Oselote

Macroeconomic Conditions Currently Not Favorable For Future Gold And Copper Prices

Gold and copper have rebounded modestly since late September as the market is now more optimistic about a slowdown in the US Federal Reserve’s rate-hiking policy to combat runaway inflation, while fears of a deep recession in 2023 are easing somewhat.

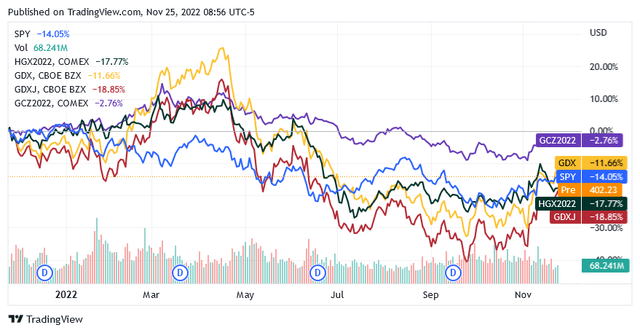

Overall, 2022 will most likely not end on a positive note for the two metals anyway. The chart below shows that unless there is an impressive rally in the commodity price by December 31st, the related futures contracts are likely to post a loss that will be quite significant for the red metal.

seekingalpha/symbol/SPY

So far this year, Gold Futures – Dec 22 (GCZ2022) are down 2.76% and Copper Futures – Dec 22 (HGX2022) are down 17.77%. Mining stocks were also disappointing as the VanEck Gold Miners ETF (GDX), a proxy index of large miners, and the VanEck Junior Gold Miners ETF (GDXJ), a proxy index of mid- and small-cap miners, returned a loss of 11.66% and 18.85%, respectively.

Analysts are skeptical about the recent recovery as the start of a new bull market and instead expect even lower gold and copper prices over the next 12 months. So, the 12-month price target for gold is $1,668.23 an ounce, while the 12-month price target for copper is $3.32 per pound, down 5% and 8.5%, respectively, from where they were at the time of writing.

With the future portrayed as unpromising for the metals, investors may want to use the recent uptick to trim some mining stock positions and refocus the funds raised, elsewhere.

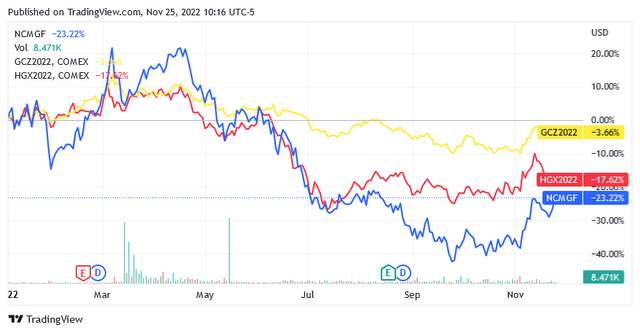

Likely, Newcrest Mining Limited (OTCPK:NCMGF) (OTCPK:NCMGY) (TSX:NCM:CA) is a holding to be reduced. The high volatility resulting from the strong positive correlation with gold and copper, as can easily be seen from the chart below, puts the stock at risk of falling dramatically as the metals test lower levels.

seekingalpha/symbol/NCMGF

The presence of relevant factors supports analysts’ 12-month price targets for gold and copper and defines a greater chance for a metallic bear market than the opposite. In addition, Newcrest Mining Limited’s asset portfolio has some weaknesses that could affect the profitability of operations.

Newcrest Mining Limited

Based in Melbourne, Australia, Newcrest Mining Limited, is engaged in the sale of gold and copper because of exploration, development and mining activities.

Australian miner owns and operates mineral deposits and projects in Australia, Papua New Guinea and Canada.

In 2022, the company produced ≈1.96 million ounces of gold and ≈120.65 thousand tons of copper and ≈1.02 million ounces of silver at a total cost of $1,595 per ounce.

For 2023, the company is forecasting higher gold production of 2.1 to 2.4 million ounces and higher copper production of 135,000 to 155,000 ounces.

The 2023 Fiscal Year Did Not Start On The Right Foot

But the year hasn’t started on the right foot, which could jeopardize the pursuit of the production target. In fact, gold production slowed down worryingly in the first quarter of fiscal 2023 ending September 30, 2022. It fell dramatically by 17% on a sequential basis to 527,115 ounces of gold.

Copper production also declined significantly, down over 16% sequentially to 32,459 tons.

Silver production, which is marginal for Newcrest Mining Limited, has also not fared very well, falling 17% to 361,957 ounces.

But even if the company manages to reach the upper limit of the production target corridor for 2023, the quarterly average will be well below the last quarter of 2022 and thus no evolution in the sense of continuous production expansion will have been achieved.

