Win McNamee

The western sanctions against Russia’s liquified natural gas (“LNG”) sector, along with the EU’s goal to replace imports of Russian natural gas in the following years, are opening new opportunities for companies such as Exxon Mobil Corporation (NYSE:XOM) to capitalize on such developments by expanding its presence in the LNG industry. As the world aims to reach carbon neutrality in the following decades, the demand for LNG is only going to increase, while prices for it should stay at relatively high levels due to tight supply caused by Russia’s inability to increase production because of sanctions. Therefore, even if the demand for oil peaks by the end of this decade, the demand for natural gas is not going to go anywhere, making it possible for Exxon Mobil to continue to create additional shareholder value even in a post-oil world.

The Current State Of Exxon Mobil’s LNG Business

In my previous article on Exxon Mobil written a month ago, I highlighted how the company will be able to benefit from Europe’s decision to stop imports of Russian oil and oil products. My discounted cash flow (“DCF”) model showed that in the current environment Exxon Mobil’s fair value is around $100 per share, which represents an upside of around 15% from the current market price. Not much has changed since that time, so there’s no point talking about the company’s valuation at this stage. It’s better to wait for the Q2 results to come out next week (scheduled for July 29) before updating the model and finding out whether my projections were close to reality.

In the meantime, the goal of this article is to focus on Exxon Mobil’s opportunities in the LNG business, which doesn’t generate as many revenues as the company’s oil business today. However, it has the potential to overtake oil profits in the following decades, especially if the demand for oil peaks by the end of the current decade.

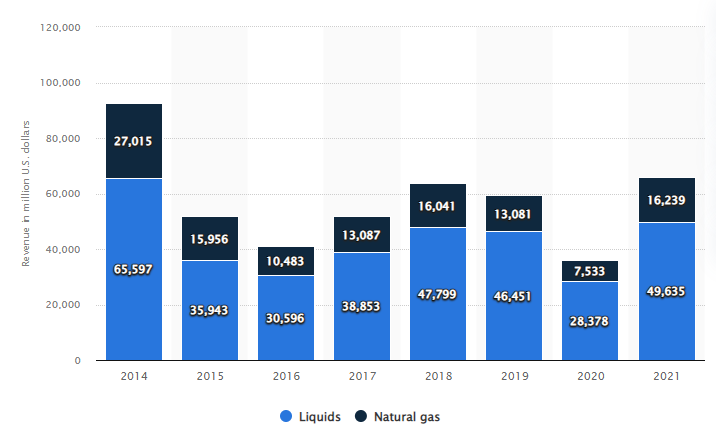

From Exxon Mobil’s website, we know that the company along with its affiliates produces 23 MTA (Million Tons per Annum) of LNG globally and exports it to clients in 30 countries. Last year, the company’s revenues from liquids and natural gas exploration and production were $49.6 billion and $16.2 billion, respectively, both up by double-digits YOY. This accounts for about 20% of all revenues in 2021, which stood at $278 billion. The main reason for the growth of revenues was attributed to the spike in natural gas prices late last year due to the tightening supply and a growing demand around the globe.

Exxon Mobil’s revenues from liquids and natural gas exploration and production (Statista)

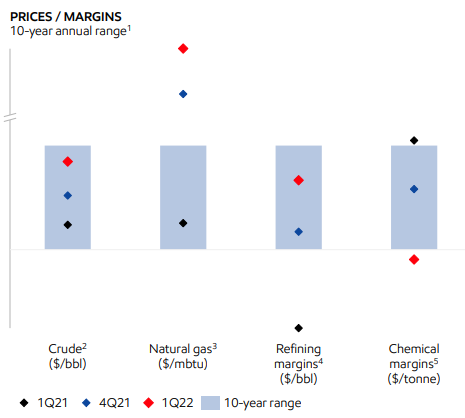

As natural gas prices continue to be at relatively high levels, it’s safe to assume that Exxon Mobil will be able to continue to perform well in the following quarters. In its Q1 earnings report, the company has already highlighted how the prices/margins ratio for natural gas has been way above the 10-year average in the last couple of quarters due to supply disruptions mostly caused by Russia’s political and military actions in Ukraine. Considering that it’s unlikely that prices will greatly depreciate in the following months due to the political reasons that will be discussed below, Exxon Mobil has an opportunity to benefit from the current favorable environment not only in a short term but in the long term as well.

