ipuwadol/iStock via Getty Images

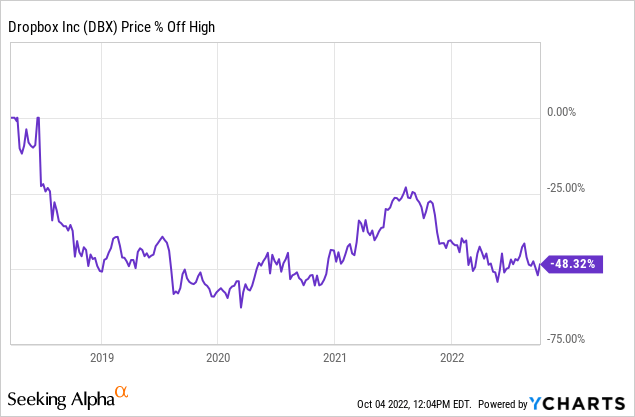

Dropbox (NASDAQ:DBX) shares have fallen 48% from their all-time high in 2018. Since then, the company has nearly doubled its revenue and tripled its profits. The stock has been going through rough times since its IPO, but that’s something that can’t be said about its core business. In my opinion, Dropbox’s management is doing a very good job and their business is still growing well. Due to this situation, I recently decided to buy DBX shares. The increasingly uncertain macroeconomic situation also made me make this purchase because I personally think that Dropbox is one of the less risky stocks.

About Dropbox

For those of you who don’t know what Dropbox actually is, it’s a cloud storage service that allows you to store various files online and then automatically sync them to your devices. You can then use these links to share all kinds of files and folders with other people, without sending uncomfortably large attachments.

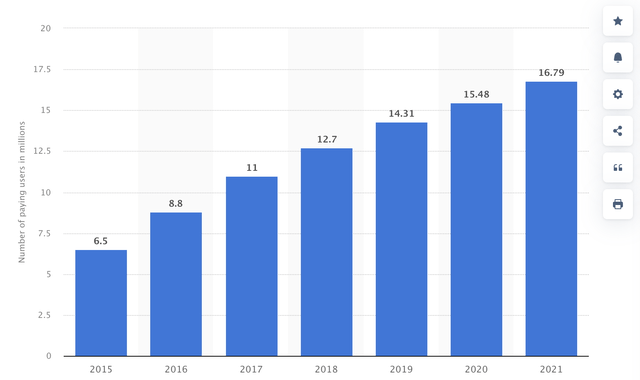

The company was founded in 2007 by Arash Ferdowsi and Andrew Houston, who is still the CEO today after 15 years. Right now, DBX has over 700 million registered users and 17.37 million paying users.

Reasons Why Dropbox Is Down 48% Since 2018

There are several reasons why Dropbox shares have lost over 48% since 2018. For one, the stock was clearly overvalued at its all-time high in 2018. That’s why the stock fell. In 2022, however, the situation is completely different and DBX is undervalued in my opinion. But we will talk about that later on.

Another reason is that there’s more and more competition. And it’s not just any kind of competition – the company competes with Apple (AAPL), Google (GOOGL), and Microsoft (MSFT). This is something that worries many investors. Dropbox has successfully fought this competition so far and, thanks to prudent management, I believe it will continue to do so in the future.

Then there’s the pretty big Wall Street disregard for DBX. Most people out there think Dropbox is a “boring” company. That’s why DBX shares don’t get the attention they deserve. As a result, shares have not performed very well in recent years. Lastly, there is still slower growth. The company’s revenue is expected to grow in the high single digits in the coming years. This is something that most investors are not entirely satisfied with. So let’s focus on Dropbox’s growth for now.

How Dropbox Plans To Grow

There are several strategies for how DBX management wants to grow its business. The first is to simply convert the registered users the company currently has into paying users. That’s something I think represents a big opportunity. DBX has over 700 million registered users and only 17.37 million paying users. Dropbox’s management uses several methods to try and convert these registered users to paying ones. It’s not exactly easy, but once the company has managed to convert a registered user to a paying user, it’s very unusual for that user to stop using Dropbox and cancel their subscription.

