JHVEPhoto

Introduction

As a dividend growth investor, I constantly seek additional opportunities to increase my future income. I acquire income-producing assets monthly to supplement the dividend income. I add to existing positions within my dividend growth portfolio and add to new positions whenever I seek to diversify myself further.

I lack some exposure to the healthcare sector in my dividend growth portfolio. I have several investments in drug distributors, health insurers, pharmaceuticals, and medical device companies. The latter is one of my favorite segments as it is often overlooked as investors focus on the more lucrative segments, mainly pharmaceuticals. In this article, I will analyze Becton, Dickinson and Company (NYSE:BDX), one of my favorites.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Becton, Dickinson and Company develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public worldwide. The company was founded in 1897 and is based in Franklin Lakes, New Jersey.

Fundamentals

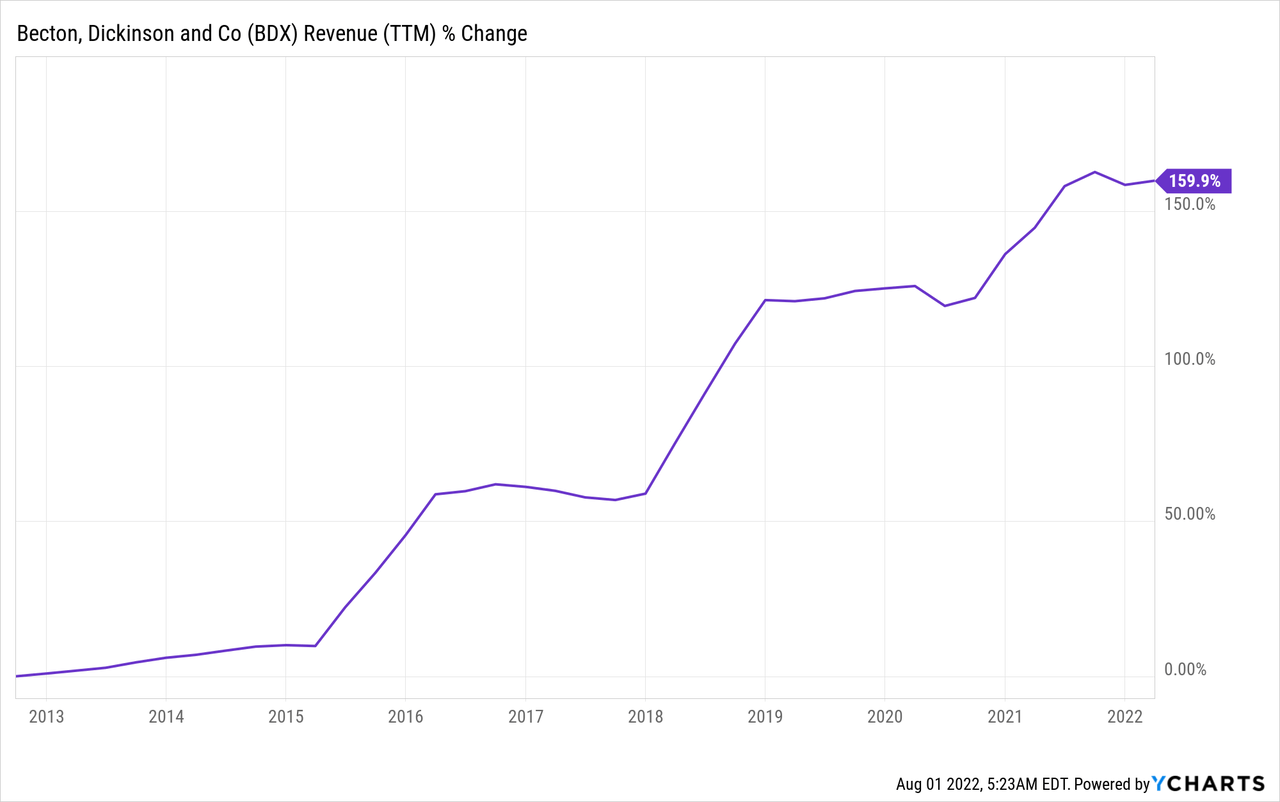

The revenues have more than doubled over the last decade. Becton, Dickinson and Company increase its sales through organic growth and acquisitions. In 2022, the company will see a decline in its revenues, as it sees fewer revenues from COVID tests and due to the spin-off of Embecta (EMBC), its diabetes care unit. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Becton, Dickinson and Company to keep growing sales at an annual rate of ~1% in the medium term.

