Scott Olson

I changed my bullish stance on Palantir (NYSE:PLTR) after reading through PLTR’s Q2 report and listening to Alex Karp’s (Palantir CEO) meltdown and brash comments throughout the 2nd quarter conference call. I had outlined why I was displeased with the decline in net dollar retention and how Mr. Karp’s commentary could have negatively impacted PLTR’s public perception. To many, PLTR is still regarded as a black-box company regardless of how many commercial clients utilize their software platforms. Q3 has officially ended, and PLTR is slated to report its results on 11/8/22. There has been a lot going on as PLTR has landed some impressive contracts, signed deals with titans of industry, received a handful of new patents, and Alex Karp has been working overtime, meeting with government officials, and speaking publicly about PLTR.

There are many reasons why I invested in PLTR directly after its direct offering. I believe that PLTR has the potential to be the 2nd most important software company behind Microsoft (MSFT) by 2030. I saw a path for growth in the commercial sector and a long runway for growth globally in the government sector. I wanted to be invested in a company that took a stance against conducting business with America’s adversaries and whose products were making a difference in the fight against human trafficking, drug smuggling, and, most importantly, strengthening our national security. Going into Q3 earnings, I am getting excited once again, and I hope the Alex Karp I watched in his latest interviews shows up, rather than the Alex Karp who was fixated on how Wall Street doesn’t understand PLTR.

Palantir has delivered new partnerships and contracts in Q3 2022.

Palantir expanded its contract and partnership base throughout the government and commercial sectors in Q3. Here are some of the most significant deals we learned about in Q3.

Commercial:

Exxon Mobil (XOM)

- XOM partnered with PLTR, adding new features to its Mobil Serv Cylinder Condition Monitoring service. PLTR’s Foundry platform will enable complete integration and advanced analysis of XOM’s library of onboard test results containing over 750,000+ data points. This will allow XOM to deliver detailed insights into vessel operations and help protect engine components from premature wear. XOM was quoted saying the following:

“The collaboration will Palantir Technologies has allowed us to significantly enhance the power, precision and speed of our Mobil Serv Cylinder Condition Monitoring solution. We can now fully leverage the big data we have gathered in our experience to develop and deploy even more powerful data-based insights, when and where they’re needed,” said Ioannis Chatzakis, Global Marine Technology Program Manager, ExxonMobil. “Vessel operators will be able to use this data for their own analysis within the platform and connect to existing vessel management platforms to help them holistically manage fleet operations and improve overall efficiencies.”

Hyundai Heavy Industries

- PLTR and Hyundai Heavy Industries expanded their partnership by over $20 million in contracts. Additional companies within Hyundai’s conglomerate will utilize PLTR’s Foundry operating system and provide an expansion into the shipbuilding industry. This increases PLTR’s business with Hyundai to $45 million over 5 years.

Beckett Collectables

- The partnership between Beckett Collectables and PLTR went under the radar, but it’s a huge opportunity. Beckett deployed PLTR’s Foundry across its platform to accelerate its digital transformation. The collectible industry is growing at an excessive pace, and the sports card industry is leading the way. The sports card market in the United States was valued at $4.7 billion in 2019 and is expected to grow at a 28.76% CAGR to $62 billion in 2027. Beckett is one of the largest names in the collectible industry, and PLTR has a runway of growth as other companies, such as PSA and SGC may seek to utilize Foundry as well.

Concordance

- PLTR and Concordance Healthcare Solutions, which is one of the largest healthcare distributors in the U.S announced a partnership to power the first, fully integrated medical supply chain ecosystem. The new ecosystem is accessible to any healthcare manufacturer, supplier, distributor, provider, or government public health agency with a license.

Government

U.S. Army Research Laboratory

- U.S. Army Research Laboratory will extend its work with PLTR to support all branches of the Armed Services, Joint Staff, and Special Forces as they test, utilize, and scale artificial intelligence (A.I.) and machine learning (ML) capabilities across the Department of Defense. This contract is worth up to $229 million over 1 year.

Department of Homeland Security

- The Department of Homeland Security renewed its contract to support Homeland Security Investigations with Investigative Case Management software. The contract is worth $95.9 million over a five-year period

U.S. Army Research Laboratory

- PLTR will expand its work to implement data and artificial intelligence (A.I.)/machine learning (ML) capabilities for users across the combatant commands. This contract is worth $99.9 million over 2 years.

