its cap-ex plans for the year. Overall, production rose 4% sequentially with a slight tilt toward natural gas.

What impresses me most about EOG is just how disciplined management runs the business. This pervades every aspect of the company. It maintains a pristine balance sheet. It holds $3.1 billion in cash and equivalent and just $5.1 billion in debt. That $2 billion net debt position is just a fraction of its $74 billion market capitalization. Because it does not maintain much debt, EOG is able to withstand downturns when they occur better than peers, so while firms like Occidental Petroleum (OXY) had to cut dividends during past downturns, EOG maintained it.

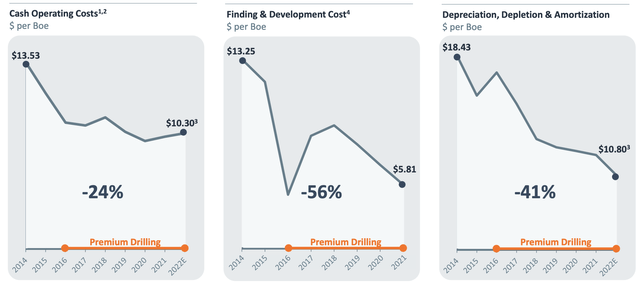

EOG is equally disciplined in controlling costs. Operating costs fell by 1% to $10.12, an all the more impressive feat considering how fast overall inflation is running. This cost control extends beyond any single quarter. EOG has cut drilling times by 42% since 2018 while also reducing sand and water costs by 46%. These efforts have led to dramatic cost savings that have resulted in making EOG more profitable and leaner.

This mindset also applies to how it manages its production growth and capital program. For the full year, oil equivalent production is set to rise about 9% to about 905 thousand barrels of oil equivalents a day. The $4.5 billion in cap-ex spending is up from $3.76 billion last year. Importantly, it screens all investments against $40 oil and $2.50 natural gas. It will not green-light expensive projects that only make sense when oil is near $100 and saddle shareholders with losses if oil prices fall. Its cap-ex programs will make shareholders money even if prices fall. Because of its investment hurdles, it is expanding most aggressively in the high-return Delaware Basin of the Permian alongside operations in the Eagle Ford.

While it is increasing cap-ex spending in a moderate way to enable high-single-digit production growth, it still is poised to generate $7.5-8 billion in free cash flow for the full year. As a consequence, I would expect H2 special dividends of about $3 for a $9.30 in special and ordinary dividends off of 2022 results, providing an over 7% yield.

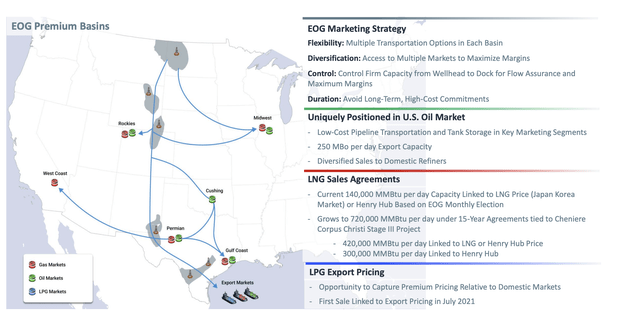

Finally, it is important to note that in Q2, EOG realized $108.42 on oil and $7.17 on natural gas, receiving $2.84 above the WTI benchmark and $0.60 above Henry Hub. Ignoring the impact of hedges (the company spent about $1.2 billion during Q2 to reduce hedges and give shareholders more benefit from rising prices going forward). EOG has consistently sold its product for a premium vs benchmark prices. This is because it has secured multiple transportation routes out of its key fields, enabling it to direct product to where prices are the highest.

What I would highlight is that EOG has lined up growing LNG sales agreements. Europe is paying a significant premium for natural gas over our domestic market as it replaces lost Russian imports. Demand for US-exported LNG should continue to grow in coming years as Europe pivots from Russia and natural gas continues to take share from coal in electricity generation. With a first mover advantage in locking down agreements and US LNG export capacity likely to grow over the medium term, I expect EOG to benefit from higher natural gas realizations over time.

EOG is trading less at about 9x free cash flow, for a free cash flow yield of about 11%. Importantly, EOG is generating this free cash flow even as it invests enough to grow production, increasing its cash flow potential. Its excellent balance sheet and relentless cost reductions also position it well for downturns, but with OPEC+ supporting prices and Russian production at risk, the fundamental backdrop is quite positive.

Investing in such a high-quality company at a double-digit free cash flow yield, particularly when that free cash flow is poised to grow over time, is an attractive opportunity that will yield good long-term returns. I would be a buyer up to an 8% free cash flow yield, at which point its combined special and ordinary dividend yield will be about 5%. That would give EOG about 30% of upside to about $165. EOG has been an excellent performer the past year, but it isn’t too late to buy in.

Be the first to comment