Slaven Vlasic/Getty Images Entertainment

Investment Thesis

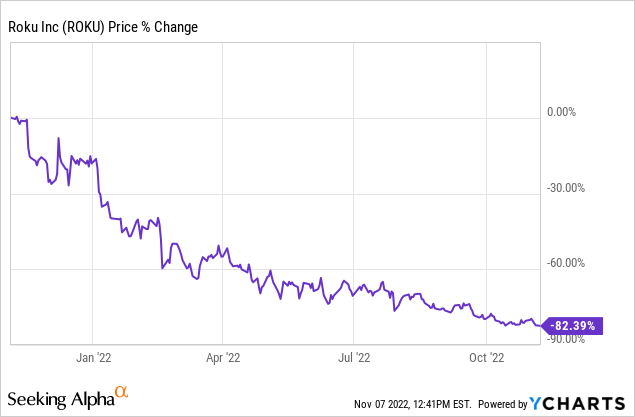

The transition from linear TV to streaming has been well under way for years, and it will continue to be a secular tailwind throughout the next decade. Despite Roku (NASDAQ:ROKU) being one of the driving forces behind this change, shares have plummeted over the past 12 months – currently sitting an eye-watering 82% below their 52-week high.

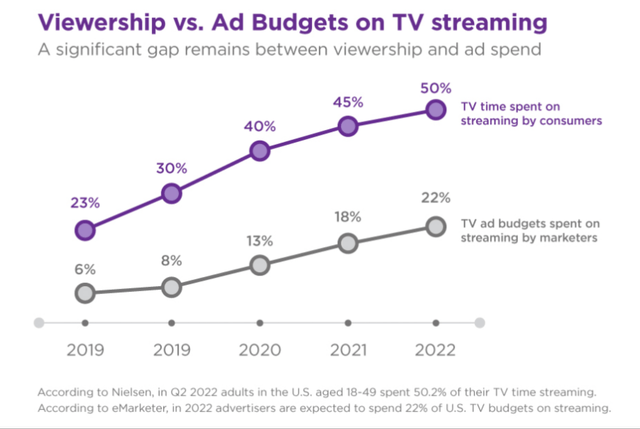

My personal investment thesis for Roku (laid out in more detail in a previous article) is the following: as a leader in the streaming space, Roku has access to millions of eyeballs thanks to its reach in connected TV. This gives it the ability to benefit from advertising revenues through FAST channels, through banner adverts, as well as the ability to benefit from revenue share agreements with content streaming services. As more consumers switch to connected TVs, and advertising dollars make their way across from linear TV to streaming, Roku should continue to be a big beneficiary of this secular trend.

Unfortunately, as the share price implies, it has been an extremely disappointing year for Roku. The company was initially hampered by supply chain disruptions, resulting in slowing sales of its Roku Sticks, and has since suffered from pullbacks in advertising spend due to the deteriorating macroeconomic environment.

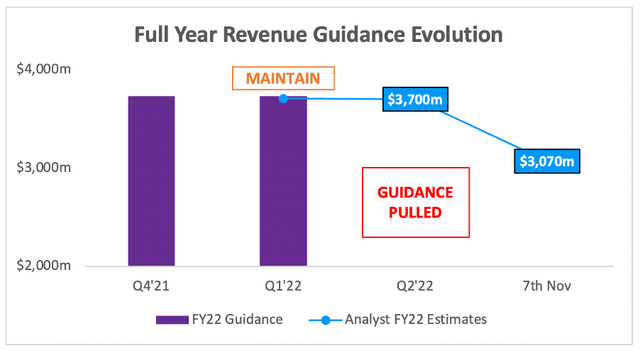

After a pretty appalling Q2 earnings a few months back, in which Roku slashed its Q3 revenue estimates and pulled its full year guidance, investors were now hoping for some better news in Roku’s Q2 results.

So, did that good news materialize?

Not really.

