Dirschl/iStock via Getty Images

After marking a high of €58 in early February 2022, shares of Austrian OMV AG (OTCPK:OMVKY, OTCPK:OMVJF) have fallen almost 30%, as a result of the conflict between Russia and Ukraine and the associated fear of gas embargoes, as well as uncertainties regarding the future of OMV’s business relations with Russia in general.

In this article, I will review the company and assess whether OMV has returned to value territory. I will also touch on the significance of the assets associated with OMV’s business relations with Russia, taking into account the data published in the company’s trading update on April 8, 2022.

Company Overview

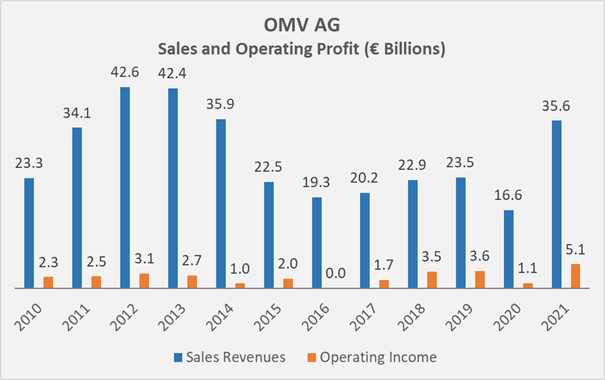

With a market capitalization of currently €14 billion and an enterprise value of almost €17 billion, OMV is one of Austria’s largest publicly traded companies. As an integrated oil and gas (O&G) firm, it produces and markets oil and gas as well as chemical products and solutions, and develops innovative solutions for a circular economy. The company’s cyclicality, but also its recent expansion in the chemicals business (see below) can be noticed from the historical trend in sales and operating income:

Figure 1: OMV’s sales and operating income trend (own work, based on the company’s 2010 to 2021 annual reports)

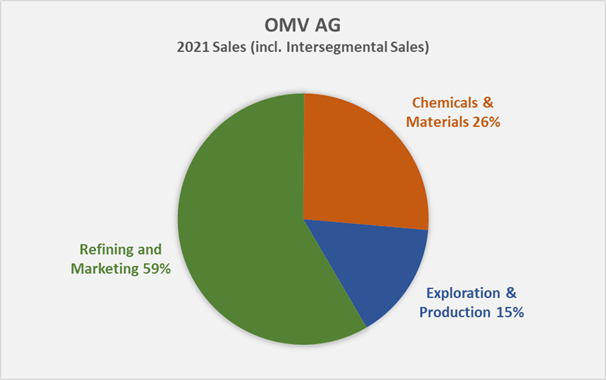

The company reports its activities in three segments, namely:

Exploration & Production: In this segment, OMV explores, develops and produces oil and gas in its four core regions Central and Eastern Europe, the Middle East and Africa, the North Sea, and Asia-Pacific. Of note, Russia was part of the Eastern European core region but the company has recently taken the decision to no longer pursue future investments in Russia. The segment’s daily production was 486 kboe/d in 2021, up 5% from 2020 and split approximately 60/40 between natural gas and liquids. In 2021, the segment generated sales of €6.7 billion and €1.9 billion, including and excluding intersegmental sales, respectively, and operating profit of €2.8 billion before impairments of €325 million, translating to an adjusted operating margin of 41% (36% unadjusted). Sales to third parties from Russia, related to OMV’s oil and gas production activities, were €562 million in 2021, up 44% from 2020, but approximately in line with 2019. The associated 2021 earnings before taxes, depreciation, amortization (EBTDA) and impairments amounted to €233 million, or 5.6% of the company’s 2021 total adjusted oil and gas production EBTDA.

Refining and Marketing: Oil refining and the production of petrochemical products takes place at OMVs three refineries in Austria, Germany and Romania. OMV also holds a minority stake in ADNOC Refining and in ADNOC Global Trading. With these assets, the company is able to process 500 kbbl/d. OMV maintains a retail network of more than 2,000 filling stations, located mainly in Austria and Germany. The company also owns gas storage facilities with a capacity of 30 TWh, holds a 65% share in the Central European Gas Hub and operates a gas-fired power plant in Romania. For comparison, Austria’s total gas storage capacity holds a working gas volume of 95.5 TWh. In 2021, the segment generated sales of €25.9 billion and €23.1 billion, including and excluding intersegmental sales, respectively, and operating profit of €1.6 billion before impairments of €718 million, translating to an adjusted operating margin of 6% (4% unadjusted).

