Nastco/iStock via Getty Images

We’ve covered “REIT Stocking Stuffers Yielding 8%.” We’ve covered “REIT Stocking Stuffers Yielding 9%.”

And now we’re going to cover real estate investment trust stocking stuffers yielding 10%.

Merry Christmas to all!

As I wrote in the 8% piece:

I’ll be writing a ‘5 REIT Stocking Stuffers Yielding 10%’ article sometime soon.

Because, yes, there are actually real estate investment trusts out there that are yielding that much without putting everything at risk. And yes, that kind of return potential in our high-cost environment can sound like a lifesaver.

Or perhaps it just sounds like ‘Cha-Ching!’ As I wrote in the first post of this series, the title might inspire ‘greed, complete with Scrooge McDuck-like money signs’ filling your eyes.

In which case, I’m also going to take this introduction to once again remind you to be safe out there. It’s never time to be cute with high yields.

“By ‘cute,'” I informed readers a few months ago, “I mean thinking you can outsmart the markets by buying into really high, unsustainable yields and other too-good-to-be-true ‘opportunities.'” You see…

“While I’m sure people manage to make money off such things here and there, the odds are not in your favor.

“You’re much – much – more likely to lose out intensely in the end when you speculate on stocks.”

I mentioned that repeatedly during the shutdowns as stock prices plummeted and yields skyrocketed. As a result, “It was easy for the intrepid to think they could get away with absolute steals.”

But we rarely can.

The Repeated Truth About Most High Yields

For those of you who have read this warning before – over and over and over again, if you’re one of my regular readers – I’m sorry if you’re yawning right about now.

Just not sorry enough to stop.

You might have learned your lesson in this regard, it’s true. But the issue remains an issue for many people still. Maybe even most of them.

We’re too prone to falling for rampant greed or rampant fear. And we lose out either way.

Also, for the record, even those of us who have learned our lesson in this regard can use reminders. That’s the way I see it. It’s too easy to forget even painfully instructive experiences in the moment when emotions are running rampant.

Think about it. You’ve learned your lesson. You swore you’d never make the same mistake again. And so you haven’t, only to see amazing success as a result.

But that success got you cocky. Or complacent. Or some other undesirable state of existence.

And so you fall again.

Or, on the exact opposite side, to quote The Atlantic‘s 2016 article “Why Mistakes Are Often Repeated“:

To err is human, surely. But why do so many people make the same errors over and over again? Several recent studies reveal how our brains don’t learn from our past mistakes to the extent we might hope. In fact, thinking about past flubs might only doom us to repeat them.

In other words, “Seeing yourself as a failure can get you down.” And when we’re feeling down, we tend to seek instant gratification – which might very well have been what brought us down in the first place.

Either way, a reminder seems in order.

Which is why I wrote all the above.

Merry Christmas to All, and to All, 5 Safe High-Yield REITs!

Again, I know I mentioned this in the two past high-yield articles. But I want you to have a very Merry Christmas AND a Happy New Year.

That not only means pointing you toward solid investments like the three I’m about to list. It also means steering you away from bad ones.

Which 10% yielders usually are.

But there are some exceptions from time to time: stocks that fall out of favor so badly based on sentiment instead of statistics. In which case, it’s time to pounce.

Or at least seriously consider pouncing. Obviously, you need to do your own analysis, not just of the stock but also of factors like:

- Your portfolio

- Your financial position

- Your risk tolerance.

Then, if all of those line up…!

The companies below are priced as if they have very little hope left. Like they’re on their last thread. They’re goners singing their swan song. (The lowercase kind, not the sleep-well-at-night acronym.)

But the facts and figures say otherwise.

Are things ideal right now?

The answer is an easy no. There are reasons for their shares being devalued.

Just not by this much. This much, by my analysis, is ridiculous.

They might not deserve to be at the top of the “Nice” list this year. But nor should they be on the “Naughty” list.

Perhaps they belong in your stocking instead!

5 REIT Stocker Stuffers Yielding 10% or More!

1. Sachem Capital (SACH) – Dividend Yield: 14.94%

Sachem Capital is a Mortgage REIT that went public in 2017, currently pays a 14.94% dividend yield and trades at a P/E ratio of 7.99.