Another way to grow is to simply convert existing paying users to more expensive plans. For example, they can try to convert a user from a standard plan to an advanced plan. Of course, management wants to continue releasing new features and developing new products, as well as improving existing ones and thereby attracting new users. This is something I think management has done well in recent years, and I think it will continue to do so in the years to come.

In addition, DBX has over 150 million monthly visits to its website. There are several ways to monetize such high traffic, and Dropbox is well aware of this. This is also another opportunity for growth. Overall, Dropbox still has a lot of opportunities how to grow.

Financials

Now, let’s focus on the financial side of Dropbox. In the second quarter of the year, the company had revenue of $572 million. What was very positive about the latest quarter were the really high gross margins, which were 81.5% – the highest gross margins in one quarter for the past few years. DBX also reported a really high free cash flow of $205 million in Q2 2022. The company generally generates a high free cash flow, thanks to recurring revenue and high margins. Dropbox’s goal is to have $1 billion in annual free cash flow by 2024, and DBX is making very good progress toward that goal, which I personally like to see.

The company also regularly buys back stock, returning value to shareholders. This quarter was no exception, as Dropbox management bought back $214 million worth of its own stock. One of the reasons why DBX is buying back its stock is that founder and CEO Andrew Houston still owns 25.62% of the company. This is something that I personally like to see, because Houston owning such a large part of the company creates a real incentive to take care of DBX and take actions that are in the best interest of the business. It can also be seen that Houston really believes in the company since he still holds such a large stake in Dropbox.

As for the balance sheet, it is in perfect order. Right now, DBX has $1.446 billion in cash and $1.372 billion in long-term debt. However, if Dropbox got into trouble, it could simply stop buying back shares and suddenly have hundreds of millions of dollars at its disposal. This is a big advantage for Dropbox. Thanks to the current ratio of 1.4x, the company is financially secure for the next 12 months. I think that Dropbox is doing really well financially thanks to the huge free cash flow.

Valuation

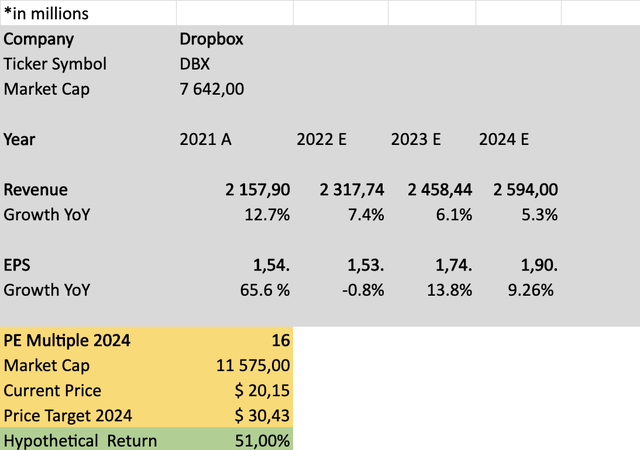

The stock is currently trading at the lowest valuation multiples it has ever traded at. It is currently trading at a forward P/E of 13. If we look at the forward market cap/free cash flow, it is 9x. This means DBX has a forward free cash flow yield of 10.9%, which is really attractive. But now let’s take a look at the simple valuation model that I created.

I used analysts’ expectations for revenue and EPS growth through 2024. In my opinion, these estimates are likely to be true. But remember that, in the past, Dropbox has almost always outperformed analysts’ expectations.

EPS in 2024 is expected to be around $1.9. Personally, I think the stock will trade for around 16 P/E in 2024. There are several reasons for this. First, the company is expected to continue to grow in the mid- to high single digits after 2024. Second, there is the good predictability of Dropbox’s revenue and profits due to recurring revenue. After that, management expects Dropbox to have a free cash flow of about $1 billion in 2024. Third, there’s a buyback that DBX will likely continue to run.

If these expectations turn into reality, then at the current valuation the stock will probably create very attractive returns. That’s why I added DBX to my portfolio.

