Denis Moskvinov/iStock via Getty Images

Introduction

Aris Water Solutions, (NYSE:ARIS) only IPO’d last fall. ConocoPhillips, (COP) gave a big vote of ratification to the company, taking a nearly 40% stake, and giving it a contract to manage its frac and produced water. It also contributed to the water management midstream assets picked up in the Concho Resources acquisition in 2020. Some of the reasons COP saw the need to invest in a company like ARIS, will become apparent later in the article. Institutions, Mutual Funds, and ETF’s have also bought into ARIS in a big way as well. If you have Dirty Water, ARIS has a plan.

The company participates in the same frac/produced water infrastructure and recycling space as Select Energy Services (WTTR), a company we just submitted to you with a buy recommendation. A case that becomes more compelling daily in the current market meltdown. I think that higher oil prices are here to stay, there just isn’t enough of the stuff go around, and that sets up a continued bull run for oil companies and the companies that provide services to them.

ARIS has rallied some 30% from its IPO price, but is now pulling back along with everything else in the “Fed put” market tantrum now underway. (No all that free money you got a couple of years ago wasn’t really free. Surprise!) In this article we will take a look at ARIS and see if there is an investment case, and at what level we might stick our toe in.

The thesis for water management

The era of casually disposing of water-of any type is coming to an end. Water resources, particularly “fresh” water are moving up the value chain. Don’t believe me? I just got a water bill from my public utility with a 90% increase in base rates. There’s one coming to your mailbox as well, along with increases for a thousand other things. The era of cheap-anything could be entering its twilight as well. That’s a broader case to make than what I am prepared to discuss at present, so we will stick to water.

As this Reuters article notes, freshwater is a scarce resource to which increasing numbers of people have limited access-

Only about 1% of water on Earth is freshwater – mostly found in ice caps – with the rest being saline, in the oceans. Of the planet’s liquid freshwater, 99% is found underground, where the quality is generally good. It can therefore be used safely, affordably and without requiring advanced treatment.

Drilling down from here. What is rapidly emerging in frac and produced water disposal, in hyperactive shale plays like the Permian, is going to shift toward recycling. This is being driven by companies’ own ESG goals of sustainable production and reducing carbon footprint in fracking operations, as well increasing government concerns. Seismic activity – a fancy name for earthquakes in this case – in areas where it was previously unknown. That fact is raising red flags and focusing a mitigation lens onto companies looking to grow or maintain oil output. This isn’t a passing fad, or something that is going away. Water is needed to frac-there is no substitute. When on production wells make water that must be dealt with. At today’s oil prices, you can afford to pump a well with a water-cut in the 90 percentile. That means a lot of water needing treatment.

The Rystad article notes that more than a dozen of operators with disposal permits in the Gardendale Seismic Response Area-SRA, affecting wells pumping into the Ellenberger formation, are coming under regulatory review, with deep impacts affecting some.

ConocoPhillips experiences the largest loss of disposal capacity, with a total of 186,000 barrels shuttered, followed by Rattler Midstream at 150,000 barrels and Wasser Operating and Fasken Oil and Ranch each with a loss of 120,000 barrels of permitted disposal capacity.

Rystad goes on to note:

The best way to hedge against regulation and cost is to invest now in the recycling network needed to handle future barrels of water. In the most recent round of sustainability reporting, many operators have been more transparent about their water stewardship, reporting standardized metrics for the investment community to analyze. In 2022, there are likely to be even more frameworks established to calculate ESG scores and benchmark operators on their water management practices, much like on emissions. Investments need to be made today to get ahead of the curve and position well for 2022.

As we will see, in ARIS we have a well-capitalized provider of water services to the frac industry. The market is growing due to demand for oil and gas, and the absolute requirement that these resources be better utilized than in the past.

Why ARIS?

The company has been killing it in the recycling space, recently signing a long term contract with Chevron (CVX) This a huge win for the company. CVX has publicly committed to growing production in the Permian, targeting a million BOEPD by 2025. When you add in similar contracts with ConocoPhillips, a company that is also growing in Permian, having bought Shell’s assets last year for $10 bn, on top of its $9.7 bn purchase of Concho Resources in 2020, and others, you have a repeatable book of business that will provide steadily increasing cash flows into the middle of this decade.