Mortgage REITs are different than Equity REITs in that they originate loans for real estate and make their money from the interest paid, as opposed to an Equity REIT that owns real estate and collects the rent.

Sachem Capital lends money for both residential and commercial real estate and differentiates itself by its underwriting process.

When originating a loan, they focus on the collateral value more so than the property’s projected cash flow or the borrower’s credit which enables them to close a loan in as quickly as 5 days. Their competitors typically take 3-6 months.

Sachem takes a conservative underwriting approach as all their loans are secured by first lien mortgages with a target 70% Loan-to-Value ratio.

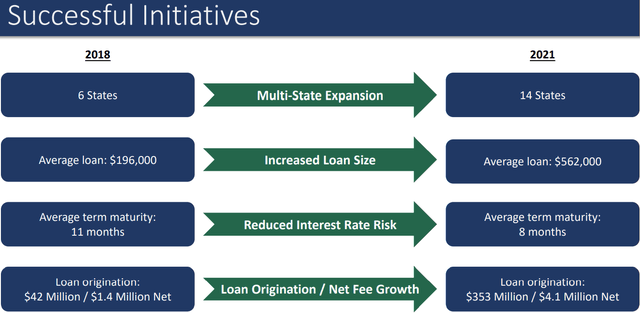

Since 2018 Sachem has shown impressive growth in several key areas including their average loan size and total loan origination.

In 2018 they had $42 million in loan origination vs. $353 million in 2021. Additionally, they have reduced their interest rate risk by reducing the average term maturity from 11 to 8 months.

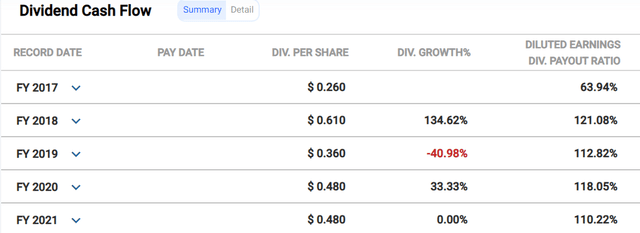

Anytime a company has a dividend yield over 10% I think it’s imperative to review the dividend history along with its safety going forward to avoid buying into a “sucker yield”.

Over its short history, Sachem has paid a dividend each quarter except for the 2nd quarter of 2020 when we were in the height of the pandemic. After that they resumed the dividend; however in late October the company cut its quarterly dividend by ~7% – from $.14 /sh to $/13/sh.

Sachem’s payout ratio when based on earnings per share has been over 100% since 2018, but keep in mind that they are required to pay out 90% of earnings and most mREITs pay out 100% of their earnings.

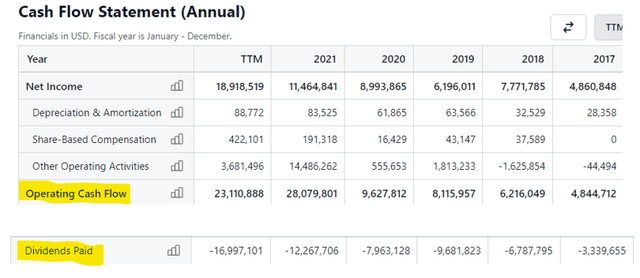

When we back-out the accrual accounting and compare the dividend to the Operating Cash Flow it paints a much better picture, with cash flow easily covering the dividend over the last 2 years as well as the last trailing twelve months (‘TTM’).

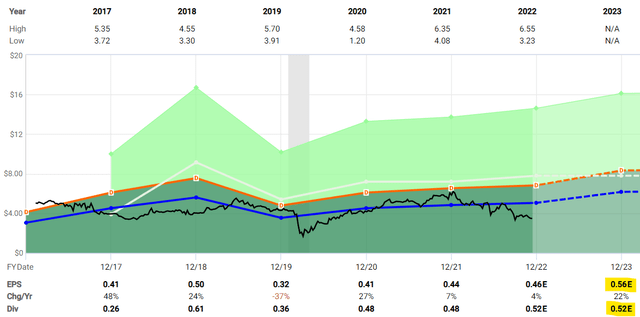

Additionally, in 2023 earnings per share is expected to increase 22% to 0.56, while the dividend per share is expected to stay at 0.52. If these projections hold up the payout ratio will be under 100% even on an EPS basis.