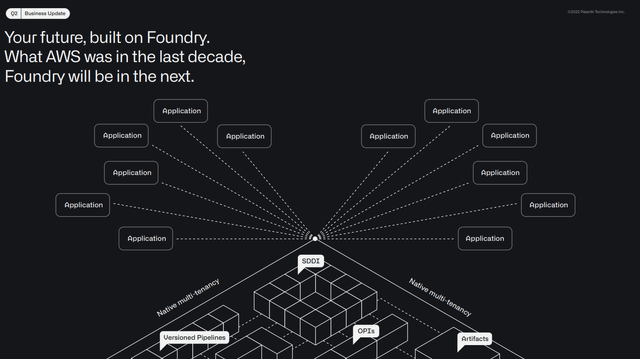

PLTR has been hard at work expanding its foothold among the commercial and government sectors. PLTR is breaking into new industries on the commercial side and expanding its relevance in others. The deal with Hyundai Heavy is a replication of what occurred with Skywise, and proves how PLTR can partner with an external company, build a specialized platform for the industry and scale it. There are many industries that are still in their infancy when it comes to their digital transformation, and PLTR is in a prime position to help transform the collectible industry, which is bigger than many realize. XOM is now the third oil & gas company, along with BP p.l.c (BP) and Kinder Morgan (KMI), which has selected PLTR as a partner. As PLTR proves its systems can optimize the largest companies, more partnerships and contracts should follow.

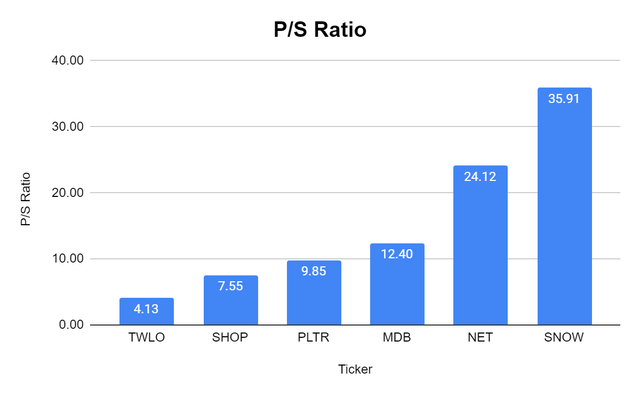

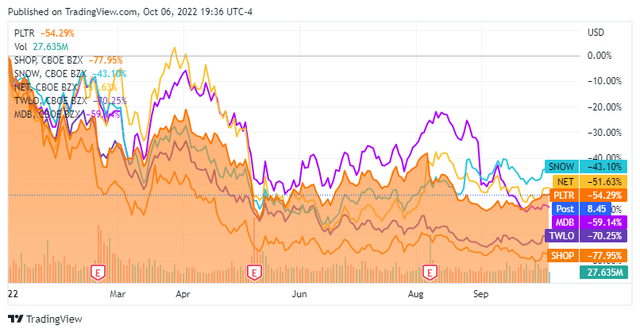

How PLTR is valued compared to its peers roughly a month away from earnings

The Nasdaq is still deep in a bear market, down -30.6% YTD. While some investors still believe this isn’t the time to allocate capital, others believe 2023 is going to set up well for comps, and the markets will rebound. I wanted to see how PLTR was being valued compared to some other companies that have been decimated in 2022. PLTR has declined -54.63% YTD, while Snowflake (SNOW) is down -43.10%, Cloudflare (NET) is down -51.63%, MongoDB (MDB) is down -59.14%, Twilio (TWLO) is down -70.25%, and Shopify (SHOP) is down -77.95%.

This group of beaten-up tech names has a P/S group average of 15.66x. PLTR trades at a 9.85x P/S multiple compared to its peers. While some would consider 9.85x to be high, I think it looks interesting compared to how some other tech companies are being valued.