Prices/Margins Ratio (Exxon Mobil)

The Stagnation Of Russia’s LNG Industry

By having the biggest natural gas reserves in the world, Russia was on its way to becoming the single biggest supplier of LNG around the globe in the following decades, taking market share from its closest competitors such as the U.S., Qatar, and Australia. If in 2020 Russia produced 30.5 MMty of LNG, out of which it exported 22MMty, around the same amount that Exxon Mobil exports along with its affiliates, then by 2035 it had a goal of exporting up to 140 MMty of LNG.

However, everything changed on February 24, 2022, when it decided to wage a full-scale war against Ukraine. We shouldn’t ignore the fact that the biggest downside of Russia is that it heavily relies on Western technology and equipment, which is crucial for the growth of its oil and gas industry. In response to Russia’s invasion, the European Union has implemented sanctions that prohibit companies of the member states to supply LNG-related equipment and technology to Russia, which includes process units for gas cooling, process units for the liquefaction of the natural gas, cryogenic exchangers in the LNG-process, etc. This is a problem for Russia, since it has been heavily relying on importing all those components due to the lack of domestic alternatives.

On top of that, Russia has also lost the expertise of western firms such as Shell (SHEL, OTCPK:RYDAF), Halliburton (HAL), Baker Hughes (BKR), and others, who have voluntarily decided to leave or wind down their operations in Russia, making it even harder for the latter to expand its LNG industry. As a result of this, Russia’s experts are questioning whether the country will be able to scale its LNG business given the lack of technology and equipment that are crucial for the proper functioning of LNG projects.

In addition to this, Russia’s Ministry of Economic Development in June published a report in which it now projects Russia to export only 30.7 MTA of LNG in 2022 and 2023, and slowly increase exports to only 37.3 MTA by 2025, in its base case scenario. At the same time, the conservative scenario suggests that Russia will be exporting less than 31 MTA of LNG up until 2026. Those projections are way below the Ministry’s pre-invasion September projections where it estimated Russia to export 38 MTA of LNG in 2023 and 50.7 MTA of LNG in 2024. Considering these developments, it’s hard to see how Russia will be able to reach its long-term target of exporting 140 MTA by 2035 and capturing 20% of the global LNG market.

Another problem for Russia is the fact that, even without implementing an embargo as is the case with oil, the EU is already on track to decrease its dependence on Russian natural gas due to Russia becoming an unreliable supplier. The Energy Information Administration (“EIA”) reports that in recent months the amount of the American LNG that’s been going to Europe has drastically increased, while the EU has been active in securing new long-term deals with Azerbaijan, Algeria, and Qatar and at the same time expanding its LNG infrastructure to stop relying on Russian imports. The latest estimates show that the European Union will be able to decrease its dependence on Russian natural gas from around 155 bcm per year to around 80 bcm per year by the end of 2023. At the same time, the EU’s long-term goal is to fully ditch Russian fossil fuels by 2027, primarily by importing additional LNG from more friendly nations. This opens new opportunities for companies such as Exxon Mobil to help Europe become more energy independent.

New LNG Opportunities For Exxon Mobil

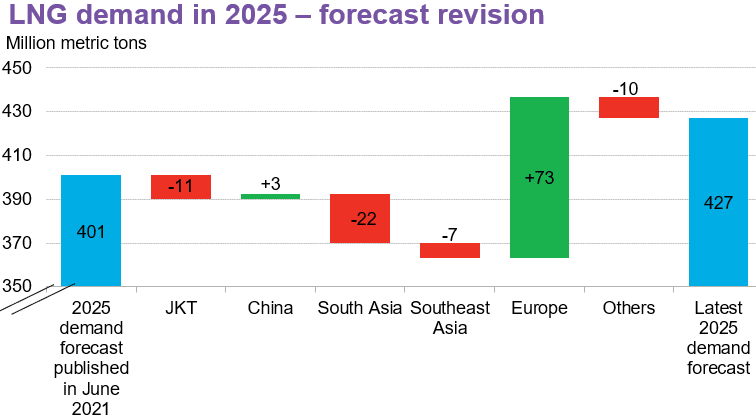

Given Russia’s inability to quickly scale the production and export of LNG due to sanctions, it makes sense for companies such as Exxon Mobil to focus on expanding their own LNG projects now. The sanctions alone have prevented Russia from supplying an additional 20 MTA to 30 MTA of LNG in the following years, while Europe’s decision to ditch Russian fossil fuels should keep the demand for LNG at high levels. Bloomberg’s latest LNG report estimates the increase in LNG demand to 427 MTA in 2025, up from initial estimates of 401 MTA.