Being that Sachem is a small cap stock with a market cap of ~$140 million it will likely experience more volatility than its larger cap peers but considering the yield it offers at 14.94% which is covered by its cash flow, and its current valuation (P/E of 7.99) trading under its historic P/E of 11.11 we at iREIT rate Sachem Capital a SPEC BUY.

2. Brandywine Realty (BDN) – Dividend Yield: 11.66%

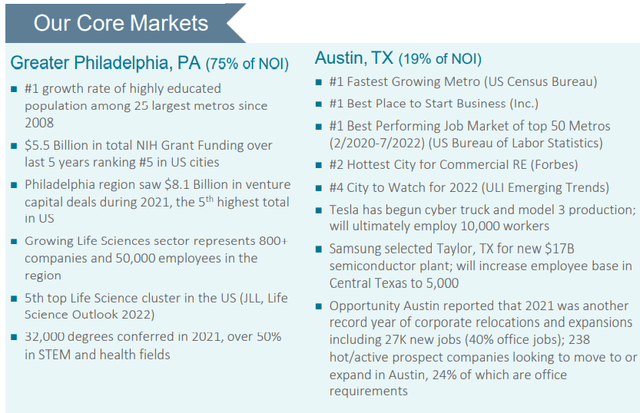

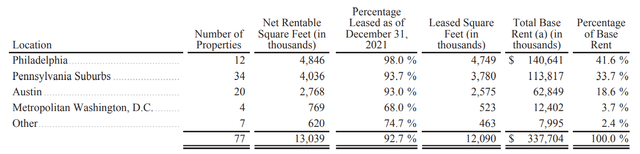

Brandywine is an Equity REIT in the office sector with properties primarily located in Philadelphia, Washington, D.C., and Austin, TX. Brandywine is especially concentrated in the Philadelphia market, where 75% of their Net Operating Income is derived.

Brandywine 3rd Quarter Investor Update

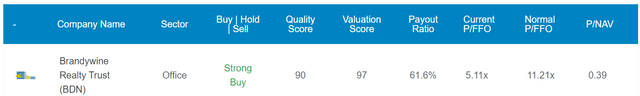

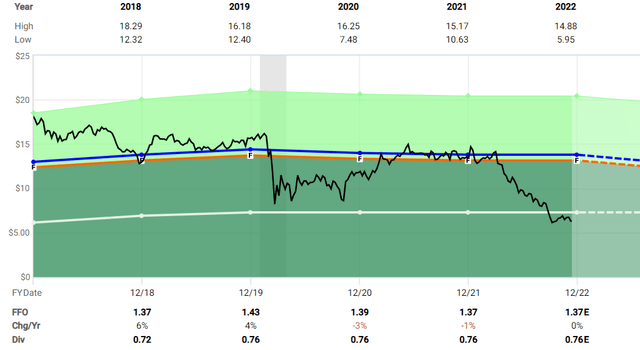

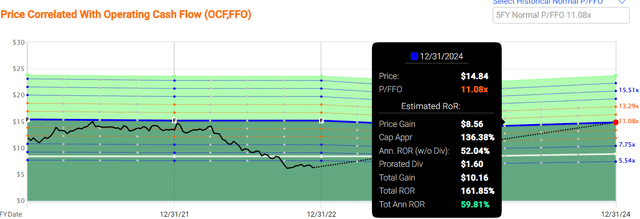

Due to the 2022 sell-off we’ve seen in REITs and the Office Sector in particular – Brandywine is currently trading at historically low valuations. As a matter of fact, the only time I could find when it traded at a lower FFO multiple was during the Great Recession of 2007-2009.

Currently it trades at an FFO multiple of just 5.11x when its normal FFO multiple is 11.21x. As one might expect with such a low P/FFO, Brandywine is also selling well below its Net Asset Value with a P/NAV of 0.39.

If Brandywine trades back to its normal FFO multiple by 2024 year end it would amount to an annualized return of 59.81%. In the meantime, Investors get to collect a well-covered dividend yield of almost 12%.

