jetcityimage

Because of fears related to the impact that rising interest rates will have on the construction space, combined with fears of a potential economic downturn, companies in the building and construction space are not seen as being particularly appealing at this time. Although this is unfortunate, it does open the door for investors to buy into firms on the cheap, even if we assume that financial performance will suffer in the near term. One really attractive prospect in this space happens to be Owens Corning (NYSE:OC). This diversified global building and construction materials firm has done extremely well to grow both its top and bottom lines in recent years. Shares look remarkably cheap, especially relative to similar firms. And even if financial performance were to suffer from here and revert back to what we saw prior to the pandemic, the company would still likely have some upside potential. For all of these reasons, I have decided to rate the business a ‘strong buy’, reflecting my belief that it offers upside potential that is drastically greater than what the broader market should achieve for the foreseeable future.

Understanding Owens Corning

As I mentioned already, Owens Corning is a global building and construction materials company. The firm has operations in 33 countries spread across the world and boasts roughly 20,000 employees throughout its network. Although the company is a global player, it is still worth noting that 67% of its revenue came from the U.S. market last year. The next largest area of concentration for it was Europe, accounting for 16.3% of revenue in all. The Asia Pacific region was just over half that at 8.8%, while all other parts of the world combined made up 7.9% of revenue.

To truly understand the company, it would be best to break it up into the three key operating segments that management has it running in. The first of these worth mentioning is the Composites segment, through which the company provides glass fiber materials that can be found in over 40,000 end-use applications. For the most part, these applications are spread across the building and construction, renewable energy, and infrastructure markets. Examples of end-use applications include, but are not limited to, roofing shingles tubs and showers, swimming pools, flooring, pipes, poles, electrical equipment, and even wind energy turbine blades. Last year, this particular segment was the smallest for the company, accounting for just 26.8% of revenue and 23.9% of profits.

The second-largest segment the company has is called Insulation. For the North American residential market, these products include thermal and acoustical batts, loosefill insulation, foam sheathing, and related accessories. According to management, they are often sold under the Owens Corning PINK FIBERGLAS Insulation brand name. The segment also produces glass fiber pipe insulation, duct media, bonded and granulated mineral wool insulation, cellular glass insulation, and other related products for the commercial and industrial markets. Brand names included here are Thermafiber, FOAMULAR, and Paroc. Last year, this segment made up 36.5% of the company’s revenue and 28.3% of its profits. Finally, we arrive at the Roofing segment. Through this, the company produces laminate and strip asphalt roofing shingles, roofing components, synthetic packaging materials, and oxidized asphalt. This was the company’s largest segment in 2021, accounting for 36.7% of revenue and an impressive 47.8% of profits.

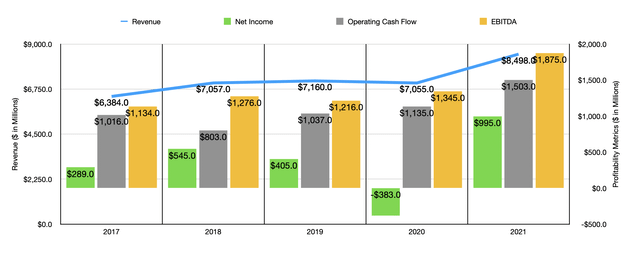

Over the past few years, management has done a great job growing the company’s top and bottom lines. Consider revenue. Between 2017 and 2020, revenue rose from $6.38 billion to $7.06 billion. Then, in 2021, revenue surged to roughly $8.50 billion. Unfortunately, not a great deal was provided in the way of detail on a macro level. But we do know that management attributed this sales increase to a combination of higher volume shipped and higher selling prices. Under the Composite segment, sales rose by 19%, with over half of that increase coming from higher selling prices. For the Insulation segment, the 22% sales increase was driven by a 12% rise in sales volume and by a $188 million increase in selling prices. And finally, for the Roofing segment, the company benefited from higher shingle and components sales volumes of 8%, with this partially offset by high unfavorable product mix. However, we do know that of the $514 million in additional revenue that segment experienced for the year, 63.2% came from an increase in selling prices.