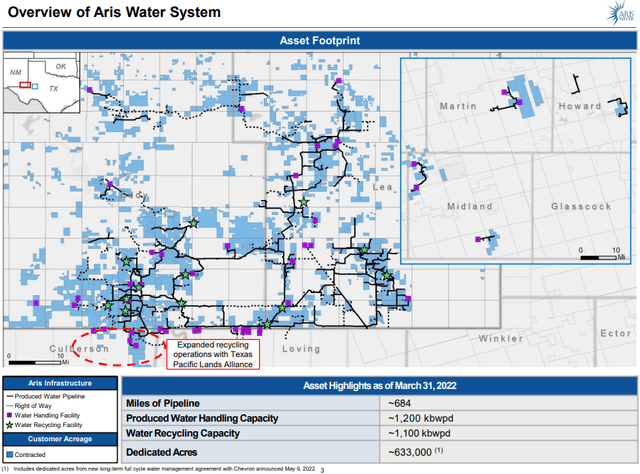

Aris Water Solutions Footprint (ARIS)

The graphic above shows the Delaware basin centric layout of the ARIS distribution and processing network.

The Texas Pacific Land alliance is a masterstroke of strategic thinking for ARIS. TP&L owns in fee over 800K acres, mostly in the Permian and the alliance enables facilities and rights of way that just wouldn’t be possible otherwise. This deal is two-fer for TP&L as they are the lessors of much of the privately held lands to oil companies. Tyler Glover, CEO of TP&L summed it up in the press release:

Having Aris develop additional strategic infrastructure on TPL’s surface acreage will further expand and enhance our ability to serve operators and customers. By working with Aris, we will drive more water volumes onto TPL’s surface acreage and facilitate further operator development on our oil and gas royalty acreage.

Then you have a blue-chip oilfield leadership roster, led by Bill Zartler as Executive Chairman. He also heads up another OFS company we’ve reviewed in this space, Solaris Oilfield Infrastructure, (SOI), (and which we will review again soon).

Aris Water Solutions Q1 2022 Results

Revenues grew ~5% to $71 mm on volumes of 1.2 mm bbl of water daily. This was led by a near tripling YoY of produced water volumes to 273K BPD. Adjusted EBITDA rose to $35.9 mm, up 54% YoY. Margins per bbl grew to $.026 from $0.14 YoY. Capex declined by half YoY to $9.8 mm. The company has $67 mm in cash, no long-term debt and an undrawn $200 mm revolver. Total liquidity was $267 mm. The company paid a $0.09 quarterly dividend for the second quarter.

The company is guiding toward full year EBITDA of $140-$175 mm, and ~$40 mm for Q-2. Capex will also increase to support the new CVX contract to $140-$150 mm on a full year basis.

Risks

ARIS is trading down today along with the market, although bottom-fishers are coming in and cutting losses. The valuation of the company is a little rich, with a PE of nearly 20, but then the same could be said for WTTR at 21.

The major risk for ARIS is regulatory. The government is being very capricious as regards the industry and its impossible to predict what stunt they may try next. Most of their ire is directed toward ARIS’ customers, but again… who knows?

Recently the Defense Production Act has been waved at the industry to compel them to produce more and charge less. Price controls will shatter production economics and drilling will fall off a cliff. I don’t see a big probability of this happening, but I get surprised every day.

Any big sanctions against their clients will roll over onto ARIS. Particularly if they get stuck with some unproductive facilities sitting in the West Texas sand. A low-risk probability, but it’s out there. It should also be said, in that event the whole OFS sector will take a leg down.

Your takeaway

Analysts are unabashedly bullish on ARIS, with 7 of 10 rating it a BUY. The price target range runs from a low of 18.63 to $26. The median is $24.

On a forward EV/EBITDA basis the company trades at a multiple of 5.6X. Not excessive for a company with its growth prospects.

I think the case for frac and produced water management is solid. There is no shale oil without fracking. Water comes out of the ground with the oil. It must be reclaimed going forward as opposed to just being pumped into the ground. Companies like ARIS should do well. ARIS is probably the clear leader in this space.

Be the first to comment