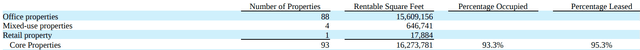

A major catalyst for the sell-off in Office REITs this year is the fear surrounding the work-from-home movement and what that means for the future of office properties. While no one can know for sure what the future holds, with the numbers and information we currently have there is no issue with Brandywine’s lease or occupancy rates.

As of 12/31/21 they had a lease rate of 98.0% in their largest market and had a lease rate of 93.7 and 93.0% in their 2nd and 3rd largest markets respectively.

Likewise, their occupancy rate was 91.3% at the end of 2021.

As a reference point, in 2018 (before the pandemic) Brandywine’s percentage leased stood at 95.3% and Occupancy was at 93.3%.

Now I could be wrong and maybe in 10 years from now all the major cities will be a collection of office graveyards, but I don’t think so. At the end of the day employers want their people in the office. They always have.

Currently employees have some leverage due to the tight labor market, but as the pendulum swings I believe employers will regain leverage for one simple reason – the Golden Rule. He who has the gold makes the rules!

Given the attractive valuation and well covered yield we at iREIT rate Brandywine Realty a STRONG BUY.

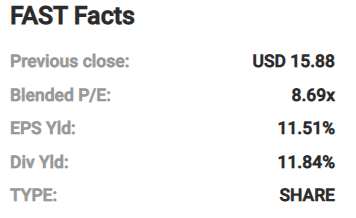

3. Chicago Atlantic (REFI) – Dividend Yield: 11.84%

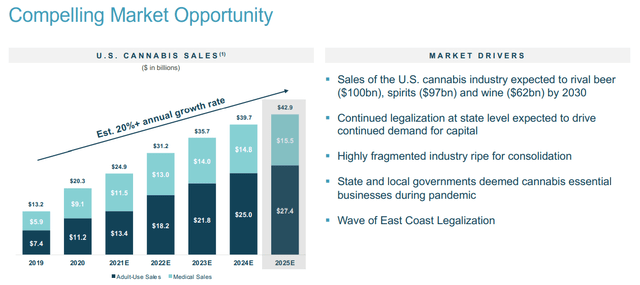

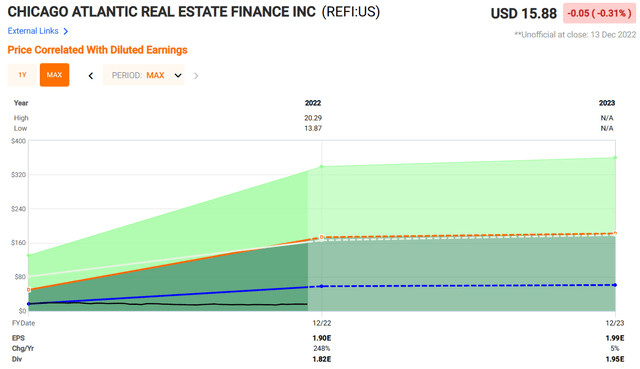

Chicago Atlantic is a Mortgage REIT that specializes in lending to the cannabis industry and has shown solid numbers since its IPO in December 2021.

This is a young company so there is a level of inherent uncertainty, but in its year as a publicly traded company it has displayed some compelling attributes. One is the industry in which it serves. Cannabis is still in the very early stages and there is a long runway for growth in this “budding” industry.

REFI – Third Quarter Supplemental

Throughout this year EPS has been on the rise and is expected to be $1.90 per share for 2022. Earnings are expected to increase to $1.99 in 2023 which would be an increase of 4.74%. However, with such a young company, projections are suspect.

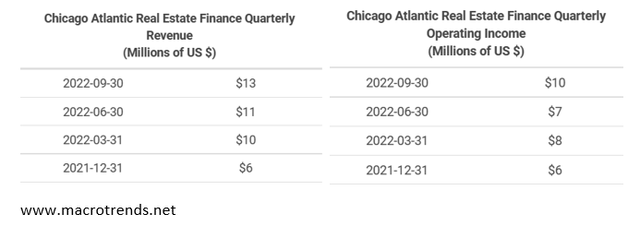

Looking at the Quarterly numbers for both Revenue and Operating Income we can see a steady increase in both since becoming public.

