Mumemories/iStock via Getty Images

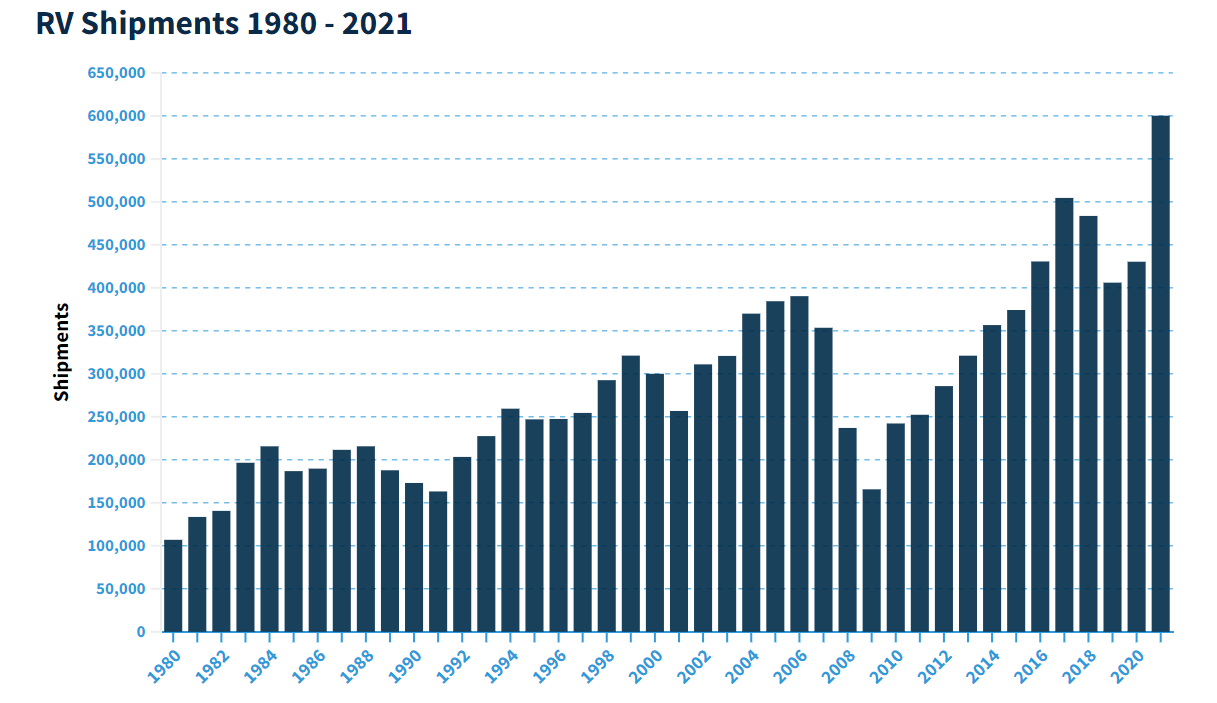

The list of industries in the US that came out of the pandemic stronger would be incomplete without mention of the recreational vehicle industry. Amid pandemic-era restrictions on travel and gatherings, RVs emerged as an ideal choice for vacationing Americans seeking alternatives to public transportation and staying at hotels. Data from the RV Industry Association indicates that in 2021 the industry shipped over 600,000 units, close to 50% higher than 2020 shipments and the second time in the industry’s history that shipments passed the 500,000 units mark (2017 was the only other time).

Historical RV Shipments in the US (RV Industry Association)

The surge in RV shipments in the past two years has been an incredible boon for Original Equipment Manufacturers (OEMs) like Thor Industries (THO) and Winnebago (WGO). THO posted 50.8% year on year growth in fiscal 2021 revenue to reach a record $12.32 billion (fiscal year ends July). Similarly, WGO’s top line grew at a blistering 54% to $3.62 billion in fiscal 2021 compared with $2.35 billion in 2020 (fiscal year ends August).

The RV industry windfalls have also been enjoyed further downstream, with RV retailers posting record performance over the past two years. Camping World Holdings (NYSE:CWH), the largest retailer by number of locations and revenue, retailed a record 126,000 RVs in fiscal 2021, reaching $6.31 billion in revenue vs $4.98 billion a year earlier. This came amid improving operational performance, with key KPIs like gross margins, EBITDA and net income improving on an absolute and percentage basis.

