grahamheywood

During these uncertain times, investors should expect some extreme volatility in the market. This is especially true of companies related to the construction space. After all, construction should be negatively impacted by rising interest rates aimed at combating inflation. One firm that seems to be escaping the pain so far from a fundamental perspective, but that is experiencing it from a share price perspective, is The AZEK Company (NYSE:AZEK). This enterprise, which operates as a designer and producer of residential and commercial building products such as decking, rail products, polymer materials designed to replace wood and other products, and more, has done incredibly well from a revenue and profitability perspective in recent quarters. Even so, driven by fear regarding the broader market, investors have not been so kind, pushing shares down considerably. Now to say that all of this downturn has been unwarranted would be incorrect. If management’s own forecasts covering the final quarter of the company’s 2022 fiscal year are correct, then pain should finally start to settle in. And when factoring in the prospect of this pain continuing and considering how shares are priced compared to similar firms, investors probably would be wise to take a cautious stance on the company.

Future pain outweighs past glories

The last time I wrote an article about AZEK was in late February of this year. At that time, I found myself impressed by the historical performance of the enterprise, particularly with its revenue and cash flow figures. I felt as though the company was fundamentally robust and that shares were priced low enough to offer investors some long-term potential moving forward. All of these factors combined led me to feel comfortable enough to rate the company a ‘buy’, reflecting my belief that shares should outperform the broader market for the foreseeable future. Sadly, I severely underestimated just how pessimistic the market would become regarding the company’s near-term outlook. While the S&P 500 is down 7.5% since I last wrote about the company, shares of it are down by 36.6%.

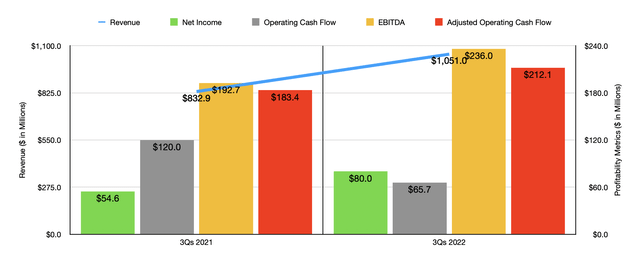

If you were to pay attention only to the core fundamental data provided by management, you would find yourself surprised that shares have reacted in this way. To see what I mean, we need only look at data covering through the third quarter of the company’s 2022 fiscal year. When I last wrote about the company, we only had results covering through the first quarter. For the first three quarters of the year as a whole, sales have come in at $1.05 billion. This represents an increase of 26.2% over the $832.9 million generated the same time last year. According to management, this increase in revenue was driven by a number of factors. For instance, revenue under the Residential segment of the company jumped by 23.7%, while revenue associated with the Commercial segment was up 45.4%. The growth for the Residential segment was largely due to higher sales associated with greater demand for the company’s products, combined with $39.7 million of additional revenue attributable to an acquisition the enterprise made. Meanwhile, for the Commercial segment, revenue growth was largely due to two different acquisitions completed by the company.

With this increase in revenue came improved profitability. Net income jumped from $54.6 million to $80 million. Even though some of the company’s cost items increased, including its cost of sales because of higher raw materials and manufacturing costs, some expenses did decrease year over year. Most notably, selling, general, and administrative costs, which dropped from 22.1% of revenue to 20.2%. With this increase in profits came a rise in other profitability metrics. Yes, it is true that operating cash flow fell from $120 million to $65.7 million. But if we adjust for changes in working capital, it would have risen from $183.4 million to $212.1 million. And over that same window of time, EBITDA also increased, climbing from $192.7 million to $236 million.

