Alena Kravchenko

Investment thesis

Alphabet (NASDAQ:GOOG) is one of the best companies ever, a money machine with an extremely dominant position in its industry. In 2022 it reached the point of losing about 30% of its value and currently sits close to an oversold zone with a fair value of $164.97, well above its current price. As of now, there is no company in the world that can compete with Alphabet in its sector; therefore, the recent slump seems like a more unique than rare opportunity to grab this company at a more than reasonable price. Finally, analyzing Q2 2022 shows that growth has not stopped despite the stunning results of the past few years, and CEO Sundar Pichai will continue to focus on targeted investments that can lead Alphabet toward dominance in other market segments. The company’s ability to self-finance is its strength that will lead it to dominate in the future as well.

Consideration on Q2 2022

“In the second quarter our performance was driven by Search and Cloud. The investments we’ve made over the years in AI and computing are helping to make our services particularly valuable for consumers, and highly effective for businesses of all sizes. As we sharpen our focus, we’ll continue to invest responsibly in deep computer science for the long-term.”

These were the words of CEO Sundar Pichai regarding a positive Q2. In this section we will look at the most important aspects of this quarterly report and what investors should consider.

Revenue growth and foreign exchange losses

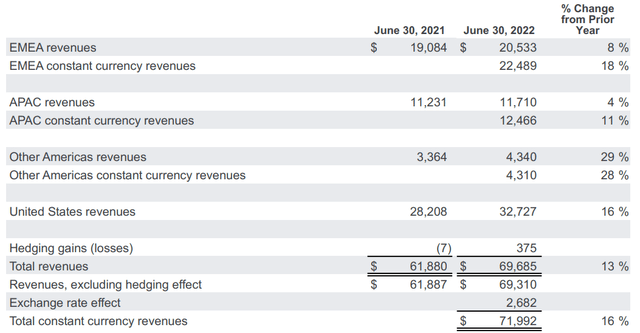

Revenues grew 13% over the previous quarter denoting less growth than last year but still very important considering how much this company earns. It is also interesting to note that this growth occurred in a difficult period economically such as the current one, proving once again to be one of the most solid companies in the world. Wanting to find a negative note related to this Q2 we can note that the growth in revenues with constant currency was greater than 3%, and this is due to a strong appreciation of the dollar on international currencies. However, the loss on foreign exchange is a problem that has plagued all U.S. companies that have a rather pronounced geographic diversification of revenues. Here are the numbers of this negative effect.

Alphabet had managed to achieve double-digit growth in each of the geographical segments considered; however, the foreign exchange loss effect weighed heavily. In EMEA revenue growth would have been 18% instead of 8% if the dollar had not appreciated so much against the euro, while in APAC growth would have been 11% instead of 4%. Finally, it is important to note that in the U.S which is the most important country for Alphabet there was a good growth of 16% between Q2 2021 and Q2 2022.

Worsened net income and unmet expectations

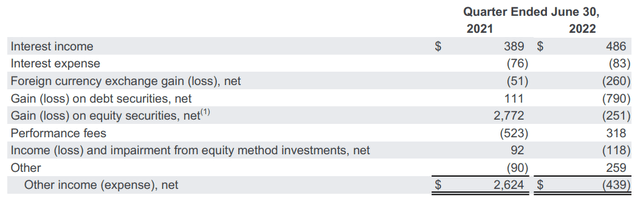

In the image above regarding Alphabet income statement we can see that there has been a significant deterioration in net income, from $18.5 billion in Q2 2021 to $16 billion in Q2 2022. The main reason behind this reduction is purely technical and does not have to do with the company’s core business, which by the way has marked a growing operating income.

Gain (loss) on equity securities includes all gains and losses, unrealized and realized, on equity investments. In Q2 2022 the net effect of gains and losses on equity investments was negative given the current ongoing economic slowdown, while in Q2 2021 there was a very good performance of the stock market that positively affected this item. Overall, the resulting net effect is significant, but I would personally focus more on operating income since the latter depends directly on how the company operates and not on external components such as market trends.