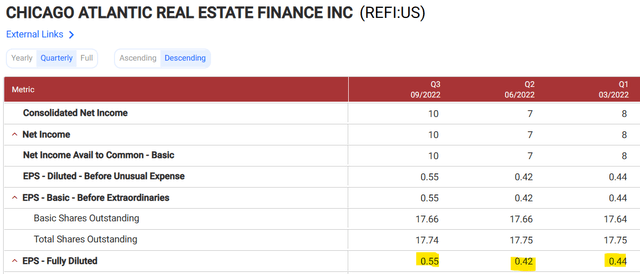

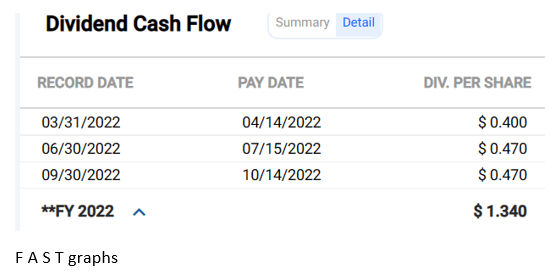

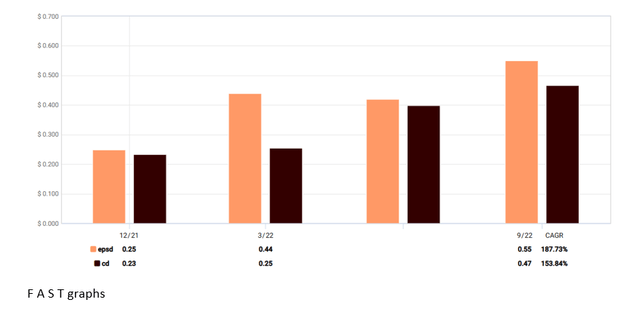

Likewise, the EPS of $0.44 in Q1-22 increased to $0.55 in Q3-22. EPS for the first 3 quarters of 2022 has totaled $1.41. Dividend payments for the first 3 quarters of 2022 has totaled $1.34. So over the first 3 quarters of 2022 the payout ratio has been ~95%, which is in line with most Mortgage REITs.

EPS vs. Dividend amount listed on a quarterly basis.

Overall Chicago Atlantic looks to have promising prospects in a very fast-growing industry. REFI is currently trading at a Blended P/E of 8.69x and offering an earnings yield of 11.51% and a dividend yield of 11.84%. At iREIT we rate Chicago Atlantic a SPEC buy.

FAST Graphs

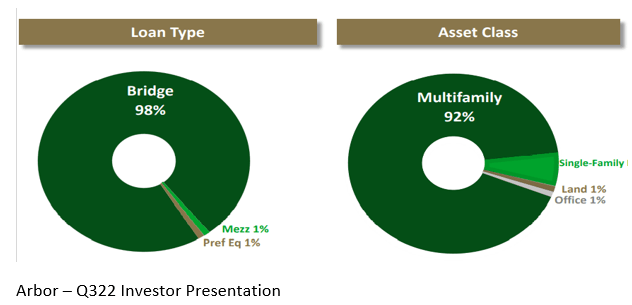

4. Arbor Realty Trust (ABR) – Dividend Yield: 10.94%

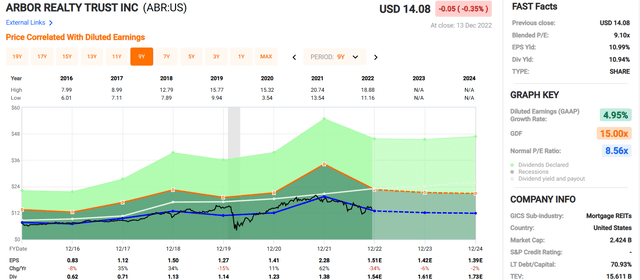

Arbor Realty is an internally managed multifamily focused Mortgage REIT with a highly aligned management team with significant ownership (~12%). Arbor currently yields 10.94% and trades at a blended P/E ratio of 9.10x.

Arbor primarily focuses on the multifamily market and offers multiple types of loan products, but primarily specializes in Bridge Loans which make up a majority of their portfolio.

Bridge Loans are typically short-term and are used by borrowers for temporary financing until they can secure permanent financing. Bridge Loans typically have high interest rates and are normally backed by some form of collateral. Due to the short duration, Bridge Loans are less susceptible to interest rate risk.

