Sundry Photography/iStock Editorial via Getty Images

Kimco (NYSE:KIM) is one of our favorite REITs given its strong ESG credentials and high-quality properties. About five years ago Kimco decided to sell its lower quality properties to improve the overall quality of the portfolio. It paid a price because the dispositions reduced AFFO, but longer term it has been a positive. We are now seeing some of the positive results from that difficult decision made at the time, as now many of the operating metrics are quite positive.

We’ve seen some commentary saying that Kimco is overvalued, and we disagree. While we do not think Kimco is a bargain at current prices, we think it is still a buy, and an argument can be made that fair value is a little bit higher. What some commentators are missing is that Kimco has a lot of leases that are going to mature soon, and which should be adjusted to much higher rents when they are renewed or leased to someone else. That, together with excellent operating results in the recent quarters, and the Albertsons (ACI) stake that Kimco has, which is worth more than $1 billion at current prices, means that Kimco is still an investment that should be considered at current prices.

The company is also making significant progress towards its strategic goals, such as its goal to have 85% of annual base rent coming from grocery-anchored properties. That statistic is now up to ~80%, so it is getting pretty close, and the company is ahead of schedule to meet the target.

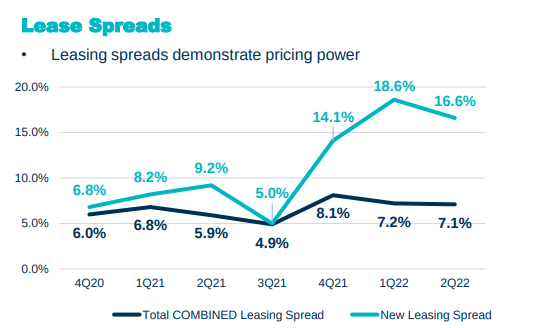

Portfolio retention rates continue to shine, with GLA retention rate during the second quarter at ~93%. Anchors and small shops are both ~10% above their respective 5-year average retention rate. The high retention rate is why Kimco had the lowest GLA vacated during a quarter over the past 10 years. This has helped the company maintain pricing power, which was reflected in the second quarter having 96% of all renewals and options at a positive rent spread.

We continue to see a positive future for the company, and we particularly liked an answer that CEO Conor Flynn gave during the last earnings call, regarding how Kimco is benefiting from certain trends:

I’d say we’re still benefiting too from the 3 major themes that pandemic induced and that’s the first one is sub-urbanization. I think we’ve seen, obviously, an uptick in population around our portfolio. The second being work from home. There’s still a hybrid model out there. So the traffic patterns are still robust to our portfolio as people are cooking more at home or going to the shopping center for lunch as they typically might have gone elsewhere or closer to the office. And then third and probably the most important is still sort of the last mile distribution component.

Target just came out with a remarkable stat this past month, saying that it’s 40% cheaper for them to deliver goods that are ordered online from their store base versus from a distribution center. So I think that is, again, in the first inning of sort of adoption across the retail landscape. We’re very, very focused in being first and last mile retail. We think that value proposition is really going to be a major differentiator for us going forward.

Second quarter results

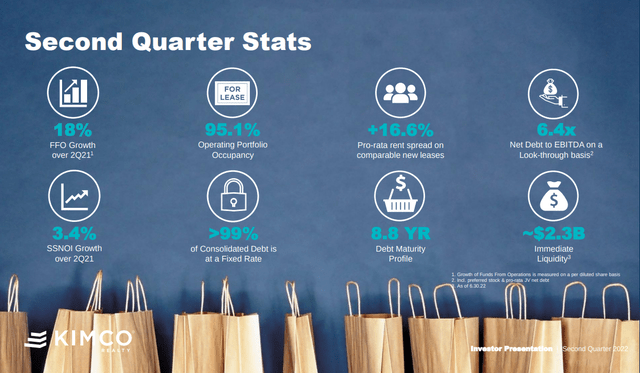

Kimco delivered a strong second quarter, highlighted by brisk leasing volume, higher occupancy, positive same-site NOI growth and a healthy increase in leasing spreads. These operational achievements led to double-digit FFO per share growth. NAREIT FFO was $246.4 million or $0.40 per diluted share for the second quarter 2022, which compares favorably to second quarter 2021 NAREIT FFO of $148.8 million or $0.34 per diluted share.

Occupancy finished the quarter at 95.1% thanks to positive net absorption. Year over year occupancy was up 120 basis points, with anchor occupancy at 97.6% and small shop occupancy at 89.2%, up 370 basis points year over year. That is the largest y/y increase in small shop occupancy in over 10 years. Same-site NOI grew 3.4% over the 2Q 2021. Other relevant statistics for the quarter are shown in the slide below.

