Nuthawut Somsuk

Investors in mortgage real estate investment trusts such as Annaly Capital Management Inc. (NYSE:NLY) received bad news this week as inflation reached a new four-decade high, increasing the chances of the central bank becoming even more aggressive with the current interest rate hike cycle.

A steeper interest rate path implies higher borrowing costs for highly leveraged investment funds and mortgage REITs, resulting in greater net interest margin pressures. The stock of Annaly Capital may fall as investors anticipate the trust’s earnings.

With risks rising and interest rates on the increase, I’d need a 25% reduction to book value to consider Annaly Capital.

Inflation Is A Serious Problem For Investors And The Mortgage Trust Industry

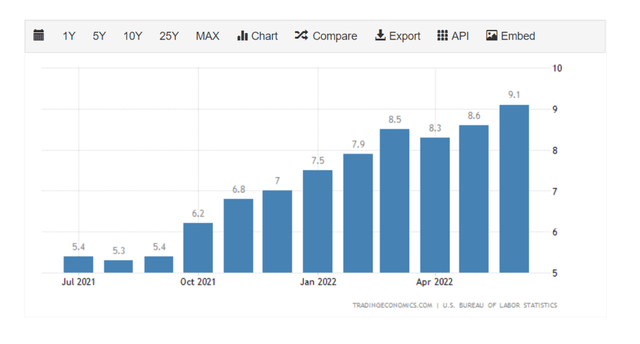

Inflation is worsening, and there is little that consumers and investors can do about it. In June, the inflation rate jumped to 9.1%, with costs rising across the board, from gasoline and electricity to food and rent. The latest inflation rate even surpassed May’s record rate of 8.6%, indicating that inflation is increasing. With the cost of practically all consumer goods growing subjectively everywhere, the inflation rate could rise above 9.1% in July.

Inflation Rates (Trading Economics)

The rise in consumer prices puts additional pressure on the central bank, which has begun an aggressive interest rate cycle to contain inflation this year. So far, the bank’s actions have done nothing to reduce inflation.

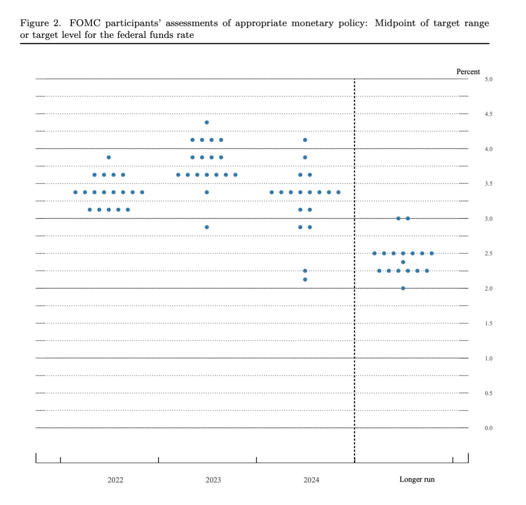

Prior to the release of inflation data this week, the median interest rate was expected to be 3.4% by the end of the current year. Because inflation is likely to continue high in the immediate term, the path of rate hikes may be steeper than planned. According to the Fed’s ‘dot plot’, interest rates are largely predicted to rise further in 2022, with rates reaching 4% by the end of the year.

Median Interest Rates (Federal Reserve)

The central bank raised interest rates by 75 basis points in June, the largest increase since 1994. With inflation appearing to accelerate from an already high level, the market is building a new consensus that signals to an even faster increase in interest rates in 2022. Some analysts predict a 100 basis point hike at the central bank’s July 26-27 meeting.

A significant rate increase of this magnitude would have significant repercussions for mortgage trusts like Annaly Capital, whose business is leveraged and requires access to low-cost funding.

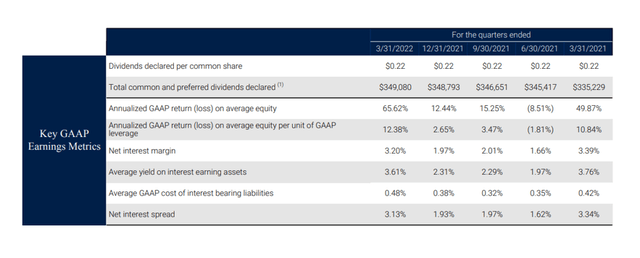

With interest rate costs forecast to rise even faster than previously predicted, the trust’s net interest margin may fall faster than expected. In 1Q-22, Annaly Capital paid an average debt rate of 0.48% to generate a net interest margin of 3.13%.

Annaly Capital’s average GAAP cost has climbed by 50% since 3Q-21, and rates have also increased in the second quarter. As a result, the mortgage trust faces significantly reduced profitability in 2022.

Key GAAP Earnings Metrics (Annaly Capital Management Inc)

I’ll Buy It At $5

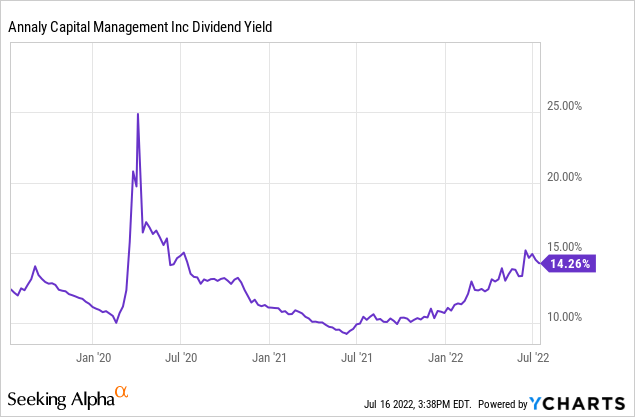

The risks associated with Annaly Capital are extremely significant; just consider the predicted stock yield of 14.26%. To me, this indicates that the market anticipates a significant decrease in trust profitability in the future, as well as a lower book value for 2Q-22.

Due to deteriorating market circumstances in the mortgage-backed securities market, Annaly Capital’s book value fell 15% QoQ in the first quarter to $6.77 per share. The book value of Annaly Capital declined three times last year, with the lone improvement happening in 3Q-21, and it was just by $0.02 per share QoQ. Given the quicker pace of rate hikes in the second quarter, Annaly Capital’s book value is projected to fall significantly again in 2Q-22. The trust’s stock is trading at $6.04 which implies an 11% discount to book value.

I believe that a considerably higher book value discount than 11% is required to justify purchasing Annaly Capital with increasing margin concerns.

At $5, Annaly Capital’s implied book value discount would be 26%, but solely based on the book value of the trust’s 1Q-22. Given that Annaly Capital is expected to announce another QoQ book value fall, the effective discount is likely to be less.

Why Annaly Capital Could See A Higher Valuation

Slower inflation growth would necessitate slower interest rate hikes, which would be excellent news for mortgage trusts because their funding costs would climb much more slowly. Interest rates are rising sharply, creating significant net interest margin headwinds for mortgage trusts. If those headwinds vanished overnight, Annaly Capital’s book value discount might narrow.

My Conclusion

Mortgage trusts face headwinds from inflation and a faster pace of interest rate hikes. With this much interest rate and net margin risk hanging over the company, a higher book value discount than the 11% we’re seeing right now is required, especially since the skyrocketing yield signals that the market is very concerned about Annaly Capital’s book value.

Annaly Capital is an appealing trust stock to consider around $5, with a significant enough book value discount that more accurately represents the trust’s mounting risks.

Be the first to comment