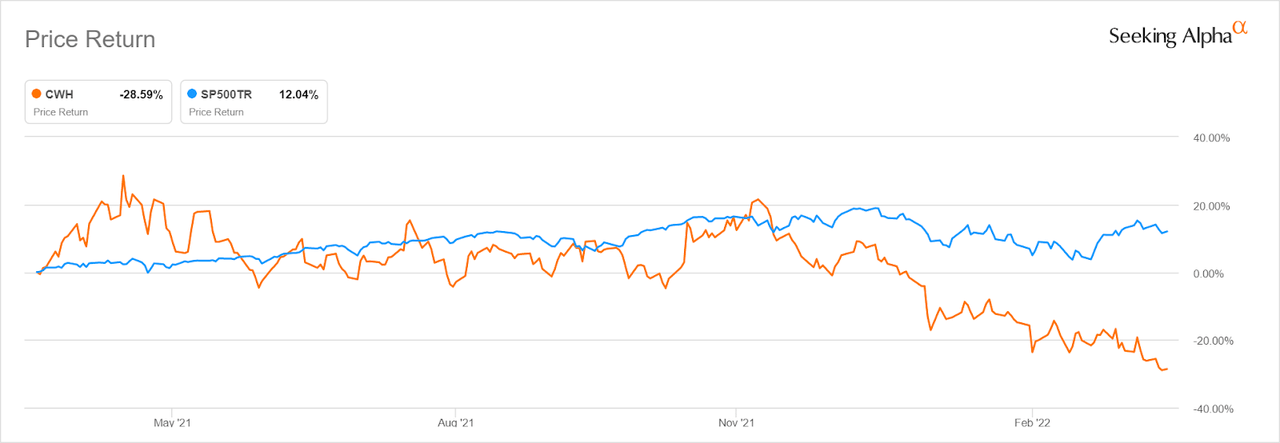

Despite this unprecedented financial and operational performance, CWH stock has performed dismally over the past year, losing more than 28% vs. the S&P 500’s 12% return.

CWH 1 year performance vs S&P 500 (Seeking Alpha)

The huge disconnect between the business performance and the stock performance merits a closer look. On one hand, it could signal an overlooked opportunity considering the business’ improved fundamentals and the fact that the RV industry’s growth is expected to continue post-pandemic (a record 9.5 million people are planning to buy an RV in the next 5 years, the RV Industry Association notes in its 2021 Annual Report). On the other hand, CW’s poor stock performance could indicate that investors are pricing in risks that the management is not sufficiently discussing or addressing.

To assess which of these is the case (we are bullish in the interest of disclosure), we will look at CWH’s key strengths and weaknesses before concluding with our take on its current valuation and why we think the stock is headed up going forward.

CWH Key strengths

CWH operates through the Camping World and Good Sam brands, which have been serving RV consumers since 1966. It also has a strong online presence. Through these consumer touchpoints, it has offered new and used RV sales, financing, parts, repairs, maintenance and other related services for more than 50 years. This has helped it build strong brand equity, which is a key strength in any booming industry, as new buyers trying a product or service for the first time often trust established brands vs newer entrants.