Roku Q3 Earnings Overview

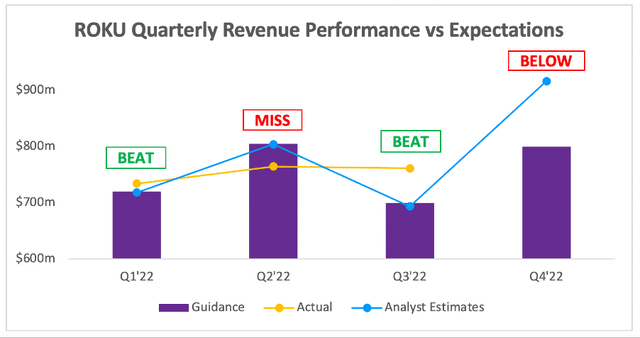

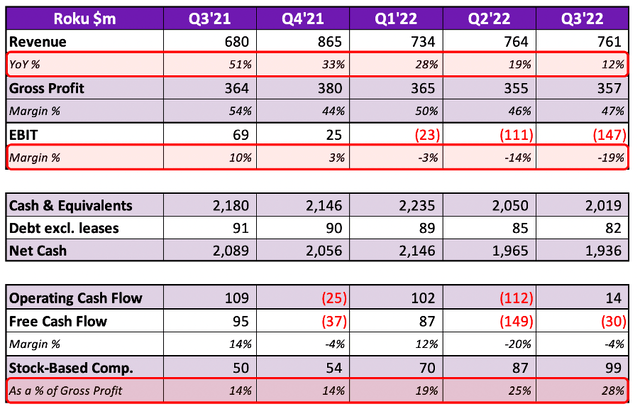

Starting from the top, Roku’s Q3 revenue grew 12% YoY to $761m, coming in well ahead of analysts’ estimates of $694m. This substantial revenue beat might sound impressive, but the analysts’ estimates were incredibly low due to Roku’s prior guidance.

Back in Q2, Roku guided for Q3 revenue of $700m, so fairly close to the $694m that analysts were expecting when Roku reported last week. The big problem was, before Roku reported its Q2 results back in July, analysts had been expecting Roku to deliver Q3 revenues of $911m! So, whilst Roku’s Q3 revenue of $761m may have been a strong beat, expectations had previously been decimated.

It’s clear to see from the below chart just how much Roku’s guidance has fluctuated around its actual results, which takes a substantial amount of credibility away from Roku’s management team.

Unfortunately for investors, it looks like Roku is making a habit of disappointing everyone when it comes to revenue guidance. For Q4, management has guided for revenue of $800m, representing YoY growth of just 6%, and once again falling miles short of analysts’ estimates of $916m. This was partially explained by outgoing CFO Steve Louden on the earnings call:

The holiday season is typically the strongest period for most companies, including Roku, but we expect this season to be different. We believe that macro uncertainties and inflationary pressures will continue to negatively impact consumer discretionary spend and these pressures will further weigh on advertising budgets, particularly the ad scatter market. We expect these conditions to be temporary, but it is difficult to predict when they will stabilize or rebound.

For our Player business, we anticipate lower sales year-over-year and margins that will be significantly lower sequentially, primarily due to traditional holiday promotional pricing. For our Platform business we anticipate that these macro pressures will offset what would ordinarily be seasonal tailwinds, and as a result our platform revenue will be slightly down on sequential basis. In addition, our Player and Platform revenue in Q4 is typically back-end loaded, which further reduces our visibility.

The knock-on effect has been analysts dropping their full year revenue expectations for Roku to $3,070m. To put this into perspective, management had guided for full year revenue of $3,732m back in Q1; management went on to pull that guidance in Q2, and analysts’ full year revenue estimates are now ~18% lower than management’s guidance from just 6 months ago.

If there’s one thing I’ve realised about Roku over the past 6 months, it’s that I’m struggling to trust the company’s management team. I understand that it’s an uncertain macroeconomic environment, but Roku’s volatile results and issues with guidance is a problem that other higher quality management teams – like those at The Trade Desk (TTD) – have not struggled with thus far.

