Massimo Giachetti

By Rob Isbitts

I rate the ProShares Short QQQ ETF (NYSEARCA:PSQ) a strong buy based on the detailed case I make below. Single inverse ETFs like this one need to be understood, as they are not quite as simple as ETFs that rely on stock prices to go up. Given 2022’s historical market climate, there might be no better time to make a concerted effort to understand PSQ.

During 2022, investors have watched helplessly as the Nasdaq 100 and stocks of the giant, iconic stocks that comprise it have fallen hard. Through Oct. 10 of this year, it lost just about one-third of its value. This is far from the first time Nasdaq investors have seen that index plunge. Sometimes, as in 2020 when the index fell by 28% in five weeks (Feb. 19 through March 23 of that year), it reverses quickly, creating a so-called “V-shaped” recovery. Other times, as during the dot-com bubble and the Global Financial Crisis, the Nasdaq was at the core of some life-changing investor losses.

It doesn’t have to be this way. PSQ is one of several “single inverse ETFs” that can help, if one understands what they are and how they can be used.

Strategy

PSQ aims to be the polar opposite of Invesco QQQ ETF (QQQ), which had over $200 billion in assets at its peak. How popular has QQQ become? On March 12, 2021, it was named the official ETF of the NCAA. If that doesn’t remind you of the dot-com bubble near its peak, then you clearly didn’t live through that era as an investor. ETFs are to be researched, bought, and sold – not paraded out in national commercials as if they are some sort of magic potion for investors.

Proprietary ETF Grades

- Segment: Inverse

- Sub-Segment: Inverse Nasdaq

- Correlation (vs. S&P 500): Very High (negative)

- Expected Volatility: High

Proprietary Technical Ratings

- Short-Term Risk (next three months): Moderate

- Short-Term Reward (next three months): Very High

- Long-Term Risk (next 12 months): High

- Long-Term Reward (next 12 months): Very High

Holdings Analysis

To maintain its inverse exposure to the Nasdaq 100 Index, PSQ does not short those 100 stocks. Instead, it relies on a combination of swaps on that index, arranged with deep-pocket Wall Street counterparties as well as Nasdaq futures, which are quite liquid. This is backed up by investments in U.S. Treasury bills of varying maturities.

Strengths

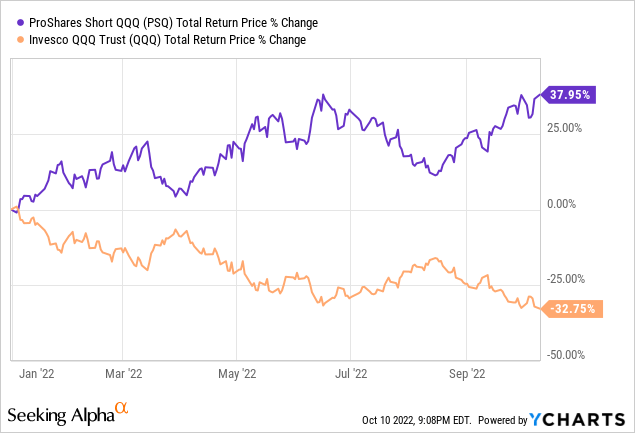

Inverse ETFs like PSQ are often thought of as day-trading vehicles. As someone who has used them, including this one, multiple times during its 16-year trading history, I vehemently disagree with that common assumption. This chart shows one reason why.

2022 has been a great stress test for many investment theories, suspicions, speculations, and – especially – myths. One myth that has consistently surrounded inverse ETFs is that they are simply day-trading instruments. That might be a valid point in some cases for inverse ETFs that use a lot of leverage. Sudden, volatile price moves in the underlying index (in this case the Nasdaq or Inverse Nasdaq) can toss around the price of highly leveraged ETFs tied to that index.

Leverage is always a risk factor with those, but PSQ is an unleveraged ETF. Such ETFs tend to be less popular with day traders, since they lack the “juice” and excitement that many of today’s trading universe seeks on a very short-term basis. Single inverse ETFs are more like the opposite of regular equity ETFs, such as those that target the broad market or a market sector. To that end, they can be much more useful within an overall portfolio that seeks to play defense as well as offense, especially during bear markets.

As you can see in the chart, it has not only matched the inverse performance of QQQ thus far in 2022. It has exceeded it. This is not the only example, but the bottom line on PSQ and holding periods is that, in my experience, liquid, single inverse ETFs like PSQ can be treated more like short positions (without the risky borrowing aspect of shorting) and less like something you need to start getting ready to sell as soon as you buy it.