Chemicals & Materials: This segment consists of OMV’s subsidiary Borealis, which is one of the world’s leading providers of advanced and circular polyolefin solutions with total polyolefin sales of 5.9 Mt in 2021 (unchanged from 2020). Also, it is a European market leader in base chemicals, the recycling of plastics and lately also fertilizers, as Borealis received a binding offer from EuroChem for the acquisition of its nitrogen business in February 2022. OMV increased its Borealis ownership from 36% to a 75% controlling stake in March 2020. In 2021, the segment generated sales of €11.6 billion and €10.5 billion, including and excluding intersegmental sales, respectively, and operating profit of €2.3 billion before impairments of €495 million, translating to an adjusted operating margin of 20% (16% unadjusted).

Figure 2: OMV AG’s 2021 segment sales (own work, based on the company’s 2021 annual report)

Going forward, OMV will transform into a leading producer of innovative sustainable fuels, chemicals, and materials, leveraging opportunities in the circular economy. The company has set itself the ambitious goal of achieving net-zero emissions for all three scopes of greenhouse gas emissions by 2050. Between 2025 and 2030, OMV expects to grow its operating cashflow at a compound annual growth rate (CAGR) of 3%. OMV’s transformation will certainly require significant capital expenditures but the company will hold on to its progressive dividend policy.

Recent Events

On March 5, 2022, the company announced that it will no longer pursue investments in Russia. OMV has ended all negotiations with Gazprom about the potential purchase of a 24.98% stake in blocks 4A/5A of the Achimov formation in the Urengoy gas and condensate field, and the basic sale agreement from 2018 has been cancelled.

OMV has also announced plans of the potential divestiture of its 24.99% interest in the Yuzhno Russkoye gas field. Going forward, the investment will be accounted for at fair value through profit and loss and was impaired by €1 billion, of which €800 million are equity-relevant. In addition, the company impaired the outstanding amount of €987 million, including accrued interest, related to the Nord Stream 2 project. As of December 31, 2021, the company reported a net asset value of €2.2 billion for its Russian assets (p. 206, 2021 annual report), and hence, more than 80% of OMV’s assets related to its business relations with Russia were written off in Q1 2022. Overall, although the write-offs are not insignificant, they still only account for 3.3% of OMV’s total assets in 2021. Starting with March 1, 2022, Russian operations are no longer included in OMV’s operating results and cashflows.

OMV Is A Conservatively Financed And Increasingly Profitable O&G Company

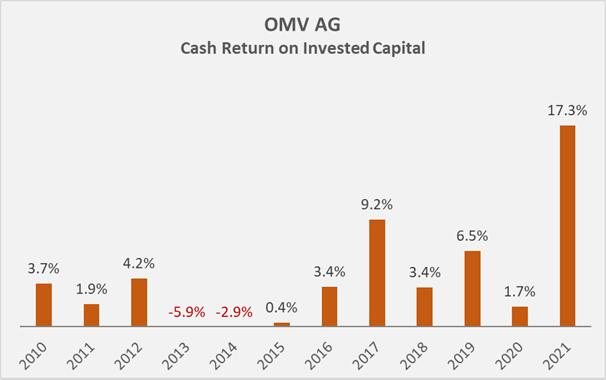

O&G companies are notoriously capital intensive and OMV is no exception to this rule. Since 2010, the company generated €45 billion in cash from operations and spent €32 billion (>70%) on capital expenditures. It is therefore easy to understand that OMV is not particularly strong at generating shareholder value. In this context, cash return on invested capital (CROIC) is a straight-forward measure, as it considers free cash flow (normalized for working capital movements and stock-based compensations) instead of net operating profit after taxes. Over the past decade, OMV has been unable to earn its weighted average cost of capital (currently estimated as 7.5%) in several years, as shown in Figure 3. Evidently, the company’s profitability is strongly tied to the price of oil.

Figure 3: OMV AG’s historical cash return on invested capital (own work, based on the company’s 2010 to 2021 annual reports)

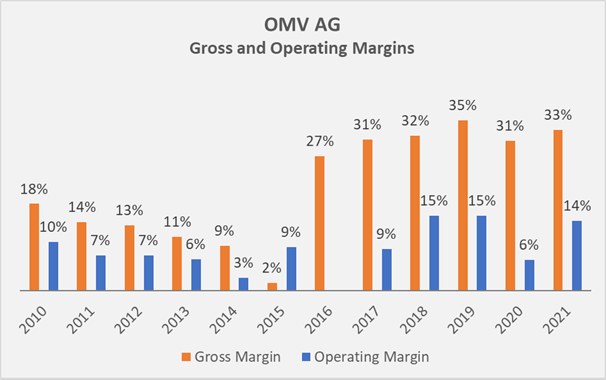

On a positive note, however, the company’s gross and operating margins have increased significantly over the past decade (Figure 4) and are expected to remain elevated as OMV transforms to a chemicals and materials-focused company.