Embedded Growth

One important thing investors have to understand about REITs in general, and Kimco in particular, is that often in-place rents are significantly below current market rates. When this happens, it gives visibility to future growth as the leases expire and are adjusted upwards.

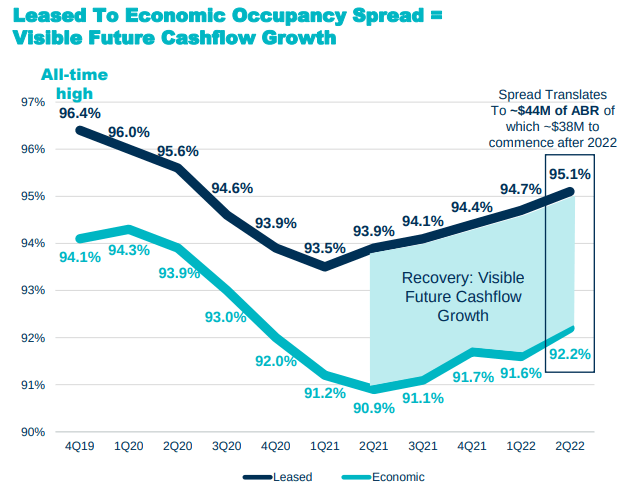

There is also the difference between leased to economic occupancy spread, as some properties are already leased but have yet to start paying rent. This is another source of future cash-flow growth, and one that is particularly important for Kimco at the moment. At the end of the second quarter the difference between leased and economic occupancy was almost 3%, which means there should be significant cash flow growth coming.

Kimco Investor Presentation

To give an idea of how much growth is embedded with existing leases that are below current market rates, the company shared that it has 211 anchor leases expiring during 2022 and 2023 with an average rent per square foot of $12.92, which should renew at much higher prices given that new anchor leases over the trailing twelve months were signed at an average of $16.82. Additionally, 10% of Kimco Realty’s pro-rata ABR is from ground leases with a mark to market of 91%. All of these should help keep lease spreads relatively high for some time.

Kimco Investor Presentation

There is also growth to come from new investments, given that Kimco is able to retain ~$200M+ of FCF after dividends and leasing capex. It will also have a significant sum of money to invest, or retire debt, once it monetizes its stake in Albertsons which is currently worth more than $1 billion.

Balance Sheet

Liquidity remains strong for Kimco with $2.3 billion of immediate availability comprised of ~$300 million in cash and $2 billion from the revolving credit facility, as well as the Albertsons investment.

Look through net debt to EBITDA, which includes pro-rata share of joint venture debt and NOI and the perpetual preferred issuances, stood at 6.4x at the end of the quarter. This is the best level achieved since the company began disclosing this metric over a decade ago, and it does not include any potential benefit from monetizing the Albertsons investment.

Guidance

The company guided 2022 NAREIT FFO per share to be $1.54 to $1.57, up from the previous range of $1.50 to $1.53. FFO should further increase once the company monetizes its Albertsons investment given that the dividend yield on this investment is very low, so almost anything they do with the funds is going to be accretive.

