Irina Kashaeva

I present another compelling preferred share opportunity that has flown under the radar. Those who follow my work may recall that I wrote a thesis titled A Rare Gift: Crestwood Equity Partners’ 22% Yield On Preferred Shares. I also wrote on the common shares in an article titled Crestwood Equity Partners: Another Safe 50+% Yield. The preferred shares are not as compelling of an opportunity as they were in 2020, but nevertheless still have the potential to offer at least high single digit and stable returns.

Background

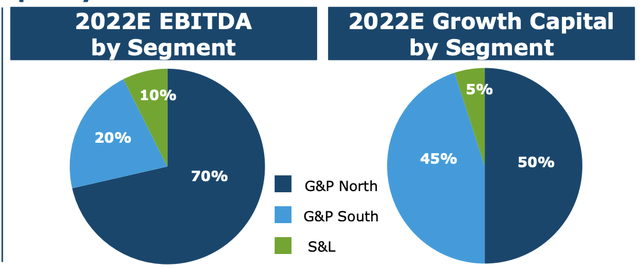

Crestwood Equity Partners (NYSE:CEQP) is a Master Limited Partnership company primarily engaged in Gathering & Processing. Segments are North (Williston and Power River Basin), Gathering & Processing South (Delaware Basin) and Storage & Logistics. The Gathering & Processing North business is expected to generate 70% of the firm’s EBITDA in FY 2022 and it receives about 50% of growth investments.

Investor Presentation December 2022 (Crestwood Equity Partners)

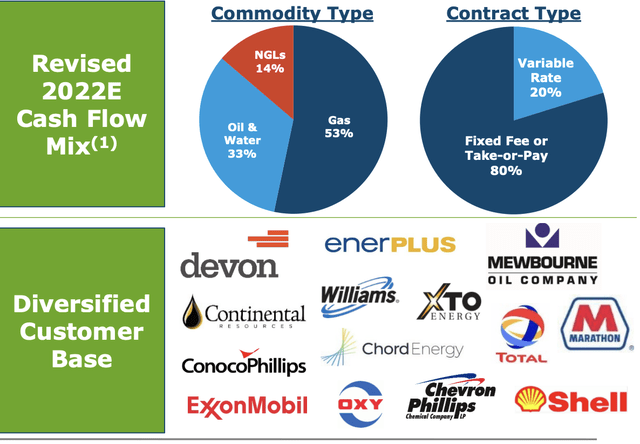

CEQP has 80% of its contracts in gathering, transportation and storage services on a fee basis, which helps the company generate stable cash flows. In addition, its largest customers are investment grade who include Shell (SHEL), ConocoPhillips (COP), Exxon Mobil (XOM), Marathon (MRO), and Enerplus (ERF).

Investor Presentation December 2022 (Crestwood Equity Partners)

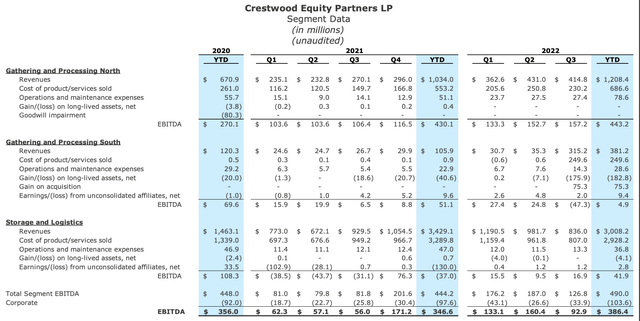

Strengthening oil and natural gas prices over the past 24 months have led to higher production from almost all North American E&P companies so it should be no surprise that revenue and profitability are up YoY both for 3 and 9-months in CEQP’s Q3-2022 results.

Investor Presentation December 2022 (Crestwood Equity Partners)

Gathering and Processing North (G&P North) segment EBITDA totaled $157.2 Million in the third quarter 2022, compared to $106.4 Million in the third quarter 2021, an increase of 48% year-over-year. Segment EBITDA increased primarily as a result of higher natural gas gathering and processing and water gathering volumes, driven by the contribution from the Oasis Midstream assets in the Williston Basin, and the continued favorable impact of higher commodity prices on the Arrow system.

Gathering & Processing South (G&P South) segment EBITDA totalled $53.3 Million in the third quarter 2022, compared to $25.1 Million in the third quarter 2021, an increase of 112% year-over-year. Segment EBITDA increased primarily as a result of higher natural gas gathering and processing volumes driven largely by contributions from the Sendero Midstream Partners LP (“Sendero Midstream”) and Crestwood Permian Basin Holdings LLC (“CPJV”) acquisitions.

Storage & Logistics (S&L) segment EBITDA totalled $11.5 Million in the third quarter 2022, compared to $15.7 Million in the third quarter 2021. Both periods exclude the non-cash change in fair value of commodity inventory-related derivative contracts. During the third quarter, the NGL Logistics business benefited from strong demand for NGL products and recently completed a successful inventory build season, positioning the business to perform well in the upcoming winter season.

