Dr_Microbe

Trees that are slow to grow bear the best fruit.”― Moliere

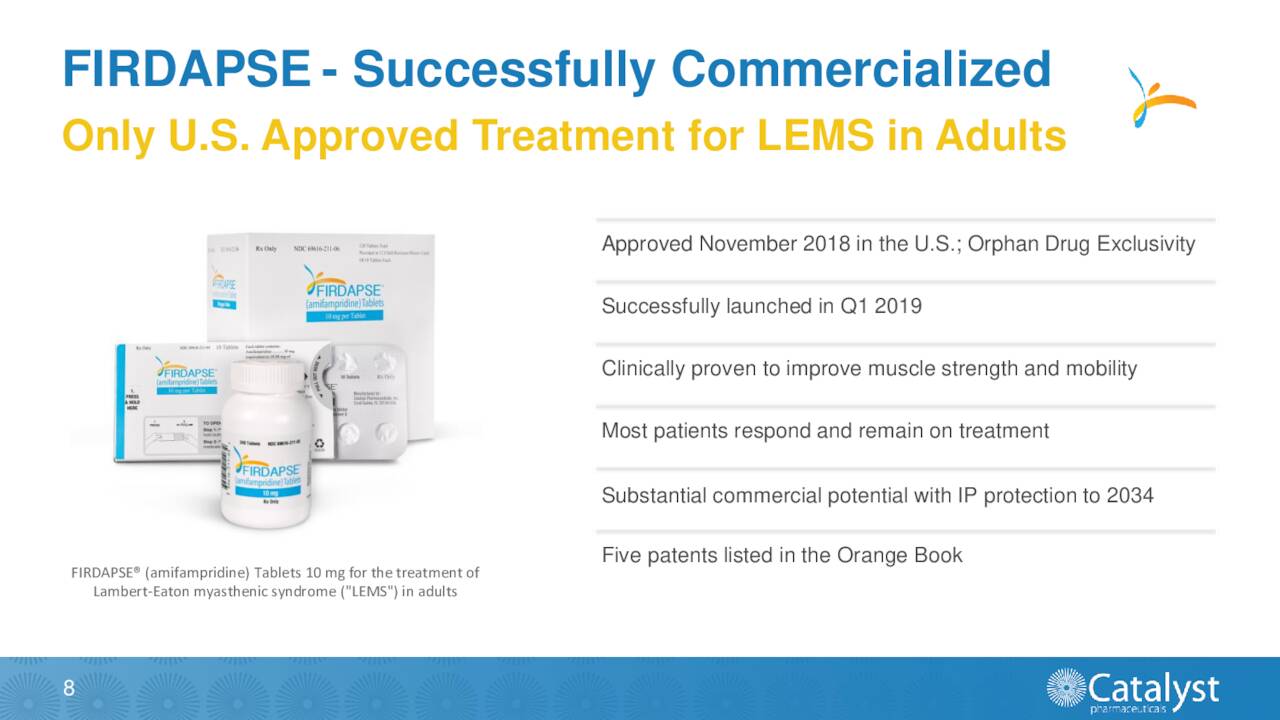

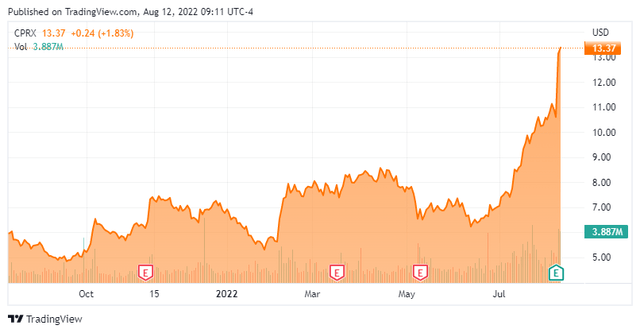

In our last article on Catalyst Pharmaceuticals, Inc. (NASDAQ:CPRX) last October, we recommended the stock as a solid covered call position or small “watch item” holding when the stock traded under six bucks a share. The stock has more than doubled since then as its autoimmune disorder therapy FIRDAPSE is gaining traction faster than expected. A potential new Orange Book Patent may extended exclusivity for this compound until February of 2037. FIRDAPSE currently has patent protection until 2034.

The company also recently posted much better than expected second quarter numbers and settled key litigation. Therefore, it seems a good time to revisit this fast-growing biopharma concern. An analysis follows below.

