Aleksandr Pykhteev/iStock via Getty Images

ASML (NASDAQ:ASML) is walking a tightrope. It continues to ship incomplete EUV systems to customers without getting paid for them as backlogs increase. At the same time, it’s facing slowing demand in certain consumer-driven market segments, primarily PCs and smartphones from some customers, which was responsible for Micron’s (MU) guidance cut and pummeled share price.

ASML experienced a fire at its facility in Berlin, Germany, that impacted EUV production. That was Jan. 3, 2022, and more than six months have elapsed through two earnings calls and ASML has not used the term “fire” in a press release or earnings call. ASML can only say in its Investor Call prepared remarks:

“We are experiencing increasing supply chain constraints which resulted in delayed system starts and requires us to increase the number of fast shipments in Q3 in order to supply our customers with systems in production as quickly as possible. With more fast shipments planned in the quarter, it will increase the amount of revenue delayed to subsequent quarters.”

I pointed out in my April 26, 2022, Seeking Alpha article entitled “ASML: Dissecting An Incredibly Poor Q1 2022 And Earnings Call,” ASML purposely didn’t provide an update of a fire impacting its EUV production, yet ASML was paid for only three systems compared with 11 the previous year.

In an attempt to educate analysts and investors, what ASML is doing is shipping incomplete EUV systems to customers, as I explain in my article:

“Because of the complexity of the EUV systems, ASML has a unique way of categorizing EUV sales vs. shipped. ASML uses the term “fast shipments,” which is in support of customers’ desire to bring systems into production as quickly as possible. By skipping some of these testings in its factory, ASML can shorten the cycle time. Final testing and formal acceptance then take place at the customer side, at which time ASML will recognize revenue.”

Headwinds in 2022

ASML got paid for three of nine systems in Q1 2022 versus 11 of 12 systems in Q4 2021. This suggests that the EUV building fire played a critical role in ASML pushing out six EUV systems in Q1 to customers without first being tested at ASML compared with just one system prior to the fire in Q4. In Q2, ASML shipped 14 EUV systems and got paid for 12, so the two fast shipments added to the 6 in Q1 totals eight fast tracked.

ASML CEO Wennink in the Q2 earnings call reported:

“For our EUV business, we still expect to ship 55 systems this year. As a result of the higher number of fast shipments, we now expect recognized EUV revenue this year on 40 systems to be around €6.4 billion, which is similar to revenue last year.”

With eight fast tracked EUV systems in Q1 and Q2, and with 15 anticipated for all of 2022, that means another seven systems for H2 2022.

In Q2 earnings call, ASML CFO Dassen also reported that:

“We are experiencing increasing supply chain constraints, which resulted in delayed system starts and requires us to increase the number of fast shipments in Q3 in order to supply our customers with systems in production as quickly as possible. With more fast shipments planned in the quarter, it will increase the amount of revenue delayed to subsequent quarters.

ASML reported that the value of fast shipments in 2022 leading to delayed revenue recognition into 2023 is expected to increase from around €1 billion to around €2.8 billion…This excludes around €1.1 billion of net delayed revenue for Q3 as a result of more fast shipments at the end of Q3 than at the end of Q2.”

Further Headwinds in 2023

Thus for the full year, ASML expects a revenue growth of around 10%. Growth is lower than previously guided (+20%) as a result of an increase in the number of fast shipments expected in the remainder of 2022, the revenue for which will be delayed into 2023 at an amount of around €2.8 billion vs. its prior expectation of €1B delay.

I had a good chuckle in Wennink’s comment about the possibility of pushouts of equipment in 2023 when he commented:

“So, we listen and we also read what customers have actually said and especially to specific Memory customers that listen, we see a slowdown, especially in the consumer segment on PCs and on smartphones. But they hastened to pick up the phone and said one thing, “I don’t think you can give our machines to other people because of this. We want those machines.””

Since I’m not a customer of ASML, I guess he didn’t read what I said in my July 11, 2022 Seeking Alpha article entitled “Assessing My 2021 Call For A Likely Semiconductor Equipment Meltdown In 2023 Impacting Applied Materials.“

In it I forecast that there will be a sharp drop in semiconductor equipment in 2023 and 2024 as a result of excessive overbuild of Foundries in 2021-22 that will lead to an oversupply of logic chips.

I also noted in a bullet: “The dour and uncertain economy is adding memory chips to the mix primarily as a result of a slowdown of consumer products like PCs.”