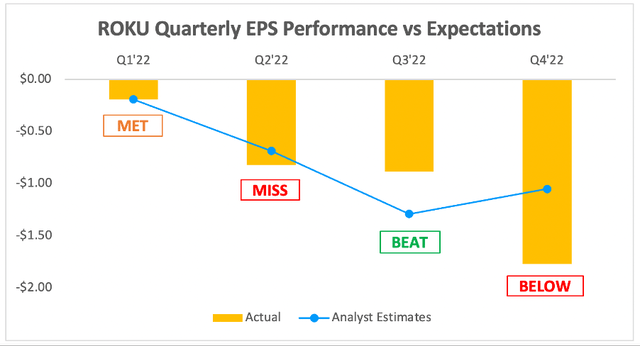

Moving onto the bottom line, and Roku beat expectations on EPS, coming in at a loss of $0.88 per share vs analysts’ estimated loss per share of $1.29.

Again, this Q3 beat is pretty underwhelming, since expectations had already been lowered too far by management’s guidance last quarter.

Roku once again guided to heavier-than-expected losses in Q4, with management guiding for EPS of -$1.77 compared to analysts’ estimates of -$1.05.

Whilst the Q3 results seemed great compared to analysts’ expectations, these beats were only driven by overly low expectations caused by management’s Q2 guidance. Unfortunately, management once again guided to a pretty abysmal Q4, and shareholders don’t have much to smile about when it comes to the headline numbers.

Macroeconomic Headwinds Continue To Batter Roku

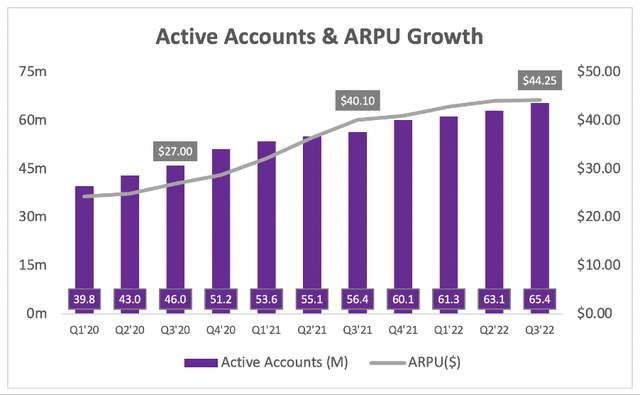

Clearly the headline numbers were not ideal, but just how bad are the underlying business trends? Well, one bright spot in this quarter was the fact that Roku managed to add an additional 2.3 million active accounts, growing 16% YoY to reach 65.4 million. On the other hand, Roku’s ARPU (average revenue per user) growth appears to be stagnating.

Once one of the most promising metrics for the company, Roku’s ARPU only grew 10% YoY, its slowest growth rate for a long time, and saw QoQ growth of just 0.3%. Roku’s ability to monetise its users has always been attractive, but I wouldn’t be surprised to see this ARPU trend start to decline in the coming quarters – a worrying sign for shareholders.

That did not stop Co-Founder and CEO Anthony Wood from pointing out some more positive trends on the earnings call:

Our opportunity as a streaming TV platform is very large and remains intact despite current ad pull back. We are not idly waiting for the ad market to improve. We added 2.3 million active accounts in Q3, which was above net adds in both 2019 and 2021. And we grew streaming hours on The Roku Channel by more than 90% year-over-year. We’re making good progress internationally, demonstrated by our results in Mexico. Last month we launched the Roku channel in Mexico, a milestone that is the result of meaningful scale and engagement that we have built there in the past three years.

The 90% increase in streaming hours on The Roku Channel is another bright spot for shareholders. In fact, this combined with the growth in new accounts should be a positive sign for long-term investors; eventually, the macroeconomic headwinds facing Roku shall pass, and when they eventually do, Roku will have substantially more viewers to target with its advertising.