Source: Q3 2022 Earnings Report

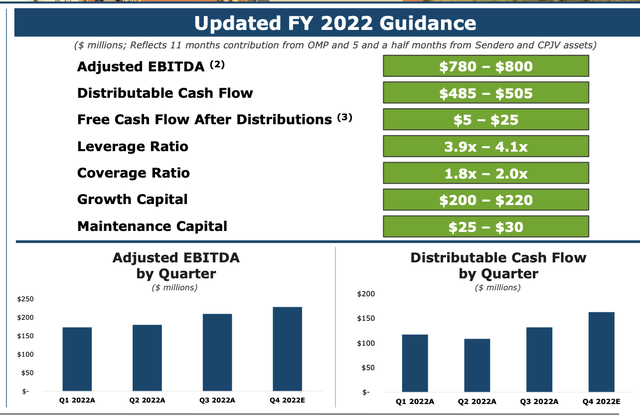

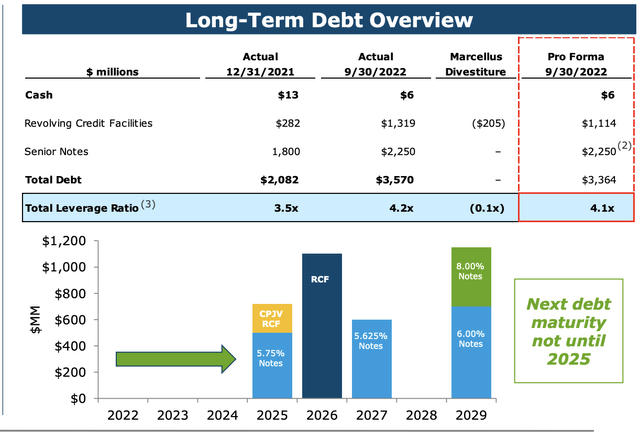

CEQP has earned $355.8 Million in distributable cash flow YTD, showing an increase of 27% year-over-year and expects as little as $485 Million for FY 2022. With as much as $220 Million in expected Growth CAPEX for 2022 and $275M in distributions to common shareholders the company is essentially in self-fund mode. I would not expect a significant dividend increase as there is priority to pay down debt and get back to its previously held Debt/EBITDA ratio of 3.5x. As a plus, there is no maturities on long-term debt until 2025, therefore rising interest rates should not materially affect cash flows.

Investor Presentation December 2022 (Crestwood Equity Partners)

Investor Presentation December 2022 (Crestwood Equity Partners)

The Preferred Shares

The common shares currently trade at a compelling 17% distributable cash flow yield, which is hardly existent in today’s market. From a pure income perspective however, the preferred shares (NYSE:CEQP.P) represent a lower risk way to get almost the same yield at 9.23% relative to 9.53% for the common. In fact CEQP preferred shares have more investor protection than most preferred shares out on the market.

The preferred shares of Crestwood Midstream were issued during a merger with CEQP in 2015 but not publicly listed until 2018. These institutional brokers were able to work out very favourable terms as a result of facilitating the merger. These favourable terms include:

- No call risk. Shares cannot be called at par or liquidation value and therefore essentially have unlimited upside potential for capital gains and the yield is limited by what the market thinks it should trade at.

- Shares are cumulative. CEQP cannot cut preferred distributions without cutting the common distribution first. In addition if CEQP misses a distribution, the obligation accumulates and the company will be required to pay all missed dividends. This is not unique to preferred shares but as an added sweetener if CEQP misses even one distribution, the distribution immediately increases from $0.2111 to $0.2567/quarter and any accrued and unpaid distributions will increase at a rate of 2.8125% per quarter.

- Conversion Option. Preferred holders can convert at any time one common unit for 10 preferred units. If the common shares were to be successful preferred unit holders can participate in the upside of the common shares. CEQP can also force conversion as well, but the price of the common is currently way too low for it to be profitable for the shareholder to convert or CEQP to force conversion, therefore we are not getting into this.

- Voting rights. Preferred unit holders have the same voting rights as common unit holders.

The purpose of this article is to illustrate how undervalued these preferred shares are when compared to cumulative preferred share issuances by Energy Transfer (ET) and DCP Midstream (DCP). I select these two companies as they are rated lower investment grade or upper speculative by Moody’s, S&P, DBRS, and Fitch much like CEQP and therefore are of similar credit quality. All shares can be redeemed after their call date in part or in full but if they are not called the rate resets at a prescribed spread over the 3-month LIBOR Rate shown below.

