Brett_Hondow/iStock Editorial via Getty Images

Elevator Pitch

I retain my Buy rating for IMAX Corporation’s (NYSE:IMAX) shares. I touched on the company’s China market and its IMAX Enhanced product in my previous article for IMAX published on November 19, 2021.

In my latest article, I highlight the multiple tailwinds for IMAX Corporation. Firstly, IMAX’s recent box office performance has been excellent and the future slate is promising. Secondly, more movie studios are moving back to having theatrical windows for their new films. Thirdly, live events could be a new growth area for IMAX in the future. Considering these positive factors, I continue to rate IMAX as a Buy.

Recent Box Office Performance And Future Slate In The Spotlight

There has been a string of good news in the past one month for IMAX Corporation relating to its box office performance.

IMAX Corporation disclosed on June 13, 2022 that it “has already exceeded its summer global box office of 2021”, despite having “eight weeks to go in the 2022 summer season.” This comes on the back of IMAX achieving a “$25 million global opening for ‘Jurassic World: Dominion'” in the recent weekend prior to this announcement. Earlier on May 31, 2022, IMAX had announced that the company had delivered “its best global four-day Memorial Day Weekend opening ever with the $32.5 million debut of” Tom Cruise’s “Top Gun: Maverick.”

It is noteworthy that IMAX Corporation’s box office performance for May 2022 and the first half of June 2022 have exceeded that of pre-pandemic levels. At Credit Suisse (CS) Communications Conference on June 14, 2022, IMAX noted that “we had a better May (2022) than we had in 2019” in terms of worldwide box office, and highlighted that it has observed the same positive trend for June 2022.

Looking ahead, the slate for the second half of 2022 and 2023 looks decent, which should be positive for IMAX Corporation’s future box office performance. IMAX mentioned some of the key movies to watch out for at the JPMorgan (JPM) Global Technology, Media & Communications Conference on May 25, 2022. The blockbuster movies in the pipeline cited by IMAX Corporation at the JPMorgan conference included “Bullet Train with Brad Pitt” and “the re-release of Avatar 1” in 2H 2022, and Tom Cruise’s “Mission: Impossible 7”, “Aquaman” and “Guardians of the Galaxy 3.”

A Recession Should Have A Limited Impact For IMAX And The Movie Industry

Investors in general are worried about a potential recession and how a reduction in discretionary spending by consumers will affect the stocks they own. In my opinion, the movie industry and IMAX Corporation are less likely to be negatively affected by a recession for two key reasons.

The first reason is that movies are a relatively “small ticket item” as compared to other expenditures. Consumers are most probably going to hold back on spending for big ticket items such as traveling overseas or buying a new home, if they need to tighten their purse strings. This point of view is validated by historical data. At the JPMorgan Global Technology, Media & Communications Conference in late-May this year, IMAX Corporation highlighted that “there have been 7 recessions since 1980”, and “the box office has grown” in “every one of those years.”

The second reason is that consumers might turn to “affordable luxuries” in such a challenging economic environment. One of these “affordable luxuries” is enjoying a good movie in a premium setting like IMAX movie theaters. As an illustration, IMAX Corporation noted at the JPMorgan Global Technology, Media & Communications Conference in May that “preview screenings” for “Top Gun: Maverick” at the IMAX theater in “Lincoln Square in New York” which cost “$30 a ticket” were “sold out” recently.

Another threat for IMAX Corporation that the market is concerned about is that of movie theaters becoming dinosaurs in the new age of streaming, which I discuss in the next section.

Movie Theaters To Remain Relevant In The New Age Of Streaming

There are recent signs suggesting that streaming will not replace movie theaters any time soon.

An April 26, 2022 article published on entertainment website Deadline cited “NATO (National Association of Theatre Owners) Chief John Fithian” saying that “simultaneous release is dead as a serious business model” which signaled the “return of theatrical windows.” Disney (DIS) and Paramount (PARA) are among movie companies with streaming services that have kept exclusive theatrical releases for their films, as highlighted in another April 25, 2022 Deadline article.

At the May 2022 JPMorgan Global Technology, Media & Communications Conference, IMAX Corporation explained that theatrical windows have come back again for a simple reason. The movie studios realize that “if you have a movie and you release it just on streaming, it does worse than if you give it a theatrical window” based on the data from various films released in recent years.

In other words, while some have seen the future of movies as a case of “theaters versus streaming”, it is clear that both have a role to play in the future of the film industry. Studios earn more when they release movies first in theaters before making them available on streaming, as highlighted above.

Going Beyond Movie Theaters

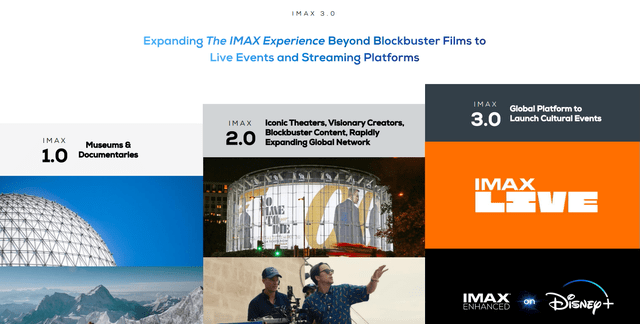

IMAX Corporation has a long growth runway ahead, as its future plans are not limited to just movie theaters. The company has a “IMAX 3.0” strategy of extending its reach into “live events and streaming platforms” as presented in the chart below.

IMAX 3.0 Strategy

IMAX’s Q1 2022 Investor Presentation

In my earlier November 19, 2021 update, I noted that the company’s “IMAX Enhanced product & technology allows consumers to watch ‘IMAX-quality’ movies at home, and this could bring in additional revenue for the company.”

Another key component of the IMAX 3.0 strategy, apart from IMAX Enhanced, is live events which the company refers to as “IMAX Live.” IMAX Corporation’s current pipeline of live events includes a “Pink Floyd legend Roger Waters (performance), and a partnership with iHeartRADIO on December’s iconic Jingle Ball concert” as revealed at its Q1 2022 earnings call on April 28, 2022. IMAX also guided at its first-quarter results briefing that it could possibly have as many as 25 live events every year in the future.

Bottom Line

There are multiple tailwinds that could help IMAX to deliver better-than-expected financial results in the short to medium term, such as more box office hits and incremental revenue contribution from live events. As such, I deem IMAX Corporation as a Buy.

Be the first to comment