OlenaMykhaylova

Last week, Ardagh Metal Packaging (NYSE:AMBP) released its half-year report. Since our strong buy recommendation with Mare Evidence Lab’s initiation of coverage, the company delivered an insignificant stock price appreciation (+1%) but the performance was positively affected by the dividend payment, in total, we are up 4.14% versus the market at -0.37%.

Before starting the Q2 analysis, we would like to reiterate our positive view of Ardagh Metal Packaging thanks to its superior growth profile, ESG status and compelling valuation. As already mentioned, we reaffirm that “can & glass producers are somehow under the market radar” – and the company’s value proposition is among the highest in our universe coverage.

More importantly, the latest decision on capital allocation and financing requirements should relieve some investors’ worrisome. Ardagh Metal Packaging’s capital discipline will balance CAPEX growth and shareholder remuneration (the company declares an ordinary dividend payment of $0.1 per quarter, and it’s currently yielding almost 6%). Despite the fact that new CAPEX growth has been postponed by a quarter, we are confident that the company will be able to deliver on its promises, doubling the EBITDA by 2025. Moreover, it is not the first time that the company lowered its CAPEX outlook, looking at the past, the can producer supported its activities thanks to leasing contracts in order to support its FCF generation.

Q2 Results

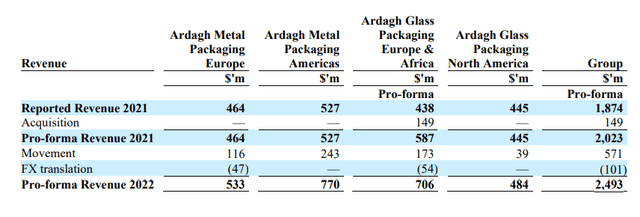

Last time we said that “despite the unfavourable market environment, our internal team is forecasting a double growth demand thanks also to the release of consumer spending after the COVID-19 pandemic outbreaks”. This was achieved by Ardagh Metal Packaging. On a quarterly basis, volume grew by 11% in the Americas and 5% in the European area. If we include the unfavorable FX impact, the company delivered a +23% in top-line sales reaching $2.49 billion. Aside from the volume growth, this number was also recorded thanks to a better product mix (specialty cans shipments were higher than last year) and higher selling prices.

Ardagh Metal Packaging Revenue development

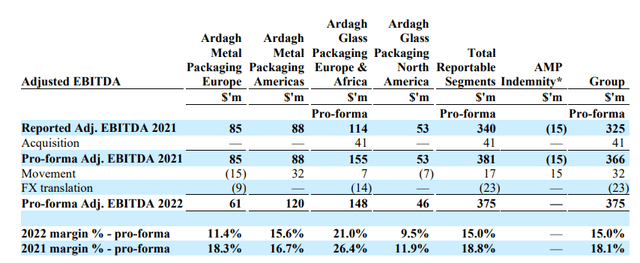

Going down to the P&L, the company was not able to increase prices over input costs. Thus, the adjusted EBITDA margin contracted compared to the previous year’s end quarter. FX translation was an issue, but more significant were the higher raw material costs such as energy.

Ardagh Metal Packaging EBITDA development

Looking at the Wall Street consensus estimate, the company beats the EBITDA expectation thanks to a good performance in the Americas and was below in Europe.

Conclusion and Valuation

Despite the second quarter’s positive beat, the company lowered its 2022 guidance, revising the EBITDA to $710 million from $750 million. According to our calculation, we estimate that at the parity exchange rate between the dollar and euro, the company will have a currency impact of more than $22 million. This is also coupled with lower shipment growth estimate as explained by the management during the Q&A call.

On the positive side, the CEO also announced a $200 million buyback (almost 5% of the company market cap) and with the quarterly dividend at 6%, we derive a return of almost 11% per year (without considering the capital upside). In our initiation of coverage, we estimated $25 million in energy pressure, and we forecasted an EBITDA level of $750 million for 2022. Today, adjusting our number and calculation, we lower our target price to $11 per share. Prologued energy price impact and FX evolutions are the main reason, but we should also consider multiple compression within the sector. Our valuation methodology is left unchanged and then we apply a 10x EV/EBITDA multiple to our 2023 forecast numbers. The company is currently trading at a 7.5x EV/EBITDA with an FCF yield of 16%. This is not justified for a company that is plan to deliver 11% in shareholder returns over the next years.

Be the first to comment