LNG Demand Forecast (Bloomberg)

Thanks to this, Exxon Mobil should benefit from these developments, as it can invest in creating additional supply for a market with an ever-growing demand. That’s why in recent months the company has been actively trying to accelerate new approvals for its LNG projects. Just last month, it approached the U.S. government in order to try and reach a deal to expand its Golden Pass LNG project in Texas, where it has a 30% stake, ahead of the schedule. At the same time, Exxon Mobil has also signed a deal with QatarEnergy to develop a North Field East project in which it has received a 25% stake and reached a deal with Papua New Guinea to construct new upstream facilities to expand its LNG capacity in the region. On top of that, the company’s floating LNG terminal near the coast of Mozambique, in which it has a 25% stake, is on track to begin production later this year. By having its LNG projects located in the U.S., Africa, the Middle East, and Oceania, Exxon Mobil has an opportunity to easily supply both European and Asian customers, who are dependent on energy imports.

Four of those projects should also increase Exxon Mobil’s production of LNG to up to 27 MTA by 2027, and help it generate over $7 billion in cash flow in the same year. For comparison, that’s around 15% of its 2021 total cash flow from LNG projects alone. After that period, the company will continue to benefit from the increased demand for natural gas, which is a more environmentally friendly fossil fuel than coal or fuel oil, as it’s highly unlikely that governments suddenly decide to stop decreasing their carbon footprints to tackle the climate change. At the same time, a well-functioning LNG infrastructure should become Exxon Mobil’s cash cow and account for a greater amount of total revenues if the oil demand peaks by the end of the current decade.

In the meantime, as the natural gas prices stay at relatively high levels due to the tight supply, Exxon Mobil has all the chances to continue to improve its performance in the following quarters, while next week’s earnings report shouldn’t disappoint its shareholders as well.

Risks To The LNG Thesis

There’s only one main risk to Exxon Mobil’s bullish LNG story. That risk is the EU’s possible decision to back off and drop the sanctions. Canada has already set a bad precedent by allowing Siemens to evade sanctions and provide a Nord Stream 1 turbine to Germany last week. At the same time, there are talks about easing some sanctions by unfreezing funds of Russian banks for the food trade. If sanctions against the LNG equipment are dropped, then Russia could once again scale its LNG industry and increase the global supply, which will drop the margins lower and decrease Exxon Mobil’s profitability.

However, I don’t see this happening in the foreseeable future. While the EU is indeed about to ease some of its sanctions that are related to the food trade, it’s also about to implement the seventh package of economic sanctions against Russian gold, which is it’s the country’s biggest non-energy export. At the same time, even if Russia somehow manages to increase the supply of LNG, the European Union, which is its biggest customer, is unlikely to fall into the same hole twice and once again start to rely on someone, who breaches contracts and misinforms about supplies.

On top of all of this, western companies that have all the expertise in building and running LNG plants are unlikely to return to Russia as well after taking impairment charges and closing their operations there a couple of months ago.

Therefore, I don’t see a scenario in which Russia significantly increases its LNG supplies and takes market share from the others.

The Bottom Line

Russia’s inability to increase the production and export of LNG proves that sanctions work. While in the short-term the country will continue to generate record revenues due to higher prices, its ability to generate meaningful returns in the European Union will be limited in the long term due to the decision of the latter to look for alternatives.

Thanks to this, Exxon Mobil will be able to continue to grow its LNG revenues and increase profits, since the demand for LNG will continue to increase, while the supply will be tight in the following years, resulting in higher prices for the natural gas in the foreseeable future.

Be the first to comment