JHVEPhoto/iStock Editorial via Getty Images

This month marks a new dawn for the Evidence Lab, more precisely our foray into the world of leisure wear. This was initiated by one of our team who focusses on growth stories who has finally convinced us to begin covering Puma SE (OTCPK:PMMAF) (OTCPK:PUMSY).

For anyone unfamiliar with the Company, Puma is a German corporation that designs and manufactures athletic and casual footwear, apparel and accessories. Famously it was founded by Rudolf Dassler, the brother of Adolf Dassler and founder of Adidas, if you don’t know the story of the two brothers behind the two brands, we suggest you look it up, it makes for interesting reading.

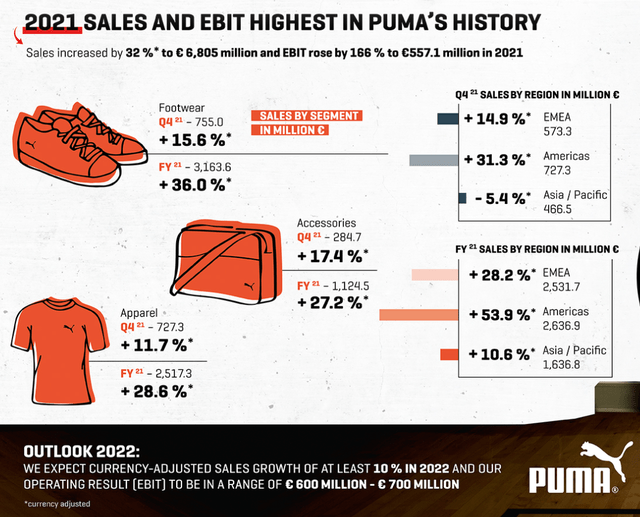

FY 2021 Results

Puma meets the criteria for our growth stock screener. After a small blip in 2020, when there was some nasty virus going around the world, 2021 saw a return to form for the Company, with revenues surpassing pre-Covid levels and their profit margin returning to between 4-5%.

In fact, sales and EBIT levels were the highest in Puma’s history, despite adverse conditions in 2021, this is testament to the Company’s excellent brand momentum and as can be seen at the bottom of the above image, Puma expects at least 10% revenue growth in 2022. The group continues to execute intelligent endorsement deals in rapidly growing markets such as its recent deal with African musician Davido who has over 20 million followers on social media. Such a deal underscores “the company’s commitment to the rapidly growing African market.” Let us not forget the plethora of other athletes and ambassadors with which the brand has key endorsement deals: Puma’s top 5 “heavy hitters” are as follows:

- Neymar, 250+ million following on social media

- Virat Kohli, 162 million

- Antoine Griezmann, 52 million

- Usain Bolt, 35 million

- Lewis Hamilton, 31 million

Despite all of this, Puma is significantly smaller by market cap compared to its “brother” Adidas and much smaller than sportswear colossus Nike. We believe that there is plenty of space for growth in revenue and subsequently profitability as scale economics becomes apparent.

Russia and Europe

Puma’s sales exposure to Russia and Ukraine stands at 3% of 2021 accounts, not a worrying figure by our calculations and we feel that this has been more than priced in. What is cause for concern however is the inflation and subsequent cost of living crisis which we are seeing in Europe which will almost definitely have a significant negative impact on consumer cyclicals on the continent. While Puma is likely to be impacted, it will be able to offset the impact through the fact that sports brands “travel” much better than ordinary clothing brands, thanks to endorsements on a global level and also thanks to its global network. 34% of pre-war revenues came from Europe including Russia and Turkey.

Wholesale?

There have been a lot of rumors circulating around Nike and Adidas’ current contracts with sports shoe retailer Foot Locker after the retail said in its Q4 call that as of Q4 ’22, “no single vendor in its stores would represent more than 55% of total supplier spend” while Foot Locker were quick to downplay rumors that Nike was pulling out of Foot Locker stores, the more level playing field will only play into the hands (or feet) of competitors such as Puma.

Conclusion

Here at the Lab, we feel like the recent stock correction on Puma has been too strong. We value the company using a DCF valuation with a LT growth rate of 3% and a WACC of 8%, arriving at a target price of 98 Euros per share compared to 74.3 Euros at the time of writing. We take confidence from the fact that the stock’s 23 PE multiple is currently at a 29% discount to its 5y average. Also, from the news last month that CEO Bjorn Gulden bought himself €500,000 worth of shares after the recent correction; we rate the stock with a buy.

Be the first to comment