How About Costs?

Investors should therefore not expect a repeat of an impressive final quarter of fiscal 2022 in terms of more tolerable total costs, which came in at $1,268 per ounce, as quarterly metal production in fiscal 2023 is on track to be lower than in the fourth quarter of fiscal 2022.

All-in costs have already resumed the uptrend and wiped out the significant improvement seen in the final quarter of fiscal 2022. All-in costs increased 21.3% sequentially to $1,538 per ounce due to lower ounces mined and sold.

Additionally, it’s worth noting that the 2022 grand finale didn’t have the expected positive impact on shares of Newcrest Mining Limited, which instead plunged more than 35% from their mid-April 2022 peak. The market followed the pattern of commodity prices, ignoring record production and costs in the fourth quarter of 2022.

Returning to the current fiscal year, the September quarter all-in costs increase could have been even more severe without the benefit of a weaker Australian and Canadian dollar against the US dollar. Mining and other on-site costs after conversion to US currency were lower.

The US Federal Reserve’s Hawkish Monetary Policy On Newcrest’s Margin Return

The US Federal Reserve [FED]’s tightening of monetary policy to reduce annual inflation has increased the cost of money and the price of the US currency as the asset has been in high demand in the market.

Now, the positive impact of the stronger US dollar on operating costs early in the current fiscal year will fade as the US FED begins to ease its hawkish stance on interest rates. It won’t be long before the US FED Commission considers a much more cautious stance on rate hikes, likely as early as December’s meeting.

That’s because the US Central Bank is finally getting the signals it was hoping for from economists who believe that even if the economy doesn’t fall into recession in 2023, it will be close enough to bring the annual inflation rate back to the 2% target.

So, the All-in Sustaining Cost margin of $579 an ounce in the first quarter of fiscal 2023, which has already declined nearly 40% sequentially due to lower metal output, is about to take the brunt of another headwind.

This is Newcrest Mining Limited’s inability to continue to benefit from its operating expenses being heavily dependent on Australian and Canadian dollars. Because of this characteristic of operating costs, a stronger US dollar versus the Australian and Canadian dollars had a beneficial impact on the all-in-sustaining cost [AISC].

AISC margin is calculated as Newcrest’s realized gold price per ounce less the AISC per ounce of Newcrest’s operations.

Therefore, a lower margin should potentially increase the number of downside risks affecting Newcrest Mining Limited shares.

Gold And Copper Prices On Newcrest’s Margin Return

Finally, metal prices won’t help profit margins either, as analysts expect gold and copper to fall. Analysts’ estimates are of course based on solid fundamentals, which broadly break down as follows.

As for gold, two main factors currently stand in the way of a strong price rally. These are the rise in interest rates and the appreciation of the US dollar. The former equates to higher coupons on bonds, which move the metal down the hierarchy of investor preference. While a revalued US currency is viewed as a better hedge against elevated inflation and the risk of an economic slowdown than the yellow metal.

With inflation remaining at a very high level [7.7% in the US in October], interest rates will continue to rise, albeit at a slower pace, making fixed-income assets much more attractive than before. This hurts the demand for gold as a hedge against inflationary headwinds.

Gold is very effective against instability due to the risk of economic recession. However, such a negative business cycle seems to be avoided and the economic downturn will be much less pronounced than initially feared.

The catalyst for an increase in demand for gold is therefore not in sight at the moment.

How about copper? A contraction in consumption, which accounts for 70% of the US gross domestic product [GDP], could be more than enough to reduce demand for copper, as the list of consumer durables and non-durables with copper as a constituent element is long. Also, people will shop less due to high inflation and more expensive consumer credit.

In addition, higher borrowing costs discourage companies from investing in the future production of goods, the realization of which requires copper, among other things.

Cadia, Telfer, And Havieron In Australia

Cadia mine’s gold production is being driven by lower gold grades. Lower production capacity used to be a problem, but not anymore as some maintenance work on the concentrator that removes the valuable metal from the mine ore should be completed.

Lower grades have a significant impact on costs as well as lower copper sales volumes and realized prices.

On Nov. 11, Newcrest Mining Limited released a feasibility study for the development of certain deep underground mining panel caves. The company intends to progressively mine very large mineral deposits and optimize the mine footprint. This will allow for increases in both mine efficiency and ore production to be expected over the life of the project.

The study shows that these panel caves will mine 231,000 ounces of gold each year along with 42,000 tons of copper over a total of 16 years of operation. However, the internal rate of return [IRR] of the project is 18%, while investors usually consider a project to be highly profitable if the IRR is not less than 30%.

Additionally, the caves under development will not begin production until fiscal 2026.