Revenue segmentation

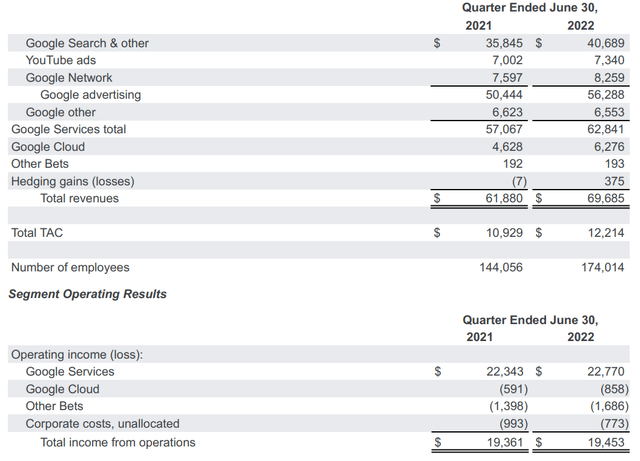

One of the peculiarities that make Alphabet an insurmountable behemoth is its ability to increase the profitability of each segment of its business, and invest its profits in order to increase its competitive advantage.

In this image you can see that every segment of Google advertising has visibly improved and there was only a small deterioration for Google other. In addition, in only 1 year Alphabet hired about 30 thousand more employees.

To conclude the analysis of the latest quarterly report, it must be said that analysts’ expectations were not met either on the EPS front ($1.28 expected) or on the revenue front ($70.04 billion), but despite that the following day Alphabet opened with a very positive pre-market. The market did not seem to react badly to this quarterly report.

Alphabet’s dominance

Beyond a good quarterly, I personally consider Alphabet if not the best, among the top 3 companies in the world. The reason I believe this is because it is simply very difficult to be able to find weaknesses.

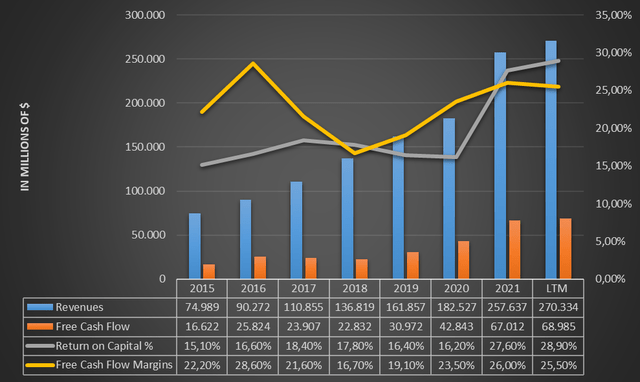

Alphabet’s ROIC has always been higher than 15% since 2015 and lately it is even touching 30%. The company gets an excellent return on the investments it makes; therefore, there is a high allocative efficiency of capital.

The free cash flow produced by this company has always been very high, and it is surprising how in spite of revenues growing fast year after year the free cash flow margin remains stable at 25%, which is excellent.

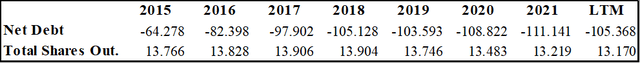

Alphabet has a net debt of -$150 billion, which means that the amount of cash this company has is extremely higher than its total debt. As if that were not enough, since 2017, Alphabet’s outstanding shares have been shrinking year after year as a result of a constant purchase of treasury stock, effectively increasing the shareholders’ stake year after year.

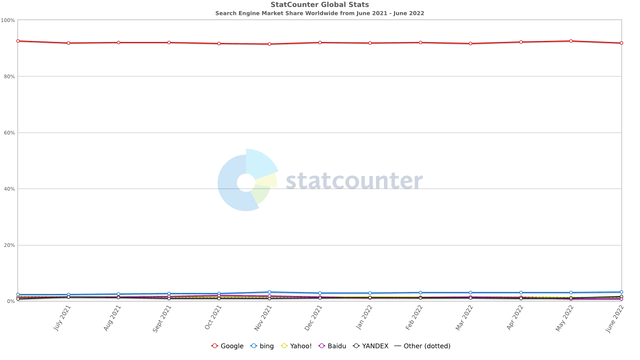

Alphabet’s overwhelming power does not end there, however; in fact, the most shocking figure is Google’s market share.

Google is almost the only search engine used as it has 91.86% of the market share. Looking at the graph, its main competitors such as Yahoo! and Bing have such a small market share that it is almost insignificant graphically. Alphabet’s competitive advantage is currently insurmountable and no company can compete. In the very long run things may change, but with a company that improves year after year and produces free cash flow of $67 billion (2021) per year I struggle to think how Alphabet can lose its dominance in the future.

Is Alphabet undervalued?

After analyzing why Alphabet is one of the best companies in the world, in this section we will look at whether it is a good buy. Just because it is one of the strongest companies in the world does not necessarily make it worth buying at any price: even the best company can turn out to be a bad investment. Three different methods of valuation will be used: multiples analysis, weekly RSI, and discounted cash flow.