Figure 4: OMV AG’s historical gross and operating margins (own work, based on the company’s 2010 to 2021 annual reports)

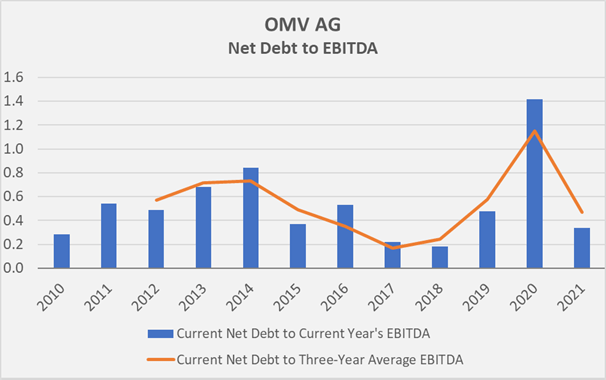

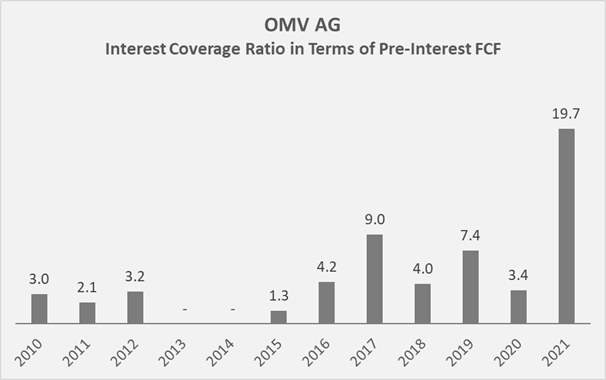

Partly because of the considerable profitability, OMV is able to maintain a robust balance sheet. Current net debt is very manageable at less than 0.4 times EBITDA, but was significantly higher in 2020 due to low oil and gas prices at the time. Note that in order to smooth the effect from 2020, OMV’s three-year average leverage ratio is also shown in Figure 5 (orange line). However, I’d argue that OMV needs to maintain a significant cash position to be able to service its debt, when taking into account the company’s wildly fluctuating free cashflow (FCF). From the perspective of FCF alone, OMV would not have been able to settle its interest obligations in 2013 and 2014 and was only barely able to do so in 2015 (Figure 6).

Figure 5: OMV AG’s historical net debt to EBITDA (own work, based on the company’s 2010 to 2021 annual reports) Figure 6: OMV AG’s historical interest coverage ratio in terms of pre-interest free cashflow (own work, based on the company’s 2010 to 2021 annual reports)

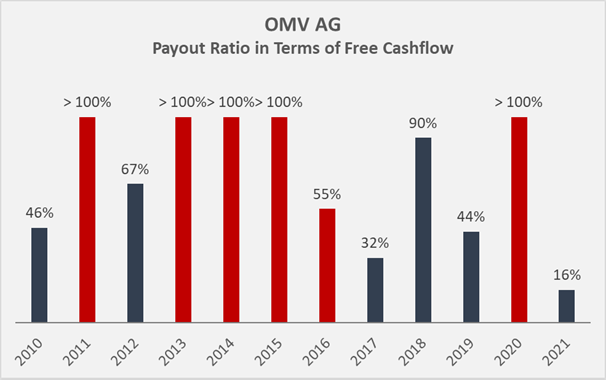

OMV’s conservative balance sheet and substantial cash buffer are also likely to be a reason why the company can continue to adhere to its progressive dividend policy. Even though OMV regularly pays out more than its FCF, it was still able to grow its dividend at a CAGR of 8% over the last decade. The recently announced increase of 24% to €2.3 per share is certainly evidence of the shareholder-friendly nature of OMV’s management. Going forward, the company aims to increase the dividend or at least maintain it at the respective previous year’s level (slide 12, Q4 2021 results presentation). In light of the expected increase in capital expenditures due to the company’s ambitious transformation, I would expect a much more conservative dividend growth rate than the aforementioned 8%, also considering that the 2021 payment of the regular dividend (€1.85 per share) and the payment to non-controlling interests amounted to almost €1 billion already. Note that I also included dividends paid to non-controlling interests in my calculation of the payout ratio illustrated in Figure 7. The company does not return cash to shareholders through buybacks, but has been able to maintain the number of shares outstanding at 327 million since 2012, despite issuing share awards as part of OMV’s compensation plan. Previously, the company increased the number of shares outstanding from 300 to 327 million through a capital increase.