|

Issue |

Ticker |

Price | Current Yield | Call Date | Spread After Call |

|

7.375% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

(ET.PC) |

$23.394 | 7.89% | May 15, 2023 | 4.530% |

|

7.625% Series D Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

(ET.PD) |

$23.88 | 8.05% | August 15, 2023 | 4.738% |

|

7.625% Series E Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

(ET.PE) |

$23.91 | 8.00% |

May 15, 2024 (callable at $25.50) |

5.161% |

|

7.875% Series B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

(DCP.PB) |

$25.03 | 7.86% | June 15, 2023 | 4.919% |

|

7.95% Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units |

(DCP.PC) |

$25.04 | 7.92% | October 15, 2023 | 7.95% |

|

Median |

7.92% |

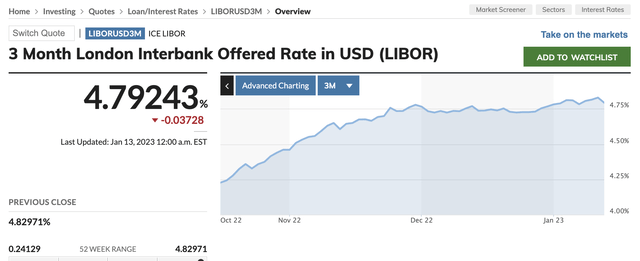

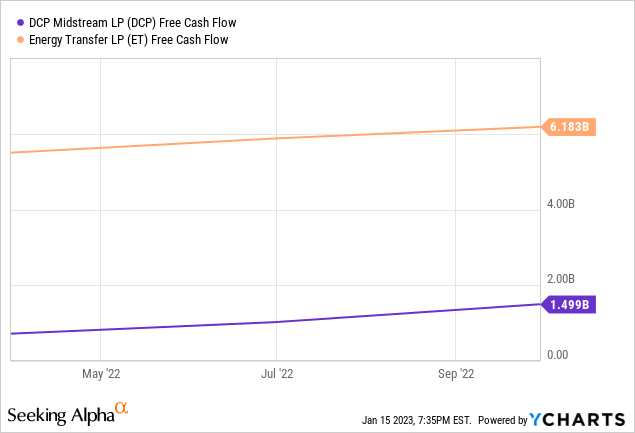

The only reason I can think of that the yields on these preferred share issuances are so low relative to CEQP.P at 9.23% is that investors expect these issues to get called with the call dates all being within the next 15 months. The Three Month Libor Rate has been well over 4.5% over the last three months, so at current rates yields will rise to at least 9% for all of these preferred share issuances when they convert to floating. The yield will actually rise above 12% for the DCP Series C shares which is likely why it trades above par. At current LIBOR Rates it may therefore be attractive for DCP and ET to redeem their preferred shares. It would still cost over $1.55 Billion for ET to fully redeem their preferred shares and $260 Million for DCP to do the same, which would be a large bite out of their free cash flow.

Three Month LIBOR Rate (MarketWatch)

Leverage for ET and DCP is slightly lower. CEQP has coverage of 2.56x on its DCF relative to preferred share distributions and debt interest expense which is still pretty high. ET and DCF, however, have 4.34x and 6.5x coverage respectively however, in large part because CEQP’s preferreds make up a larger part of its capital structure. Still the preferred shares are covered by equity over 3x so does this really warrant a 134 bps premium on ET’s Series C Preferred Shares and a 137 bps premium on DCP’s Series C Preferred Shares?

I would say there is still substantial mispricing going on.

| Ticker | Debt/EBITDA | DCF Coverage on Preferred Shares |

| CEQP | 4.0x | 2.56x |

| ET | 3.68 | 4.34x |

| DCP | 3.50x | 6.50x |

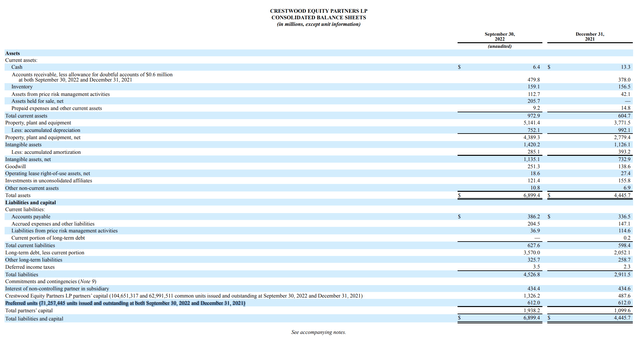

Investor Presentation December 2022 (Crestwood Equity Partners)

Conclusion

It seems extremely odd that ET and DCP, two companies with similar asset bases and credit quality, can have such low yields on their preferred shares relative to CEQP. Moreover, ET and DCP’s preferred shares don’t have the same “sweeteners” that CEQP’s issue has such as the lack of “call risk”, voting rights and a conversion option to participate in the upside of the common shares. Assuming the median yield between DCP and ET’s preferred shares is fair, which I think is too low, would imply a fair price of $10.66/share which would imply 17% upside. Investors can enjoy a well-covered 9.23% yield while waiting for the market mispricing to disappear which is why I think this preferred share issuance is a sure fire way to generate at least high single digit and stable returns for the next few years.

*** Please note depending on where you live different tax rates will apply on distributions regardless of whether this is held in a tax advantaged account as a result of the MLP structure. Please look into that before purchasing this security.

Be the first to comment