Sundry Photography

Thesis

We present a timely update to our post-earnings article on ASML Holding N.V. (NASDAQ:ASML), as the market forced it down steeply in the September selloff as it closed in on its July lows.

We had encouraged investors to consider waiting for a pullback before adding exposure, as it demonstrated a topping price structure, highlighting caution is appropriate. Notwithstanding, we remain confident in the robustness of its July lows, which was also shown in its recent bottoming process.

Furthermore, ASML remains confident in its execution in ramping its revenue growth in FY23 despite facing significant supply chain challenges in FY22. Moreover, revenue recognition from its fast shipments should also help its revenue growth recover markedly in FY23. Notwithstanding, the company cautioned that a deeper-than-expected recession could affect its recovery cadence, forcing its customers to potentially push out CapEx builds as they ride through the semi and economic downturn.

However, we assess that the market had adequately de-risked ASML’s valuations relative to its historical average, even though it still trades at a premium against its wafer fab equipment (WFE) peers.

Accordingly, given the pullback, we revise our rating from Buy to Strong Buy. We urge investors to use near-term downside volatility to pick up more positions and ride with the EUV lithography leader through the cycle.

The Market Had De-Risked ASML’s Valuation

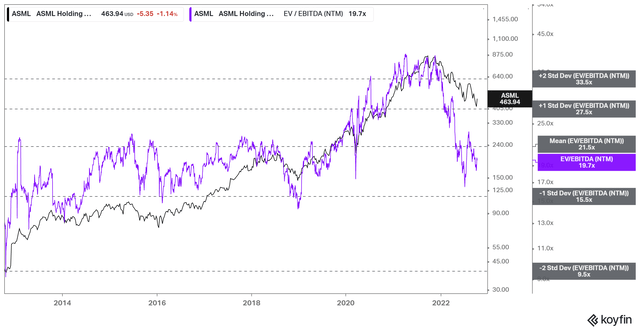

ASML NTM EBITDA multiples valuation trend (koyfin)

As seen above, ASML’s NTM EBITDA multiples fell quite close to the one standard deviation zone under its 10Y mean in July. That zone also supported ASML’s long-term uptrend over time. While we cannot rule out that more CapEx pushouts could lead the market to de-rate ASML further, we believe the current valuation is attractive from a reward-to-risk perspective.

ASML highlighted in a recent September conference that it had yet to see demand destruction from its customers for orders through FY23. Furthermore, given the supply chain disruption, it has been unable to fulfill all its orders. As a result, its revenue growth has already faced these headwinds as it looks to normalize its supply chain.

Therefore, we believe that unless the pushout is so significant, the consensus estimates (bullish) are unlikely to be impacted markedly. Accordingly, we think it justifies our optimism about its valuations at the current levels for investors to consider adding exposure more aggressively.

Its Major Customers Are Still Looking To Invest Aggressively

ASML highlighted that the nearshoring/onshoring of the semi supply chain has also lifted its expectations on advanced nodes equipment to support these strategic initiatives.

For instance, Micron (MU) committed to a capital commitment of up to $100B to build its leading-edge facility in upstate New York, even though it revised its CapEx spending recently for 2023. Hence, we believe the underlying secular drivers underpinning ASML’s lithography equipment remain robust and could even accelerate due to geopolitical drivers.

Samsung (OTCPK:SSNLF) also highlighted that “it would triple the amount of advanced chips it produces in the next five years,” as it sees robust medium- to long-term demand for its leading-edge products, despite the near-term headwinds.

Given ASML’s long-term order book visibility, we believe it offers investors clarity on the company’s revenue stability, despite the worsening macroeconomic headwinds.

Therefore, we encourage investors to look ahead, given the significant battering in its stock and attractive valuations.

Despite that, we must highlight a critical risk investors must consider. The Biden Administration is looking to extend its export restrictions on the semi supply chain to hobble China’s efforts to ramp up its advanced nodes capability.

As such, investors should expect near-term downside volatility. However, we believe the secular long-term drivers in meeting demand ex-China remain intact. Furthermore, it already has EUV restrictions in place, lowering the impact of further restrictions on its equipment sales.

Is ASML Stock A Buy, Sell, Or Hold?

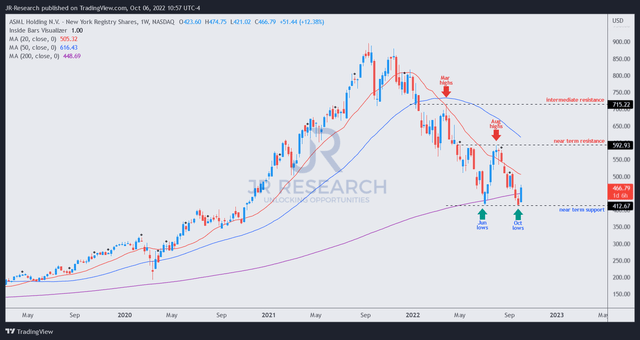

ASML price chart (weekly) (TradingView)

We observed that the recent selloff could have spooked some buyers off the train in September, as it sent ASML tumbling toward its July lows.

However, the pullback helped to de-risk the entry levels significantly for investors who bided their time. Moreover, the price action over the past week has been constructive, which also bodes well with our observation of its long-term chart.

Furthermore, the 200-week moving average (purple line) has been a robust pillar to underpin the recovery of its medium-term uptrend over time. As a result, we are increasingly confident that the current entry levels offer investors an attractive reward-to-risk profile.

As such, we revise our rating on ASML from Buy to Strong Buy. In addition, investors are urged to leverage potential downside volatility to add more aggressively, as the recent recovery could lead to some selling digestion.

Be the first to comment