Company Overview:

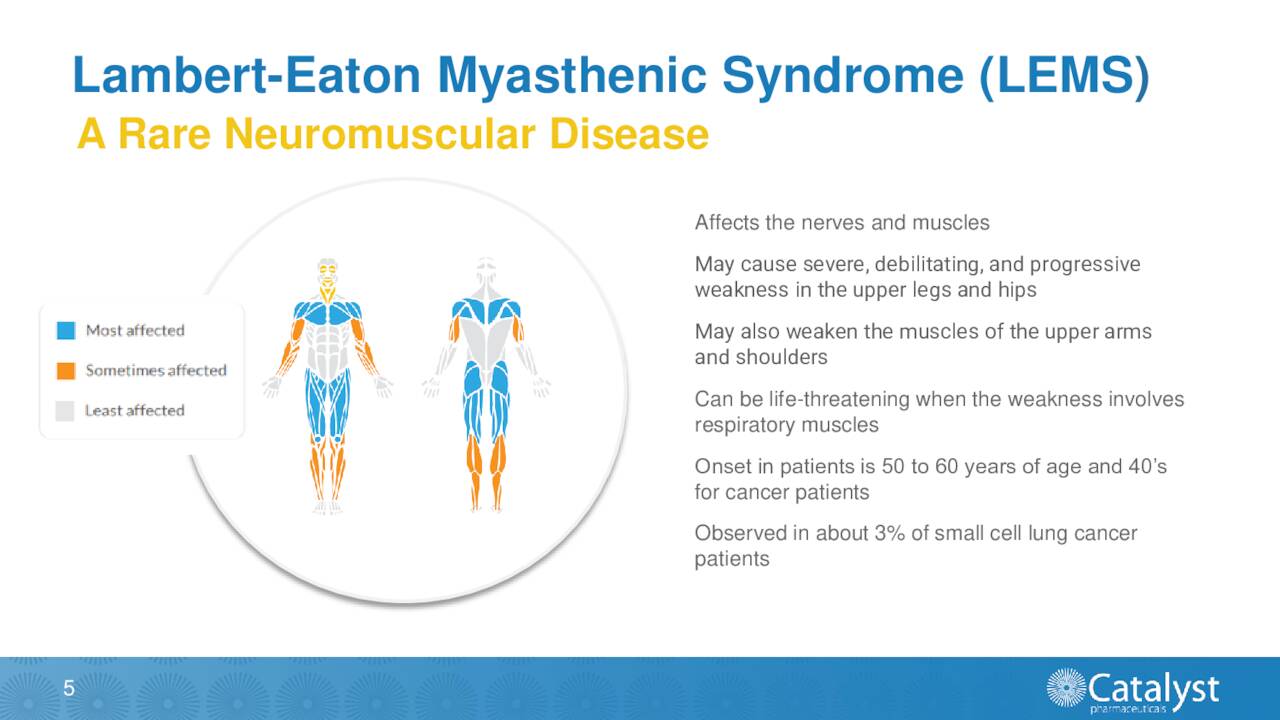

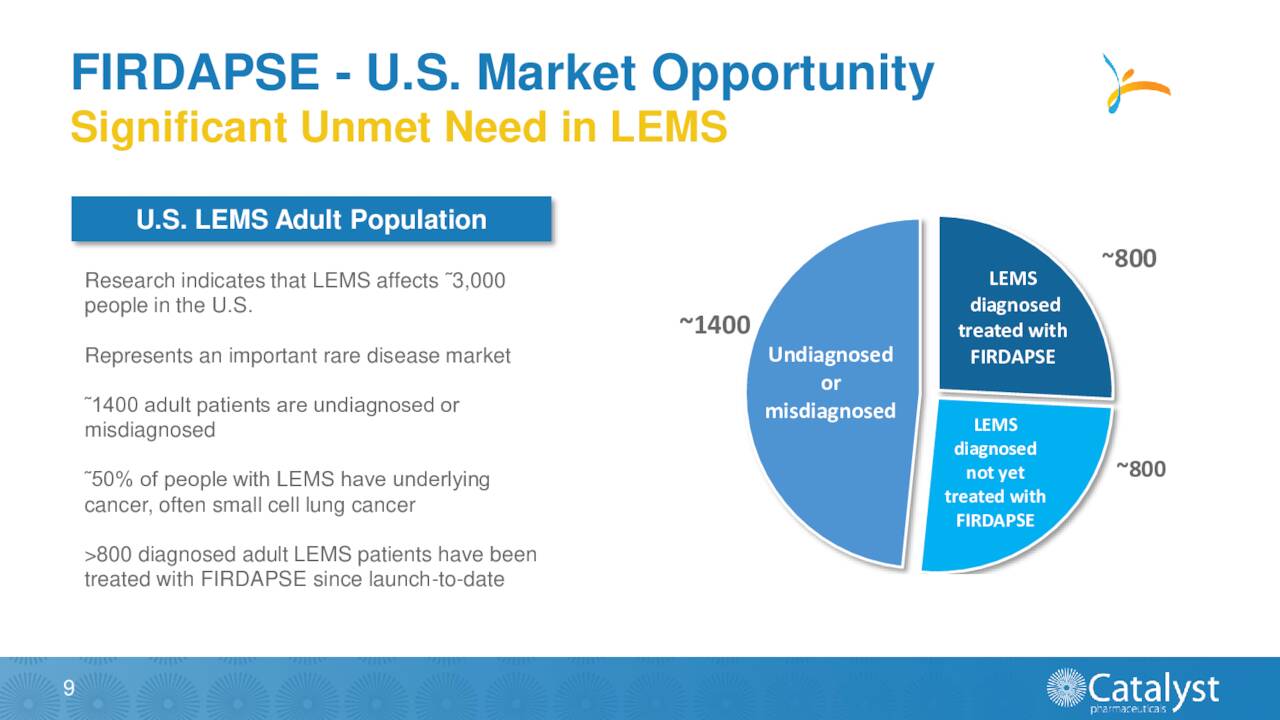

Catalyst Pharmaceuticals is based in Coral Gables, FL. The company is focused on developing and commercializing therapies for people with rare debilitating, chronic neuromuscular, and neurological diseases. Its primary product is FIRDAPSE which is an amifampridine phosphate tablets for the treatment of patients with lambert-eaton myasthenic syndrome or LEMS. This disorder affects approximately 3,000 individuals in the United States. The compound was also approved for Canada in 2020.

May Company Presentation

It also has Ruzurgi for the treatment of pediatric LEMS patients. It should be noted that the FDA has accepted the company’s supplemental NDA seeking approval for the use of FIRDAPSE as a treatment for pediatric LEMS patients The stock currently trades just north of $13.00 a share and sports an approximate market capitalization of $1.35 billion.

May Company Presentation

Second Quarter Results:

On Tuesday, the company posted second quarter numbers that easily beat both top and bottom line expectations. Catalyst had 28 cents a share of non-GAAP earnings as net product revenues rose over 55% on a year-over-year basis to $53 million. Net product revenues were up over 23% sequentially driven by the transition of Ruzurgi patients converting to FIRDAPSE treatment as well as robust organic growth. FIRDAPSE had 36% more naïve new enrollments in Q2 than in Q1 as well.

Despite the beat, management maintained full year guidance of $195 million to $205 million, which would represent 38% to 45% growth over FY2021. They did say they expect to be in the upper end of that guidance. Leadership also expects cash operating expenses of $65 million to $70 million in FY2022 with adjusted EBITDA in the range of $100 million to $105 million.

