Antonio_Diaz/iStock via Getty Images

Thesis

Software is playing a predominant role in our everyday lives. GitLab’s (NASDAQ:GTLB) platform is at the center of the creation of code required to build the next generation’s leading applications. The market opportunity for software development (primarily newer Agile/DevOps methodology) is extremely large. As the gap between tech and business teams shrinks, the number of developers and non-technical developments that interact with DevOps will continue to grow in the overall economy. The company has shown that it can execute as evidenced by their revenue growth of over 60% YoY over the past 3 years.

GitLab has a very high Dollar-based net retention rate (DBNRR) of 152%. This is amongst one of the best in software. It signals that the product is sticky amongst its userbase and points to evidence that they can continue maintaining growth at a larger scale (almost without growing new customers as fast.)

Introduction

GitLab is a company that provides a DevOps platform that provides the ability to develop, secure, and operate software in one platform. The platform allows for collaboration amongst developers, IT, operations, security, and business teams to deliver business outcomes. The ultimate goal of DevOps is to allow teams to collaborate and work together to shorten the development lifecycle and evolve from delivering software on a slow periodic basis to rapid, continuous updates. GitLab’s strategy is predicated around agile development, iteration and continuous development (CD), and continuous iteration/integration (CI).

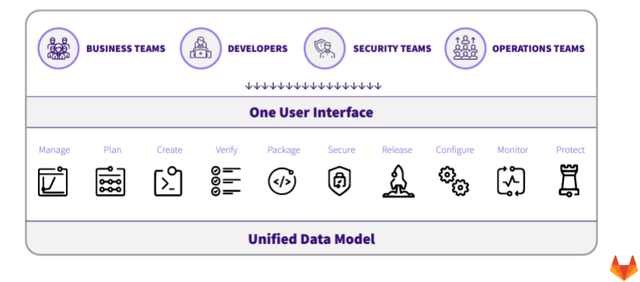

The image below shows the stakeholders involved in a typical DevOps team and all the steps required to build software within the unified data model. GitLab’s competitive advantage is its ability to provide a full product stack and centralize everything that an IT and business team would need to deliver projects.

GitLab Product process/Investor Relations

Product advantage and expansions

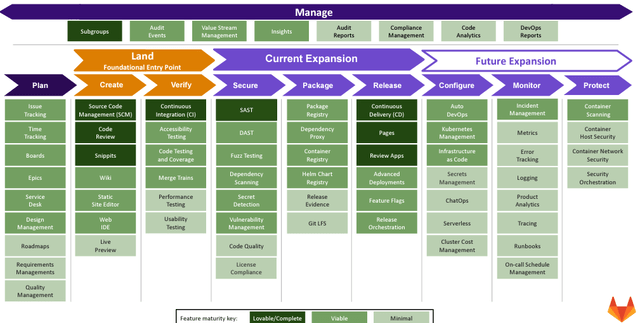

One of GitLab’s competitive advantage is that they have the most comprehensive product that covers all the major areas of software development. The image below is an overview of the important steps necessary to manage the entire lifecycle of software. The big observation below is that GitLab has products that align within each of those segments. The darker green represents fully-built products by GitLab and the lighter green color represents more open-source products available on their platform.

GitLab’s product types/Investor relations

The second major takeaway from this image is to show the land and expand motion for their sales. A typical customer buys GitLab to create and build code (Land section) and overtime realizes they need more features. This has led to a high dollar-based net retention for GitHub.

It is most often used for coordinating work amongst teams of software developers who are collaboratively developing code. This leads us to another important aspect of the product which is the definition of Continuous Integration (CI), Continuous Development (CD), and source code management (SCM). These are key components of the software development lifecycle that allows for tracking changes within software on an ongoing basis instead of making those changes within one large batch.

Competitive Advantages

1. One of GitLab’s biggest strengths over competitors amongst developers is that they have built a strong specialty within CI, CD, and SCM. The company was one of the earliest companies to adopt an agile approach to software. These areas together with a platform that covers all the key areas of the lifecycle has been their biggest strengths against competitors. GitLab’s platform spans all six major buckets of DevOps solutions as discussed earlier, If GitLab is successful in driving penetration across all six, it could generate revenue growth materially for many years.