Steven Fiorillo, Seeking Alpha

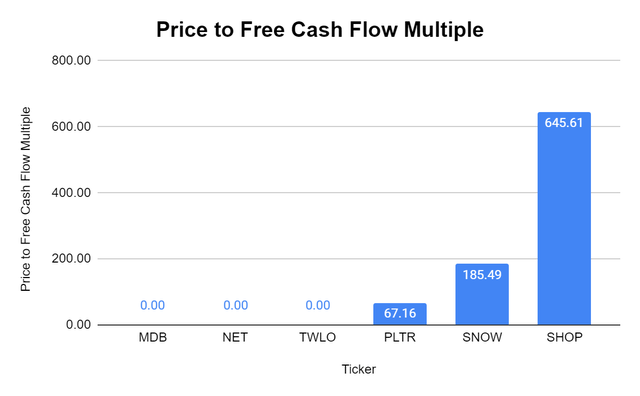

PLTR has the lowest market cap of the group at $13.68 billion, while SNOW has the largest market cap of $60.45 billion. I have heard commentators on CNBC and Bloomberg talk more about Free Cash Flow (FCF) in 2022, than I have in the past 5 years. FCF has been my favorite metric to get an idea of how companies are being valued in the market. FCF is often looked at as one of the best measures of profitability as FCF excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. To some investors, FCF is more important to analyze than net income because it’s harder to manipulate as it is a true indication of the company’s cash. FCF is also the pool of capital that companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business. With every investment, you’re paying the current value for a company’s present and future cash flow.

MDB, NET, and TWLO have generated negative FCF in the TTM, yet they have larger market caps than PLTR. PLTR has generated $260.2 million of FCF in the TTM and trades at a 67.16x FCF multiple, while SNOW trades at a $185.49x FCF multiple, and SHOP is trading at a staggering 645.61x FCF multiple. These companies are still in their growth phases, and have tremendous revenue potential in the future. Looking at PLTR’s P/S ratio and its price to FCF, it looks very attractive compared to other popular tech companies that have been crushed in 2022.

Steven Fiorillo, Seeking Alpha

Why I am not giving up on PLTR

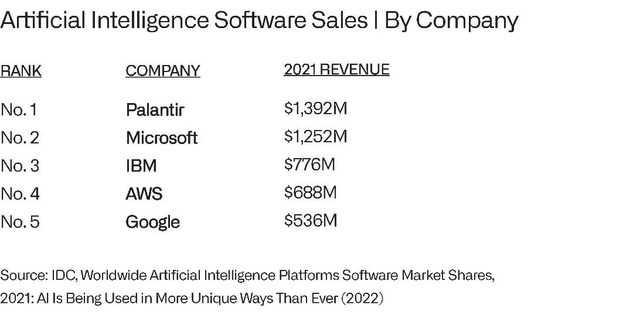

According to the IDC Worldwide Artificial Intelligence Software Market Shares report, PLTR was ranked #1 in A.I. market share and revenue. PLTR leads Microsoft by over $100 million and completely overshadows International Business Machines (IBM), Amazon (AMZN), and Alphabet (GOOGL) presence in the space. A.I. and ML are the next frontiers of computing, and it’s hard to imagine a technological future without progression. PLTR is beating out big tech, which has the ability to allocate as much capital as they desire to dominate this space.

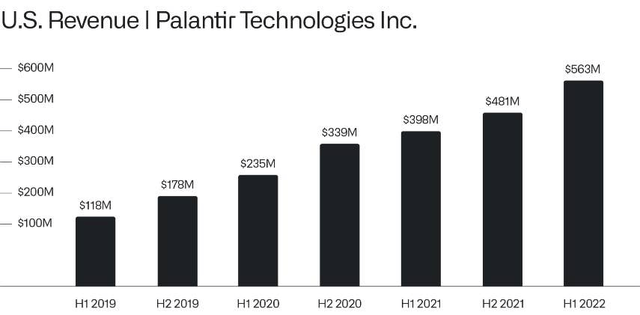

PLTR’s U.S operations are growing at an impressive rate. Over the past 3 years, PLTR’s U.S revenue in the first half grew by 377.12% ($445 million) from $118 million to $563 million. YoY PLTR’s U.S revenue grew 41.46% ($165 million) in the first half of the year.

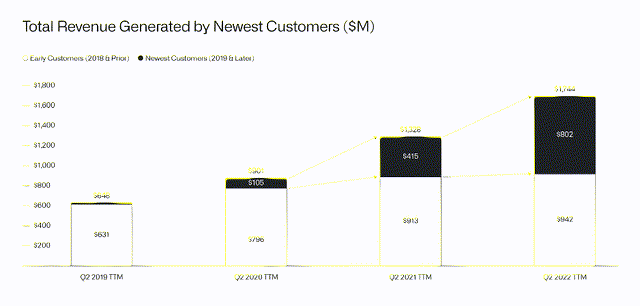

PLTR has separated its customers as pre-2019 and post-2019. Over the past 3 fiscal years, on a YoY basis, PLTR has grown its revenue from pre-2019 customers by $311 million (49.29%) from $631 – $942 million. From PLTR’s post-2019 customers, YoY revenue has increased by $785 million (4,617.65%) from $17 million to $802 million over the past 3 fiscal years. This is incredible, as 45.99% of PLTR’s revenue over the TTM comes from customers that have been onboarded post-2019.

