Wolterk

It’s been a rough year thus far for the restaurant industry group (EATZ), and the small-cap Mexican brand El Pollo Loco (NASDAQ:LOCO) has not been spared. In fact, the stock is one of the worst performers in the industry group, down 37% year-to-date, a 1200 basis point underperformance vs. its peer group. This can be attributed to limited unit growth combined with continued margin pressure, with restaurant margins down nearly 600 basis points in Q2 alone. That said, there are green shoots (inflation potentially peaking, productivity gains, more effective marketing), and the company has a new 5.0% buyback program. Hence, I see the stock as a Speculative Buy below $10.00.

El Pollo Loco Menu (Company Website)

Q2 Results

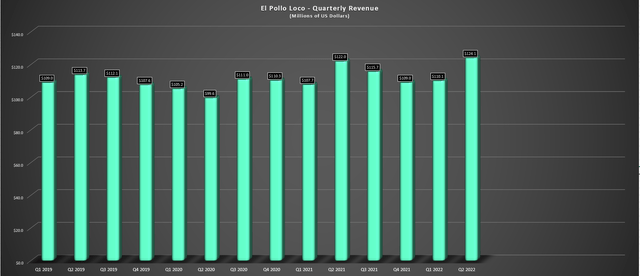

El Pollo Loco (“EPL”) released its Q2 results in August, reporting quarterly revenue of $124.1 million, a 2% increase from the year-ago period. The company reported that system-wide comparable sales were up 7.5% year-over-year, driven by a 2.9% increase at company-owned restaurants and a 10.6% increase at franchised restaurants. The lower revenue despite high single-digit pricing can be attributed to a decline in company sales from selling eight restaurants in the period. Overall, this was a satisfactory quarter, helped by the success of its Shredded Beef Birria limited-time offer, with the company considering keeping beef on the menu due to its success.

El Pollo Loco – Quarterly Revenue (Company Filings, Author’s Chart)

Unfortunately, while sales came in near expected levels, margins disappointed again, with restaurant contribution margins sliding to just 15.0%, down from 20.8% in the year-ago period. This was related to commodity inflation of 21% in the period which led to a 370 basis point increase in food & paper costs, while labor was up 150 basis points to 31.0% due to wage inflation and overtime costs. The result was that the company saw a more than 20% decline in quarterly earnings per share of $0.21 vs. $0.29 in the year-ago period despite the higher sales.

Beef Birria LTO El Pollo Loco (Company Website)

While this was certainly negative, there are some reasons to be cautiously optimistic. For starters, the stock is now down over 50% from its highs, suggesting lots of negativity is priced into the stock at this point. Secondly, the company continues to use TikTok to target its younger customer base, and it’s working – enjoying record tostada sales with a 400 basis point improvement vs. previous peak levels. Meanwhile, it’s hired a VP of Digital Marketing and plans to re-vamp its mobile app and website to allow it to enhance its loyalty program. On the development front, it’s signed two new deals in Seattle and California/Oregon with very experienced multi-unit operators, suggesting a path back to steady unit growth.

From a productivity standpoint, the company has made changes to reduce complexity and reduce the hours required to complete certain tasks. This includes de-stemming serrano peppers, pre-chopping cilantro, adding new food processes for salsa, and using salt tanks for cleaning grills. Meanwhile, the company noted that it is seeing significant progress from a retention and applicant flow standpoint, and 95% of company-owned restaurants are now staffed for all day parts across all operating hours, a meaningful improvement.

Lastly, customer scores remain at 2-year highs and drive-thru times are down by 1 minute – a great sign in an environment where consumers are becoming pickier as discretionary budgets dwindle. Overall, these signs are encouraging and suggest that while the recent results are certainly not up to par, the future could be bright after a tough few years for the company. This is especially true from a margins standpoint, with industry-wide commentary suggesting that inflation may be peaking in Q2/Q3, providing some help from a profitability standpoint.