ABR IR

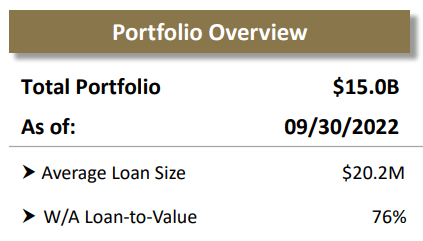

As of 9/30/22 Arbor total portfolio stood at ~$15 billion with an average loan size of ~$20 million and a weighted average Loan-to-Value of 76%.

ABR Q3-22 Investor Presentation

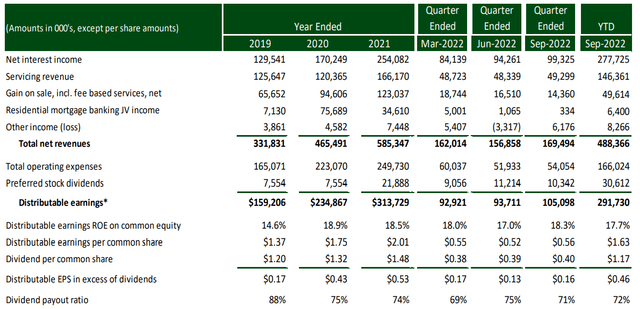

As shown below, Arbor has one of the best payout ratios for all Mortgage REITs, even rivaling the payout ratios for most Equity REITs. They had distributable EPS in excess of dividends of $0.53 in 2021 and YTD they have $0.46 in distributable EPS in excess of dividends.

So the dividend is very well covered, especially for a company in the mortgage REIT sector which typically has a payout ratio over 90%. Additionally, Arbor has shown solid Net Interest Income and distributable earnings growth over the past 3 years and look to continue that trend in 2022.

ABR Q3-22 Investor Presentation

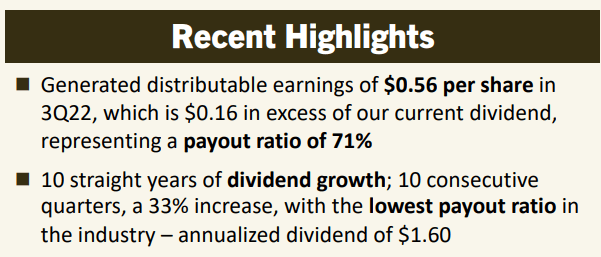

On top of the growth in Net Interest Income and earnings, Arbor has 10 straight years of dividend growth, a 33% increase, with the lowest payout in the industry.

ABR Q3-22 Investor Presentation

Given the solid operational track record, the well covered dividend, and attractive valuation we at iREIT rate Arbor Realty Trust a SPEC Buy.