In early August, Catalyst Pharmaceuticals settled a patent infringement litigation with Jacobus Pharmaceuticals and PantherRx Rare. This was related to these companies’ marketing of Ruzurgi. Within this deal, Catalyst acquired specific Jacobus’ intellectual property rights, including the rights to develop and commercialize Ruzurgi in the U.S. and Mexico. Jacobus will get a small cash upfront payment and low single digit royalties on sales. Leadership noted:

Ruzurgi is not currently approved for distribution in the U.S. as the FDA converted Jacobus Pharmaceuticals’ Ruzurgi approval for pediatric use to a tentative approval after a U.S. Appeals Court declared that the approval of Jacobus’ application for Ruzurgi violated Catalyst’s orphan drug exclusivity for Firdapse to treat LEMS“

As part of this settlement, Catalyst acquired two U.S. patents related to Ruzurgi as well as the other company’s inventory of the drug.

Analyst Commentary & Balance Sheet:

Since second quarter results posted, Piper Sandler ($16 price target, up from $9 previously), H.C. Wainwright ($18 price target) and Truist Financial ($17 price target, up from $12 previously) have all reissued Buy ratings. Approximately eight percent of outstanding float of the shares are currently held short. The company ended the quarter with just over $220 million of cash and marketable securities against no long term debt. In March the company implemented a share repurchase program that has bought $19 million worth of shares through the first half of 2022. During its recent earnings conference call, management stated it had made “significant progress in their efforts to identify acquisition opportunities” so a “bolt on” purchase is a possibility on the horizon.

