bravo1954/E+ via Getty Images

Great news!(?)

The S&P 500 Index roared to the upside on Wednesday afternoon following the announcement by the U.S. Federal Reserve that it would be raising interest rates by another 75 basis points to combat high inflation. It should be cautioned reading too much into this initial post Fed reaction, as markets have a long history after an FOMC meeting of doing the exact opposite on Thursday and Friday versus the post 2PM Wednesday afternoon reaction. Nonetheless, the +2.6% jump in the S&P 500 and the +4.3% advance in the NASDAQ 100 warrants taking a closer look at the context of these gains and whether they are well grounded or fanciful.

First, investors supposedly cheered the Fed’s announcement because it demonstrated that the Fed is fully committed to fighting stubbornly high inflation. Um, OK. I’m all for central banks tightening monetary policy when the market demands it, but the 75 basis point rate hike delivered by the Fed is something we effectively knew was coming for weeks. Some teased the idea of 100 basis points a few weeks back when the June CPI came out, but the Fed quickly put the kibosh on that idea by dispatching a few Fed members to jawbone the market back to 75 bps. The fact that CME Fed Fund Futures were implying a more than 70% probability of a 75 basis point hike provides further confirmation that today’s Fed announcement should have come as no surprise at all to the markets.

The second explanation for the euphoric market reaction in the wake of the Fed’s announcement on Wednesday afternoon is straight out the reverse psychology textbook. So this is how the story supposedly goes. Because the Federal Reserve is tightening so aggressively right now to combat inflation, they are increasingly hurtling the economy into a recession. With inflation back under control and the economy firmly in recession by the end of the year, the Fed will be reversing course and lowering interest rates in order to revive economic growth. In short, today’s interest rate hiking “flip” will be followed by a rate cutting “flop” after not too long.

If this is what markets are banking on right now – the idea that the aggressively tightening Fed will soon be back to their interest rates slashing ways – I hate to say it, but I think investors will be gravely disappointed this time around.

Instead, the following is much more likely. The quantitative easing game is very likely over for the foreseeable future. And while the Fed might take a break at some point from further rate hikes, they are not likely to consider cutting rates anytime soon barring an extreme reversal of circumstances. The following are some key points in support of these conclusions.

Price is truth

First, the futures markets are not even assigning probability to a Fed interest rate cut any time soon. According to the CME FedWatch Tool, the following are the latest expectations for future Fed policy movements at their next four FOMC meetings (the current target rate is now 2.25% to 2.50% following Wednesday’s meeting).

September 21: At least a 50 bps rate increase to 2.75% to 3.00%

November 2: At least a 25 bps rate increase to 3.00% to 3.25%

December 14: >70% probability of at least a 25 bps rate increase to 3.25% to 3.50%

February 1: >30% probability of at least a 25 bps rate increase to 3.50% to 3.75%

It’s not until the March 15, 2023 when the markets start to price in the possibility of a Fed rate cut, but the probabilities remain low for even a 25 bps to 50 bps rate through next summer with the highest probabilities landing the Fed Funds rate in the 3.00% to 3.25% by this time next year.

While the probabilities for the future Fed Funds rate are certainly subject to significant changes over time, the fact that the current baseline expectation according to the markets is for the Fed Funds rate to be another 75 basis points higher a year from now versus today is far from the soon-to-be-easing scenario that some investors are increasingly pondering.

Inflation risks remain complex

While I’ve made the case that inflation pressures are fading, this does not mean that the high inflation problem that has been plaguing the U.S. and global economy over the past year is going to go away overnight. Instead, these pressures are likely to fade in fits and starts over the coming months.

Of course, this assumes that inflation pressures do not ignite anew going forward. The Fed is certainly doing its job to reduce demand through its aggressive rate increases, which should do its part in alleviating pricing pressures. But if supply chain disruptions persist or are exacerbated by potential developments such as another COVID case spike or more geopolitical instability such as Russia’s invasion of the Ukraine, then it remains more than possible that the higher price pressure from reduced supply more than offsets on net the lower price pressure from reduced demand.

If nothing else, continued supply chain disruptions along with a potential further shift away from globalization and toward nationalization not to mention the possibility of continued geopolitical instability have the potential to keep pricing pressures elevated versus what we became accustomed for so many years in the post Great Financial Crisis period.

