Michael Vi/iStock Editorial via Getty Images

LendingClub (NYSE:LC) share price remains at somewhat distressed levels and largely reflects macro concerns and fears of the most anticipated recession in U.S. history.

The contrarian in me is now thinking that the Fed may just succeed in executing softish lending. I think the Fed will need some luck and for inflation to moderate or roll over in the next quarter or so.

I suspect the Fed’s playbook is to talk tough, upfront as many rate hikes as it can early on and convince the market of its credibility that it will curb inflation no matter rain or shine. Precisely so that it won’t have to raise rates as high as 4% or above. My base case currently is that the Fed will raise rates to about ~3% and then pivot sometimes towards the end of Q3 or Q4.

So far, the playbook seems to be working, and a number of green shoots are appearing including commodities rolling over (copper, iron ore, and lumber), 10-year Treasuries and Bunds yields have moderated, and the break-evens are suggesting that inflation expectations are well-anchored.

The economy is clearly slowing down, and consumers’ real income is declining. Whilst the Fed cannot control supply chains or the price of energy (directly), it affects interest-sensitive aspects of the economy, especially housing.

As noted above, the Fed will need some luck (geopolitically or otherwise), but we may just end up having a softish landing. I define softish lending as a technical or shallow recession that avoids an outsized rise in unemployment and massive destruction of demand in the economy.

But hope is not a strategy – and therefore, when I consider my investment thesis in LC, understanding the risks in deep recessionary conditions is key.

What are the risks for LC?

The top three risks for LC in my view are:

- Credit risk – The risk of outsized credit losses on its personal loans book. Its main assets comprise personal loans with no collateral (typically refinancing of credit cards)

- Marketplace platform risk – the risk that investors will flee the platform during recessionary times or due to bad performance of loans originated by LC

- Competition risks – competition from multiple players including traditional Banks and other FinTechs.

Outsized credit losses

To begin to size potential credit losses in a deep recession, I will use the results of the Fed’s 2022 stress tests, otherwise known as CCAR. The severely adverse scenario sets out a deep recession including substantial market dislocations across real estate, equity, and bond markets. Most relevantly, it also projects the unemployment rate to reach 10%.

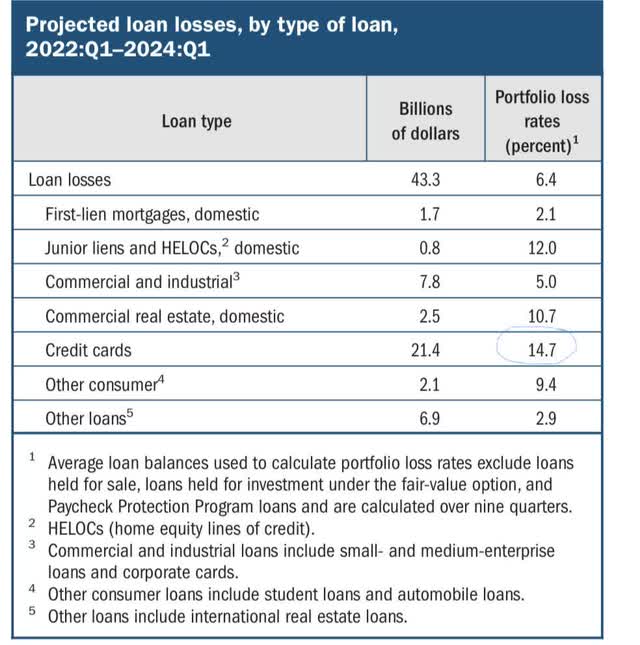

I will also use Citigroup (C) credit card loans as a benchmark given a similar overall FICO score to LC’s current portfolio. The loan loss projections for Citi are shown below for credit cards. It is 14.7% over the two-year period.

Fed’s 2022 CCAR results

Extrapolating this to LC’s current portfolio of ~$2.3 billion of outstanding loans results in projected credit losses of ~338m over two years.

However, LC already holds ~$173 million of loan provisions in its consumer loan book.

It will also likely generate significant pre-tax pre-provision income (on existing assets) and holds approximately $900 million in equity to cushion any loan losses. Even in such an adverse scenario, LC’s position looks quite secure, especially given the current high capital ratios (CET1 of 16%).

Furthermore, to add some context to CCAR, the Fed’s models are extremely conservative when they come to projected loan losses. Banks’ CEOs, such as Jamie Dimon of JPMorgan (JPM) frequently express their views that actual loan losses are extremely unlikely to be as high as the Fed’s models suggest.

The above back-of-the-envelope extrapolation also doesn’t take into account mitigating actions by management or any benefits that may accrue to LC due to superior Credit underwriting leveraging AI and machine learning. LC’s credit performance in the recent pandemic was ~30% better than the industry average.

Marketplace Platform risk

The risk that investors will flee the platform in a severe economic downturn is very real.

However, LC is now a bank with access to stable low-cost deposits and plenty of capital to deploy. LC is in a different strategic position now and has a competitive advantage of being a licensed bank compared to most other FinTechs. In such a scenario, LC could choose to fund carefully selected prime assets on its balance sheet at a very attractive risk-reward outcome and continue to deepen relationships with existing clients.

Competition risk

Personal lending is a highly competitive and fragmented industry. The competitors include both traditional banks as well as other FinTechs.

LC’s main use case is a consolidation of credit card debt. This already became an annoyance to large credit card issuer banks. Banks such as JP Morgan and Citigroup heavily invest in client acquisition, rewards, and balance transfers knowing that some customers will carry high-yielding debt from month to month. LC effectively eats their lunch by taking their customers away with an enticing proposition (lower interest cost, convenience, and improved credit score).

At some point, the banks may wake up and smell the coffee and look to modify their business model and play defence.

At this juncture, I view this as somewhat unlikely. The credit card business is still very attractive to banks with a high teen ROE (mostly). I do not envision them taking the risk of cannibalizing their still-profitable current business model in the near term.

Takeaway

Even if there is a recession, I think it is likely to be mild (or technical recession only). LC will survive and likely thrive in most plausible scenarios.

The recent Banks’ Q2 earnings reports are very encouraging. For example, Citigroup reported an 11% year-on-year growth in outstanding card balances. This is a great harbinger of LC’s future performance.

According to Citigroup, credit losses in Cards are also currently running at a level of ~50% lower than their usual run rate. The consumer seems to be still very healthy indeed.

I am very much looking forward to LC’s Q2 earnings call. I am certain much more detail will be provided on LC’s playbook for handling a downturn.

I expect a strong performance in Q2, but as always, the outlook for the rest of 2022 will matter more.

Be the first to comment