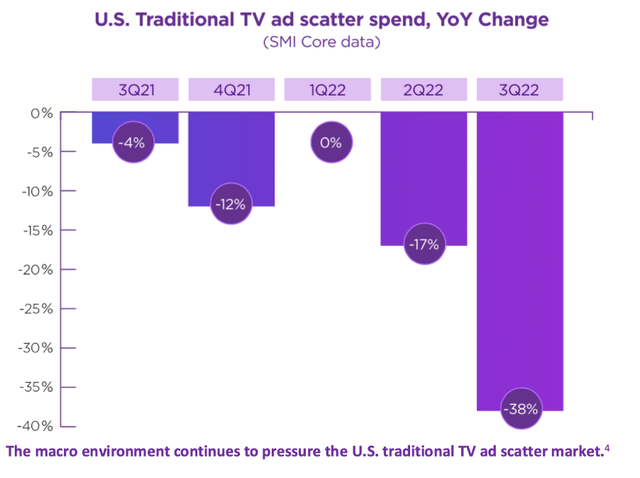

Now investors have been hearing management blame the difficult macroeconomic environment for some time now, but do they have a point? Well, it would appear so – according to SMI Core data, the advertising spend for traditional TV advertising fell a whopping 38% YoY in the US; that’s during a period where there should have been some boost from political advertising – yikes!

Given this, perhaps Roku should be given more credit for the fact that its Platform revenue increased 15% YoY to $670m in Q3. I think the amount of credit given will be down to each individual investor, but there’s no denying that Roku is feeling the pinch right now from plenty of issues that are out of their control.

Plus, Roku remains the number one selling smart TV operating system in the US, and there are still plenty of secular tailwinds that should drive it onto long-term success. The problem right now is that the temporary headwinds have hit the business hard, and management have done a very poor job of steadying the ship. Arguably, this has been made even worse by their latest venture…

Roku’s Smart Devices: Incredibly Smart or Painfully Stupid

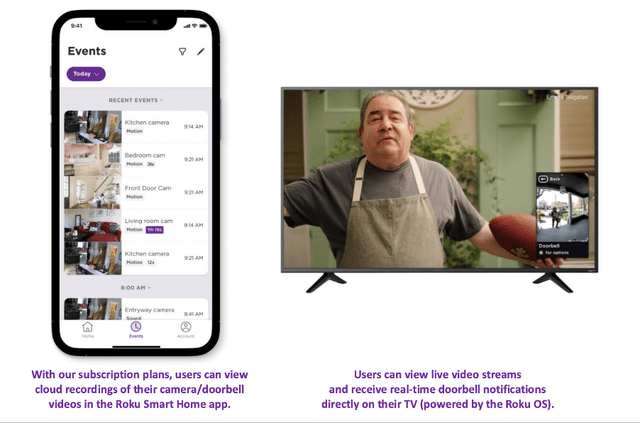

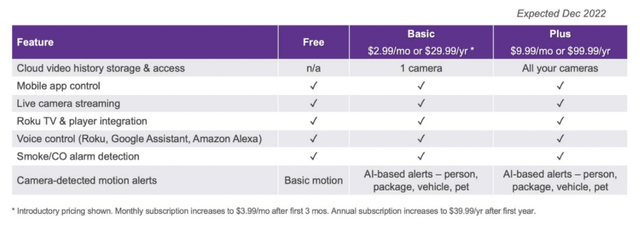

I’ll admit to doing a double taken when I saw Roku talking about doorbell cameras in its Q3’22 shareholder letter – but, apparently the company does that now!

Thankfully, CEO Wood gave a little bit more color on the call:

We continue to innovate and execute. Last month, we launched new smart home products to build new service revenue streams. We believe every device in the home will be connected by software and services, but it’s still early days. For example, only about 20% of U.S. households have IT cameras. Additionally, the existing smart home experience is fragmented and difficult to use. As the number one selling smart TV OS in the U.S., we have the technology and expertise in hardware, software, and services to deliver a smart home ecosystem that is simple, powerful and delightful. We launched in this category with strong retail distribution at Walmart, America’s number one retailer.

Right now, I’m trying to figure out whether or not this decision is very smart or very stupid. Being the leading smart TV OS certainly gives Roku a rationale to play within the smart home industry, particularly due to its specialization in creating great hardware and software. On the other hand, this move could scream desperation from a company that is struggling for ideas and whose current business is faltering.