Industry-Wide Trends & Recent Developments

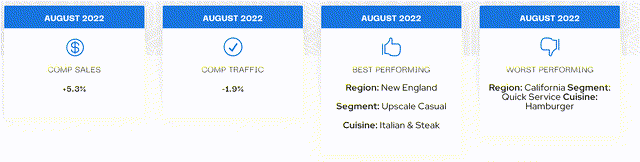

Looking at industry-wide trends, there’s lots to dislike, with August industry-wide traffic coming in at negative 1.9% according to Black Box, though this was a slight improvement from a sequential standpoint from July levels at negative ~5.0%. Although sales did bounce back in the period, the relief from a gas price standpoint pales in comparison to rising gas, utility, mortgage, rent, and grocery costs, which are all pressuring discretionary budgets at a time when credit debt is high and personal savings rates are at multi-year lows.

August Restaurant Industry Traffic (Black Box Intelligence)

Unfortunately, El Pollo Loco has up to 45% of its guests being in the sub $50,000 household income category, with this category seeing the largest change in consumer behaviors in the industry from a demand standpoint. This is not ideal for El Pollo Loco, though it is better positioned than peers in the casual dining space with a lower average check and a solid value proposition. Meanwhile, its marketing is much more effective, suggesting it should be able to weather the storm better than in previous recessions. That said, this is a clear risk and one reason (among many) that I have avoided the stock until now.

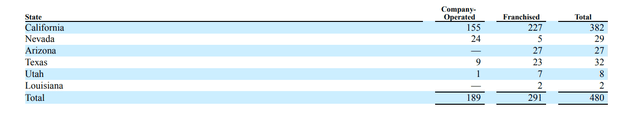

The other negative worth discussing is the FAST Act (AB 257), which California Governor Gavin Newson recently signed, which is not ideal for a company with considerable California exposure like El Pollo Loco (382/480 locations at year-end 2021). This bill would increase the power of fast-food workers in California and authorize the creation of a Fast Food Council, which would be comprised of representatives from labor and management to set minimum stands for wages, and security, among other things. The worst case would be that the minimum for fast-food workers could increase to over $20.00 an hour quite quickly, with the council able to bump up wages by the lesser of 3.5% or the increase in the CPI for every year thereafter.

Michaela Mendelsohn, Chief Executive of Pollo West Corp. and owner of six El Pollo locations in LA, noted in the LA Business Journal that she would have to look at the possibility of moving out of the state if this goes through. This would not only deteriorate unit economics at existing locations but be a significant impediment to future growth in California, with even higher wages putting a dent in already-pressured margins. The timing of this bill is especially surprising given that many operators have gone through hell the past two years and are finally starting to recover from a profitability standpoint as inflationary pressures ease and staffing levels improve.

California Restaurant Exposure – El Pollo Loco (Annual Report)

Overall, I see this as a negative and added uncertainty for the El Pollo Loco thesis because it is one of the brands most exposed to California, along with Del Taco (JACK) and Chipotle Mexican Grill (CMG). The good news is that the FAST Act is being challenged already, and while this would weigh on the investment thesis, it’s not yet in place. So, while this creates uncertainty and favors under-weighting restaurant stocks with significant California exposure, there is still some for this to be blocked before it potentially goes into effect on January 1st, 2023.

Valuation & Technical Picture

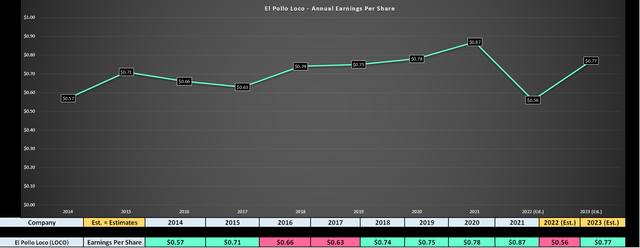

El Pollo Loco has ~37 million shares outstanding and a share price of $10.60, translating to a market cap of ~$392 million. This leaves the stock trading at 18.9x FY2022 earnings estimates, a premium to its historical earnings multiple of 18.7. Given the difficult operating environment and recessionary environment impacting industry-wide traffic, a more reasonable earnings multiple for the stock is 15.0, in my opinion. If we multiply this figure by FY2023 annual EPS estimates of $0.77, I see a fair value for the stock of $11.55.