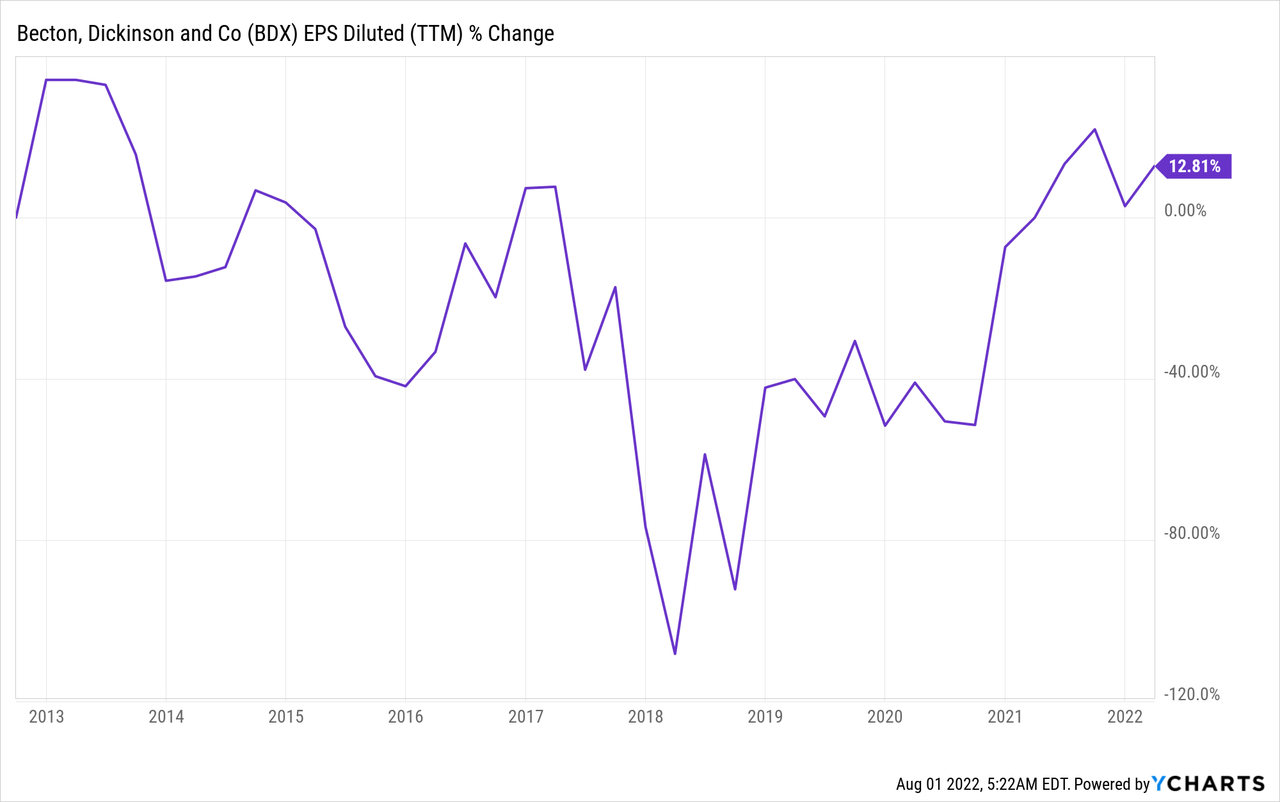

The EPS (earnings per share) of Becton, Dickinson and Company may be a bit confusing. The company GAAP earnings increased by only 13%, but the non-GAAP EPS increased by more than 140%. EPS increase is attributed to the sales growth. Despite higher share count and lower margins, Becton, Dickinson and Company managed to maintain significant growth. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Becton, Dickinson and Company to keep growing EPS at an annual rate of ~2% in the medium term.