Multiples analysis

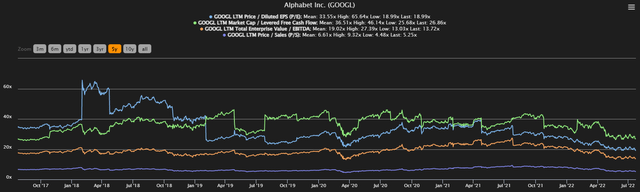

In this section we will analyze Alphabet’s current multiples and compare them with its historical values. There will be no comparisons with similar companies simply because I believe that no company can be compared to Alphabet, so we better rely on its historical values. The averages considered refer to the last 5 years, and the current multiples to July 26.

- The current P/E is 18.99x while the average has been 33.55x

- The current market cap/levered free cash flow is 26.86x while the average has been 36.51x

- The current EV/EBITDA is 13.72x while the average has been 19.02x

- The current P/S is 5.25x while the average has been 6.61x

Two considerations can be made in light of these results:

- All current multiples have lower values than in the past. This is normal, since for obvious reasons Alphabet’s growth rates cannot be as high as in the past, moreover the price per share collapsed in 2022.

- If we looked at the multiples values individually, although lower than in the past they are not that low despite the recent market cap collapse. This is mainly due to Alphabet’s dominance: if you want to invest in such a dominant company you must pay an additional premium to be a shareholder. I think it is unlikely for a company like Alphabet that multiples will reach even lower values unless the market has gone crazy.

Overall, I consider Alphabet currently trading at convene multiples that are unlikely to be lower in the future.

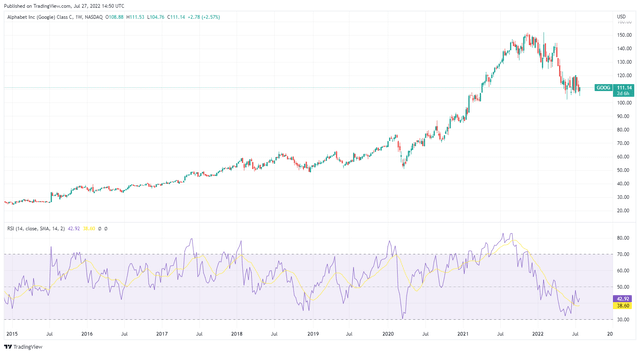

Weekly RSI

From a purely technical point of view, the weekly RSI appears to be oscillating within an oversold zone, even close to March 2020 levels. According to this indicator, Alphabet is currently undervalued. For a company like Alphabet, a 30% drop like the one that occurred is definitely not a common situation and I think it is worth taking advantage of.

Discounted cash flow

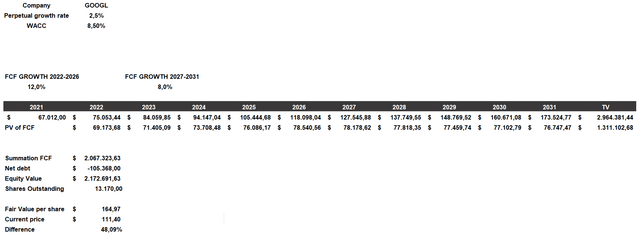

Each investment is the present value of future cash flows; therefore, through this model we can understand what the company is worth based on future profitability. Most of the data included are based on my own assumptions, so these are purely personal and not objective considerations. The model will be constructed as follows:

- The cost of equity will be 8.50% and considers a beta of 1.1, a country market risk premium of 4.2%, a risk-free rate of 3.50% and additional risks of 0.25%. The cost of debt will be 5.16%.

- The capital structure considered will be 100% equity since Alphabet has a strongly negative net debt. The resulting WACC will therefore be equal to the cost of equity.

- Free cash flow growth will be calculated from the 2021 value and will be 12% for the first 5 years and 8% for the next 5. Personally, I consider these growth rates more than feasible for Alphabet; in fact, I would not be surprised if they are exceeded.

According to my assumptions, Alphabet’s fair value is $164.97 per share, while the company is currently trading at $111. According to this model, Alphabet is undervalued, and not by a small margin. To find such a company so undervalued is a rare opportunity that I think should be taken advantage of. Should the price continue to fall what I will do is continue to buy by averaging down (obviously avoiding overweighting it within the portfolio), after all I am buying one of the best companies in the world at a discounted price.

Be the first to comment