2. GitLab is positioned in Gartner’s Leaders Quadrant of the 2021 Magic Quadrant for Enterprise Agile Planning Tools. Gartner estimates show that only 20% of users currently are using a DevOps methodology as their primary strategy to create software, hence, creating a massive future opportunity.

3. The competitive nature of this field belongs to a few players. Microsoft (MSFT) (GitHub), Atlassian’s (TEAM) Jira, and GitLab dominate the software development market. Almost every developer you speak too are familiar with these companies. This dynamic of product-virality and familiarity as an open-source company should continue to favor GitLab.

GitLab‘s Go-to-Market strategy as a strength

GitLab espouses the OSS model at heart. Open-source (OSS) is computer software that is released under a license in which the copyright holder grants users the rights to use, study, change, and distribute the software and its source code to anyone and for any purpose. Due to the fact that it is freely available, many users have hopped on the platform. As a result, GitLab has built a strong and loyal community of over 3-million developers that interact with their software (although many are free users), but this has built a strong brand recognition amongst developers/technical teams.

Another key component of their go-to-market is a strong self-serve solution for SMBs and individual developers. Finally, in recent years, their GTM strategy has evolved into focusing on the enterprise. They have sales Account Executives that target enterprises where initial sales are made for tens or hundreds of seats followed by the adoption of follow-on orders that drive expansion within an enterprise.

Financials

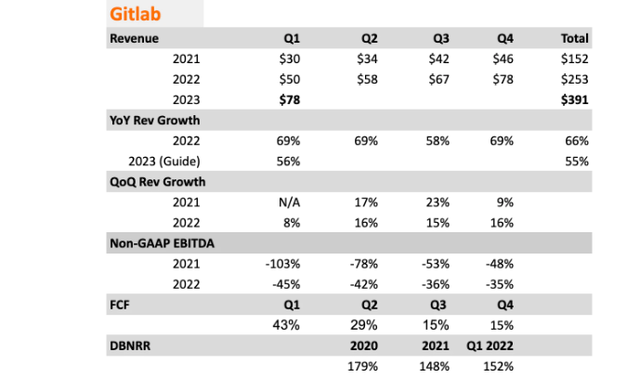

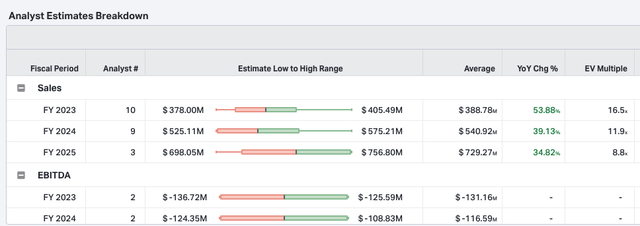

I have created a spreadsheet that highlights all the key metrics for GitLab over the past 4 quarters. The company has been averaging over >60% top-line revenue CAGR over the last 5 years. They are forecasted to grow over 53% again in CY 2022 and 40% in FY 2023. Customers have been growing at a healthy rate, averaging 66% CAGR over the last 3 years. In this past fiscal, 100K customers have been growing 75% and 73%.

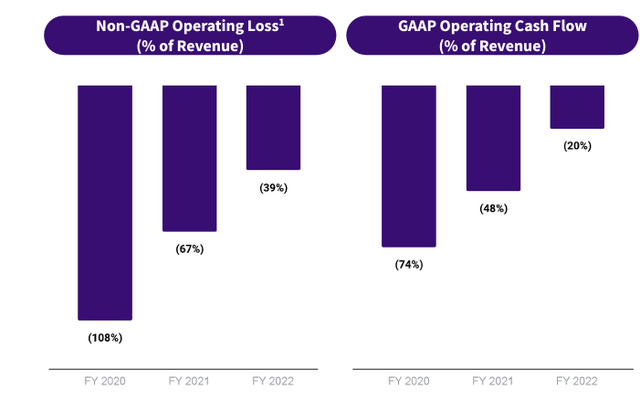

Margins are improving

On the bottom line, the business margins are showing major improvements. They are becoming more cash efficient and narrowing their losses. It is also important to note that the company is fully remote, as a result, they do not have to pay for plant, property, and equipment (PPE).