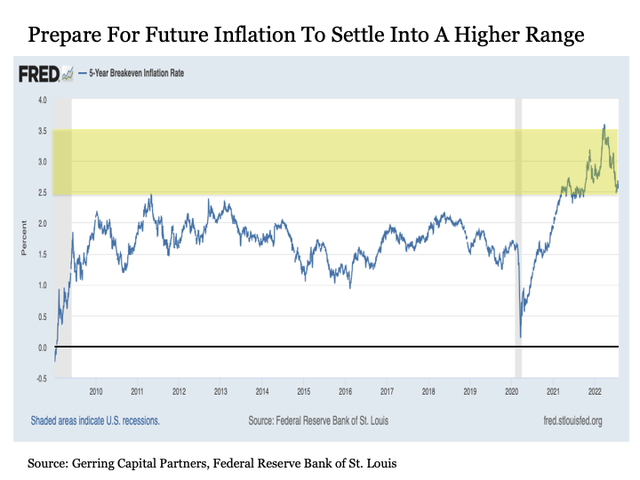

Put more simply, investors that became used to an inflation rate that struggled to hold the Fed’s 2% target for so many years should be prepared for an inflation rate that persists at a higher than desired rate at least in the short-term and that eventually settles back into a higher range – perhaps 2.5% to 3.5% – with greater pricing unpredictability going forward. The chart showing the 5-year breakeven inflation rate below highlights this possibility.

Federal Reserve Bank of St. Louis

Lessons From Past Inflation

Arguably the most significant reason more than any others on why the Fed is likely to continue raising interest rates for the foreseeable future and is unlikely to consider cutting rates barring extreme circumstances is the lessons monetary policy makers have learned from inflation’s past.

Basically, the Fed cannot simply raise interest rates until inflation starts to head lower, then abandon the effort by starting to cut rates to support growth. It would be nice if it worked that way, but history has shown otherwise. Instead, the Fed has to raise interest rates aggressively to fight the current high inflation problem, and they need to keep interest rates high even after inflation has come back down and is seemingly under control.

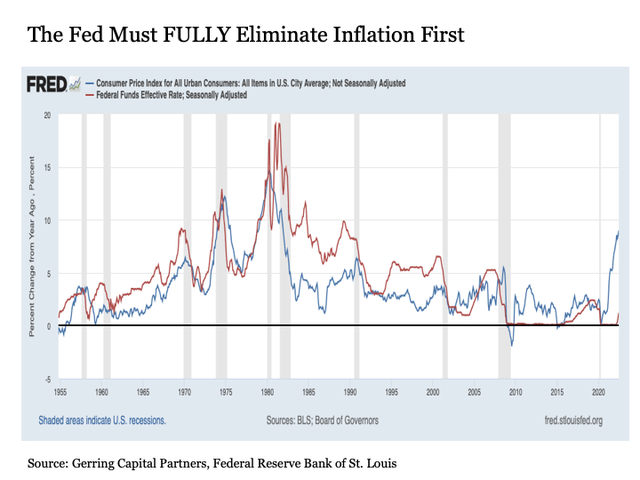

In many ways, the Fed’s inflation challenge is similar to taking antibiotics to treat an illness. Even if the patient is feeling better, they must finish the entire course of antibiotics to eradicate the sickness. If not, they risk the potential for the illness to come back even worse than it was before. The same exact principles apply to the Fed’s inflation fight. This is demonstrated in the chart below, which shows the inflation rate as measured by the annual percentage change of the Consumer Price Index (blue line) and the Federal funds effective rate (red line).

Federal Reserve Bank of St. Louis

To emphasize this key point about the persistence of the Fed’s inflation fight, consider the period from 1970 through 1982 in the chart above. The inflation rate was rising sharply heading into the 1970 recession, and the Fed Funds rate was rising accordingly. But once the economy fell into recession, the Fed started cutting interest rates just before the inflation rate had peaked. So while the inflation rate declined during and after this recession, it bottomed at an elevated rate before turning back higher again.

The Fed once again raised interest rates as inflation surged into the 1973-74 recession, but once again the Fed started cutting interest rates around the time that the inflation rate peaked. While the inflation rate eventually came down coming out of the 1973-74 recession, it once again bottomed at an even more elevated level before turning back higher again.