Cadia is expected to produce between 560,000 and 620,000 ounces of gold and 95,000 to 115,000 tons of copper in the current fiscal year.

Telfer mine is reporting an increase in injuries while certain processing equipment, including crushers, is being held for scheduled maintenance, affecting mill throughput. Plus, the economics of this asset tend to see a significant increase in AISC when copper is trading lower.

Also in regards to the Telfer operation, the miner recently announced an extension to the mine’s life, including the fiscal year 2025, following the approval of a project called the West Dome Stage 8 Cutback. That is, mining will take place bench by bench from the top of the open pit through subsequent operational pushbacks, which should improve mining efficiency at the open pit. The decision to perform an extraction on the next pushback depends on external global factors such as metal prices and exchange rates.

The Havieron Project, which is jointly operated with Greatland Gold plc (OTCPK:GRLGF) on a 30% to 70% agreement [Newcrest holds the largest interest], is constrained by geotechnical along with hydrogeological factors. However, the company sees potential for growing mineral resources.

Lihir And Wafi-Golpu In Papua New Guinea

The site of Lihir suffers from low gold concentration in the mineral which is having a significant impact on production and costs. While facility throughput is subject to company policy to shut down facilities every two years. The plant is expected to be shut down again in September 2024 quarter.

Water supply restrictions due to the La Niña-induced drought in the Pacific Ocean have limited the throughput. According to the company, long-term weather forecasts indicate that La Niña will last into 2023.

Newcrest Mining is working to not be unprepared in the event of a prolonged drought, but as La Niña weather patterns are exacerbated by the effects of climate change, the risk remains high.

Plus, the company aims to reduce gold loss during flotation activities that separate the valuable ore mineral from the gangue.

Discussions between Newcrest Mining and Harmony Gold Mining Company Limited (HMY) and the government of Papua New Guinea for approval of a metals project called the Wafi Golpu Project resumed following the appointment of a new government for Papua New Guinea in August 2022.

The project is located in the Morobe province, home of the Hidden Valley mining district and known for the presence of significant gold and silver deposits.

Investing in Papua New Guinea comes with a high risk due to the high seismicity of the region. Papua New Guinea is located on the Pacific Ring of Fire, where frequent earthquakes occur. Recently, two important ones have occurred a short distance from each other. The first occurred last May in the Bismarck Sea, about 200 km offshore and at a magnitude of 6.3. The second earthquake occurred in the eastern part last September, causing multiple damage and casualties with a magnitude of 7.6.

Brucejack And Red Chris In Canada

Brucejack has been reporting more injuries at the mining site lately. Mining operations were halted and investigated in late October following the deadly incident involving an indentured worker responsible for property maintenance. The Brucejack mine reopened on Nov. 16.

Brucejack mine gold production is currently being impacted by lower gold grades. The company is working to streamline operations.

The instability of the Red Chris gold circuit and the periodic maintenance of the asset affect production. The company says these issues are on track to be resolved, but gold grades are instead expected to decline over the fiscal year.

When copper is trading lower in the market and the company is selling fewer pounds, the AISC tends to deteriorate significantly, even if the gold business is doing well.

The drilling activity seems to indicate that a larger mining area with high-quality mineralization can be exploited in the future.

The Stock Valuation

According to the above, despite the recent recovery, shares of Newcrest Mining Limited could be facing a sell-off.

On Nov 25, shares closed regular hours at $13.42 per unit, below the long-term trend of the 200 moving average of $15.20.

seekingalpha/symbol/NCMGF

The recent rebound in the stock price appears to be short-lived and shares will most likely enter a new bearish mode.

The 14-day relative strength indicator of 65, meaning the stock is far from oversold despite falling more than 20% to date, suggests the stock price has plenty of room to fall further if the market wishes.

Influenced by the macroeconomic factors discussed above and the company’s operational issues, the likelihood of a downturn in the market for Newcrest Mining is currently high.

The stock has a market cap of $12.03 billion and a 52-week range of $10.03 to $21.40.

The stock also trades on other North American markets under the following symbols. Market valuations are as of Nov. 25.

Newcrest Mining Limited (OTCPK:NCMGY)’s stock was valued at $13.51 per share on the Over the Counter [OTC] market with a market capitalization of $12.09 billion and a 52-week range of $10 to $21.94.

Newcrest Mining Limited (NCM:CA)’s stock was valued at CA$18.87 per share on the Toronto Stock Exchange [TSX] with a market capitalization of CA$16.09 billion and a 52-week range of CA$13.81 to CA$28.

Conclusion

Since there are several downside risks associated with this stock right now, the investor who decides to sell Newcrest Mining stock cannot be blamed.

Be the first to comment