Khanchit Khirisutchalual/iStock via Getty Images

Article Thesis

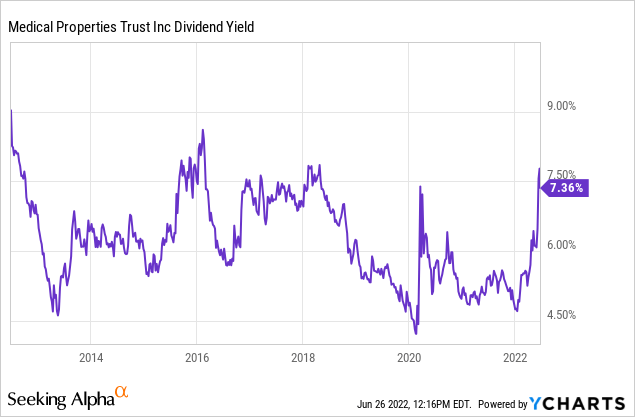

Medical Properties Trust, Inc. (NYSE:MPW) has delivered compelling dividend and earnings growth in the past. In recent months, its shares have come under a lot of pressure, which has made its dividend yield explode upwards, to close to 8%. I do believe that Medical Properties Trust is an attractive income pick at current valuations, although investors should keep an eye on some of the risks in Medical Properties Trust’s portfolio when investing in this healthcare REIT.

MPW Stock Key Metrics

Medical Properties Trust owns hospital properties primarily, which is an asset class where demand isn’t very cyclical. Lease terms are long and MPW benefits from high occupancy rates throughout the economic cycle – whether the economy is good or bad, hospitals operate and people require treatment. This is why Medical Properties Trust managed to perform very reliably in the past, and the same should hold true in the future as well:

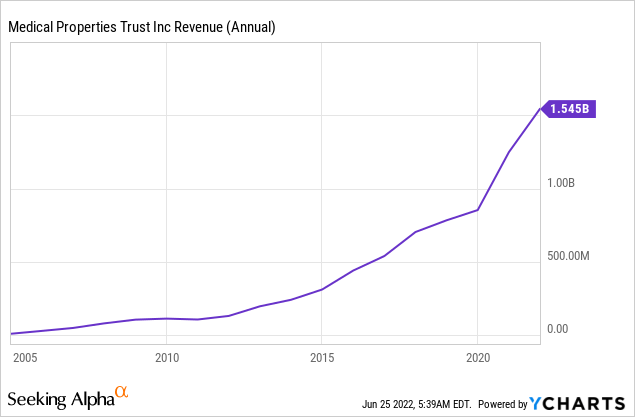

For well over a decade, Medical Properties Trust’s revenue has been either rising or remained stable. Overall, revenues rose exceptionally for much of that time frame, driven by a range of acquisitions. In contrast to other REIT subsectors such as malls, hotels, and so on, Medical Properties’ niche has allowed the company to be a steady long-term performer with solid execution during any crisis, including the pandemic and the Great Recession.

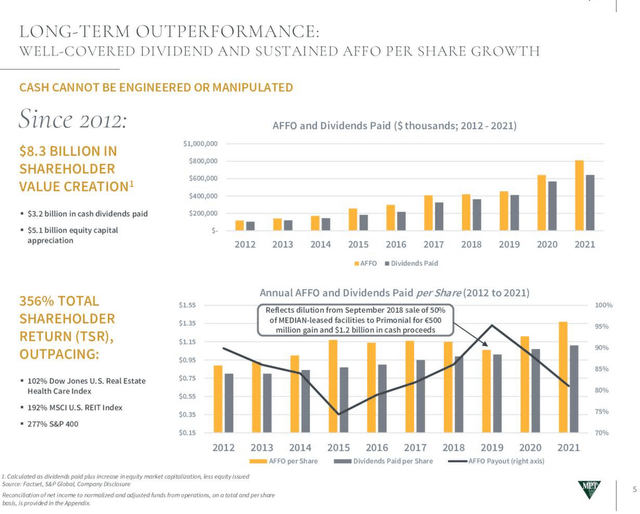

Over time, Medical Properties Trust grew its adjusted funds from operations and dividends meaningfully. Adjusted funds from operations do adjust for a couple of items that are not correctly reflected in GAAP funds from operations, such as straight-lined rent.