By the end of the 1970s, inflation was screaming higher and the Fed finally learned its lesson and started applying the monetary policy medicine the economy needed. The Fed raised interest rates to combat the spiraling inflation problem, but even after the inflation rate was definitively coming down, the Fed kept their foot on the gas. They continued to raise interest rates for a period, then keep interest rates high until the pricing fever was finally broken and inflation came back down to much lower levels. This was a process that played out over a few years, not a few months.

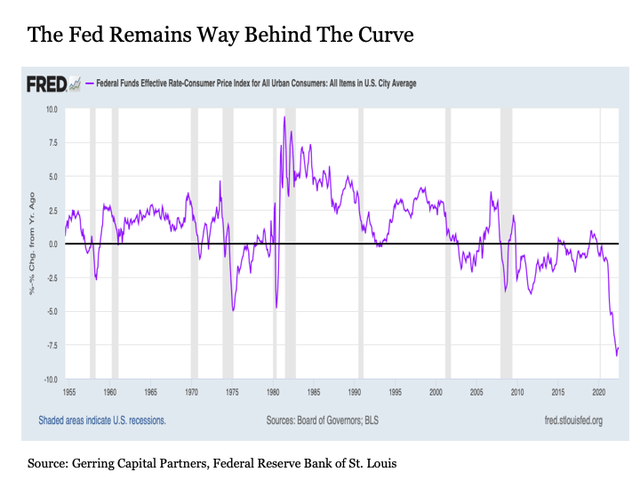

So where does the Fed stand today with its current inflation fight? Consider the chart below, which shows the spread between the Federal Funds rate minus the annual inflation rate as measured by the CPI.

Federal Reserve Bank of St. Louis

Think of the above chart the following way. When the spread is above the zero line, it demonstrates a Fed that restrictive in its policy against inflation. Conversely, when the spread is below the zero line, the Fed is accommodative despite inflation pressures. The policy error that took place during the 1970 and 1973-74 recession was that Fed policy became too easy, too soon during these recessions as demonstrated by the spread crossing below the zero line. This planted the seeds for inflation to not only bottom at a higher rate but subsequently surge to greater heights. It was not until the Fed kept this spread stubbornly positive in the early 1980s that the Fed finally snuffed out the inflation problem.

Contrast these past episodes to where we are today. Not only is the spread not positive in response to currently high inflation, it remains as negative as it has been in recent history. In other words, Fed policy remains ultra-accommodative in the context of current inflation rate.

Now the Fed continues to make the bet that the inflation rate will eventually come back down to meet the Fed Funds rate at its still low but rising level. And financial markets including the stock and bond market are showing confidence in the Fed and that their view will be proven correct.

But what if the Fed is wrong? Or what if inflation bottoms at a much higher level and resumes its climb higher just as it did during our past two episodes in the early 1970s? These are the risks the Fed continues to run by having started tightening monetary policy waaaaay too late and still running well behind the curve today. This is a challenge that may take years to fully sort out, not months.

More importantly, given the lessons of past inflation episodes coupled with where the current inflation rate is relative to the Fed Funds rate, the Fed has essentially no room to start cutting interest rates anytime soon. Instead, they need to maintain interest rates as high as they can reasonably raise them well after the inflation rate comes back down to help protect against any future inflation resurgence that may be inevitable anyway given how late they were in starting to respond and how far behind they remain in the process.

Bottom line

Stock investors should have measured expectations about any idea that the Fed might not only stop raising interest rates but also abruptly turn to start cutting interest rates any time soon.

If the Fed is following the playbook learned from its past inflation fights, the game plan calls for continued rate hikes even after the high inflation fever is broken, and keeping rates high for a stretch even after inflation has come back down.

If the Fed betrays this strategy and becomes distracted by slowing growth and/or falling financial asset prices, they run the risk of making matters far worse for far longer by clearing the way for an even bigger inflation spike the next time around.

Thus, investors are right to cheer the Fed’s increasing discipline to take on the inflation fight, but it is likely premature to express this enthusiasm in their stock portfolio any time soon, as the Fed’s inflation fight is likely to play out over time and bring with it some tough stretches for risk assets along the way.

Be the first to comment