I hope Q2 was an anomaly with net dollar retention and declining commercial consumer growth. PLTR is seeing the largest amount of revenue growth coming from its largest customers, as their YoY TTM growth rate at the end of Q2 was 31.33%. PLTR’s U.S. commercial revenue has increased by $260 million (702.70%) over the previous 3 fiscal years. 100% of this growth came from new customers as its pre-2019 customer revenue base declined from $34 million to $29 million. I believe the progress PLTR made in Q3 from what I have seen in the press releases, will pay off. PLTR is executing on partnering with the world’s largest companies and is scaling throughout multiple sectors.

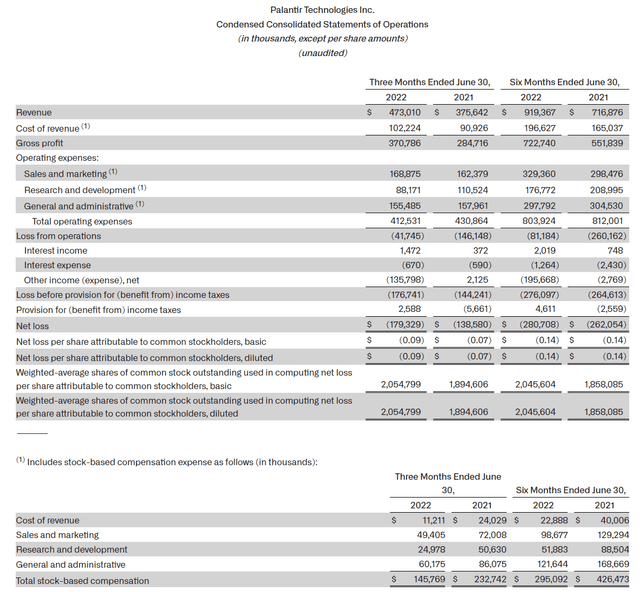

I can’t get bullish again until I see progress in share dilution and net dollar retention, but that doesn’t mean I won’t add shares into earnings

There are several factors, including net dollar retention and share dilution, which I will be paying close attention to in Q3. My concern is that PLTR was utilizing shares to grow its sales department, and the sales department delivered decelerating growth. PLTR paid $145.77 million in stock-based compensation throughout Q2 2022. $49.41 million of its issued stock-based compensation went to sales and marketing costs. From its operation expenses, sales and marketing were the only line item that expanded (4%). Net dollar retention is the combination of the revenue renewal amount and the additional revenue from upselling or cross-selling to existing customers minus churn. In Q2, net dollar retention declined QoQ for the first time from 136% to 120%.

While I like PLTR’s valuation compared to other tech companies that have been beaten up, I am still not pleased with PLTR’s expenses. PLTR’s total operating expenses are declining in addition to its loss from operations, but I am displeased with PLTR’s utilization of stock. I understand that PLTR has to use stock as an incentive to attract top talent, but I want to see accelerating growth if more is being spent on sales and marketing. On the commercial side, PLTR had strung together several consecutive quarters of YoY growth, yet in Q2, not only did net dollar retention decline and its YoY growth trend also declined. I want to see how the Q2 deals materialized and if PLTR can get back to a YoY growth trend or if a new sequence of declining numbers is going to form.

For me to get bullish on PLTR again, I need to see the net dollar retention and commercial growth trends accelerate instead of declining. At this valuation I am slowly adding to my position to dollar cost average, but I am not adding aggressively in case Q3 amplifies the flaws I saw in Q2

Conclusion

Interviews like this is exactly what I want to see from Alex Karp. I believe he is doing a good job of being the face of Palantir and improving its image after the Q2 meltdown. As of now, I still believe PLTR will be one of the most important software companies of the decade, and this could be one of the best times to acquire shares. I am in the red, and I am adding to dollar cost average, but I am being cautious. PLTR started to show cracks in Q2, and Q3 will be very important. I still plan on giving PLTR another 4 earnings calls until I call it quits, but if Q3 resembles Q2, that thesis may change.

Be the first to comment