El Pollo Loco – Earnings Trend & Forward Estimates (YCharts.com, FactSet, Author’s Chart)

So, while the stock has been crushed over the past 18 months (down more than 50% from its Q1 2021 highs), I still don’t see the valuation as overly attractive. This is because there’s currently only a 9% upside to my conservative fair value estimate vs. a current share price of $10.60. In a difficult environment, if I’m going to pay nearly 15.0x forward earnings, I think the more attractive bet is Restaurant Brands International (QSR), a global franchisor (99% franchised) with much better margins. That said, El Pollo Loco’s total return jumps to 27% for investors eligible for the special dividend (shareholders on record as of October 24th), which is a more attractive upside case.

El Pollo Loco – Historical Earnings Multiple (FASTGraphs.com)

Moving to the technical picture, El Pollo Loco looks to have some room for upside, with strong multi-year support at $9.00 and no resistance until $12.60 and $14.85. So, from a swing-trading standpoint, pullbacks below $10.15 should provide an attractive buying opportunity. However, if the stock rallies above $13.20, I would view this as an opportunity to book profits, given that it would head into the upper portion of the trading range ($9.00 to $14.85), increasing the risk of a drawdown. To summarize, I would view pullbacks below $10.15 as buying opportunities but rallies above $13.20 as selling opportunities.

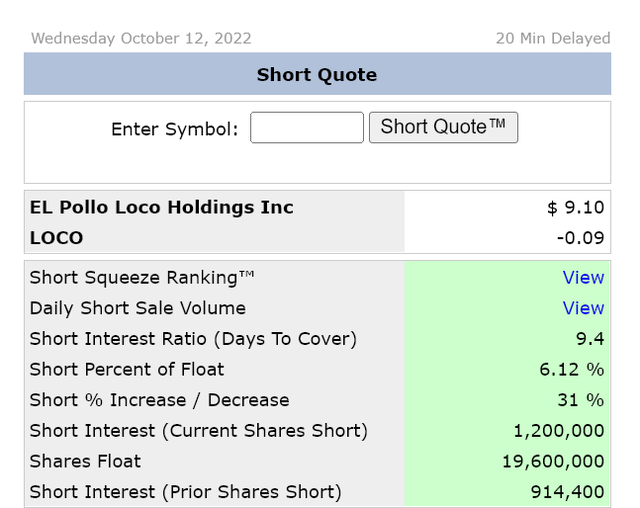

The good news for EPL investors is that management is armed with a tool to defend its share price, suggesting a higher likelihood of support holding up at $9.00 per share if the company chooses to buy back shares opportunistically. As noted, the current share buyback program allows for the repurchase of up to 5% of the float, a significant amount that would certainly make a difference and could also help to boost annual earnings per share. While I would not have been elated with this announcement above $12.00 per share, where the stock would be closer to fairly valued, I think the choice to buy back shares below $10.00 opportunistically is wise while also helping to restore some order to the market and put pressure on shorts.

El Pollo Loco Short Interest (ShortSqueeze.com)

Summary

El Pollo Loco has had a difficult couple of years, which has certainly shown up in its share price, with the stock plunging more than 50% from its highs above $21.00 in Q1 2021. Unfortunately, the most recent quarterly report wasn’t much better, and while the company is confident that inflation could peak in Q3, we should see further margin pressure short-term with reduced sales leverage and rising commodity prices. That said, there are green shoots (productivity gains, strong satisfaction scores, more effective marketing), and the outlook has become brighter with a buyback program and special dividend. So, while I continue to prefer stocks like Restaurant Brands International and First Watch (FWRG), I would view El Pollo as a Speculative Buy below $10.00.

Be the first to comment