In the above chart, we see overall company-wide AFFO and dividend growth. As suggested by the huge revenue growth the company had experienced in the past, AFFO growth and total dividends paid per year grew by hundreds of percentage points over the last decade. On a per-share basis (data for this can be seen in the second chart), growth has not been this extreme. This can be explained by the fact that Medical Properties Trust issued new shares at a rapid pace in that time frame. With most companies, share issuance and a rising share count are a red flag. But in the case of REITs, share issuance is to be expected and is actually a positive thing when proceeds are used in an accretive way. Since REITs pay out a large portion of their income via dividends, their ability to self-fund growth via the cash flow they generate from their operations is limited. When companies want to grow fast, they have to finance their growth by issuing new shares, which is what Medical Properties Trust did in the past and what the company will also do in the future. Since those proceeds have been invested into properties that generate attractive starting yields, this has been accretive on a per-share basis. Despite a high payout ratio, Medical Properties Trust has managed to grow its adjusted funds from operations by more than 50% on a per-share basis over the last decade. For an income vehicle, that kind of growth is very solid and can easily produce double-digit total annual returns when one buys with a starting dividend yield that is high enough – right now that’s the case, I believe. Let’s take a closer look at what MPW’s dividend means for investors and the total returns they can expect going forward.

What Should Investors Know About Medical Properties Trust’s Dividend?

Medical Properties Trust is currently paying out $0.29 per share per quarter, which equates to annual dividends of $1.16. This results in a dividend yield of 7.5% for someone buying at the current share price of $15.50. For those that bought at the lows last week, yields were as high as 8%.

Medical Properties Trust is forecasted to earn $1.83 this year (adjusted funds from operations per share) according to the Wall Street consensus. This means that the company will pay out around 63% of this year’s AFFO in the form of dividends, as long as there is no further dividend increase throughout the year. The dividend has been raised earlier this year, thus I believe it is a realistic assumption that we won’t see another dividend increase this year. A 60%-70% payout ratio is not overly aggressive but relatively high for most stocks. For a REIT, that’s not a high payout ratio at all, however.

In fact, many stable low-risk dividend growers in this space operate with considerably higher dividend payout ratios, such as Realty Income (O) or W. P. Carey (WPC), with payout ratios of 74% and 82%, respectively. By comparison, Medical Properties Trust’s dividend payout ratio in the low 60s is conservative. This should ease concerns about a potential dividend cut – from what we know today, that is pretty unlikely. Even a moderate earnings decline of 20% would not force a dividend cut – and based on MPW’s business model with long lease terms and due to the fact that hospitals are required in any economic environment, such an earnings decline is rather unlikely. I thus believe that Medical Properties Trust’s dividend is pretty safe, which makes it attractive due to the high-yield shares offer right now. This is also underlined by the fact that MPW’s dividend yield has rarely been this high in the past:

During the Great Recession, Medical Properties Trust’s dividend yield rose into the double digits, but since then, shares mostly offered a dividend yield in the 6% range or so. Shares only briefly offered yields of more than 7.5% in early 2016 and during the interest-rate driven sell-off in early 2018. Not even during the COVID sell-off in early 2020 did MPW’s dividend yield rise above where it stands today. From a yield perspective, right now could thus be a historically good time to buy shares in this dividend growth stock.

Dividend growth has averaged 4% over the last 3, 5, and 10 years. We can thus say that Medical Properties Trust is a relatively predictable income growth stock, as there were no large ups and downs when it comes to the company’s dividend growth rate. It is, however, noteworthy that dividend growth actually accelerated slightly, from 3.6% over the last decade to 4.4% over the last three years. But even if dividend growth were to revert back to the 3%-4% rate going forward, investors could realistically expect total returns in the 11% range when we account for the dividend yield of 7.5%. In fact, even if MPW’s dividend growth slows down to just 2.5% a year, the REIT could deliver 10% annual returns before factoring in potential tailwinds from multiple expansion. If dividend growth continues at the more recent 4%-5% rate, MPW could deliver 12% annual returns going forward. None of these scenarios are bearish, and the 12% annual return scenario is actually very attractive, I believe. Even 8%-10% annual returns from a stable recession-resilient business would be compelling from a risk-reward perspective.

Is MPW Stock A Buy, Sell, Or Hold?

Management has proven that it is able to guide the company successfully with a clear long-term focus. Massive shareholder value has been created by management’s growth focus despite the fact that the company has issued new shares regularly. Investors benefit from predictable dividend growth and when they buy at a high starting yield, total returns are quite attractive.

With a large portion of inflation-linked contracts, Medical Properties Trust should see its rent proceeds grow significantly in the current environment. If inflation stays high for longer, as some investors and analysts believe will be the case, MPW is well-protected. In fact, if its debt gets inflated away while rent proceeds and the underlying value of its properties climb, MPW could be a winner in a high-inflation world.

Right now, shares trade at only 8.4x forward FFO, which is a pretty low valuation. Even in a bearish no-growth-at-all case, the current valuation would be far from excessive. Based on historic growth patterns and the high starting yield of 7.5%, I do believe that 8%-10% annual returns can be expected even under pretty conservative assumptions. In a more bullish scenario, returns of 12% or even more are possible as well. All in all, I do believe that Medical Properties Trust is an attractive value at current prices. This income pick looks good for retirees and other investors interested in getting a resilient and still pretty high income yield.

Be the first to comment