I, for one, don’t mind Roku taking this risk, as long as it doesn’t cost too much and doesn’t distract management from Roku’s primary offering, especially since the business is already going through a rough patch. If this is a bet with a substantial asymmetric upside, then good luck to management! At least they didn’t spend billions of dollars to come up with ground-breaking inventions such as legs (I’m looking at you Meta (META)).

Only time will tell, but this is currently neither a good nor a bad thing in my view – more just an interesting thing, and I look forward to seeing its progress.

Quick Take: Roku’s Core Financial Metrics

Let’s also take a quick look at Roku’s financials, and specifically just how quickly they have been deteriorating.

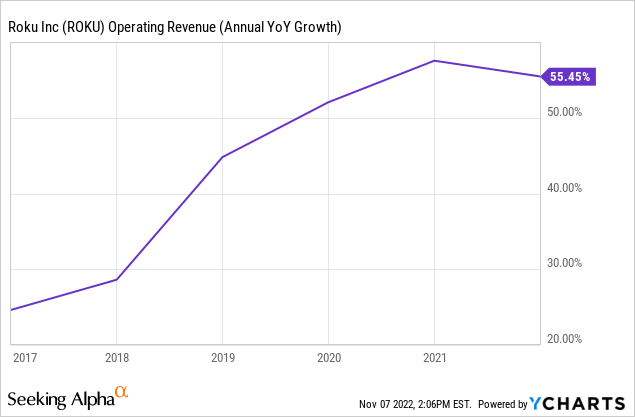

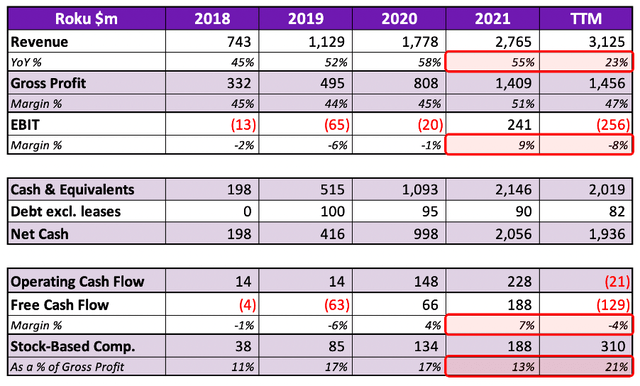

Starting with a view on Roku’s trailing-twelve-month trends, and revenue growth has decline from 55% in 2021 to 23% and falling over the past twelve months. This has coincided with tumbling EBIT margins, as supply chain issues, excessive hiring, and inflation increased Roku’s costs, with revenue growth failing to keep pace.

CFO Steve Louden provided investors with some more color on the drivers behind the revenue decline and falling margins:

Roku player unit sales remained above pre-COVID levels and the average selling price decreased 6% year-over-year, as we continue to insulate consumers from higher cost to prioritize account acquisition.

…But notably, the OpEx year-over-year growth rate is still high but that’s largely the result of that hiring increases late last year and early this year. So we’re focused on driving the sequential OpEx growth rate down.

Looks like Roku is yet another technology company that rapidly increased its headcount in 2020 and 2021, expecting a ‘new normal’ in the economy, but is now having to quickly slow down hiring – or perhaps even consider layoffs, as we have already seen from plenty of larger technology businesses.

Moving down to the quarterly figures, and this makes the sharp slowdown in revenue growth all the more apparent. Revenues grew 51% YoY in Q3’21, and just 12% in Q3’22, with EBIT margins consistently declining over the past five quarters.

But what really stood out to me is the level of stock-based compensation paid out by Roku. This has increased consistently over the past five quarters, each time being a larger portion of the company’s quarterly gross profit, despite the decline in both share price and business fundamentals. This is probably driven by Roku’s excess hiring, and will take a few quarters to normalise, but it isn’t exactly pleasing to see as a shareholder.

Clearly pretty much all of Roku’s financial metrics are trending in the wrong direction, but the most important thing to note is the company’s net cash position of $1,936m. The amount of free cash flow Roku is losing is nothing compared to that cash hoard, meaning that Roku is almost guaranteed to survive any sharp economic downturn; furthermore, if it can survive, then it will come out of it a much leaner and more efficient business – combine this with all the tailwinds that it still benefits from, and Roku could end up being a fantastic long-term investment.