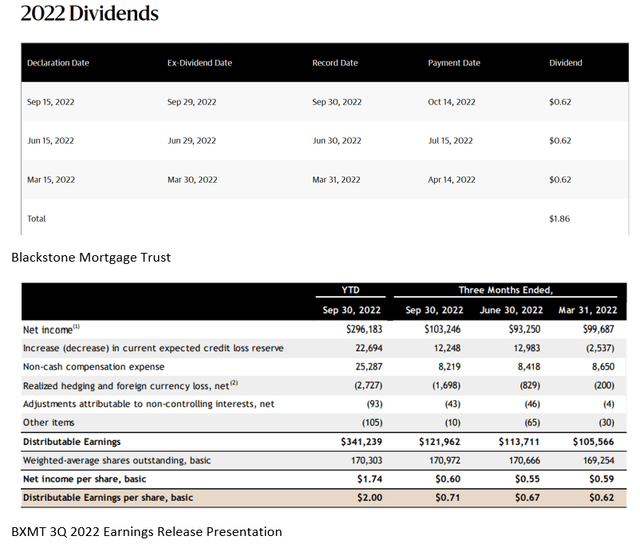

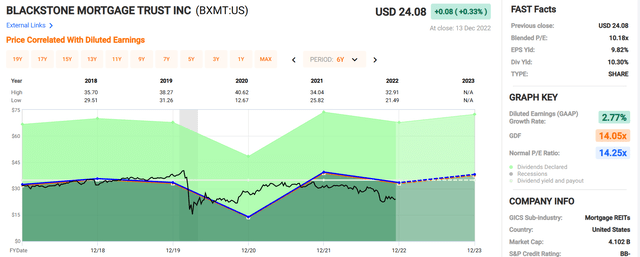

5. Blackstone Mortgage (BXMT) – Dividend Yield: 10.30%

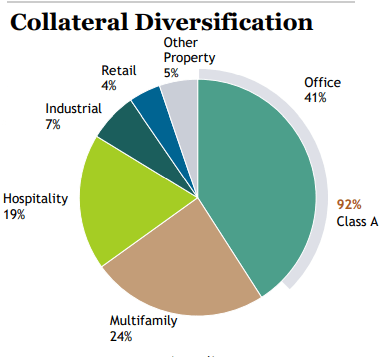

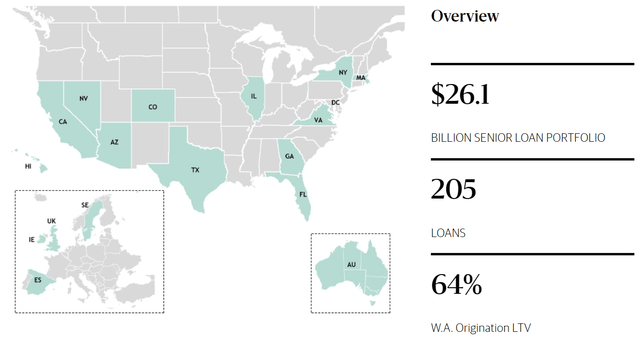

Blackstone Mortgage Trust is an externally managed Mortgage REIT that issues senior loans that are collateralized by commercial real estate. They operate in North America, Europe and Australia and hold a $26.1 billion senior loan portfolio with a conservative weighted average Loan-to-Value of just 64%.

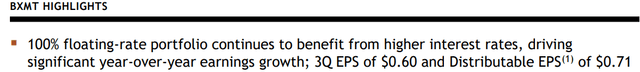

Blackstone Mortgage has a 100% floating-rate portfolio of loans which benefits from higher interest rates. With the current interest rate environment Blackstone Mortgage should continue to benefit from this loan structure.

BXMT Q3-22 Investor Presentation

Blackstone Mortgage has a diversified mix of collateral properties with Office, Multifamily, and Hospitality properties making up the bulk of their collateral.

BXMT Q3-22 Investor Presentation

So far in 2022 Blackstone Mortgage has issued 3 quarterly dividends totaling $1.86 while their Distributable Earnings per share is $2.00 YTD. On a quarter-by-quarter basis their Distributable Earnings covers or exceeds the dividend for each quarter in 2022.

BXMT Q3-22 Investor Presentation

Currently Blackstone Mortgage is trading at a blended P/E of 10.18x when its normal P/E is 14.25x so by this measure BXMT is attractively priced. Given the current valuation and well covered, high yield dividend – we at iREIT rate Blackstone Mortgage Trust a SPEC buy.

In Closing

The average dividend yield for the above-referenced REITs is 11.9%.

So, assuming you bought $100,000 in these REITs (on an equal weight basis) you would be collecting annualized income of around $11,900.

That’s enticing!

However, I believe these REITs should be yield-enhancers to your intelligent REIT portfolio.

In other words, instead of putting all of your hard-earned capital in just a few high-yielding stocks, I recommend buying some ultra-safe common shares in names like Prologis (PLD), Realty Income (O), VICI Properties (VICI), American Tower (AMT), Digital Realty (DLR) and others.

Perhaps you could anchor your intelligent REIT portfolio with at least a dozen of these higher quality REITs and then sprinkle in some higher yielding names (like the ones I list in this article) and some preferreds (finishing up a monthly preferred article now for iREIT on Alpha members).

The net result of this so-called “Anchor and Buoy” strategy is that you get a well-diversified REIT portfolio that could yield around 5.5% to 6.5% with plenty of icing on the cake – especially if you purchase shares with a sizeable margin of safety.

I would not recommend putting all of your capital to work with just stocks with double-digit yields. That’s an extremely risky value proposition as far as I’m concerned.

Nonetheless, at the end of the day, every investor has his or her own risk profile.

Good luck to ya!

Merry Christmas and Happy Holidays.

Be the first to comment