Wennink may be discounting the slowdown in consumer product affecting memory companies such as Micron, as I mentioned above, but he’s also discounting the oversupply of logic chips and the impact on ASML of possible pushouts of processing equipment, which I’m closely monitoring.

Analysts are just beginning to cut estimates of WFE sales in 2023, nearly a year to the day after I published my initial thesis of this meltdown in a June 25 2021 Seeking Alpha article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.”

Investor Takeaway

ASML has positioned itself in the enviable position of being the only equipment supplier of lithography equipment capable of delineating a pattern on a wafer at the 5nm node. ASML has a 100% share of the EUV system market, an 85% share of the ArF DUV immersion system market, a 70% share of the ArF DUV dry system market, an 80% share of the KrF DUV market., and a 25% share of the i-line system market. This is according to our report entitled “Sub-100nm Lithography: Market Analysis and Strategic Issues.”

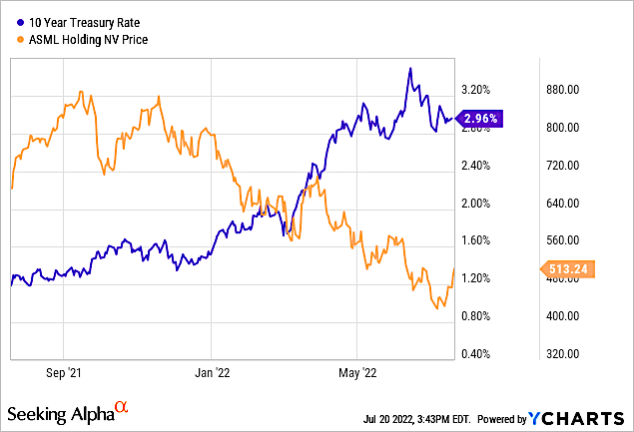

ASML’s share price has dropped 25% in the past year, as shown in Chart 1, but price drop has had strong correlation with the 10-year Treasury note. I discussed this relationship extensively in a July 1, 2022, Seeking Alpha article entitled “Why Are Tech Stocks Selling Off And What Is The Outlook?“

YCharts

Chart 1

Based on my analysis below, since investors are primarily concerned with share price performance, they shouldn’t discount the impact on the macroeconomy on performance.

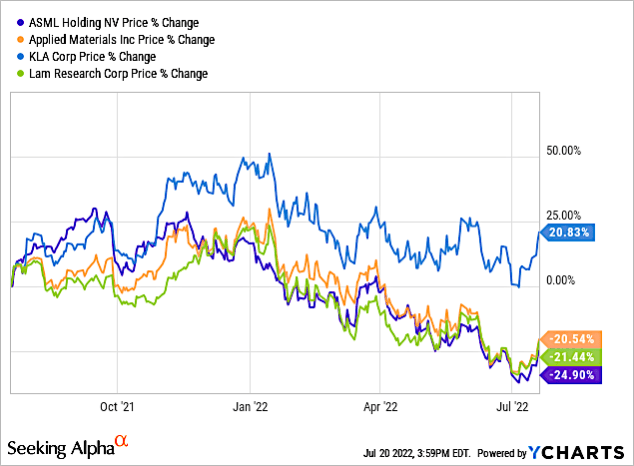

Despite its poor showing, investors can gain solace in the fact that technology stocks are traded as a sector and not individually, due to lack of intimate knowledge of the industry by analysts and investors alike.

This is clear from Chart 2, which compares share price percent change over a one-year period for ASML and peers in the semiconductor process sector Applied Materials (AMAT), Lam Research (LRCX) and KLA (KLAC).

YCharts

Chart 2

ASML may be discounting my thesis that a meltdown in semiconductor equipment was coming in 2023. I suspect it’s because EUV systems are at a high back order from previous years and from 2022, which I estimate at 90 units through 1H 2022. This represents nearly two years of DUV shipments. And we are still kept in the dark about the fire in Berlin six months ago as fast shipments increase.

ASML is attempting to salvage revenues and earnings in a two-year period marked by chip supply-chain shortages in 2021 and parts shortages in 2022 that has been due to poor management of the company. ASML purposely has not provided an update of the fire, but continues to suffer shipment delays and revenue pushouts, and that’s another sign of poor management.

I rate ASML a sell, not only based on problems with EUV deliveries, but headwinds coming from its DUV sales line, which I have discussed extensively in previous SA articles.

Be the first to comment