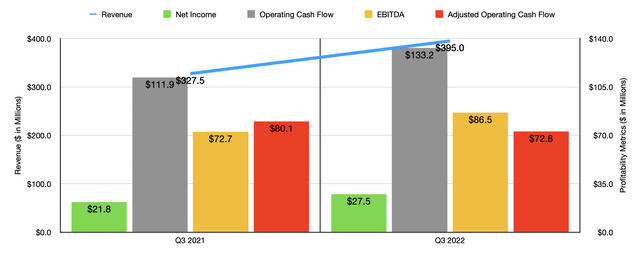

Even when you look at the third quarter alone, figures for the company looked pretty robust. Revenue of $395 million beat out the $327.5 million reported in the same quarter one year earlier. Net income rose from $21.8 million to $27.5 million. We saw an increase in operating cash flow from $111.9 million to $133.2 million. Though, it should be said that the adjusted figure for this dropped from $80.1 million to $72.8 million. Offsetting that, however, was EBITDA, which grew from $72.7 million to $86.5 million.

Unfortunately, it’s not how the company performed recently that investors are paying the greatest attention to. Rather, it’s what they fear of the near-term outlook. For the fourth quarter of the company’s 2022 fiscal year, which management is about to report on November 28th, analysts are anticipating sales of $288.9 million. That would represent a substantial decline compared to the $346.1 million reported the same time last year. Though this may seem outlandish, management gave guidance for sales of between $276 million and $302 million. Meanwhile, analysts expect earnings per share of $0.11, with adjusted earnings per share of $0.18. Management, meanwhile, is expecting earnings of between $0.15 per share and $0.19 per share.

This sudden expected downturn compared to how the company has fared so far this year relates a lot to the company’s inventory strategy. In the latest quarter, inventories for the business totaled $322.1 million. That was up from the $172.8 million reported the same time last year and compared to the $299.2 million the company reported in the second quarter of this year. Year over year, the value of finished goods inventories almost doubled from $109 million to $200.6 million. Although management said that they remain excited about the long-term picture for the enterprise, they did say that a weakening in the market requires what they call a ‘recalibration’ of their channel inventory.

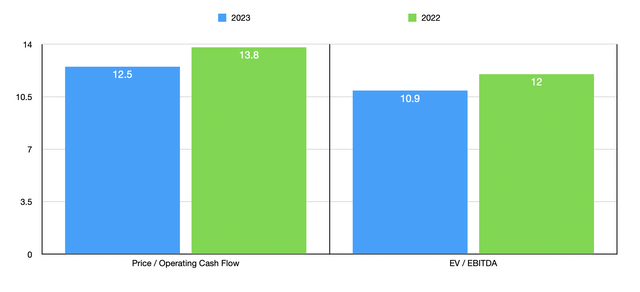

For the years they whole, the company does expect revenue of between $1.327 billion and $1.353 billion. Meanwhile, EBITDA should be between $295 million and $307 million. Management did not give any estimates when it came to other profitability metrics. But if we assume that adjusted operating cash flow will change at the same rate that EBITDA should, then we should anticipate a reading for this year of $228 million. Based on these figures, the company is trading at a forward price to operating cash flow multiple of 12.5 and at a forward EV to EBITDA multiple of 10.9. By comparison, using the data from 2021, these results are 13.8 and 12. As part of my analysis, I compared the company to five similar businesses. On a price-to-operating cash flow basis, these companies ranged from a low of 6.3 to a high of 104.4. Three of the five were cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range was from 5.7 to 11.7. In this case, AZEK was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The AZEK Company | 13.8 | 12.0 |

| Builders FirstSource (BLDR) | 10.0 | 6.2 |

| UFP Industries (UFPI) | 10.8 | 6.9 |

| Griffon Corporation (GFF) | 104.4 | 11.7 |

| Owens Corning (OC) | 6.3 | 5.7 |

| Simpson Manufacturing (SSD) | 40.1 | 14.1 |

Takeaway

Based on all the data we have at our disposal, AZEK seems to me to be at something of a crossroads. If you were to judge the company’s potential based on its most recent financial performance, you would expect further upside from here and you would be perplexed by the downturn that shares have experienced. But clearly, the tide is turning against it because of bloated inventories and weakening demand. This is certainly problematic in the near term and investors should tread a bit more cautiously. In this case, I wouldn’t necessarily be worried to the point of downgrading the company because these are often short-term issues. But when you factor in how shares are priced relative to similar players, I do think a downgrade from the ‘buy’ I had it at previously to a ‘hold’ today is warranted.

Be the first to comment