Weaknesses

PSQ’s biggest weakness is inherent in its mission: It essentially shorts the Nasdaq 100 Index. So, it follows that a sustained rise in the price of that index will lead to a predictable outcome for PSQ: It will lose a lot. That’s where investors using PSQ must have a strong rationale for how they will use it. Whether it’s as a small offset to a long-heavy portfolio of stocks and/or ETFs, a method of positioning oneself “net short” the stock market, or even part of an arbitrage strategy (whereby you are long a traditional equity ETF and long PSQ), any inverse ETF should be researched and fit into a portfolio in a way that makes sense to the investor using it. This is not as simple as a “buy or sell” decision. Context – specifically, what is in your portfolio around it – matters a lot. So, PSQ’s biggest weakness might actually be the potential human error of misunderstanding it and thus, misusing it.

Opportunities

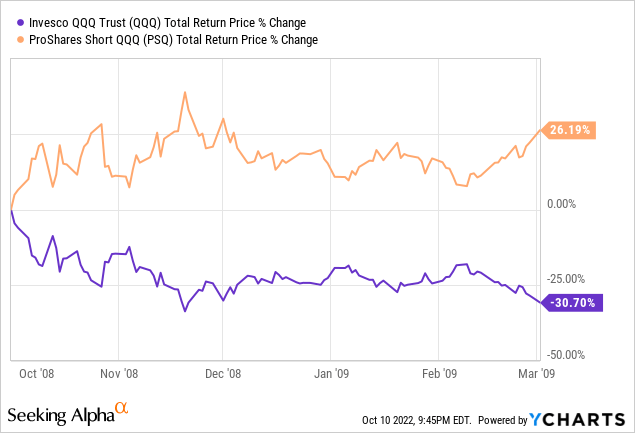

How big a potential opportunity does PSQ represent to investors right now? Consider the chart below, showing the path of PSQ and QQQ during the 18-month Global Financial Crisis from the fourth quarter of 2007 through the first quarter of 2009. During that tumultuous period, the Nasdaq fell 53% from peak to trough. Shown above is the period from this time of year (October) in 2008 through March 2009.

From Oct. 31 of the previous year (2007) through Sept. 29, 2008, QQQ had already lost 33% of its value, similar to the climate today. As expected, PSQ was a huge winner. Then, this happened.

As Al Pacino famously said in the popular movie, “Scent of a Woman,” PSQ was “just getting warmed up.” As the Nasdaq proceeded to fall another 30% over the next five months, PSQ rose to the occasion, as it was built to do, and gained 26%.

This is one historical example. But it is also important to note that during the worst Nasdaq 100 collapse of all time, from 2000-03 (the dot-com bubble), that index fell by – make sure you’re sitting down for this one – 83%. I’m not predicting anything here, other than that if the Nasdaq’s severe decline is not yet over, PSQ is an ETF that any risk-management-focused investor should be familiar with.

Threats

There is always a chance that the swap market can implode, or that PSQ will cease to operate with the consistency that it has, in line with its mandate, since 2006. But any investment, whether one that pursues gains in favorable markets or gains in market declines, carries risk. Again, this is why portfolio management and risk management are so important, especially in today’s unprecedented investment climate.

Rating

One of my core investment principles is to recognize that any investment can appreciate in price at any time. What distinguishes one investment from another at any point in time (including right now) is how much risk accompanies that appreciation potential. When considering that – and the extensive, continuous work my team and I do to assess market reward/risk tradeoffs – I conclude that PSQ is a strong buy. This is despite its year-to-date success.

I own PSQ in my portfolio now as one of my larger positions. I have owned it for a good portion of this year, and it has been a performance driver amid one of the worst January-September periods in modern investing history. While I am not the type of investor who flips back and forth from “all in” to “all out,” preferring to see things as a constant reward/risk balance, I do see the potential for PSQ to continue to pay off as a defensive component of a portfolio, and as a way to do what I have been urging investors to do since last year: “attack the bear.”

The stock market can always rally in a flash, and PSQ will naturally do the opposite if the Nasdaq 100 Index rallies. We’ve seen that multiple times this year. But if you, as I do, continue to view rallies as bear market bounces and not a fresh new bull market, PSQ is a potential tool to have in your box for a while.

Conclusion

For reasons I have never been able to figure out, investors are consistently told that in a bear market they should run to cash and/or bonds. Those are far from the only strategies available. And, in 2022, bonds have been nearly as bad as stocks. So, it makes sense that investors should look around for something more instead of just sitting there and taking it.

They don’t have to be traders or hedge fund managers. They simply need to adopt an approach that includes a strong defense to go with whatever offensive strategy they are using in their portfolio. PSQ is one of several ETFs designed with this in mind. So, while QQQ gets promoted in national TV commercials, take a look in the mirror, so to speak. There you will find PSQ, a viable cog to consider for attacking a bear market.

Be the first to comment