Valuation

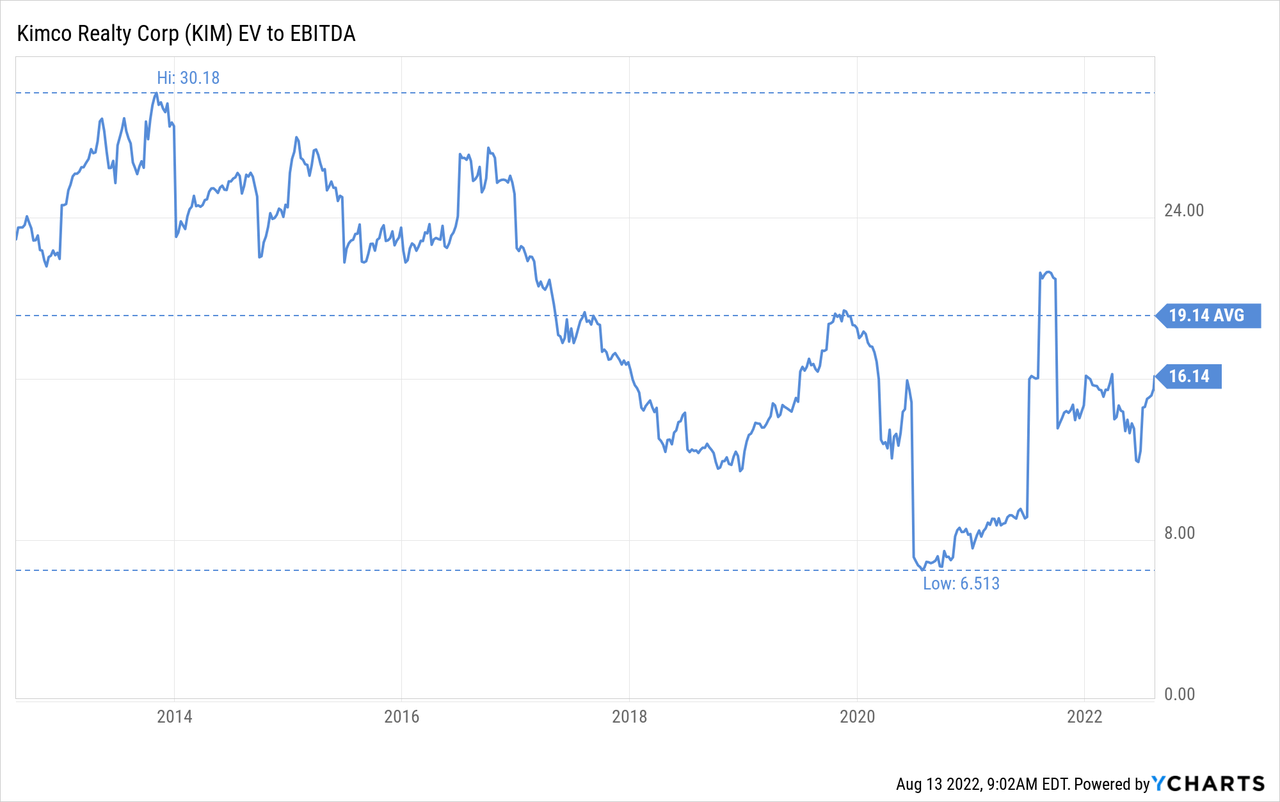

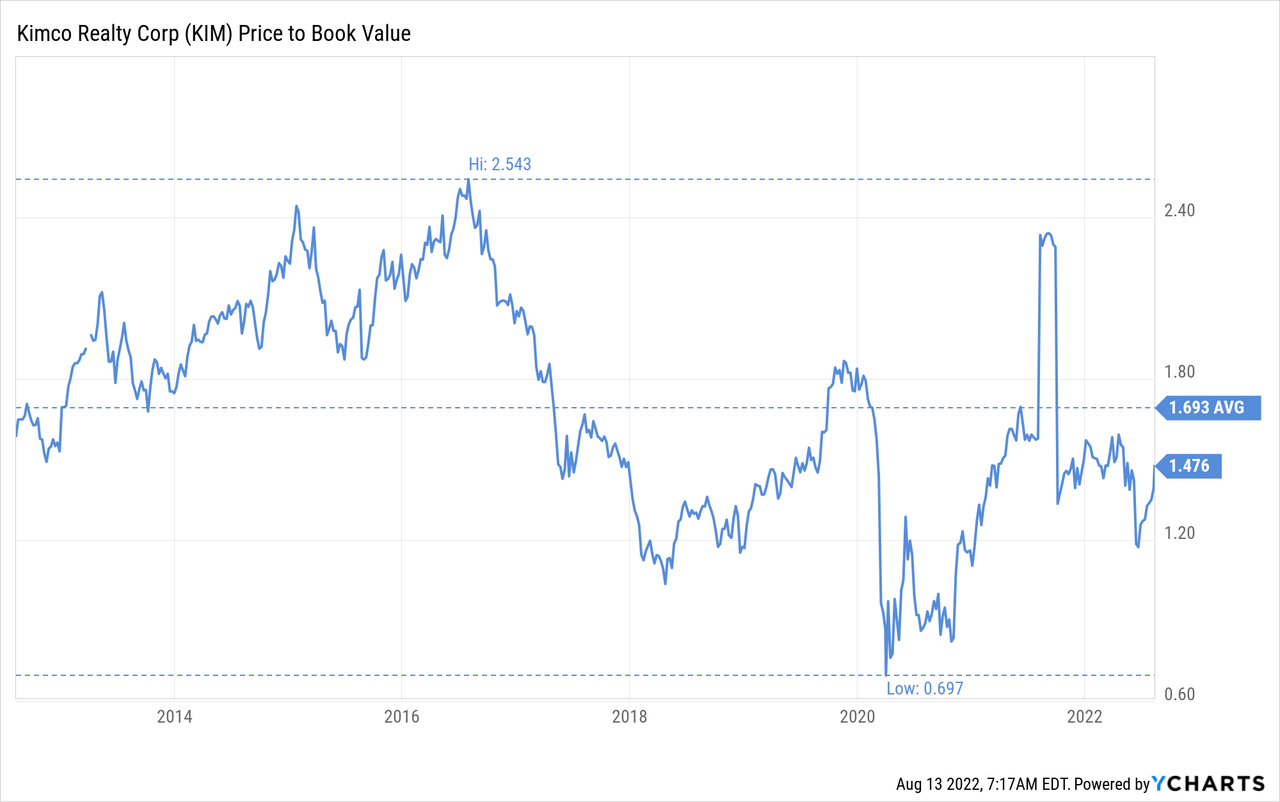

Most valuation metrics point to the company being relatively fairly valued, but this metrics are not incorporating the significant embedded growth that we discussed earlier. EV/EBITDA is currently below the ten-year average of ~19x.