GitLab’s Financials/Investor Relation

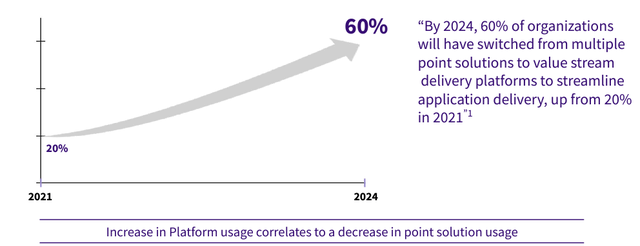

The Market: Software DevOps is large

According to Gartner, the TAM for Global Infrastructure Software is estimated to be $458B by the end of 2024 (11.8% CAGR). The addressable market opportunity for GitLab within the DevOps market is ~$40 billion. DevOps involves solutions a variety of steps from software requirements planning, and deployment into production environments to the observability market that monitors your infrastructure/code. The market is large primarily as Gartner estimates that only 20% of organizations are utilizing the most modern forms of software development.

GitLab’s Market/Investor presentation

Competitive Risks

Differences between GitLab and Microsoft’s GitHub

blog/2016/01/27/comparing-terms-gitlab-github-bitbucket/

Microsoft GitHub has around 70M+ Developers compared to GitHub’s 30M+ developers and more than 1 million active license users. The competition is fierce. Microsoft has the cash and prowess to build upon its DevOps resources internally. Many customers are careful of GitHub to avoid customer lock-in issues with Microsoft. GitLab also continues to incorporate the Open Source contributions and integrates them into their platform much quicker which helps developers tremendously as compared to Microsoft which might not have the right corporate structure to enable that speed of deploying those changes.

There is also Atlassian that leverages Jira for planning and issues management. GitLab also somewhat competes against open source Jenkins (16M users). OS Jenkins helps automate parts of software development related to building, testing, and deploying, facilitating continuous integration and continuous delivery. JFrog is another competitor in this market but they are mostly focused on software artifact repositories.

The core difference is GitLab has Continuous Integration/Continuous Delivery (CI/CD) and DevOps workflows built in. GitHub lets you work with the CI/CD tools of your choice, but you’ll need to integrate them yourself. Typically, GitHub users work with a third-party CI program such as Jenkins, CircleCI, or TravisCI. Meanwhile, GitLab has everything built into the ultimate tier that makes it easy for the user. Another important difference is GitHub puts speed first, while GitLab focuses on reliability. To learn more about the differences between GitHub and GitLab, read this article: link here. The competition is fierce but this market is large enough for multiple players and GitLab has so far shown they have a niche that appeals to their product.

Finally, GitLab is much closer to developers. Today, GitLab boasts of over 2000+ active contributors to their platform improvement. This enables GitLab to get a quick grasp of the important challenges facing developers. This allows for rapid product innovation than Microsoft’s GitHub will be able to emulate as quickly.

The future revenue and margin growth opportunities for GitLab include providing advanced features and products across more mature stages of the DevOps lifecycle. Secondly, there is an opportunity to drive growth by acquiring new customers and driving expansion amongst the existing customer base. Lastly, the more they can drive more productivity for developers, the more developers will continue to rely on them.

Valuation

GitLab currently trades for an EV/Sales of 16x on NTM sales of $389M (53% YoY) growth. Additionally, the company’s dollar-based net retention rate of 152% continues to support that the company can continue to maintain such high growth as long as they incrementally grow their customer base every year at a healthy clip. Finally, they have a strong balance with cash of $934M.

Conclusion

In summary, GitLab has built a great product that plays a major role in the everyday lives of developers. GitLab plays an integral role in the software development process for startups and large enterprises at large. it is a mission-critical software that can continue to grow despite an inflationary market. GitLab has built an incredible go-to-market strategy that fully utilizes a good bottoms-up sales motion for distributing their product. The latest re-acceleration in revenue growth is a testament to the increased adoption in this market that is still relatively early. I will continue to follow the story.

Be the first to comment