JuSun

I wrote an article a while ago about the merits of investing in every day companies that even a sixth grader can understand and appreciate, like Lowe’s (LOW). In fact, many of these types of companies serve essential needs that make them durable businesses and investments.

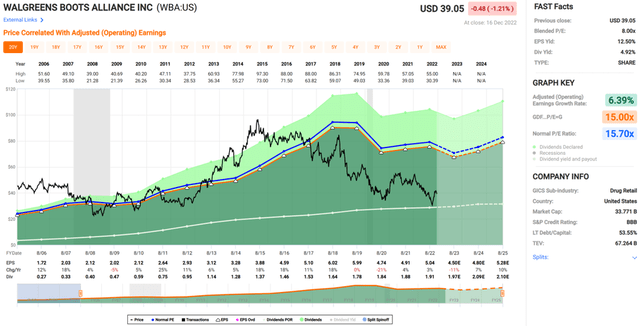

This brings me to Walgreens (NASDAQ:WBA), which appeared way too cheap back in early October, when I last visited the stock. The stock has soared by 27% since then, far surpassing the 5.6% rise in the S&P 500 (SPY) over the same timeframe. In this article, I highlight why WBA remains undervalued with a near 5% yield.

Why WBA?

Walgreens Boots Alliance is a global leader in retail pharmacy with over a century’s experience in the space. It brands itself as “America’s Drugstore” and has around 13,000 locations in all 50 states and Europe and Latin America.

WBA enjoys a strong brand that’s well-recognized and trusted by consumers, which has helped to drive customer loyalty and contribute to its success over its many years of operation. Walgreens also has a strong online presence and a wide range of products and services that it offers through its website and mobile app, which has helped it to attract and retain customers in the digital age.

Walgreens derives leg up against online competitors such as Amazon (AMZN) due to the fact that 75% of American households live within a 5 mile radius of a Walgreens store. This wide-ranging presence enables WBA to offer convenience advantages to customers who can purchase products at competitive prices while getting their prescriptions filled. Moreover, WBA is leveraging some of its store footprint to provide primary care services.

Nonetheless, WBA has seen headwinds in recent years, as gross margins have come under pressure due to the growing power of pharmacy benefit managers and their negotiating power. However, with headwinds come opportunity for the company to evolve and transform itself, as peer CVS Health (CVS) has done in recent years.

This includes investments in its digital platform, which has seen strong traction, as reflected by the 37% digital sales growth in fiscal 2022, and this is on top of the 74% digital sales growth that WBA saw last year. Moreover, WBA is effectively managing costs, as retail margins expanded by 100 basis points and management has a near-term target of $3.5 billion in annual savings through its cost management program.

Looking ahead, I see potential for its recent $9 billion acquisition of Summit Health-City MD to be a solid revenue driver going forward, as it further solidifies WBA’s ongoing transition into a more holistic healthcare company. The merits of this acquisition were highlighted by Morningstar in its recent analyst report:

This acquisition represents yet another example of Walgreens turning its strategic focus toward healthcare services. We expected accelerated growth in its U.S. health segment as a result of this acquisition and recent VillageMD acquisitions—Shields Health Solutions and CareCentrix.

With the pending combination of VillageMD and Summit Health-CityMD, Walgreens will create a multi-payer platform that provides accessible, quality care for patients. VillageMD already holds expertise in value based care and Summit Health-CityMD will accelerate a path to more risk-based care while providing geographic expansion throughout the Northeast U.S. and Oregon.

Meanwhile, WBA maintains a solid BBB rated balance sheet. It’s also worth noting that WBA has a material stake in drug distribution giant AmerisourceBergen (ABC), and WBA recently sold $1 billion worth of its stake in ABC for debt paydown and for the funding of its aforementioned acquisition of Summit Health.

WBA also currently yields nearly 5%, which is one of its highest yields in its operating history. Notably, WBA is also a dividend aristocrat, and appears set to continue its dividend growth tradition with a safe pay-out ratio of 38%.

Lastly, I continue to find WBA to be attractive at the current price of $39, with a forward PE of just 8.7, sitting well below its long-term normal P/E of 15.7. I see potential for the valuation gap to close with continued momentum around WBA’s transformation efforts and cost management program.

Investor Takeaway

Walgreens Boots Alliance has been transforming itself to become a more holistic healthcare company, and its recent acquisition of Summit Health-City MD bodes well for its long-term prospects. This, combined with cost management efforts could drive meaningful results in the near to medium term. Meanwhile, investors get paid to wait with a juicy dividend yield at the current low valuation from this dividend aristocrat.

Be the first to comment