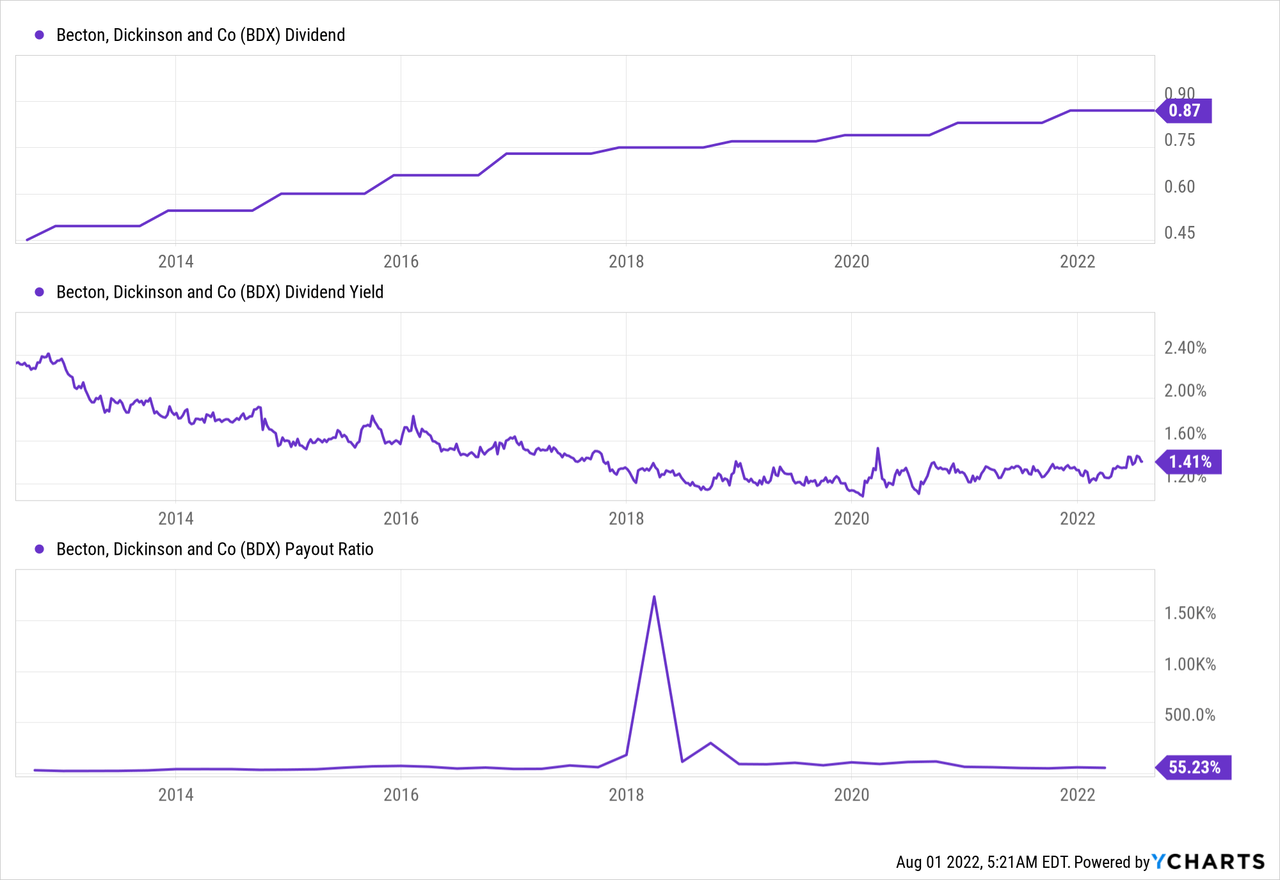

Becton, Dickinson and Company is a dividend aristocrat that will become a dividend king in December as it increases its annual dividend for the 50th year in a row. The company offers a 1.4% dividend yield, which is safe and unlikely to be cut as the payout ratio is 5% based on GAAP earnings, and 25% based on non-GAAP earnings. Investors should expect additional mid-single digits increases in the medium term as the company usually maintains a 30% payout ratio.