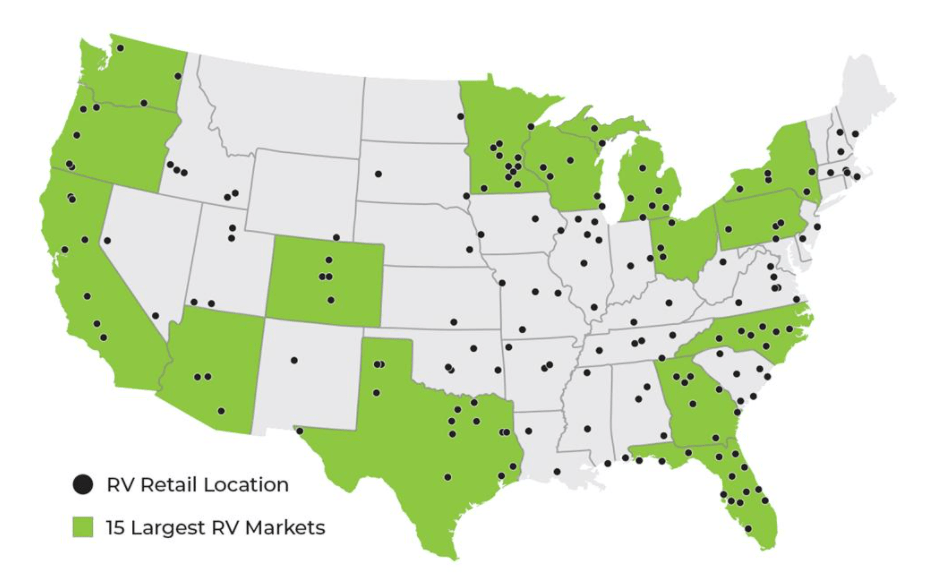

In addition, the company enjoys significant scale, with over 185 locations in 2021, representing an increase of 16 new locations from 169 locations 2020. In its earnings call, CEO and Chairman Marcus Lemonis noted that the ambition is to continue growing the number of locations at a similar cadence for the foreseeable future. The company aims to be operating in 45 of 48 States in the next 1 and ½ years.

CWH national footprint (10-K)

Scale is positive for two reasons. The first and obvious one is it brings the company’s products and services closer to consumers, which is a competitive advantage at times of growing demand. Scale also helps CWH monetize its installed base of RVs more efficiently and effectively, growing revenues from sales of parts and services such repairs while improving the overall customer experience.

-

Improving Margins and Focus on Used RV segment

CWH is growing its revenue and its footprint without destroying value. Gross margins and operating margins have been improving while Selling, General and Administrative expenses as a percentage of gross profit have been declining.

Its gross profit margin in 2021 was 35.75% compared with 31.28% in 2020, and 27.18% in 2019. Operating income margin in 2021 was 12.18% compared with 9.40% in 2020 and 2.70% in 2019. Likewise, net income margin was 4.03% in 2021 compared with 2.25% in 2020 and (1.24%) in 2019.

These improvements are partly attributable to efforts the management has been making to contain SG&A. In 2016, SG&A to Gross Profit ratio was 70% compared with 64% in its last earnings.

The improved margins are also the result of the increase of new and used RV prices in 2021 following supply chain disruptions that pushed costs and prices higher. The tables below, with data extracted from CWH’s 10-K, illustrates this.

|

Units Sold |

2021 |

2020 |

Percentage change |

|

New vehicles |

77,777 |

77,827 |

(0.1)% |

|

Used Vehicles |

48938 |

37,760 |

29.6% |

|

TOTAL |

126,715 |

115,587 |

9.6% |

|

Average selling price |

2021 |

2020 |

Percentage change |

|

New vehicles |

$42,422 |

$36,277 |

16.9% |

|

Used Vehicles |

$34,456 |

$26,082 |

32.1% |

The data indicates that used RVs sales growth has been stronger despite greater price increases compared to new RVs price increases. Used RVs tend to be more price inelastic as the consumer is not checking whether a unit is cheaper relative to last year but whether it is cheaper relative to a new RV.

It is therefore a good sign that CWH has not only been able to grow used vehicle units 29.6% in a year but continues to focus on expanding this segment. “We plan to grow our used RV business from 1.7 billion to 3 billion. At our historic average of 20% to 26% gross margins, this should generate 300 million to 400 million of incremental gross profit, and a meaningful portion of that will flow to the bottom line,” noted CEO Lemonis in the last earnings call.

The company plans in 2022 to expand its dealerships to include a number of pre-owned superstores (“Preowned Mega-Centers”) focusing on used RVs, service and restoration, and our finance and insurance offerings.

-

Returning capital to shareholders

CWH has been aggressively returning capital to shareholders through share repurchases and hefty dividends. In 2021, it repurchased $156 million worth of shares. Its Board authorized an additional $150 million of buyback availability, bringing the total available capital for buybacks at the beginning of 2022 to $200 million.