Figure 7: OMV AG’s historical dividend payout ratio in terms of free cashflow (own work, based on the company’s 2010 to 2021 annual reports)

Is The Company A Buy At Current Levels?

Investors who dislike the volatility of companies in the O&G sector are likely to appreciate OMV’s increasing diversification into the chemicals and materials sectors. Nevertheless, OMV is expected to remain a highly cyclical company for the foreseeable future and should thus be purchased at or near the bottom of the market cycle. In March and October of 2020, shares of OMV traded at a sizable discount to fair value but have appreciated to €58 in early February 2022. Mainly due to the war between Russia and Ukraine and OMV’s exposure to Russian assets, the shares have lost almost 30% of their value and currently trade in the low-€40 range.

In terms of price-to-sales, the shares are currently trading at a 15% discount to their historical average valuation (i.e. a current multiple of 0.39). Given the very strong FCF in 2021, the shares appear significantly undervalued with an FCF yield of currently 45% and compared to the historical average of 7%. However, due to the notoriously volatile cashflows in the O&G sector, at least the three-year average FCF should be considered, which nonetheless still results in a very compelling FCF yield of over 20%. The decline in OMV’s share price from €58 to the low-€40 range certainly more than reflects the above-mentioned impairments. However, I would like to emphasize that a share price of €58 was very optimistic and certainly did not take into account a possible recession and probably even considered an oil price of $80 per barrel of Brent to be sustainable.

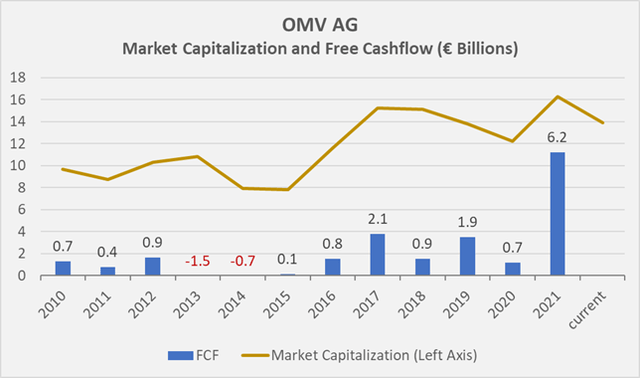

Comparing OMV’s historical market capitalization to its FCF (see Figure 8) confirms that such companies are best bought when earnings are down, as it was the case in 2014 and 2015 or in early and late 2020 (not shown due to the plots time resolution). Note that the market capitalization values in the chart reflect the average share price observed in the month following the announcement of the company’s annual results.

Figure 8: OMV AG’s market capitalization and free cashflow (own work, based on the company’s 2010 to 2021 annual reports and the average share price observed in the month after the company announced each year’s earnings)

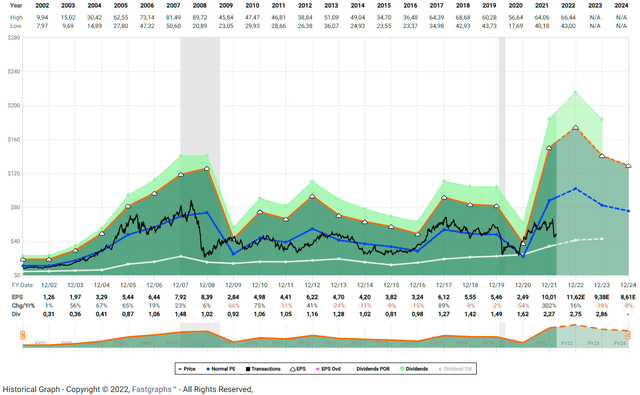

Probably because OMV’s shares also trade as ADRs in the U.S. (ticker symbol OTCPK:OMVKY), a FAST Graphs plot is available. The plot in Figure 9 is based on adjusted operating earnings and illustrates that the shares understandably trade at a substantial discount to a price-to-earnings ratio of 15, which is considered normal in FAST Graphs. Based on current earnings, the stock is certainly cheap, but I doubt that they are sustainable going forward, as is also shown by the earnings estimates in the plot (dashed lines).

Figure 9: FAST Graphs chart for OMV AG’s ADRs, based on adjusted operating earnings (obtained with permission from FAST Graphs)

The current dividend yield of 5.4% is certainly tempting and well above the historical average of 4.0%, mainly due to the recent generous 24% increase. I own shares of OMV in my dividend stock portfolio, but admittedly would not add to my position at the current price, also considering that OMV is more and more becoming a chemicals and materials company and I originally purchased it as an integrated O&G company. In terms of total return, OMV can be anything from a horrible to a good investment, further underscoring the importance of only buying the stock at the bottom of the cycle.

Be the first to comment