Profitability for the company has also generally followed revenue higher. Between 2017 and 2019, net income rose, in a somewhat lumpy fashion, from $289 million to $405 million. The firm saw $383 million in 2020 but then rebounded in 2021 with a net profit of $995 million. Other profitability metrics have also been positive for the company. Operating cash flow went from $1.02 billion in 2017 to $1.50 billion in 2021, while EBITDA rose from $1.13 billion to $1.88 billion.

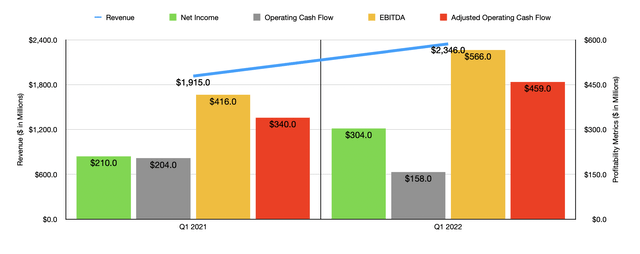

For the 2022 fiscal year, the company continues to demonstrate attractive growth. Revenue of $2.35 billion achieved in the first quarter of the year represents a year-over-year improvement of 22.5%. The company continues to benefit from strong pricing for its products. But it is also benefiting from multiple acquisitions it has engaged in. Though the terms were not disclosed, the company has made a number of purchases in recent months even. The most recent was of Natural Polymers, an entity that should bring shareholders $100 million in annualized revenue. And shortly before that, it acquired WearDeck, a business that should generate $60 million in annual revenue. Net income for the company has also increased, climbing from $210 million last year to $304 million this year. Operating cash flow actually fell, declining from $204 million to $158 million. But if we adjust for changes in working capital, it would have risen from $340 million to $459 million. Along the way, EBITDA also increased, climbing from $416 million to $566 million.

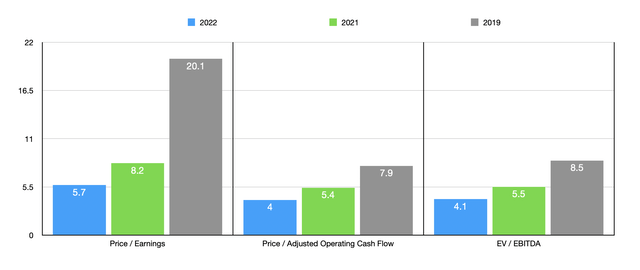

No guidance has been given for the 2022 fiscal year as a whole. But if we annualize results experienced so far for the year, we should anticipate net income of $1.44 billion, adjusted operating cash flow of $2.03 billion, and EBITDA of $2.55 billion. Using these numbers, we can easily value the business. For instance, the firm seems to be trading at a forward price to earnings multiple of 5.7. The price to operating cash flow multiple is 4, while the EV to EBITDA multiple should be 4.1. Even if we assume that financial performance for the rest of the year is weaker, allowing the company to match what it achieved in 2021, these multiples would still be low at 8.2, 5.4, and 5.5, respectively. To be even more conservative, I also decided to price the company based on 2019 results. Doing so, we end up with multiples of 20.1, 7.9, and 8.5, respectively. Although the price-to-earnings multiple might be lofty, the other two are very low. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 12 to a high of 33.5. Using the price to operating cash flow approach, the range was from 16.2 to 27.9. And using the EV to EBITDA approach, the range was from 9.3 to 17.9. Using our 2021 figures, we can see that Owens Corning was the cheapest of the group across the board.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Owens Corning | 8.2 | 5.4 | 5.5 |

| Lennox International (LII) | 18.0 | 19.1 | 14.8 |

| Advanced Drainage Systems (WMS) | 33.5 | 27.9 | 17.9 |

| Fortune Brands Home & Security (FBHS) | 12.0 | 16.2 | 9.3 |

| Allegion (ALLE) | 19.8 | 23.3 | 15.9 |

| A. O. Smith Corporation (AOS) | 18.5 | 17.1 | 12.1 |

Takeaway

Based on the data provided, it seems to me as though Owens Corning is doing quite well for itself. The company continues to expand both through strong demand and the acquisitions it is making. Shares are cheap on an absolute basis and this remains true even if financial performance falls back to what it was prior to the pandemic. And relative to similar firms, the company is most definitely cheap. For all of these reasons and in spite of the real risk that an economic downturn could hurt demand to some degree, I have decided to rate the business a ‘strong buy’ at this time.

Be the first to comment