Michael Vi/iStock Editorial via Getty Images

Elevator Pitch

Palantir Technologies Inc. (NYSE:PLTR) is a better buy compared with Snowflake Inc. (SNOW). I prefer PLTR over SNOW because the former has maintained a good balance between revenue growth and profit margins. Palantir is expected to grow its top line by more than +30% every year going forward, while still delivering normalized net profit margins of above +20% in the future. In comparison, Snowflake’s top line growth expectations are better, but it is relatively less profitable. More importantly, Palantir is much cheaper than Snowflake based on the forward Enterprise Value-to-Revenue metric.

How Are SNOW And PLTR’s Stock Performance?

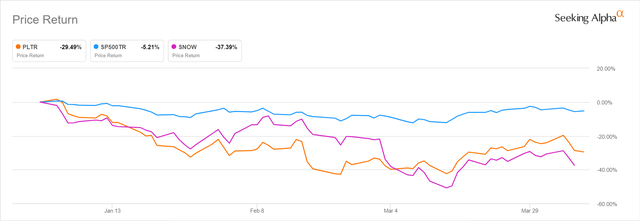

The year-to-date stock price performance of SNOW and PLTR have been poor on both an absolute and relative basis.

Snowflake’s And Palantir’s 2022 Year-to-date Share Price Performance

The shares of Palantir and Snowflake were down by -29.5% and -37.4%, respectively, so far this year. During the same period, the S&P 500 declined by a relatively modest -5.2%. Both SNOW and PLTR saw their shares fall the most around mid-March 2022. A March 11, 2022 Seeking Alpha News article highlighted that “Snowflake shares fell sharply” on the day alongside “several other cloud-related stocks, as investors continued to shun technology stocks.”

Apart from weak investor sentiment which has hurt the share price performance of technology stocks in general, there are also company-specific headwinds relating to Snowflake and Palantir which I detail in the next section.

SNOW And PLTR Stock Key Metrics

Both SNOW’s and PLTR’s forward-looking guidance disappointed the market. This was a key factor that led to the sell-down in their shares in 2022 year-to-date.

Starting with Palantir, the company released the company’s Q4 2021 financial results in a media release issued on February 17, 2022, before the market opened. PLTR’s shares subsequently fell by -16% to close at $11.77 on the day of the earnings release. Palantir has yet to fully recover from its post-results announcement correction, as its last closing share price of $12.84 as of April 7, 2022 was still -8% below its pre-results stock price of $13.97 (closing price on February 16th).

PLTR’s top line expanded by +34% YOY to $433 million in the fourth quarter of 2021. This was +4% above what the market had expected. The company’s robust revenue growth was driven by a +71% YOY increase in the number of customers, from 139 as of December 31, 2020 to 237 as of year-end 2021, as per its recent quarterly results presentation. Palantir grew its client base much faster than what Wall Street was expecting; the sell-side’s consensus 2021 year-end estimate was 219 clients, according to S&P Capital IQ.

However, Palantir’s non-GAAP adjusted earnings per share contracted from $0.03 in Q4 2020 to $0.02 in Q4 2021. More significantly, PLTR’s fourth-quarter bottom line was approximately -44% below the market consensus’ EPS forecast. Palantir’s total adjusted costs (excluding stock-based compensation) rose by +42% YOY to $309 million in the most recent quarter. This was largely attributable to a substantial jump in commercial sales headcount, from 12 as of end-2020 to 80 as of December 31, 2021, as indicated in PLTR’s Q4 2021 results presentation.

Looking forward, PLTR’s revenue guidance was encouraging. As per its Q4 2021 earnings press release, Palantir guided for Q1 2022 revenue of $443 million (implying +30% YOY top line expansion) and “annual revenue growth of 30% or greater through 2025.”

However, Palantir’s near-term profitability guidance didn’t meet market expectations. The company expects to achieve a non-GAAP adjusted operating profit margin of 23% in the first quarter of this year, which is much lower than Wall Street’s consensus Q1 2022 operating margin estimate of 28%, as per S&P Capital IQ. At the Morgan Stanley (MS) Technology, Media & Telecom Conference on March 9, 2022, PLTR explained that “the investments in the product” in 2021 “drove more improvement faster than we actually thought they might,” and the company is “giving ourselves a little space there to invest as aggressively as possible.”

Moving on to Snowflake, its Q4 2021 revenue of $360 million beat the sell-side consensus by +3% and this represented a +102% YOY growth. But SNOW’s shares still dropped by -15%, from a $264.69 close on March 2, 2022 to $224.02 on March 3, 2022 (post-earnings release). In the next one month or so, Snowflake’s stock price declined further, closing at $213.88 as of April 7, 2022.

SNOW’s shares performed poorly because investors were unsatisfied with the company’s fiscal 2023 (YE January 31) revenue growth guidance. Based on the midpoint of Snowflake’s management, the company expected its revenue to increase by +66% in FY 2023. This implied a substantial slowdown in SNOW’s top line expansion, as the company’s sales grew by +106% in fiscal 2022.

