turk_stock_photographer/iStock via Getty Images

Tax Loss Strategy

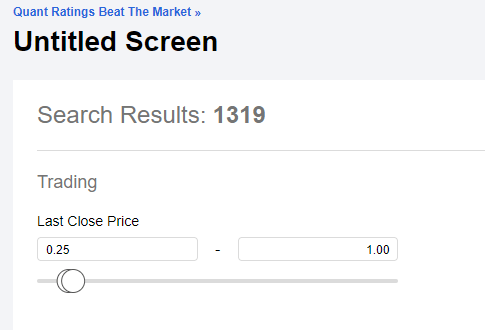

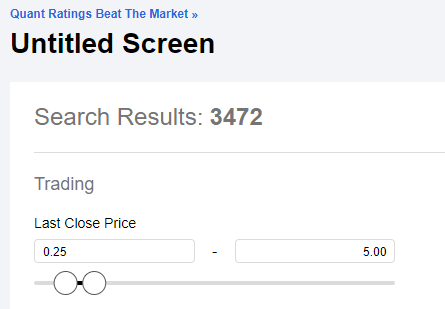

As I discussed in a previous article, I’m beginning to accumulate a basket of stocks that are selling off near year end as investors try to realize capital losses to offset any gains they may have realized in 2022. I gave my basic criteria in the earlier article, but one factor I forgot to mention, was that I tend to prefer stocks priced between $0.25 and $5. This is based on tracking past years’ performance, but I’m a bit worried that there are more beaten down stocks than in the past, so this might not be a beneficial screening factor for 2022. For example, using Seeking Alpha’s screener, I see that there are 1,319 stocks trading between $0.25 and $1, and 3,472 stocks trading between $0.25 and $5. I don’t have stats on this from previous years, but my inclination is that these numbers would have been substantially lower in 2019 for example. Nonetheless, I’m keeping it as a screening criteria and will tally up the final results in March of 2023.

Seeking Alpha screener Seeking Alpha screener

I also mentioned in the previous article that I try to space out my buys since sellers of these stocks are pressed for time and hence can sell indiscriminately. As of Friday, I now have one full position, and that is in Achilles Therapeutics (NASDAQ:ACHL). (I also managed to pick up a half position in InflaRx (IFRX) which was the topic of my first tax loss article.)

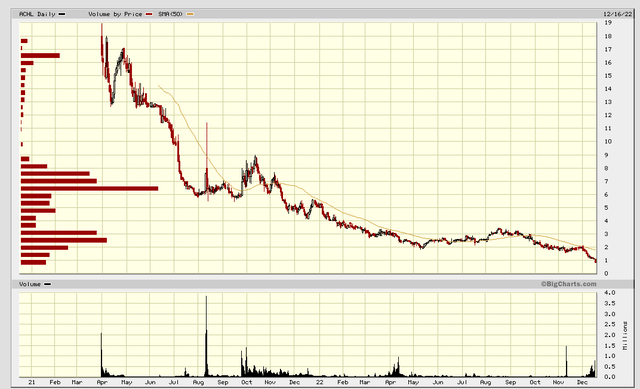

Let’s begin by looking at two charts to identify what I believe to be tax loss selling.

First is the two year chart. I normally go even further back, but in this case the company was listed less than two years ago, so there’s no additional data to be had.

Scrolling through the company’s news feed, other than posting worse than expected earnings (which isn’t usually a big factor for early stage biotechs), I don’t see any major disappointments that caused this steady decline in share price. Rather, I’d attribute it to the major selloff that’s occurred in biotech over that time, a selloff which has disproportionately affected earlier stage companies.

The three month chart below shows what I believe to be recent indiscriminate selling suggestive of a tax loss seller, given that the only recent news has been a positive patent granting on November 22, 2022 and a relatively positive data presentation discussed below. Here is the patent news:

- Achilles Therapeutics (NASDAQ:ACHL) said a U.S. patent no. 11,504,398 was granted which covers the treatment of patients with an immunotherapy targeting clonal neoantigens detected using Achilles Clonality Engine (ACE), including vaccine, antibody and autologous T cell therapy approaches.

- The company noted that ACE is a proprietary method for determining clonality of patient-specific mutations that drives the PELEUS bioinformatics platform.

With that introduction out of the way, let’s briefly look at the company and the risks of buying it.

