RonFullHD/iStock via Getty Images

You would think that at a time when energy prices have skyrocketed and the profits of some of the companies in the space have hit all-time highs, all players in the space would be doing quite well. But sadly, this is not the case. To see what I mean, we need only look at Argan (NYSE:AGX), an enterprise that provides engineering, procurement, and construction services to the power generation market, and that also provides industrial fabrication and field services for both the light and heavy industrial space. Recently, revenue achieved by the company has been dropping and cash flows and profits have followed suit. When factoring in the company’s massive amount of cash, the overall risk to shareholders looks limited. And shares look fairly affordable. But even with the stock tanking, I do think it’s hard to rate the company any higher than the ‘hold’ I had it out previously unless we see some sort of improvement moving forward.

Energy-draining times

Back in the middle of October of 2021, I wrote an article about Argan, diving deep into the company’s business model and discussing whether or not it made sense to invest in. At that time, I called the company an interesting player because of how cheap shares were trading and I said that the enterprise carried with it a very low amount of risk in the sense that bankruptcy is almost impossible absent something material like fraud. I was turned off, however, by the company’s volatility and that led me to ultimately rate it a ‘hold’ to reflect my view that shares should generate performance that would more or less match the broader market for the foreseeable future. Since then, that call has not been terribly off the mark. While the S&P 500 is down by 7.8%, shares of Argan have dropped a slightly more significant 11.6%.

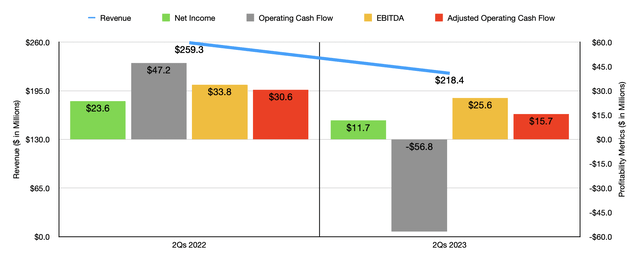

To see why performance has been rather weak, it would be helpful to cover how the company has been performing so far this year. For the first two quarters of the company’s 2023 fiscal year, sales came in at $218.4 million. That’s 15.8% lower than the $259.3 million generated the same time last year. According to management, this decline was driven in large part by a $30.9 million decline in the power industry services category, with sales dropping because of the company’s construction activities associated with the Guernsey Power Station project passing peak levels. The company also experienced weakness when it came to the industrial fabrication and field services portion of the firm, with revenue plunging 19.9% in response to the amount of pipe and vessel fabrication and field services demanded by clients dropping.

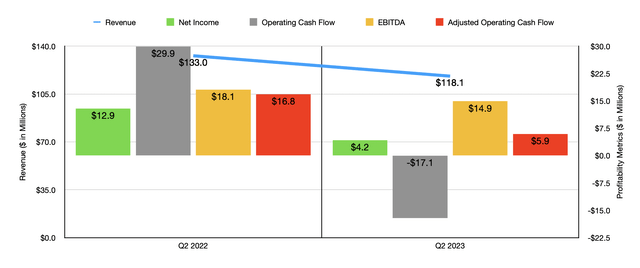

With this drop in revenue also came an unfortunate drop in profitability. Net income plunged from $23.6 million to $11.7 million. Operating cash flow declined from a positive $42.7 million to a negative $56.8 million. Even if we adjust for changes in working capital, it still would have taken a beating, declining from $30.6 million to $15.7 million. Meanwhile, EBITDA saw the smallest decline, dropping from $33.8 million to $25.6 million. As you can see in the chart above, the financial performance of the company was weak in the second quarter on its own as well. Sales dropped from $133 million to $118.1 million. You can also see that every profitability metric followed a similar trajectory during this time. Interestingly, this pain has not stopped the company from buying back stock. In the second quarter alone, the company repurchased $26 million worth of shares. That brings share buybacks from last November through the end of the second quarter of this year to $74 million in all.

Truth be told, we don’t really know what to expect for the 2023 fiscal year in its entirety. We do know that in most quarters the company had been experiencing some weakness in performance obligations. For instance, in the second quarter of 2022, this number came out to $467.9 million. By the end of the second quarter of this year, it had fallen to $371.8 million. At the same time, however, the number in the second quarter was higher than the $339.2 million reported in the first quarter of this year. So while results are weaker year over year, they have shown some strength as of the latest quarter. Simply annualizing results for 2023 as a whole, we would get net income of $18.9 million, adjusted operating cash flow of $29.4 million, and EBITDA of $40.7 million.

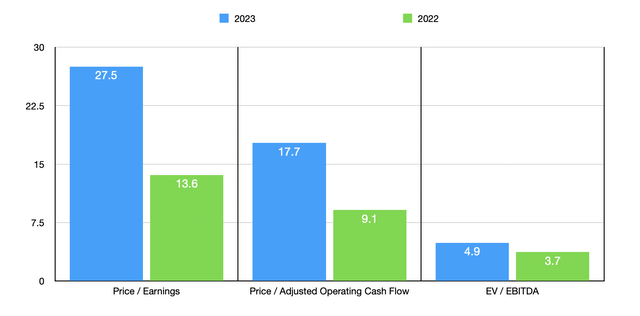

Based on these figures, the company is trading at a forward price-to-earnings multiple of 27.5. The forward price to adjusted operating cash flow multiple would be 17.7, while the EV to EBITDA multiple, on a forward basis, would be 4.9. To put these numbers in perspective, using the data from 2022 instead, we would end up with multiples of 13.6, 9.1, and 3.7, respectively. The reason why the EV to EBITDA multiple for the company is so much lower than the other metrics is because the company has no debt and has cash on hand of nearly $319 million. That drastically reduces the enterprise value of the firm. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.3 to a high of 74.7. In this case, four of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was from 2.5 to 36.8. Three of the four companies that had positive results were trading cheaper than Argan was. Meanwhile, using the EV to EBITDA approach, we end up with a range of between 7.1 and 126.8. In this case, was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Argan | 27.5 | 17.7 | 4.9 |

| Great Lakes Dredge & Dock (GLDD) | 21.7 | 36.8 | 8.5 |

| Concrete Pumping Holdings (BBCP) | 18.2 | 5.8 | 7.1 |

| Tutor Perini (TPC) | 8.3 | 2.5 | 10.1 |

| Northwest Pipe Co (NWPX) | 14.6 | 11.1 | 8.1 |

| ReneSola (SOL) | 74.7 | N/A | 126.8 |

Takeaway

Clearly, the 2023 fiscal year is not currently looking all that great for Argan and its shareholders. Revenue and profitability figures are falling but we did see in the latest quarter some improvement in performance obligations. That alone is a positive sign, as is the fact that the company has no debt and a significant amount of excess cash. But when coupled with the fact that shares are getting a bit pricier, I cannot yet bring myself to upgrade the company from a ‘hold’ to a ‘buy’ even though I believe that it should continue to add value to its shareholders for the long haul.

Be the first to comment