Snowflake attributed the weaker-than-expected revenue growth guidance for FY 2023 to platform performance improvements, which will provide more value to its clients. SNOW acknowledged at the Morgan Stanley Technology, Media & Telecom Conference on March 8, 2022, that “every performance improvement we do, we may have a revenue hit,” but it stressed that “those customers are consuming more” in around half a year’s time.

In the subsequent two sections of the article, I will touch on the similarities and the differences between Palantir and Snowflake.

Do Snowflake And Palantir Share The Same Market?

Snowflake and Palantir do share the same market to a large extent.

A December 2020 research report published by Harris Williams classified both PLTR and SNOW as infrastructure software companies. More specifically, the investment bank placed these two companies in the “data” sub-segment of the infrastructure software sector alongside other listed companies like Splunk (SPLK) and Alteryx (AYX), among others.

Harris Williams’ Definition Of The Data Sub-segment Of The Infrastructure Software Sector

Harris Williams

In a blog post published on November 11, 2020, Palantir describes itself as a “software company” which builds “digital infrastructure for data-driven operations.” This provides support for Harris Williams’ categorization of PLTR as an infrastructure company that belongs in the data sub-category.

In summary, both companies operate in the infrastructure software market. This is also where the similarities between PLTR and SNOW end, as I highlight in the next section.

How Do Snowflake And Palantir Differ?

Referring to PLTR’s November 2020 blog post (which I referred to in the preceding section) again, Palantir mentioned that it plays the role of “data processor.” PLTR emphasized that its platforms “allow organizations to better manage” data “by bringing the right data to the people” and enabling “them to take data-driven decisions” and “conduct sophisticated analytic.”

In contrast, Snowflake’s cloud data platform known as Data Cloud is mainly focused on data warehousing and data sharing; and it partners with other companies to offer solutions such as data analytics to its clients, as per the chart below.

SNOW’s Data Cloud Platform And Partnerships With Other Data Analytics Companies

I touch on the two companies’ growth prospects in the long run in the next section.

What Are Snowflake And Palantir’s Long-Term Outlooks?

Both Snowflake and Palantir have long growth runways.

Interactive Data Trends (IDC) has forecast that new data created will expand at a CAGR of +23%, from 64.ZB in 2020 to 175ZB in 2025, according to a January 31, 2022 article published in CDO Trends. As more data gets created, it is natural that this will boost demand for data warehousing, sharing, processing, and analytics going forward. This will be positive for both PLTR and SNOW.

PLTR and SNOW are expected to deliver robust top-line growth and profit margin expansion over the next few years. Snowflake will grow its revenue at a faster pace compared with Palantir, but the former’s profitability will still be inferior to that of the latter.

According to consensus sell-side financial estimates sourced from S&P Capital IQ, Snowflake’s sales are forecasted to increase by a forward four-year CAGR of +57.0%. Over the same period, Palantir’s top line is predicted to grow by a slower CAGR of +34.5%, which is still pretty decent. In terms of profitability, Wall Street expects PLTR’s normalized net profit margin to widen from 20.0% in 2021 to 26.8% by 2025. In comparison, SNOW’s normalized net profit margin is forecasted to improve from 0.3% in fiscal 2022 (YE January 31 or approximating calendar year 2021) to 9.1% in FY 2026.

SNOW is a pioneer and leading player in the cloud data warehousing space, which explains its strong revenue growth. But Snowflake’s profit margins are low on an absolute basis and inferior to that of PLTR as well. A key factor contributing to Snowflake’s modest profitability is the company’s dependence on third-party vendors such as Microsoft’s (MSFT) Azure and Amazon’s (AMZN) AWS. In my July 20, 2021 article for SNOW, I noted that the company’s key suppliers of public cloud services are also the company’s competitors and “have a big impact on Snowflake’s path to profitability.” This is the most significant downside risk for SNOW.

On the other hand, a key concern for Palantir has been its reliance on government organizations. This implies that the company’s revenue can be negatively impacted when the government’s budget shrinks. But there have been encouraging signs with respect to client (commercial customers versus government clients) diversification in recent quarters. PTLR’s commercial segment has been rapidly growing in recent quarters, as its commercial revenue growth went from +28% YOY and +37% YOY in Q2 2021 and Q3 2021, respectively, to +47% YOY in Q4 2021.

In comparison, Palantir’s government revenue increased by a slower +26% YOY in the fourth quarter of last year. Also, as I mentioned in an earlier section of my article, Palantir has invested significantly in commercial sales headcount so as to further support the growth of the commercial segment.

In a nutshell, both companies’ long-term outlooks are decent. But PLTR has struck a better balance between top-line growth and profitability compared with SNOW, as evidenced by the consensus financial forecasts.

Is SNOW Or PLTR Stock A Better Buy?

PLTR stock is a better buy. Palantir boasts superior profit margins, and Snowflake is growing its top line at a much faster pace. But the gap in valuations between the two is huge; PLTR and SNOW are valued by the market at consensus forward next twelve months’ Enterprise Value-to-Revenue multiples of 11.9 times and 30.7 times, respectively, according to S&P Capital IQ. Taking into account the difference in the two companies’ valuations and future financial forecasts, I view Palantir as the more appealing investment candidate of the two.

Be the first to comment