Achilles Therapeutics

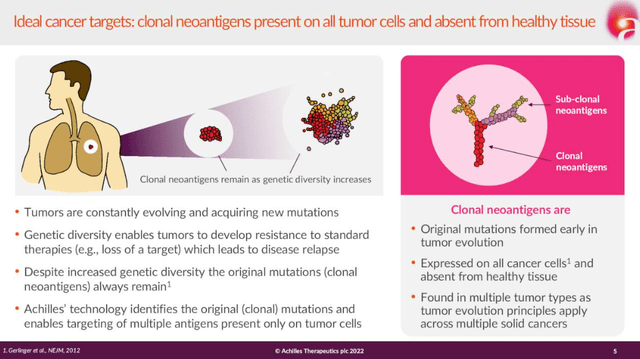

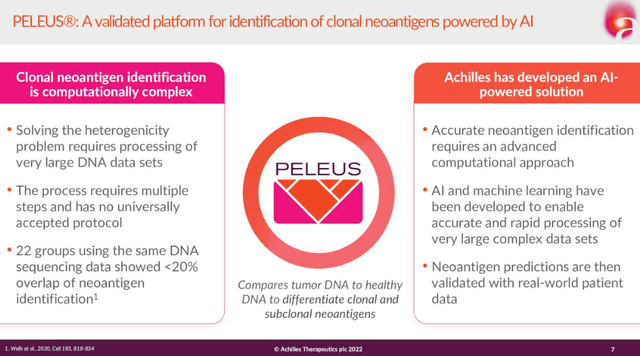

Achilles Therapeutics is a UK based oncology company which is attempting to use Artificial Intelligence (AI) to provide personalized cancer treatment, using clonal neoantigen reactive T cells (for which the company uses the acronym CNeT).

A corporate presentation from April illustrates the basic principal behind CNeT.

By targeting original mutations, aka clonal neoantigens, the cancer can’t as easily develop drug resistance as these original mutations always remain part of the cancer.

Figuring out what the original mutations consist of, however, is tricky. So ACHL has developed an AI solution to help with this task.

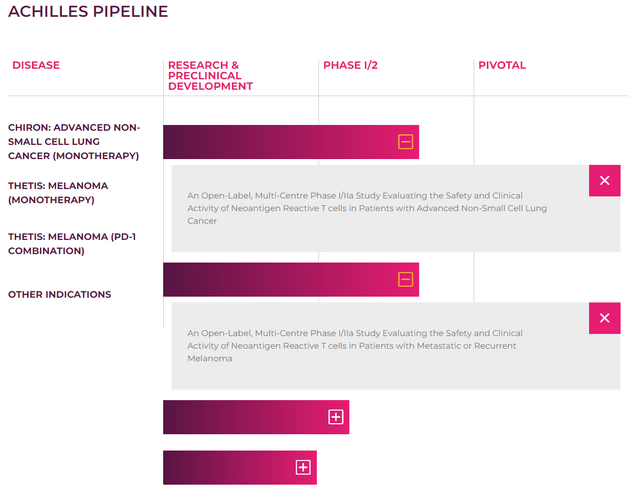

The company’s pipeline is given on its website, with two programs in Phase I/IIa development.

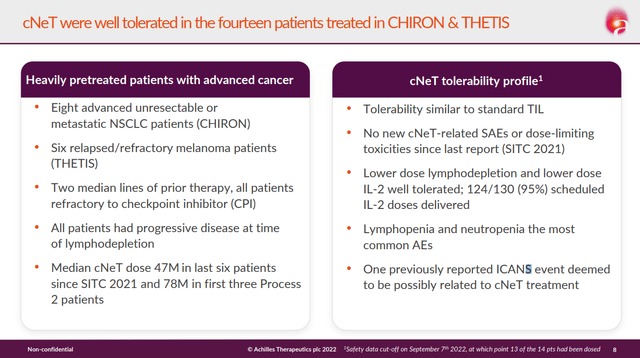

On December 6th, 2022, ACHL gave a positive update on its two lead programs while presenting at the ESMO Immuno-Oncology Congress. It is important to understand that both programs are being tested on heavily pre-treated patients which is obviously a difficult population. Early data shows similar safety profiles to standard TIL immunotherapy (see this excellent primer for a basic explanation of TIL).