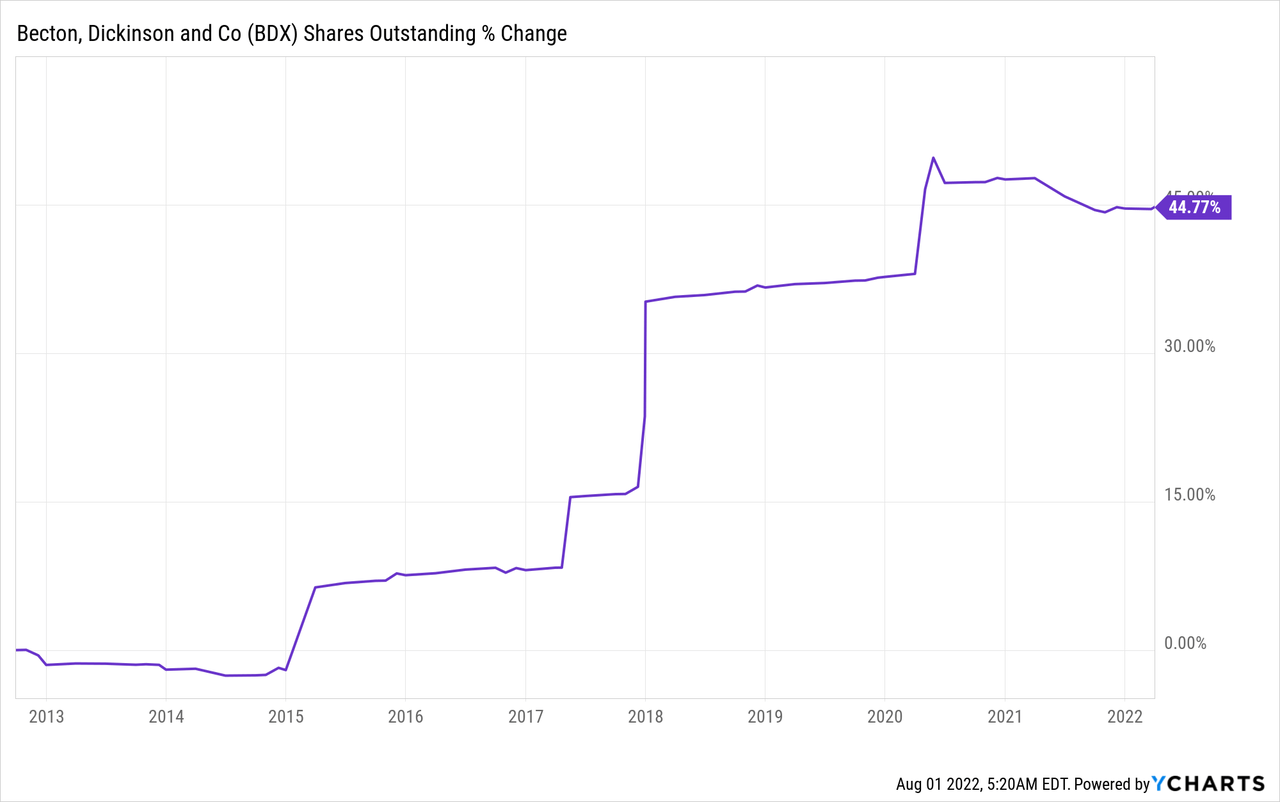

In addition to dividends, companies reward their shareholders with buybacks to return capital to shareholders. Buybacks support EPS growth and are effective when companies are growing. Over the last decade, the number of shares of Becton, Dickinson and Company increased by 45%. The increase is attributed to stock-based compensation and shares issued to fund the company’s acquisitions.

