AscentXmedia

Published on the Value Lab 24/7/22

Enel Chile (NYSE:ENIC) was by far one of our worst calls last year and the year before. The company has only gone down, and that has been in large part due to being on the wrong side of history in the commodity environment. Besides the fact that there were direct indexations to commodity prices in its contractual agreements, and unlucky situation with their hydropower assets forced them to buy gas unexpectedly at the record high spot prices to keep Chileans supplied with electricity. However, now things are really turning around for them, and with the Q2 upcoming we expect to see real reversals in their fortunes.

A Blockbuster Q2?

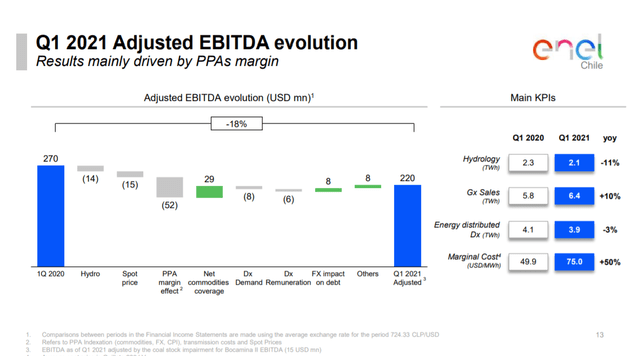

In Q2 2021, we were seeing some of the worst of the purchase price agreement indexation effects kicking in and hurting margins quite meaningfully. Those agreements were moving against Enel Chile due to indexation against the value of the Chilean peso and the value of commodity prices. The commodity price that matters most for the Chilean economy and for Enel Chile was the copper price. Rising copper prices caused the Chilean peso to revalue meaningfully as its their key export, and connected to the overall rise in commodity prices Enel Chile suffered quite a lot.

EBITDA Evolution (Q1 2021 Pres)

However, with rising rates coming in and inflation being a key indicator of monetary authority austerity action commodity prices have fallen substantially across the board with the exception of those geopolitically elevated by the situation in Ukraine. Copper has fallen dramatically since the Q1 2022 and in Q2 we expect that these further declines are going to reflect in the PPA margins and reverse some of last year’s effects.

Copper Price (Tradingeconomics)

Likewise, the Chilean peso has fallen a good deal (10%) with the appreciation of the dollar and the hurt experienced by commodity levered currencies.

The last quarter was already seeing benefit in PPA sales both in terms of volume but also the indexation effects as these commodity reversals began. The brunt of the effect should be expected next quarter, on top of newly completed generation projects to add to the segment revenues.

Conclusions

We think that the EBITDA could start nearing 2020 levels. While gas prices still weigh on some of the assets ENIC runs, for the most part the recovering hydrology situation and PPA margin effects could start restoring the EBITDA to above the beleaguered 2021 levels. We think that a multiple between 6.6-5.5x EV/EBITDA are possible on those normalized EBITDA figures. This is excluding the steady growth in capacity that ENIC develops annually.

Moreover, ENIC runs the regulated utility concession for Chile. This ends up being rate and inflation indexed due to the remuneration schemes and effects. There are risks around the socialist streak of the new government, but they’d be aggressively stirring the pot to oust the operators of their electricity distribution. That’s the kind of thing that could spur its own revolution were power to stop being supplied.

ENIC ends up being a play on commodity reversal. While hydrology risks are occasional and remain something investors should be concerned about, especially to the extent that it can be associated with global warming (we are hesitant about making that connection), the stock trades pretty cheaply for a regulated utility. Some of that could be chalked up to its geography and the government that rules over it, but it offers some margin of safety nonetheless. Are we buyers? No, we’ve been a little too burned on it and we know of better opportunities. But we are bullish.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment