tawatchaiprakobkit

After selling off half of our position in Triterras (OTCPK:TRIRF) when it became controversial, we stuck with the other half as the business model has a lot of potential and the company had a lot of cash and the shares could be uplisted again as the fraud allegations subsided.

But we put the company in our ‘moonshot’ category, which is the very high-risk/reward type of stock that can land you a multi-bagger but most of these will be duds. Basically, these are like out-of-the-money options.

The company only reports twice a year, which they did on November 30, and the results were sobering. The company is plagued by covid, or to be more precise, their customers, small and medium-sized commodity traders, are plagued by it (H1CC):

The worldwide COVID pandemic has had a negative effect on the trade industry as a whole and the SME community of traders in particular. The business shutdowns and resulting supply chain disruptions cause great distress in our industry to both SME traders and their sources of financing alike. Trade credit insurance a risk mitigation vehicle used by commodity trade finance lenders became significantly less available and premiums increased. This was compounded by bankruptcies of trade credit lenders, for example, the failure of GreenCell that further reduced finance resources available to the industry.

It is still a very attractive segment as these S&M traders face a $1.5T shortfall in financing as they are not interesting for most banks due to all the paperwork and risk.

However, the Kratos platform does away with the paperwork and doesn’t incur risk as it’s a match-making platform. Still, the industry headwind is such that the company had to take a $14.4M write-down on receivables, which obviously isn’t a good sign.

Transaction volume in H1 came down to $1B, from $4B last year, that’s also not good even if revenues managed to increase by 15% to $26.4M. However, that was primarily due to their new trading segment which produced $20.7M in revenue that wasn’t there last year.

However, that segment produced $20.3M in COGS so the gross margin on these activities is tiny.

What is positive is that the number of users on their platform increased substantially (+89%) to 249. There are a few other interesting developments:

- The company has moved away from sole reliance on S&M commodity traders opening up the platform for supply chain finance business through the acquisition of Invoice Bazaar in May 2021.

- The company also moved away from the focus on East Asia and added new areas in the Middle East and North Africa (see a previous article)

- The company has secured ISO 27001 Information Security Management certification and fully transitioned to AWS-managed Hyperledger blockchain structure

- The company is working on Kratos 2.0 a no/low code version

A bottleneck for progressing seems the presence of lenders on the platform, but they are taking several initiatives to address this:

- Casting the net wider, from banks to general credit funds, multi-strategy asset funds and institutional lenders among others.

- Show the returns that can be gained by lending its own funds with the help of its $15M trade-finance investment fund.

Some progress seems to have been booked (H1CC):

as of October 2022, we added five lenders to the ecosystem, but many of them are in the early stages of their rollout.

On the supply chain lending business (H1CC):

In order to demonstrate the viability of our supply chain finance lending alternatives to potential new lenders, the company required its own assets into lending transactions for various transaction structures from which we generated significant income and began establishing a track record of lending success that we can share with prospectus third-party lenders.

The company is also engaged in marketing efforts like news on its website, videos on its YouTube channel, and revamping its website, as well as direct marketing campaigns on social media.

Finances

Some metrics:

- Revenue +15% to $26.4M

- Trade finance was 39.9% of revenues

- The average transaction fee is 0.57% (unchanged)

- COGS $22.1M vs$1.3M on $20.3M new trading cost module

- SG&A -29% to $10M on a decline in legal expenses

- Impairment loss of $14.4M on trade and loan receivables

- AEBITDA -$19.1M (vs +$4.1M) on increased impairments

- Net loss $21.6M vs net income of $27.3M in H1/22

- Cash $33.9M

Cash

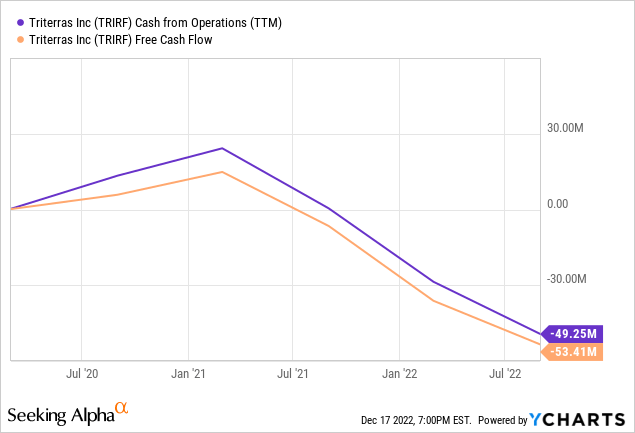

The graph below doesn’t inspire a whole lot of confidence:

The cash burn is still substantial but management has plans to reduce that (H1CC):

collecting $4.25 million from our insurance credits related to the transaction lawsuit settlement. Further, redeeming our $20 million investment in trade credit partners, and improved collections of outstanding trade and loan receivables as well as actions we spoke of in terms of improving our operational results.

Management is predicting breakeven sometime next year but that remains to be seen. Uplisting the shares to the OTCBB isn’t likely to happen anytime soon.

Valuation

The company has 76.5M shares outstanding (and 26M warrants but one can forget about these as they have an execution price of $11.5), so their market cap (at $0.5 per share) is just $38M, which is just $4M above cash.

Conclusion

The company potentially fulfills an important need and faces a huge market opportunity, besides, the platform is so flexible that it can be extended to other segments and geographies and functionality can be added and it has done all of that.

However, almost everything that could go wrong did go wrong. While they’ve largely cleared the previous trouble with the accounting problems, they are now hit by the mother of all industry downturns.

And the worst thing is that there is no end in sight and their cash is starting to get depleted. Yet there is still considerable potential for a recovery. The company keeps on adding users to its platform and has also had some success adding finance companies.

If a recovery comes, things could move pretty fast, we know they were really quite profitable and cash flow generating before. So we can’t write the company off completely, but neither can we recommend buying the shares here as the situation is really binary.

Be the first to comment