Valuation

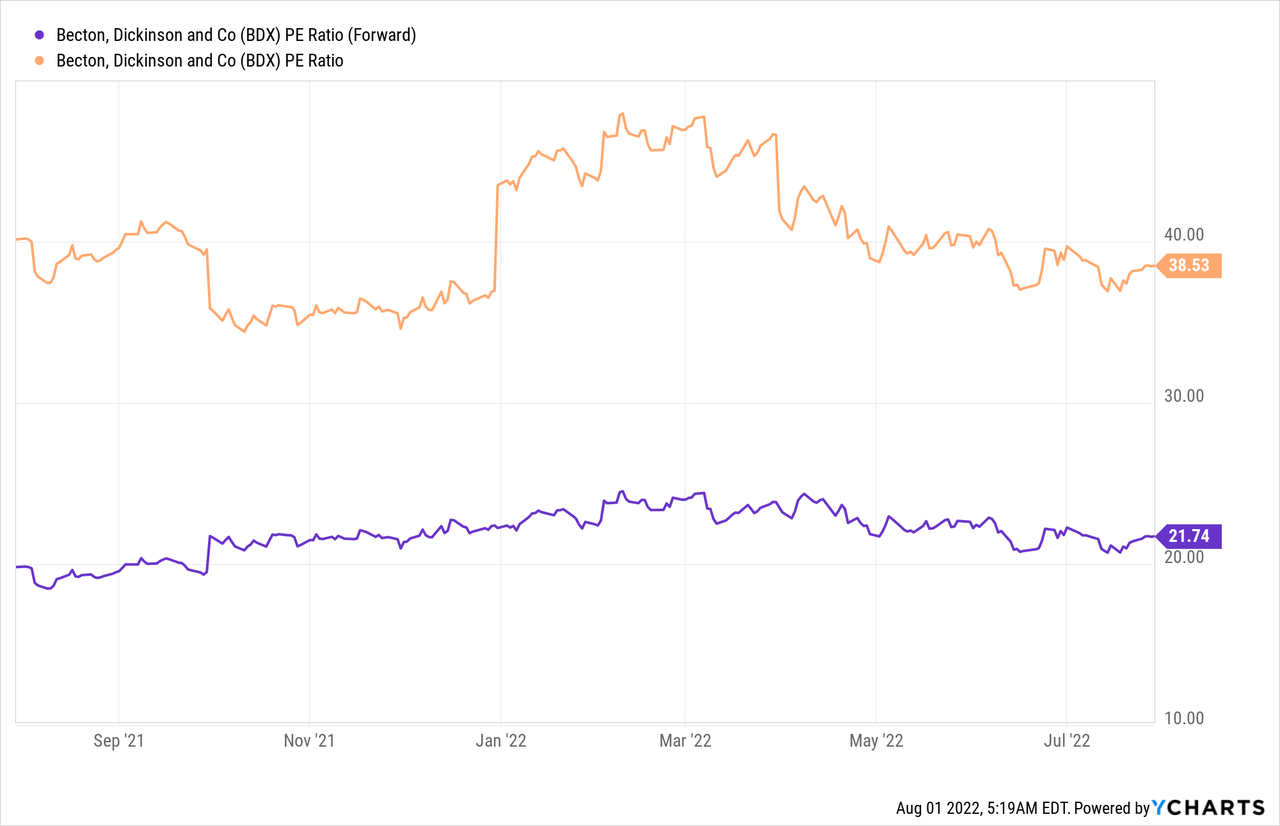

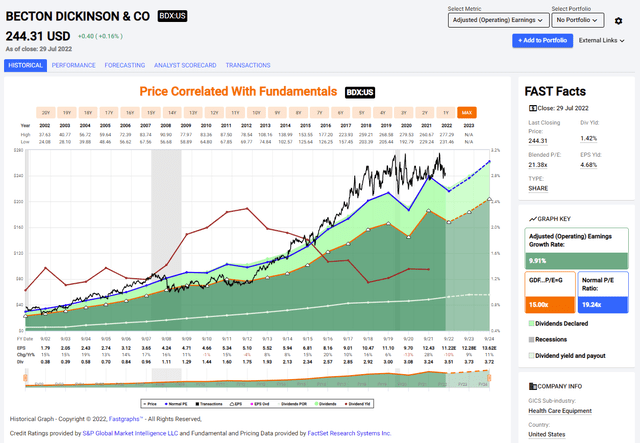

The current P/E (price to earnings) ratio of Becton, Dickinson and Company is 39 using the GAAP EPS of 2021 and 21.74 when using the forecasted non-GAAP EPS for 2022. It is, in my opinion, a high valuation for a company that is growing at a low single digits rate. The company aims to achieve more significant growth, but in the meantime, the valuation should suit the current growth rate and the one expected in the medium term.