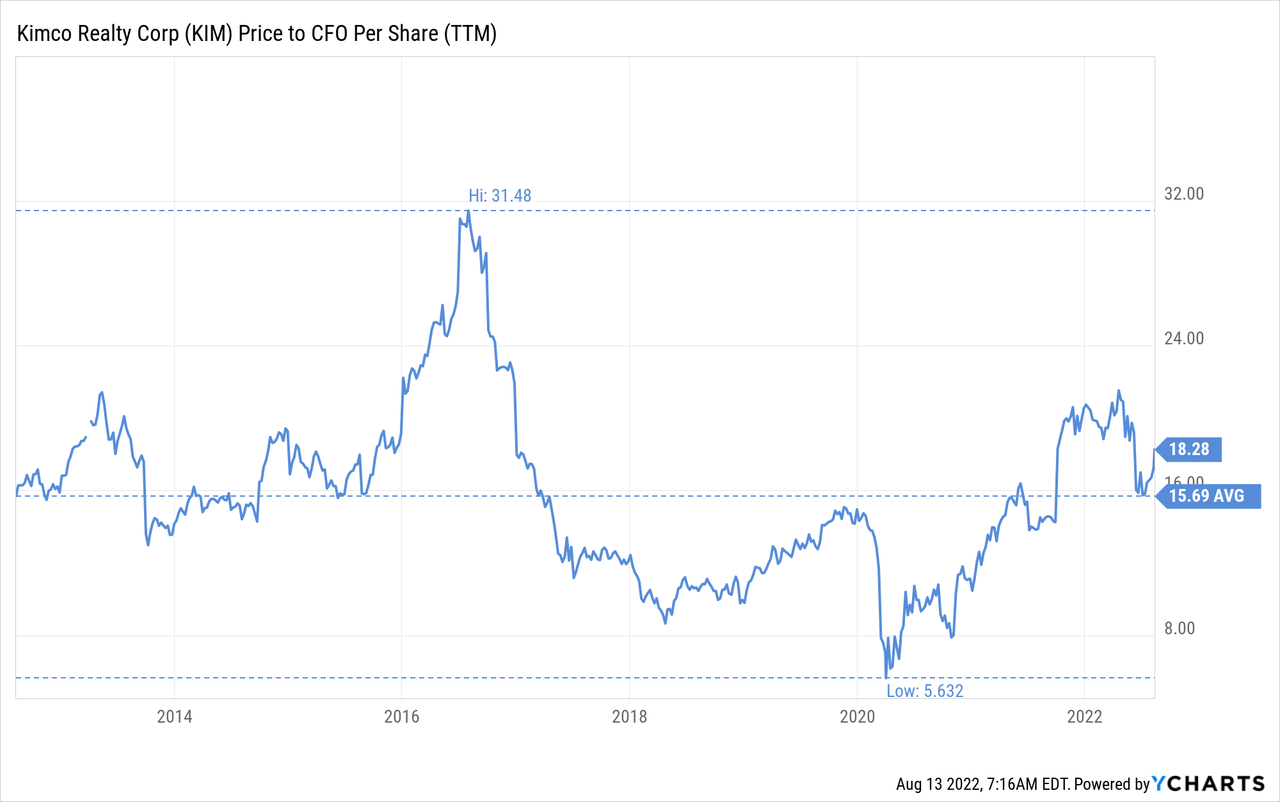

Price to cash flow at ~18x is a little bit above the ten-year average of ~15x, but we still consider it a reasonable multiple on an absolute basis.

Price to book value at 1.4x is below the ten-year average of ~1.7x, despite the fact that the average quality of the company’s portfolio has in general improved.

Risks

Kimco is one of the REITs that suffered significantly from the Covid lock-downs, with many of its tenants not paying rent at the time. Should that episode, or something similar, repeat itself Kimco could be very negatively affected. There are also worries about the effect e-commerce has on shopping centers, but with many retailers implementing omni-channel strategies, and the type of retailers Kimco has in its centers, we are not overly worried. Another thing to take into consideration is the amount of debt Kimco has, which at the moment appears very manageable, but we would prefer if it is further reduced.

Conclusion

While several valuation metrics point to Kimco being about fairly valued at the moment, we believe that the embedded growth from below market rents, the leased to economic occupancy spread, and the Albertsons investment, mean that Kimco is actually a little bit undervalued. One should also take into consideration that the portfolio has been on average improving its quality, as the company disposed of lower quality assets over the last few years. All in all, our point is that Kimco is still worthy of investment consideration.

Be the first to comment