Roku Stock Is Priced Extremely Attractively

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Roku is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

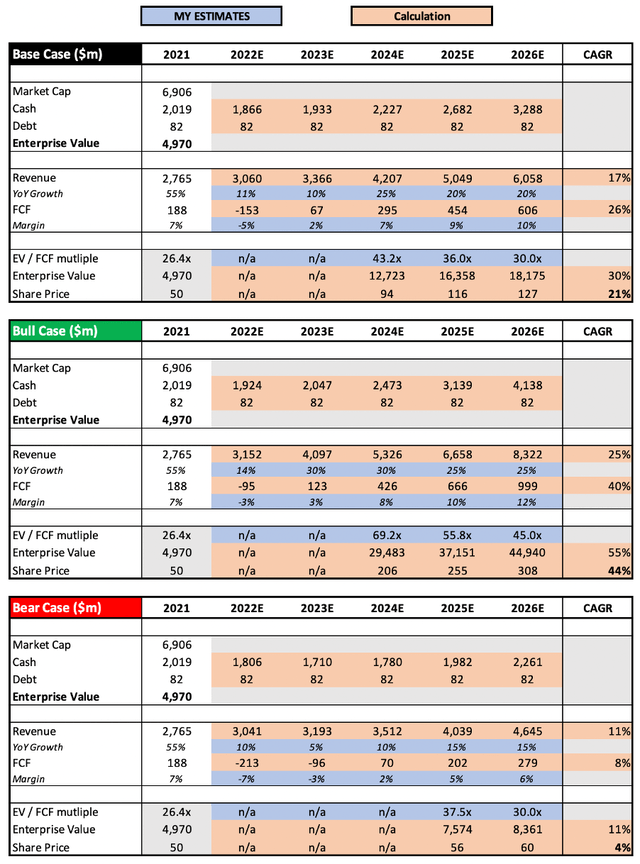

There are only a few changes to the assumptions that I had made in my previous article, owing to Roku’s latest results. I have reduced Roku’s revenue growth rate for 2022, in line with the latest expectations, and I have also slightly reduced the free cash flow margins in 2022 and 2023.

Put all this together, and I can see Roku shares achieving a CAGR of 4%, 21%, and 44% in my bear, base, and bull case scenario. By any measure, Roku is currently a ‘cheap’ stock – the problem is, most ‘cheap’ stocks are cheap for a reason, and it’s up to individual investors to decide whether or not they think Roku can find success once again, or if this is a value trap.

Bottom Line

It was yet another disappointing quarter for Roku, with management once again taking the market by surprise with disappointing forward guidance. The financials of this business are also deteriorating rapidly, and I don’t think it will be long before ARPU starts to decline. Roku is also struggling to cope with the difficult headwinds that many companies are faced with right now, and this is weighing down even further on its results.

But, consider the following: Roku was an incredibly fast growing company even before it had a pandemic boost. There are several secular trends that continue to drive streaming forward, so it would make sense for investors to consider the opportunity offered by the leading US smart TV operating system.

It’s also worth highlighting that a company doesn’t just turn rubbish overnight. Clearly, Roku’s share price became fundamentally disconnected from its financials to the upside in 2020 and 2021, but it’s fair to argue that it is now disconnected to the downside. Roku is having a difficult time, but this is driven substantially by macroeconomic headwinds that are:

- Out of Roku’s control

- Temporary

I can’t predict when the economy will turn around, so I don’t know how much more pain Roku shareholders are in for. Yet I believe that the current share price is just ridiculously good value considering the secular tailwinds driving Roku, especially when investors consider that Roku has an extremely healthy cash balance and will almost definitely survive a downturn.

It’s been an intriguing quarterly report to read through and make a judgment on, but I truly think that in five years’ time, this will have looked like an incredible buying opportunity. There is undoubtedly execution risk with this business, and I personally will be weighting it accordingly in my personal portfolio.

Putting all this together, I will reiterate my previous ‘Buy’ rating on Roku.

Be the first to comment