May Company Presentation

The Chief Medical Officer disposed of just over $1 million worth of his holdings in late June in the mid $6s – Oopsy… There has been no other insider activity in the stock so far in 2022.

Verdict:

The current analyst consensus has the company earning just under 70 cents a share as revenues rise more than 40% in FY2022. For FY2023, the analyst community has Catalyst earning roughly 80 cents a share on $235 million of revenue. Earnings/revenue projections are likely to move up in coming weeks due the big second quarter “beat.”

May Company Presentation

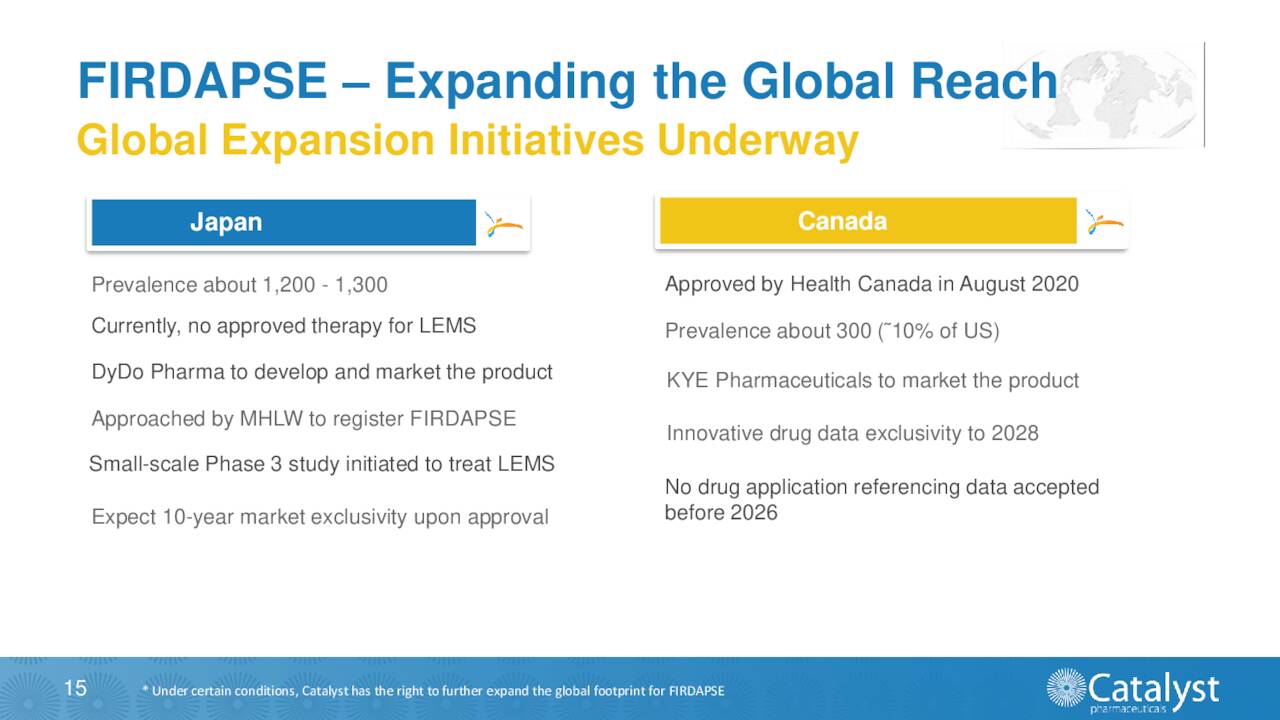

The company is obviously executing well and is not unreasonably expensive on an earnings basis given its growth. The FDA approval for FIRDAPSE to treat pediatric LEMS patients is likely to come before yearend, which is a small win given only around 30 children are identified as having this condition in the U.S. A Phase 3 trial is underway in Japan that hopefully will lead to an NDA for FIRDAPSE in late 2023 or 2024, opening up a more significant market. The company also has efforts ongoing to continue to identified undiagnosed LEMS patients, a big potential target in regards to the overall LEMS population.

May Company Presentation

I left some money “on the table” by not buying the straight equity in CPRX given its run up. However, I did manage to ‘roll‘ my options within my covered call holdings earlier this year and picked up additional premiums. When my position expires in the money in September, I will probably execute the same strategy if the shares fall back into the $12.50 a share range utilizing the March $12.50 call strikes.

He that can have patience can have what he will.“― Benjamin Franklin

Be the first to comment