Dropbox’s Moat

Now let’s focus on Dropbox’s moat. Why should people use Dropbox instead of alternatives like Google Drive, Onedrive, Box, and many others? I think there are several reasons why DBX is better than these alternatives.

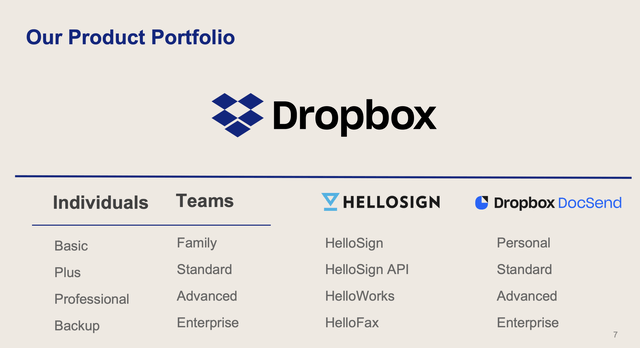

First is safety. This is a huge advantage of Dropbox, and it’s something that management has been working on for over a decade. Dropbox is simply the most secure of all its other alternatives. Second is DocSend. DocSend is actually quite similar to Dropbox, but has features that Dropbox lacks, making it a great complement to the entire company. One of the features that DocSend can offer and Dropbox does not have is very advanced insights about documents. DocSend simply offers great analytics about given documents, which DocSend people can then use for greater efficiency of their business.

Then there’s HelloSign. Thanks to HelloSign, you can sign documents online safely and easily. HelloSign is actually very similar to DocuSign (DOCU), which currently has a market cap of $10.7 billion. Keep in mind that Dropbox is only trading at $7.7 billion right now. HelloSign also allows you to see different analytics.

Dropbox management is always introducing new features, and the company recently introduced a shop that’s a platform for the sale of various digital content that users store on Dropbox. Dropbox also introduced Replay, a video collaboration tool that collects, manages, and responds to feedback all in one place.

Overall, Dropbox actually has almost everything you need in one place. Dropbox is easy to use, it’s always introducing new features and products, it’s secure, and once folks start using it regularly and paying for a subscription, it’s very rare for them to cancel their subscription. That’s Dropbox’s moat.

Dropbox’s Investor Presentation

Risks

The biggest risk that Dropbox has is competition. DBX competes with Apple, Google, Microsoft, etc. – all huge companies that also have more resources than Dropbox. DBX has been competing with these giants for a number of years, and so far it has been doing it very effectively and successfully. The main reasons are the continuous improvement of DBX and the very effective acquisitions that the company has made over the last few years. However, if management isn’t able to improve Dropbox as well as it has so far in the next few years, there is a considerable risk that the competition will begin to take away DBX’s market share and the company’s revenue and profits will gradually begin to decrease. In that case, I would really consider possibly selling the stock.

Personally, I’ll be watching everything closely. If Dropbox management keeps introducing new products and features and if they continue to make intelligent acquisitions, then I think everything will be fine.

Catalyst

One catalyst that has a chance of happening is DBX being acquired by another company. In my opinion, acquiring Dropbox makes a lot of sense for several companies. So far, the biggest candidates for the acquisition of Dropbox are Adobe (ADBE) and Salesforce (CRM). Although Adobe recently made a huge acquisition and bought Figma, they might be interested in acquiring DBX in the next few years. The acquisition of Dropbox is still just speculation, but there is a chance that it will actually happen.

Conclusion

DBX is, in my opinion, a company that has been overlooked by the market for several years. The stock is currently trading at a very attractive valuation. Dropbox has recurring revenue, which is a huge advantage, and because of that it has really high margins. The company also has great management that has made some really smart acquisitions over the past few years. Overall, Dropbox’s balance sheet is in good shape and, with high free cash flows, I think they’re really comfortable financially. There is a risk and that is competition. But Dropbox has competed effectively against those big names in the past few years thanks to constant improvements to the platform and smart acquisitions. If Dropbox manages to maintain this trajectory in the future, then it should offer very attractive returns to patient investors.

Be the first to comment