In August 2021, CWH doubled the annualized dividend from $1 to $2 per share. This year, the management team with Board approval announced another 25% increase in the annualized dividend to $2.50 a share. This currently represents a 9.29% yield.

CWH Key weaknesses

-

Uncertainty of whether it will execute expansion effectively and efficiently

CWH is in expansion mode and this carries inherent risks worth discussing. To begin with, the company has pulled guidance for FY22, which could be interpreted by investors as management not being crystal clear about what its expansion will deliver. To be fair, removing guidance became somewhat acceptable post-Covid. However, it’s not reassuring if it’s done at a time when expansion is on the agenda.

Historically, CWH has delivered mixed results in terms of expansion. For example, its 2017 acquisition of Gander Mountain & Overton via bankruptcy auction, enabled it to acquire the target’s inventory at cost and to add 74 stores in months. It was a way to buy cheap assets and increase the store count by over 50% at the time. However, as Seeking Alpha Author Justin Polce pointed out “the Gander acquisition turned out to be full of thorns”. In an article on CWH he writes, “The very nature of acquiring distressed assets means, well, you’re buying distressed assets. The problems were innate and in order to fix them, operating expenses went through the roof. The company’s “net income attributable to Camping World Holdings, Inc.” dropped from $189 million down to a $60 million loss (from 2016 and 2019, respectively).”

Whenever a company’s management announces ambitious expansion plans, there is always the temptation by investors to buy. However, expansion can be a double-edged sword and CWH’s past expansions certainly indicate that things could go wrong.

-

Impact of possible recession on inventory and balance sheet

One of the main stories in the news cycle in the past weeks and months has been the risk of recession as analysts mull the impact of inflation and interest rate hikes on demand and economic growth.

If this risk materializes (and some may argue recession is already here with us) stocks in cyclical sectors that depend on consumer discretionary spending like CWH will be hit hard. This is because consumers generally reduce big ticket expenditures during times of economic uncertainty.

This will not only impact CWH’s revenue growth, but also its balance sheet. The company closed 2021 with $1.79 billion in inventory on the books, a 58.40% increase from $1.13 billion in 2020. This increase, while positive in times of strong demand, could prove to be a thorn in the flesh in times of waning demand. Declines in demand can lead to reevaluation of the value of that inventory combined with difficulty converting it. This will hurt the balance sheet considerably in view of the fact that the $1.79 billion in inventory as at 2021 accounted for around 40% of the $4.37 billion total assets in the period.

-

Impact of interest rate hikes and on cost of capital

Another concern is the pace at which CWH has increased its debt. Between Q3 and Q4 2021, CWH’s long-term debt increased from $1.075 billion to $1.378 billion, or an increase of $303 million. Short-term borrowings increased by almost 100% from $520.7 million to $1.01 billion.

Historically, CWH has successfully gotten cheap debt, including floor plan debt. This is shown by the fact that floor plan interest expense has declined from $40.1 million in 2019, to $19.6 million in 2020 and $14.1 million in 2021. Similarly, other interest expenses declined from $69.3 million in 2019, to $54.68 million in 2020 and $46.91 million in 2021.

With rate hikes already underway, the impact this could have on CWH’s cost of capital could be material considering it has now increased the size of its debt load substantially. Although liquidity is not an immediate problem, unforeseen challenges such as revaluation of inventory, declining sales momentum and increased interest rates, could put financial stress on the company.

Valuation and conclusion

CWH is trading at 3.9X trailing earnings and 4.4x forward earnings. This is more than 60% off the sector median and its 5-year average. Such a steep discount usually means one of two things: the underlying business is fundamentally broken or the stock is setting up for a monster rally. We are inclined to believe the reality is closer to the latter. The fact that around 40% of the float is held short also adds a positive speculative flair to this investment, as the shorts will cover, potentially creating a squeeze.

At current valuations, and having considered the key strengths and weaknesses, we are cautiously buying. The main risk we see is the debt uptake in a high interest rate environment and the inventory being reevaluated due to a recession-induced decline in demand. If the business can continue performing at the current pace, however, these risks should not be an issue. We will be watching the next earnings to assess these risks and see how the used RV segment is growing, given this is where growth came from in 2021 and will likely come from going forward.

Be the first to comment