ArtistGNDphotography

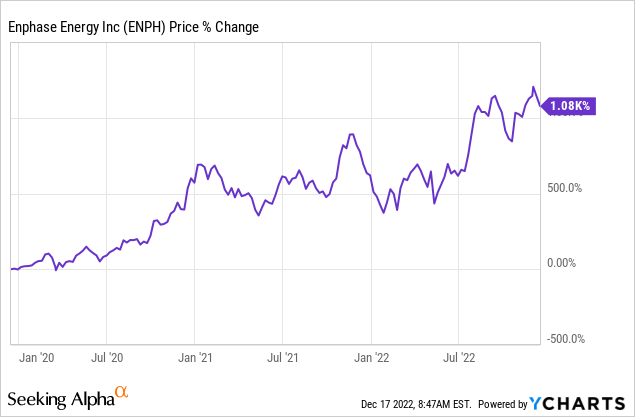

Enphase (NASDAQ:ENPH) has come to represent the riches possible under the transition to zero-carbon technologies. The Fremont, California-based company is up nearly 65% year-to-date in a year that saw almost every other industry including climate economy stocks crumble. Even more staggering, the company is up 1,000% over the last three years. There is no other climate economy stock that has such a return profile and Enphase has single-handedly carried the performance of a sleuth of renewable energy ETFs from Invesco Solar Portfolio (TAN) to iShares S&P Global Clean Energy Index (ICLN).

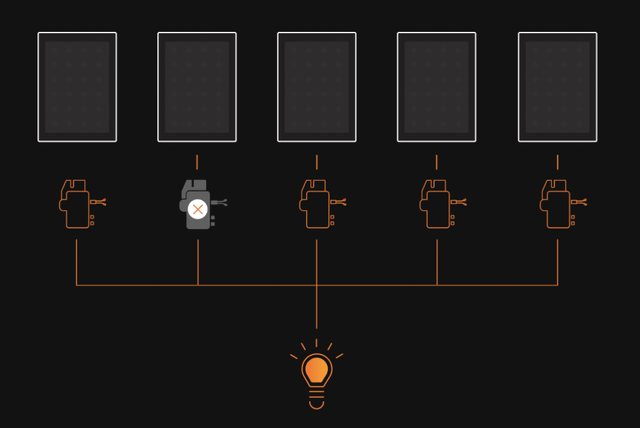

Founded in 2006, the $41 billion company launched the latest iteration of its microinverter series last year. The IQ8 allows solar PV owners to convert DC power to AC power and embeds greater resiliency as it allows solar systems to generate power during an outage.

As microinverters offer no single point of failure, they allow a solar PV system to keep working even when a microinverter fails. This creates the conditions for more consistent energy production during the lifetime of ownership versus string inverter systems which have a single point of failure. Hence, the bull case for the company has been built on the growing demand for home and business solar PV systems and the corresponding microinverter architecture required to transform the electricity produced into a format usable by households and businesses.

Strong Cash Flow Is Set To Mould The Next Three Years Of Capital Returns

To state that I’m bullish on the decarbonization trend would be an understatement. I’ve dedicated a whole section of my portfolio to building long-term positions in climate economy stocks. Clearway Energy (CWEN.A), Array Technologies (ARRY), and Atlantica Sustainable Infrastructure (AY) all currently feature as my bullish picks. This section is built with the simple premise that climate change is real and we need to transition from what Tesla’s 2006 Master Plan described as a mine-and-burn hydrocarbon economy towards a solar electric economy.

But I’ve always been sensitive to starting an Enphase position due to the company’s high multiple. Bulls would be right to state that the multiple follows what has been consistently strong financial results that are increasingly being backed up by healthy and growing free cash flows.

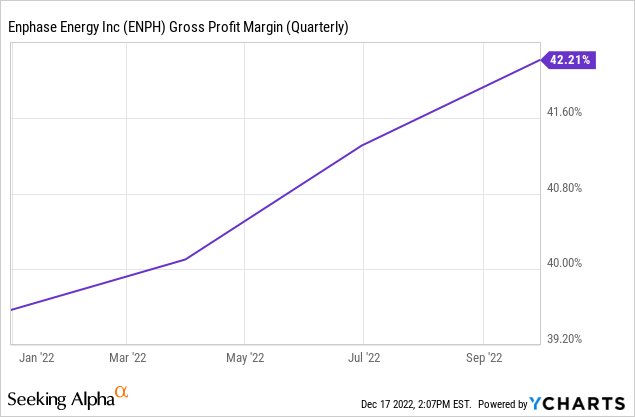

Indeed, results for the company’s last published fiscal 2022 third quarter results saw revenue come in at $634.71 million. This was a growth of 80.6% over the year-ago quarter, an increase of 20% sequentially, and a beat of $18.85 million on consensus estimates. With around 47% of the company’s third quarter microinverter shipments being IQ8, non-GAAP gross margin came in at 42.9%.

This was around a more than 150 basis points improvement from the second quarter and helped drive a GAAP operating income of $135.4 million, up from $37.4 million in the year-ago period. This blockbuster 262% increase in year-over-year operating income meant free cash flows came in at $179.1 million as cash from operations increased by 66.4% over its year-ago comp. Cumulative year-to-date cash from operations now stands at $491.1 million, higher than fiscal 2021 and just under its last two fiscal years combined. Hence, the bull thesis is clear, growing demand for solar PV systems on the back of the drive towards decarbonization will form the foundations for Enphase to consistently generate strong FCF for the foreseeable future.

Harnessing The Power Of The Sun

Enphase’s fast-paced growth is set to keep on going on the back of the Inflation Reduction Act. The IRA will extend the investment tax credit for residential solar to 30% for another decade and will also implement a standalone ITC for storage with the same terms. This bodes well as Enphase has expanded its business to include storage systems.

The IRA also includes a provision for a $0.11 per AC watt production-based tax credit for domestic manufacturing of microinverters. This has accelerated plans for another manufacturing site that will be based in the US. Management stated that four to six manufacturing lines will now be built by the second half of 2023. Fundamentally, the IRA will likely come to represent the single most pivotal piece of legislation for the climate economy and Enphase now stares at a decade of growth. With Enphase expanding to EV charging points for residential and commercial customers with its acquisition of ClipperCreek earlier this year, the company has positioned itself to fully ride the growing zeal of decarbonization now set to be ramped up by the IRA.

But this exposure is not cheap. Enphase’s price-to-non-GAAP forward earnings ratio stands at 69.58, 275% higher than its sector median. Whilst the company’s future fully aligns with my climate economy portfolio and it has become a cash-generating machine, the valuation has not provided a palatable entry point. This is a hold for current investors.

Be the first to comment