Non-Small Cell Lung Cancer

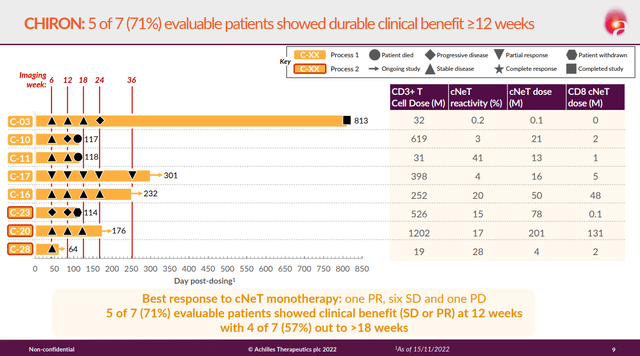

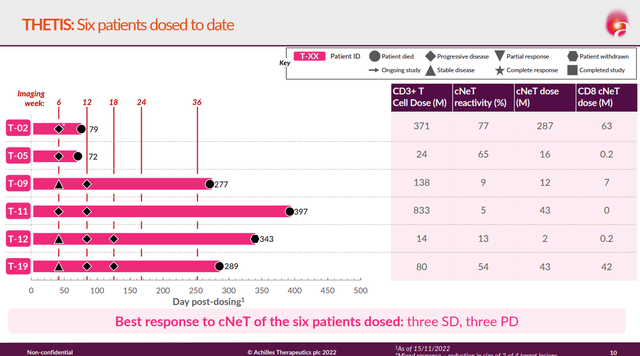

Here is a swimmers plot showing the early results in non small cell lung cancer. Of the 8 patients, four are still on treatment, one has completed the study and three have died.

Melanoma

And here is one for melanoma, though 5 patients have died and the remaining 6th patient has withdrawn. Again, all of these patients had progressive disease when they entered the study. In any case, I would think the company would prioritize the NSCLC indication given these two sets of results.

Cash Position

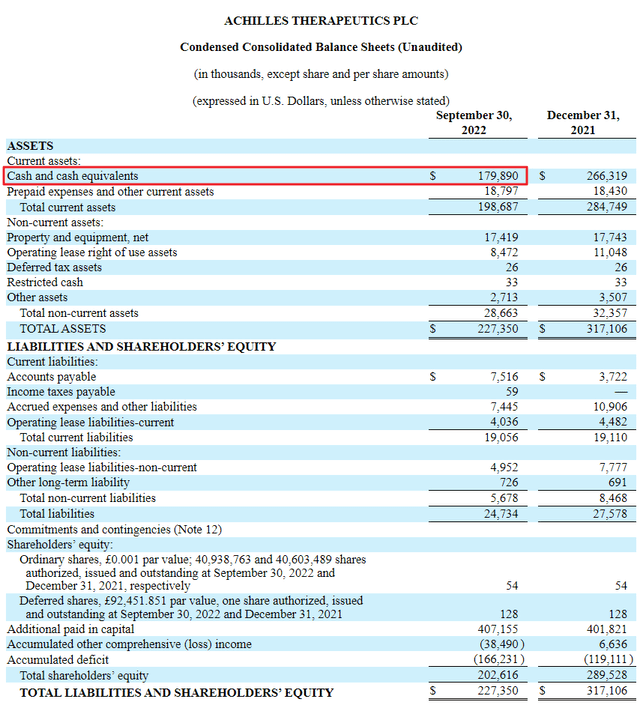

As of September 2022, the company has about $180M in cash which it estimates will support all planned operations through Q1 2025. This is important as it reduces the risk of an dilutive financing occurring in the near future. And with about 41M shares outstanding, it means the company has $4.40 of cash on hand per share, i.e. it is trading at almost 25% of its cash value. This too greatly reduces the risk of holding these shares.

Quant Rating

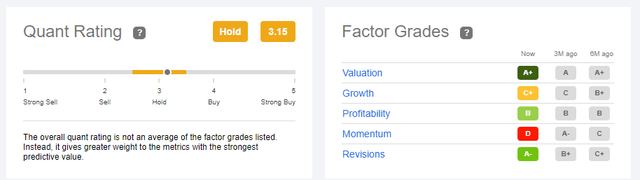

Seeking Alpha has a quant rating of 3.15 (HOLD) on the stock. Given the cash position, the valuation grade is A+, but recent price action drags the momentum grade down to D.

Risks

ACHL is an early stage biotech with a new approach (using AI and focusing on clonal neoantigen reactive T cells) which can easily fail to generate meaningful data and never make it through a Phase III trial and even then may not be commercially successful. Thus any capital invested here can be fully lost.

However, in the short term I think some of the risks are somewhat mitigated by the fact that the company is trading for about a quarter of its cash on hand.

Trading Strategy

I have purchased a full position of ACHL for my tax loss basket and plan to sell in increments if the stock bounces from now through the end of February. In any case I will sell my remaining position by the end of February or mid-March at latest.

Be the first to comment