XH4D

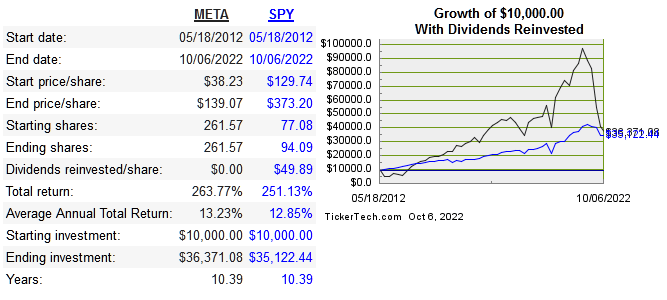

Meta Platforms (NASDAQ:META) is one of the most divisive companies in the world today. My goal with this article is not to give any moral judgment about the company or to look at it through a political lens. My aim is to analyze the business fundamentally and see if now is a good time to invest. Below is the share price CAGR since IPO:

dividendchannel

Financially speaking, META is an advertising company and a massive one at that. Amazon (AMZN) and TikTok are absolutely taking advertising market share from the META/GOOG duopoly, but this doesn’t mean META is destined to keep declining.

Below are the return on capital metrics compared to peers:

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

Revenue 10-Year CAGR |

|

META |

19.9% |

19.3% |

45.9% |

45.1% |

41.3% |

|

GOOG |

16.3% |

15.2% |

14.2% |

19.7% |

21.1% |

|

-6.5% |

-4.7% |

n/a |

n/a |

47.2% |

|

|

-45.1% |

-35.9% |

n/a |

n/a |

102.9%* |

*6-year

AAPL iOS Changes

THere’s no way to sugar coat it, Apple’s (AAPL) changes to the iOS have already led to billions in lost revenue for META and will continue to hamper the top line in the future. This is the biggest headwind they face, and there is essentially nothing that can be done to reverse this. In that respect, the good old days are over, but META has been able to pivot in the past and currently has the financial firepower to do it again.

Damage Control

After the whistleblower scandal last year, META made a series of moves that I believe were solely PR/damage control to try and do something about negative sentiment. Changing the name from Facebook to Meta, and openly touting the long term investments in VR/AR served the purpose of drawing attention away from the whistleblower issue.

I’m not implying that the metaverse investments were made solely for PR purposes, there is a real, long-term plan. What I’m suggesting is that had there been no scandal, the metaverse plans would have been kept secret for much longer. It just so happened that all things Web 3.0 were peaking in popularity during this time, so changing the name and being public about metaverse intentions successfully brought attention to META’s role in this future technology and away from the whistleblower issues.

The Metaverse

I have no unique insight as to exactly how the company’s investments in VR/AR will turn out. There are some basic deductions that can be made though. Firstly, for a company to openly admit that current investments might not pay off for five to ten years is extremely rare, and this kind of language is tough for short-term oriented Wall Street to digest. META acquired WhatsApp in 2014, but only started monetizing more recently, which displays the kind of patience that we should expect in regards to VR.

Next is the fact that industry growth in VR/AR simply adds to the TAM for digital advertising. US digital advertising is projected to grow at 13% CAGR, while VR and AR combined are anticipated to grow at 40%.

I don’t know exactly what the future of VR/AR holds, but I do know that it will increase in importance as the years go on. META doesn’t have to be the leader in this space in order to have success as far as ROI. All big tech companies shamelessly clone each other when a particular thing is working i.e. short form video. This will naturally happen as VR/AR grows.

The bottom line is that the metaverse will be a new opportunity to generate ad revenue, and future success will come from the ability to effectively advertise in this emerging category. If another big tech company ends with higher market share, it doesn’t mean META fails, it just means ad revenue won’t be quite as high.

Capital Allocation

One of the brightest signs overall is the increasing trend of share repurchases. The fact that shares have been beaten down is great news for the share reduction strategy. Share count peaked in 2017, and has been reduced each year, currently 4% lower than in 2017. Only last year were the buybacks increased significantly, but it will take a few years for the consequences of this buyback strategy to be visible. In 2020 only $6.2 billion was used for repurchases whereas last year $44.5 billion was spent buying back shares.

The biggest headwind as far as capital allocation is the FTC blocking acquisitions that META would like to make. This is already happening in the VR space with the FTC trying to block META’s acquisition of Within. In hindsight, the Instagram acquisition was an incredible deal that greatly increased META’s value. This kind of opportunity will never be available again for META, so investors should understand that M&A will play a very small role in the future of the company.

They began to take on significant debt recently, which was a first for them. Long term debt has increased considerably when compared to the average amount in the past, but is at very manageable levels. Free cash flow was $39.1 billion in 2021 versus long term debt of $12.7 billion.

Risk

The biggest risk is simply slower and slower growth in the future, caused by acquisitions being blocked and/or a general failure to adapt. There’s no logical bear case for META to go to zero, they will still grow even in the worst case scenario. People warn when the phrase “this time its different” is used, but in the case of a big tech company like META, there is some truth to it. The position META is in differs completely from an IBM or GE when they were at peak market caps. The company is still gushing in profits, and being a technology company, they can adapt in ways that old-economy companies never could.

Valuation

Below is a comparison of multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

META |

2.8 |

7 |

9.3 |

3 |

|

GOOG |

4.4 |

12.6 |

18.7 |

5.2 |

|

TWTR |

6.1 |

95.6 |

-37.5 |

5.5 |

|

SNAP |

3.6 |

-23.7% |

95.8 |

5.1 |

There is an obvious discount on a relative basis, especially considering that SNAP and TWTR are both money-losing companies. All of the controversy that META has been through seems to hide the important facts, such as 33.2% operating margins, 28% net margin, and a 23% ROIC over the TTM. A growth company whose products are used by most of the world, with such high margins and returns doesn’t deserve to be treated like a value stock

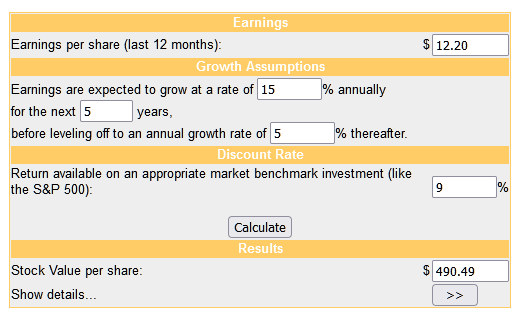

My DCF model is below:

moneychimp

Even using EPS growth less than half of the previous decade, META is clearly undervalued. When you consider that CEO Mark Zuckerberg is only 38 years old and intends to steer the ship for decades to come, you are guaranteed to have zero agency costs for several decades. How many companies can you honestly say that about today? This fact combined with the clear undervaluation makes this a rare opportunity where growth and value converge.

Conclusion

While it may be impossible to not bring in any bias whatsoever, investors need to realize that the current share price is disconnected from reality. The reality is that META is still a growth company with a very long runway considering the industry they operate in and the fact that Zuckerberg will remain in charge for many years to come.

This is one of those rare occasions when growth and value converge, it is the proverbial “fat pitch.” The bearish sentiment has driven the price of this stock down, but it could end up being a blessing as META is beginning to ramp up share repurchases. Don’t let short term bearishness disguise the potential upside of this growth company.

Be the first to comment