The graph below from Fastgraphs.com emphasizes how Becton, Dickinson and Company is now detached from the historical trend. In the last two decades, the average P/E was 19.24, and the growth rate was 10% annually. We now see a P/E ratio of 21.7 and a lower growth rate. The company will have to either grow faster or become more attractively valued to be an attractive investment at the moment.

To conclude, Becton, Dickinson and Company is a reliable company that offers investors steady top and bottom line growth. It uses its excess cash flow to acquire peers and reward shareholders with dividends. However, this package comes at a great price, and I believe that when the company grows slowly, it cannot justify the current forward P/E ratio of almost 22.

Opportunities

Diversification is a key growth opportunity for Becton, Dickinson and Company. Despite being an American company, only 56% of its sales come from the United States. Having 44% of the revenues coming from the international markets is negative in the short term as the USD is strengthening. Still, it allows the company to capitalize on crucial business opportunities around the globe and not rely solely on the American market.

Another growth opportunity for the company is M&A activity. Following the decline in the market, it may be even a more attractive path. The company has a budget of $2B annually for acquisitions. The latest acquisition was the acquisition of Parata Systems for $1.5B in July 2022. This company is leading in the pharmacy automation business, and the purchase is part of the company’s strategy of developing and acquiring higher-margin products.

The company is constantly investing in its pipeline for new products. The company targets spending 6% of its revenues on R&D, equating to $1.2B annually in addition to the $2B it allocates for growth through M&A. The company has several promising products in its pipeline, including BD Libertas, a prefilled wearable injector that enables self-administration of larger doses for chronic diseases.

Risks

The company is suffering from a declining operating margin. The margin declined from 20% in 2012 to 17% in 2021. The company aims to improve the operating margins to 25% by 2025, but the combination of inflation and higher labor cost may make it harder to achieve. It is a crucial milestone for the company’s strategy, and failing to execute it may hinder growth in the medium term.

The competition is the most significant risk for the company in the long term. The medical devices field has high barriers to entry, but there are some leading firms currently competing. Giants like Johnson & Johnson (JNJ), Medtronic (MDT), and Abbott Laboratories (ABT), together with smaller peers and startups, are fighting for market share.

COVID testing sales are decreasing significantly. Sales of COVID tests in Q2 were $214M, and in the same quarter of 2021, sales reached $474M. Sales of COVID tests will likely continue declining in the foreseeable future. The company will have to find new revenue streams as these tests accounted for almost 10% of the company’s sales. In the short term, this is the explanation for slower growth.

Conclusions

Becton, Dickinson and Company is a great company showing high-quality execution and growth for decades. The company is growing its top and bottom line and uses the proceeds for buybacks and dividend increases. The company has additional opportunities for growth, which will continue its growth story in the long term.

There are also risks to the investment thesis. The field is competitive, and the pandemic had a limited positive impact on sales, which will have to be replaced. The company also works on improving margins, yet so far, they are still declining. The most challenging aspect for me with the company is the current valuation. The valuation seems high at 21 times forward earnings. The company reports its Q3 earnings on Thursday.

The analysts’ consensus, as seen on The Wall Street Journal and Seeking Alpha, expects declining EPS and sales. EPS is excepted to be $2.5, and sales are expected to be $4.47B. The company will have to beat expectations and offer more positive guidance for the year to justify the valuation. I do believe that quality companies should trade for a higher valuation. However, unless the company bears expectations and raises the guidance, I think it is a HOLD at more than 21 times earnings. It will be attractive when the price is $200-$215.

Be the first to comment